It’s the Aussie spring property boom but sellers don’t seem to want to go to market right now

Via Getty

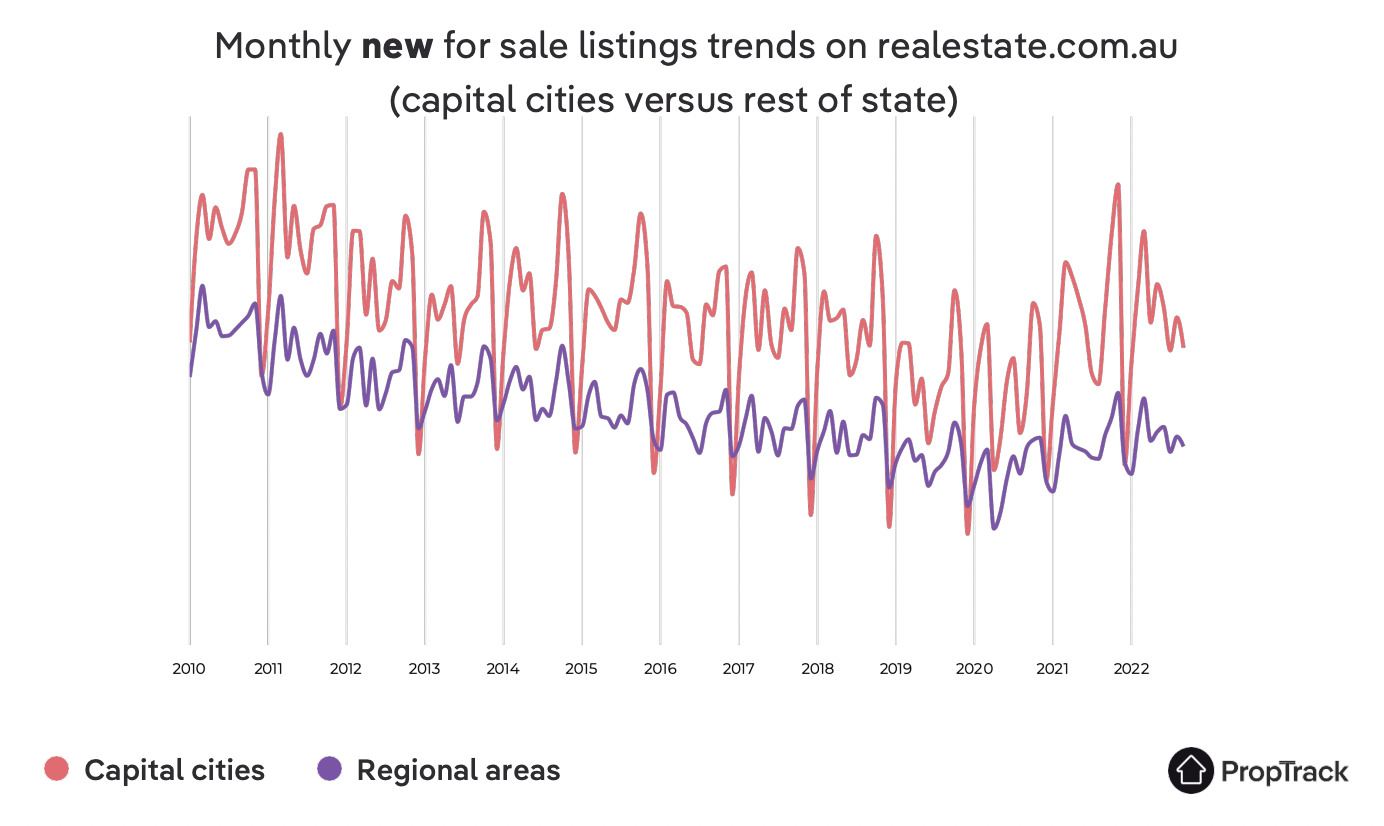

Local property markets have had a real sluggish start to the spring selling season, with PropTrack analysts seeing a sharp decline in the monthly number of houses coming onto the market via listings platform realestate.com.au in September:

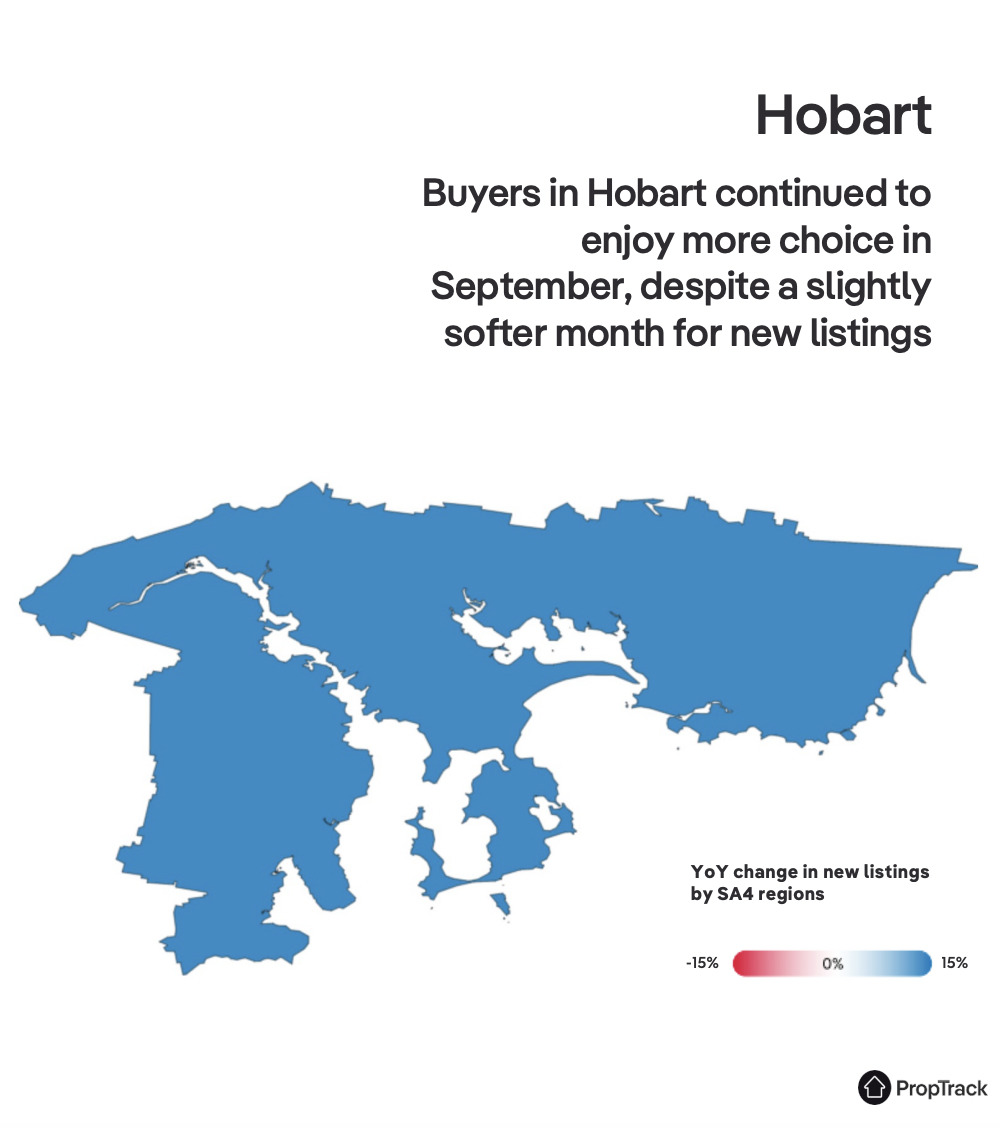

Although – before we go any further – one market is enjoying a spring bonanza with plucky Hobart seeing its total stock of properties available for sale surging again in September (6% month-on-month), the ninth straight monthly lift.

This brings the Tassie capital’s total listings up a stunning 72.1% on this time last year.

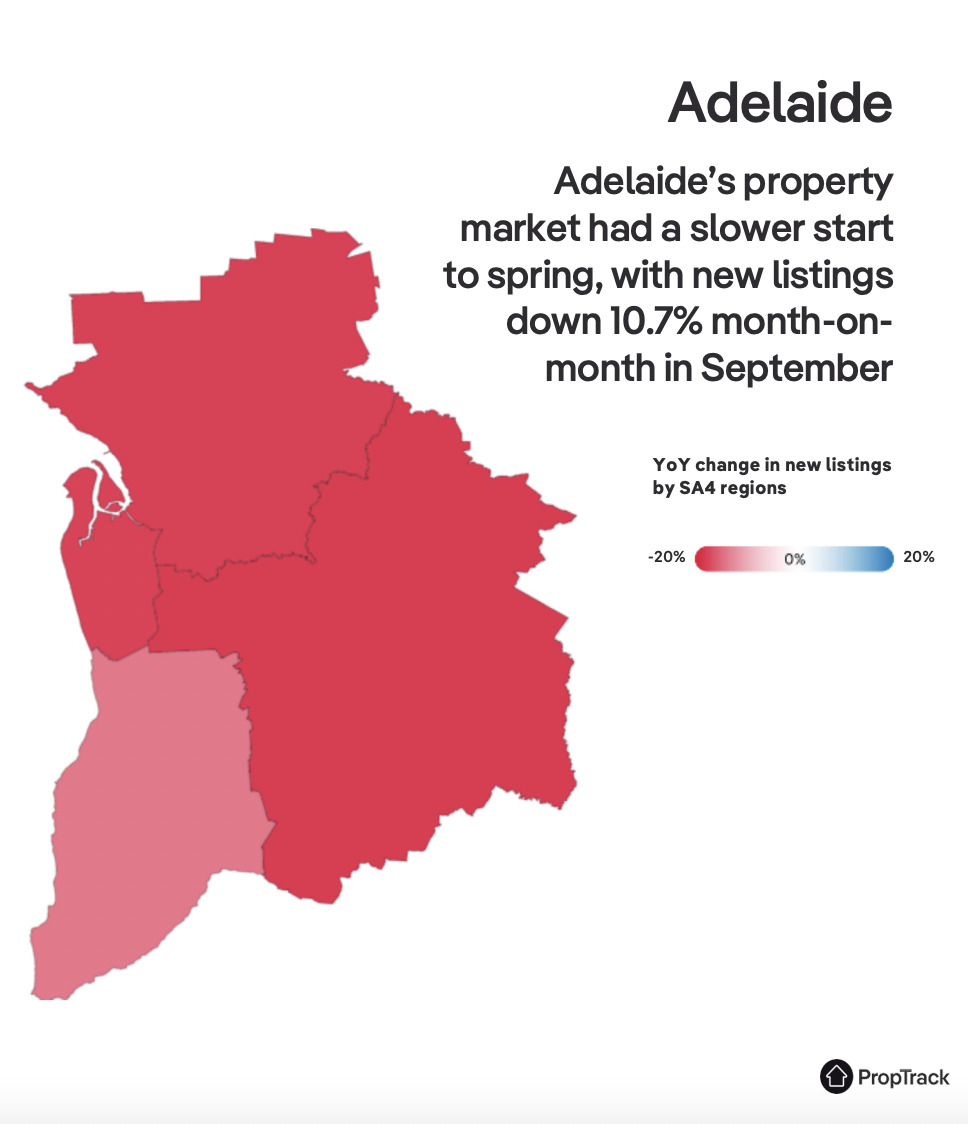

Compare that to tightly held Adelaide (red is tight, blue is not):

That’s consistent with data out of CoreLogic which shows the highest annual rise in home values nationwide was across Regional SA, at 22.2%. (The lowest rate of change in values was across Sydney, down -6% over the year.)

Then here’s Hobart:

New listings nationally on realestate.com.au were down 7.5% month-on-month in September – in part because of public holidays – which PropTrack economist Angus Moore says likely put the brakes on going-to-market decisions.

Moore says Aussie home prices have continued to decline in most cities after growth hit multi-decade highs in 2021 and are now down 3.4% nationally from the peak in March.

“(The unseasonably) slower month for new listings could be an indication that we are starting to see activity slow after a very busy first half of the year in property markets.

“However, with only one month’s worth of data (and a public-holiday-affected month at that), it is too soon to be able to draw firm conclusions.”

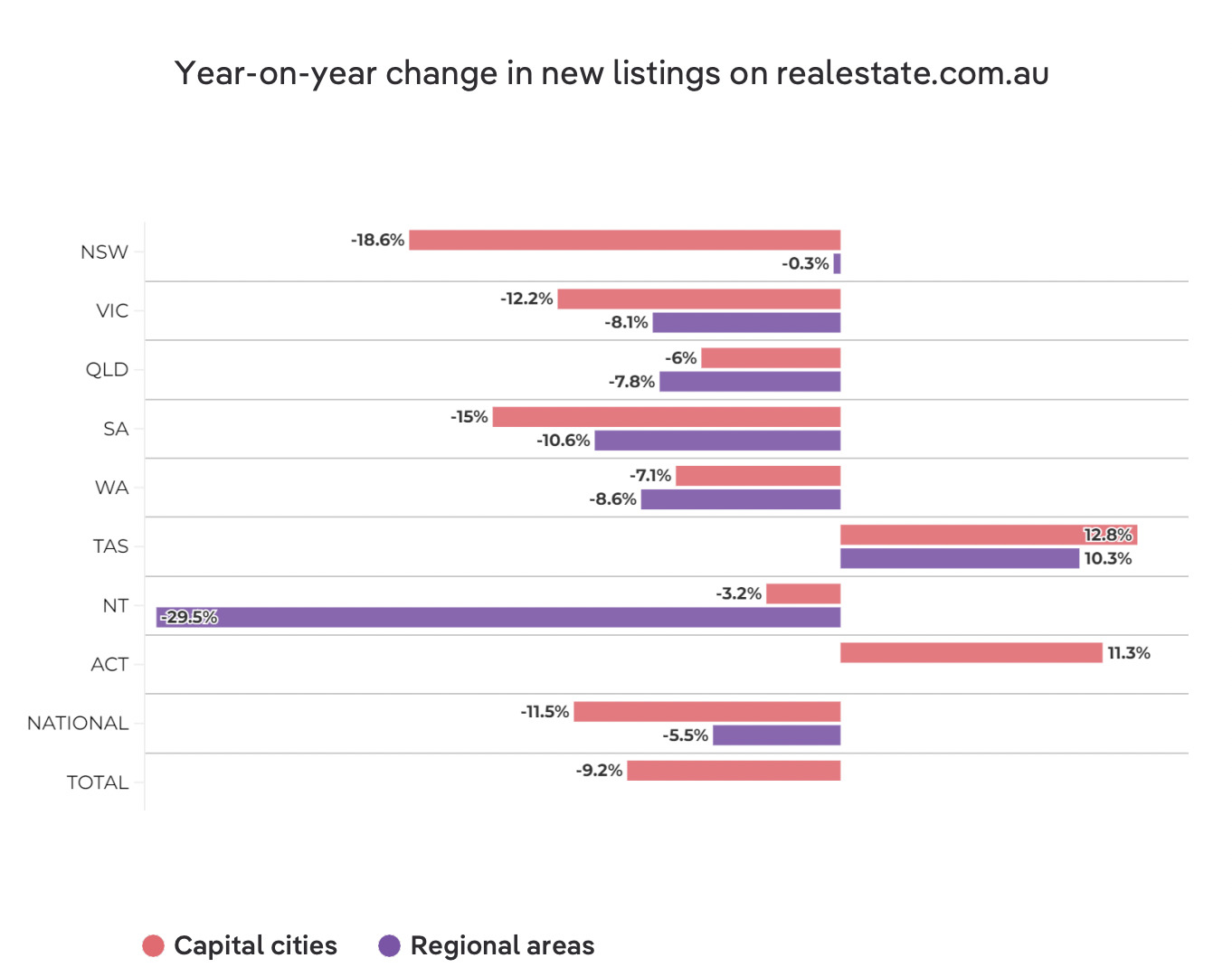

New listings are down 9.2% year-on-year nationally.

Capital city listings fell 9.3% month-on-month in September and a very large 11.5% compared to the same time a year ago.

According to PropTrack, while Sydney, Melbourne, and Canberra activity had begun to ramp, all three cities were still in lockdown this time last year, following the worst of restrictions through July and August.

Regional areas also saw activity slow in September, with 4.7% fewer new listings than in August, and new listings down 5.5% compared to the same time in 2021.

Other notable takeaways:

- While most capital cities had fewer new listings in September, Canberra (+0.5%) and Darwin (+2%) recorded small increases.

- Sydney (-13%), Melbourne (-6.8%), Brisbane (-13.3%), Adelaide (-10.7%), Perth (-5.1%) and Hobart (-0.7%), all experienced monthly declines in new listings.

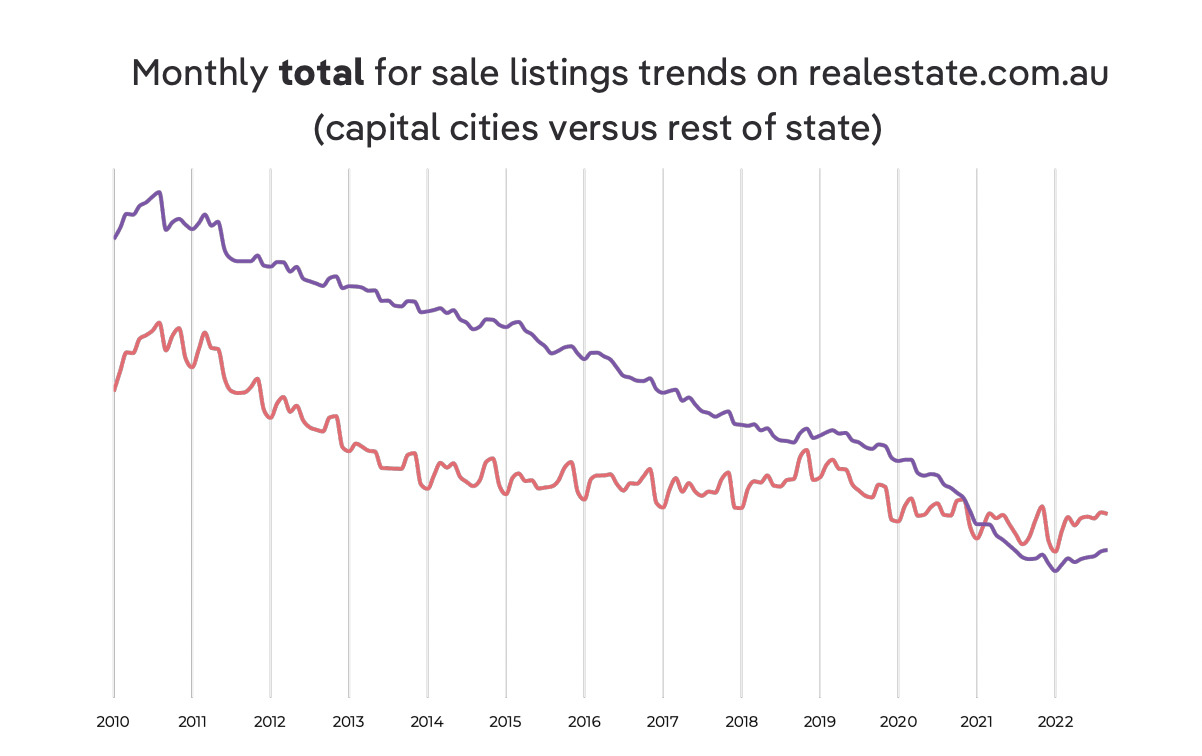

- Despite a quieter month, options for buyers in most cities have improved substantially over 2022.

- The stock of properties listed for sale in Sydney, Melbourne and Canberra is above the prior decade average, while Hobart has seen a 72.1% year-on-year surge.

The cost of the cost of money

And while events like the Queen’s Day of Mourning likely impacted new listings, it’s undeniable that the cost of money here at home – and around the world – is rising fast as the central bank (Reserve Bank of Australia) persists with its intense tightening cycle, with a sixth straight rate rise in October, bringing the cash rate up 2.5% points since May.

“The RBA is likely to continue raising rates over the course of 2022, which will reduce borrowing capacities for prospective buyers and place greater downward pressure on prices in the near-term.

The combined value of residential real estate in Australia fell to $9.6 trillion at the end of September, down from $9.7 trillion in the previous month.

According to CoreLogic dwelling values across Australia are 1.7% higher than they were this time last year, down significantly from a cyclical peak of 22.4% recorded in the 12 months to January 2022.

While the housing market downswing has become more broad-based, CoreLogic says the monthly rate of decline slowed to -1.4% in September, from -1.6% through August.

“Looking further ahead, the fundamental drivers of demand remain strong, with unemployment very low, wages growth expected to pick up over this year, and international migration increasing.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.