It’s the stupid economy: RBA holds again at 4.35%

News

News

At its June meeting the RBA left the cash rate on hold at 4.35% as widely expected, leaving it unchanged now for seven straight months.

The central bank reiterated it’s “not ruling anything in or out”, but the tone, including the language used in Governor M. Bullock’s fascinating press conference was a bit more hawkish than in May, suggesting more risk of a hike than a cut in the near term.

What’s the point of making the decision and then breaking with years of tradition and holding a post-match presser?

Well, unlike her predecessor Dr P. Lowe, Gov. Bullock is not afraid to stray from the official statement, as she did on Tuesday, with the addition of some welcome emphasis, colour and even a little extra meat to the bones of the official Statement.

At about 3.20 mins into the video linked above, Gov Bullock says:

“We’re on a narrow path. It does appear to be getting narrower… We need a lot to go our way, if we’re going to bring inflation down to the 2% target range.”

The words alone are stronger than anything being studied in the official Statement.

But more importantly, the bank chief’s tone and body language… the way she scrunches up her face like she bit into a mealy apple when she says “we need a lot to go our way,” speak volumes to the delicate state of affairs in monetary policy in this country .

After the RBA call, local shares fell off, while bond yields and the Aussie dollar rose slightly. And while the moves were marginal, Dr Shane Oliver, chief economist & head of investment strategy at AMP, said this was a reflection of the hawkish edge to Tuesday’s proceedings.

The next key events in this unending inflation adventure – June quarter inflation data at the end of July, any early insights on what the impact of the fed gov’s tax cuts might have on the Aussie shopper and any revisions to the RBA’s economic forecasts set for August.

So. The first red flag in the RBA’s Statement – the Board retained their exciting “not ruling anything in or out” line, suggesting the RBA’s preference for its ongoing neutral bias, but with the rider that nothing gets a free pass.

“But its language remains relatively hawkish – particularly around inflation declining more slowly and continuing excess demand – with Governor Bullock confirming that the option of another hike was again discussed but a cut was not,” Dr Oliver said.

“And the return of a comment at the end of its post-meeting statement that the RBA ‘will do what is necessary‘ to achieve a return of inflation to target underlines that this was a ‘hawkish hold’ leaning its commentary a bit more hawkish than was the case in May.

“All of which suggests that the risks in the near term are still skewed towards another hike, particularly if June quarter inflation to be released at the end of July surprises on the upside again.”

This makes the August RBA meeting – where the bank also usually reviews its economic forecasts – an absolute blockbuster.

“Critical,” in the words of Dr Oliver and “potentially live” for a hike, if the June quarter inflation surprises are unhappily on the upside.

This one wasn’t live, according to the whims of financial markets, pretty much the entire forecasting community and the CBA economics team.

According to CBA’s head of Australian economics Gareth Aird, the decision makers of Martin Place retained the neutral bias but stressed anew the uncertainty in the Aussie economic outlook.

“We did not consider today’s meeting ‘live’. And the on‑hold decision meant the focus for markets was on the Statement accompanying the decision and the Governor’s press conference,” Aird said.

“The post-match statement left the key paragraph pertaining to forward guidance unchanged. The Board reiterated that, ‘the path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out’.”

Here it is, for the diehard fans:

Uncertainty was once again a key theme within the Statement, according to CBA.

“Indeed the word uncertain appeared eight (8) times in today’s Statement compared with seven (7) times in the May Statement. The upshot is that the Board is going out of its way not to provide any forward guidance given the cross currents in the economic data.”

That’s because inflation, Aird says, is proving a little stickier than the Board anticipated at the start of 2024.

“The first heading in the Statement on Tuesday was, ‘Inflation remains above target and is proving persistent‘. This compares with the May Statement heading, ‘Inflation remains high and is falling more gradually than expected‘. It’s a shift in words, but not a change in message.

“The Board is still concerned about the pace at which inflation is falling (i.e. the Board is somewhat anxious about the gradual pace at which inflation is declining).”

But Aird adds that the bank is also concerned… “that household consumption picks up more slowly than expected, resulting in continued subdued output growth and a noticeable deterioration in the labour market”.

Aird reckons, “reading between the lines”, the RBA Board looks increasingly worried that walking the narrow path between preserving the labour market, whilst returning inflation to the target band in good time “is getting narrower.”

“We retain our base case that the next move in the cash rate is down. And we have November pencilled in for the first rate cut.

“But given the challenging underlying inflation backdrop, as well as a labour market that is loosening more gradually than expected, the runway is shortening between now and November.”

The risk to our call is increasingly moving towards a later start date for an easing cycle.

“And given the Board’s concerns about the path of inflation in the very near term the risk sits with a rate increase in August if the Q2 24 trimmed mean CPI is uncomfortably high.

“In summary the outlook for monetary policy this year is uncertain. So we very much agree with the Board’s elevated use of the word uncertain in today’s Statement.”

Dr Oliver says that in leaving rates on hold the RBA recognises that high rates are continuing to rebalance demand and supply, inflation is past the peak, there’s a whole lot of uncertainty around the outlook for consumption and that these new government energy rebates will temporarily trim headline inflation.

“But it also noted that there is continuing excess demand, the labour market is easing but remains tight, government budgets may impact (presumably boost) demand, inflation has been easing more slowly than previously expected and services inflation remains persistent.

“We continue to see rates as having peaked, with rate cuts starting late this year. However, the risk of another hike is high – if inflation surprises on the upside again this quarter.”

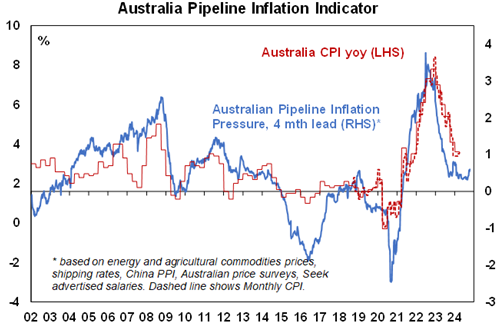

Source: Bloomberg, AMP

Lower inflation reads in the US (after a period of hotter inflation readings earlier this year) is also a positive sign for Australia according to AMP.

Aussie inflation has been lagging that in the US (both on the way up and now on the way down), as has the central bank’s response to it.

Similarly, Dr Oliver says the lower increase in minimum and award wages this year granted by the Fair Work Commission supports the RBA’s assessment that wages growth has likely peaked.

“So all up we continue to see the trend in inflation remaining down ultimately helping to avert another rate hike and allowing the RBA to start cutting rates in November or December (with a 0.25% cut to 4.1%).”

Finally, Australian economic growth remains very weak with the economy virtually stalling in the March quarter.

Retail sales and household spend show consumer sentiment is most ordinary under the weight of high rates and cost of living pressures.

The chart below shows a composite mix of economic indicators that lead – like building approvals, consumer and business confidence and the yield curve – are coincident with (like employment and retail sales) or lag (like unemployment and corporate delinquency rates) the economy.

“While none are at recessionary levels, they all remain very weak and certainly not suggesting of any overheating that may require further rate hikes,” Dr Oliver says.

Source: Bloomberg, AMP

“The path to rate cuts will likely remain bumpy and while our base case is for the first cut to come at year end, the risk of another rate hike in the near term is material as is the risk of a further delay in rate cuts into next year,” Shane adds.