It’s horses for courses and April was ASX Resources: Selfwealth’s latest best of

Small potatoes. Via Getty

I really like being gifted the data drops every month or so from the growing family of madly convenient broker platforms.

I am also a huge fan of the ‘democratisation’ of stuff. These trading app-platform-thingys are a fine example.

No longer do you need to be an overeducated suited up mug in a striped starched shirt and a penchant for cocaine to trade global markets.

And if I wasn’t such a terrible dunce at money, I’d probably jump on one myself.

So before we get into it – remember – this is better a broad measure of what the casual, semi-pro, fun-loving Aussie investor is trading, minus the institutional, sophisticated and/or know-it-all cohort.

And so it is with this sobering (if not terrifying) thought, that we delight in presenting the little listed Aussie broker platform, SelfWealth’s (ASX:SWF) latest analysis on what the most traded ASX stocks across its platform were for the month of April.

Banks, resources, pharma and vanilla ETFs

According to the numbers, Selfwealth investors showed greater buying conviction for commodities, bank stocks and your garden variety of the usual ETFs tracking the ASX.

During a month where BHP launched (and as yet fluffed) a mega-major takeover, and the prices of fan fav commodities – copper, gold, and coal – all began to climb, SWF reports that resources stocks were back in fashion among the most popular trades on the platform.

Wrapping April

Pretty much everywhere, equity markets found themselves under some pressure last month. One needn’t wind back the clock too far to recall that inflation both here and in the states refused to wither and die-die-die… while conflicts escalated across the Mid east and In Ukraine.

Those headwinds flowed through to the local market, where the benchmark S&P/ASX 200 was down almost 3% for the month.

Energy shares were one of the biggest contributors towards last month’s pull-back, while consumer staples, real estate, and telecommunication shares also led sector declines.

In line with the ASX Energy sector’s sharp decline last month, shares in Woodside Energy Group (ASX:WDS) finished the month 7.4% lower.

That result ensured a more than 2-year low for WDS, which coincided with growing concerns among economists about the economic outlook if monetary policy remains restrictive for some time.

Nevertheless, WDS was the second-most actively traded share in the Selfwealth community last month, with more than two-thirds of all trades being ‘buys’.

Sold on remestemcel-L

Just. People love Mesoblast (ASX:MSB). Buying or selling. MSB always seems to feature prominently.

And so it was in April, SFW reports MSB jumped from 11th place to 3rd spot, and buying remained a popular trade throughout April.

And that was well done, team. Because the share price in the Aussie regenerative medicine firm surged more than nearly 75%, extending the near 90% rally recorded in March.

The catalyst for the first rally was news that the US Food and Drug Administration advised the company it has provided sufficient data to support the submission of its Biologics License Application for its remestemcel-L treatment for paediatric patients with steroid-refractory acute graft versus host disease.

A few short-term traders have since piled into the stock, Selfwealth says, with volatility a bot of a hallmark of trading over the more recent weeks.

Back to digging

Alongside Woodside and the iron ore majors, South32 (ASX:S32) , Evolution Mining (ASX:EVN) , and Whitehaven Coal (ASX:WHC) demonstrated signs of strong trading interest in resources shares.

The trio slotted into the top 20, albeit showing varying levels of trading conviction.

Commodity prices may have played a role, with copper touching a two-year high, gold setting a record high, and coal prices rebounding in April. Shares in S32 were up 19.7% for the month, while EVN and WHC delivered monthly gains of 13.4% and 8.7% respectively.

Smolten caps

Elsewhere,Zip Co (ASX:ZIP) , DroneShield (ASX:DRO) , and Appen (ASX:APX) kept their resurgent level of popularity, with the trio in the spotlight after an extended period of modest trading interest.

Recent trading has been underpinned by strong share price returns across recent months, as per SFW.

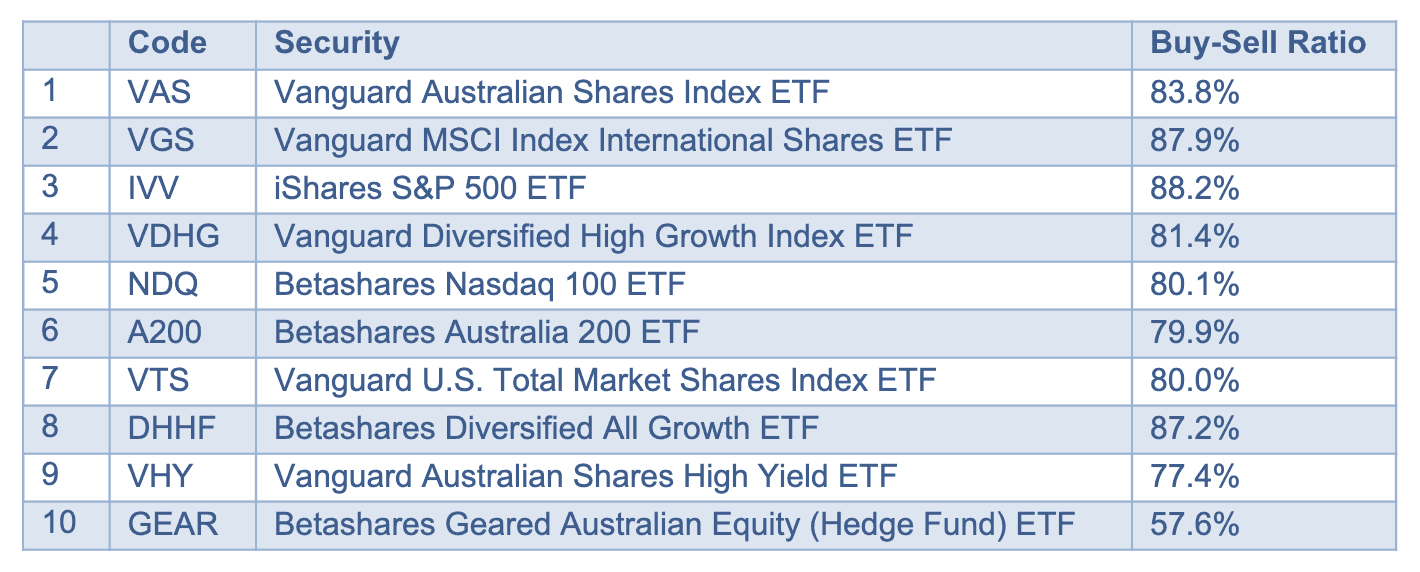

Top 20 shares by trades

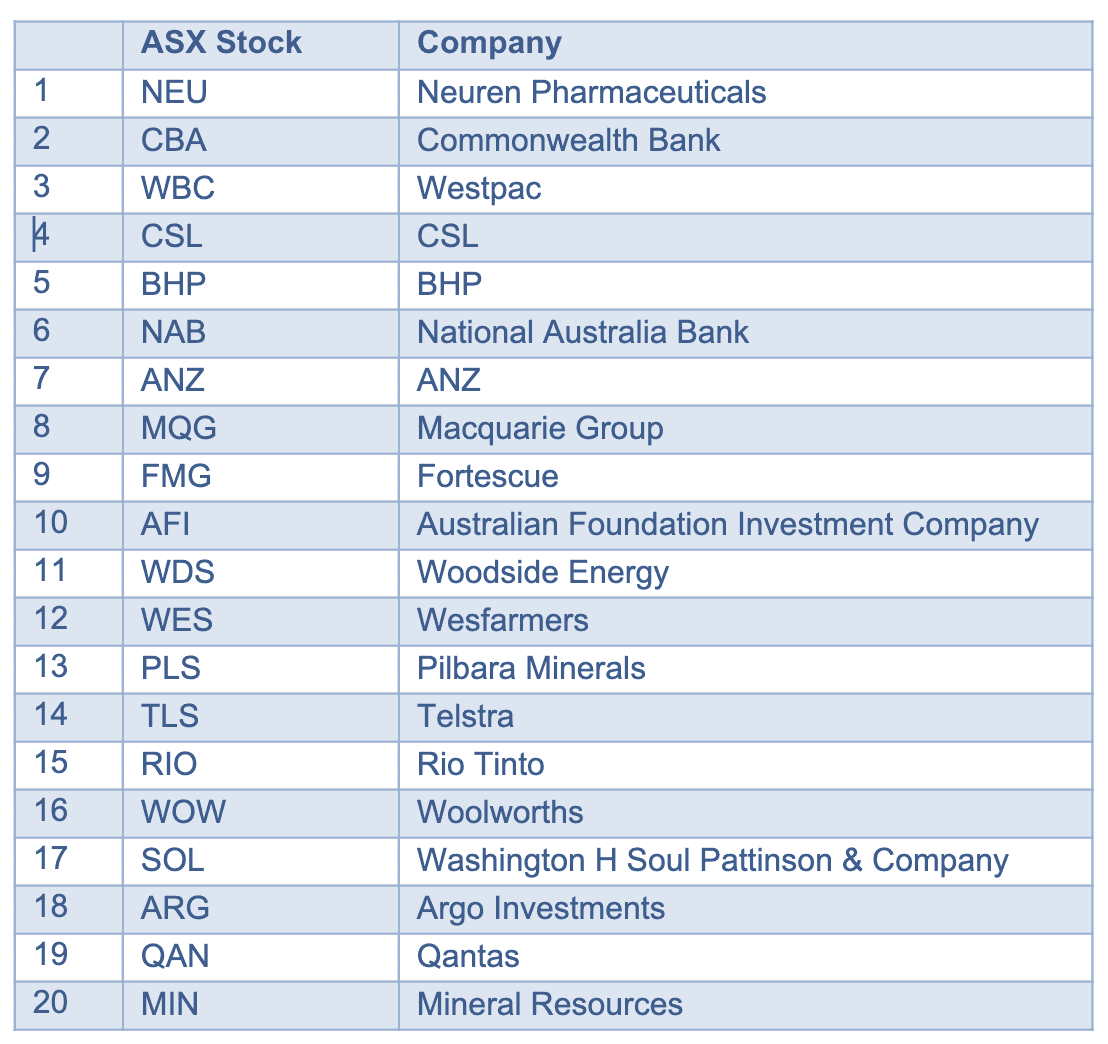

For the third time in as many months, there was a marked increase in buying conviction across ASX-listed ETFs. Whilst in previous months this trend was mostly associated with funds tracking US indices, April saw a shift to ETFs focused on the Australian share market.

For example, the buy-to-sell ratio for the Vanguard Australian Shares Index ETF (ASX:VAS) rose 9.7 percentage points month-over-month, while the BetaShares Australia 200 ETF (ASX:A200) recorded a 7.8 percentage point increase compared with the result from March.

Top 10 ETFs by Trades

The biggest Australian

Not only the most actively traded share by trade volume, BHP (ASX:BHP) also topped the list in terms of the greatest money flow throughout the month, with around $64 million worth of shares traded.

The mining titan made the news as it made a $60bn takeover offer at London-listed rival Anglo American, which has thus far been a big of a face-palm thing.

And good old Aussie big bank shares also enjoyed strong buying support ahead of the segment’s reporting period, and with US-listed peers handing down results over recent weeks. Westpac (ASX:WBC) , Australia and New Zealand Banking Group (ASX:ANZ) , and Commonwealth Bank (ASX:CBA) all recorded a buy-to-sell ratio above 50%, which meant an inflow of funds into these names across the platform.

The last time that at least three major banks achieved this feat in the same month was September 2023.

Welcome, GMG

Making its first-ever appearance among the SFW top 20, it’s a big hello to the Australian integrated commercial and industrial property operator Goodman Group (ASX:GMG).

GMG made the grade as the 18th most-traded ASX-listed share by value.

Although money flow was broadly split down the middle in terms of buying and selling, the broader real estate sector fell 7.8% as bond yields climbed higher and investors assessed the prospect for interest rates to stay higher for longer.

Top 20 securities traded by value

What were the most popular ASX shares and ETFs?

Right up top is Neuren Pharmaceuticals (ASX:NEU).

The local pharma’s share price is up about 750% in the last three years, and more than 105% over the last quarter.

So…

Anyhoo… leapfrogging both CSL (ASX:CSL) and BHP, the country’s oldest bank Westpac apparently eased itself into third place among the most popular holdings on the April version of the platform.

While WBC shares slipped 0.5% across the month, the value of community holdings in WBC increased by 3% in the lead-up to the major bank’s half-year results, which were subsequently announced in early May.

Also advancing up the list, Woolworths (ASX:WOW) finished the month in 16th spot. Based on trading sentiment, Selfwealth buyers were largely ‘bullish’ towards the stock, which saw the value of community holdings grow by 3.7%, despite WOW shares shedding 3.8% throughout April.

The supermarket giant was in focus due to a Senate inquiry into supermarket prices, which also scrutinised the company’s profits.

Finally, Qantas (ASX:QAN) returned to the top 20 for the first time since November 2023.

The airline’s share price touched an eight-month high in April. The market responded favourably after the company announced an expansion of its Frequent Flyer program, while also launching an on-market share buyback of up to $448 million Qantas shares.

As with the most popular ETF to buy and sell, Vanguard Australian Shares Index ETF (ASX:VAS) also remains the top held ETF by Selfwealth investors, with Vanguard MSCI Index International Shares ETF (ASX:VGS) in close second position.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.