iPHONEY: Can an Apple even fall off its tree?

Apple rn. Via Getty

If it rallied this year, the stock price of world market’s most valuable company – Apple (APPL) – was either driving, or giving directions.

But Apple shares are now down 9% from their most recent high. In just two days last week the iPhone inventor’s stock comparatively haemorrhaged – giving up 6% – which in APPL-language is circa US$200bn ($311bn) of market cap.

Which in our language is the entire market cap of BHP (ASX:BHP) plus, let’s say, a Macquarie Group (ASX:MQG).

Okay. APPL shares jumped on the subsequent (Friday) session and by the close regained about US$40bn in market value.

Yet here we are. Hot off the apparent confirmation that China really has banned all government officials and a very many state-owned-enterprise flunkies from using an iPhone at work, Apple is looking a little iffy going into one of the biggest days of the pomaceous calendar – the ritualistic unveiling of Apple’s latest world-changing iPhone.

Only – and this is one of the problems – we’re on the eve of the big keynote and it just doesn’t feel very pomaceous, nor world-changing neither.

Going by the lofty APPL standards so beloved of investors like Warren Buffett, it’s been a dismal back half so far.

August was altogether no good for APPL, which saw it hit with a very swift correction after dropping 3Q earnings.

Though the company delivered solid, bordering-on-cracking results, the bar had already been set up in the stratosphere, which can happen if you’re still on a new high going into a big reveal.

And the other problem – the more a stock like APPL slips, the more excited Wall Street analysts get.

They lined up after the share price drop and the earnings call to raise their target prices and wax lyrical of where the iPhone maker might be, with a September product launch just round the corner.

A launch which finds itself bizzarely competing for column inches and social media posts with the US Bureau of Statistics and the latest consumer price index (CPI) read which drops on the same day.

It’s difficult to say which will move markets more.

I could be wrong. I often am, according to a recent survey of Stockhead colleagues.

Maybe the iPhone #15 is dynamite and China’s loss of revenue insignificant.

It could be revealed at 3am tomorrow Sydneham time that the new iPhone can make free cappucinos and read minds, but after 14 previous iterations on the same theme, I’m probably going to be disappointed if it doesn’t.

Even for the diehards, surely it’s getting harder to dress like Steve Jobs and lose your mind over a different colour mix, a more ESG charger, an extra upside-down camera or an inbuilt 22G connection.

What really makes 2023 interesting is that Launch Day – for the first time – is now less about Apple’s new toys and more about Apple itself.

Well, actually, according to APPL it’s about wanderlust, which OFC they’ve reimagined as “wonderlust”…

Wonderlu… I can’t even say it. Wanderlust: The countdown

APPL lost that 6% in a blink.

The fall was a shock, but the situation shouldn’t have been – and that’s also a shock.

China wants to get nutty and expand its ban on iPhones to both government insiders and now all the government-backed agencies and state-run companies.

Fine. It’s not like China hasn’t been acting weird since 2008.

When you make all your stuff in Guangdong and they sell like hotcakes all over the PRC – surely someone, somewhere has gamed out a plan B, C and D for when the US-China trade war (already absorbing the chip industry) spills out onto your backyard.

According to reports out of Bloomberg, APPL just renewed its contract for modem chips with Qualcomm Inc, and that suggests its Plan B to wean itself off China-sourced supply chains and go build its own components isn’t on the fast track, if indeed on any track.

Much is at stake. Ask Buffett’s Berkshire Hathaway.

At the end of June, a full half (circa 50%) of Warren’s entire equity securities portfolio was invested in a single stock.

APPL represents $180bn of Berkshire’s $350bn investment.

Berkshire jumped into APPL just seven years ago, in 2016, and that position has snowballed into a StayPuft Marshmallow monster.

And Buffett is just one among a devotedly bullish army of Apple adorers.

The crowd aren’t used to lingering questions. And right now there’s suddenly a few of them.

Questions swirling around the rarified air of a company worth more than the entire German Bourse:

Did we pass peak iPhone? Is that it for APPL and China? How far will this damage extend? Will APPL need to find a new manufacturer? Can it offset the revenue loss? What cunning Chinese mobile companies could fill the empty seat?

Uncertainty and Apple

As we close in on the big product launch, there’s several core near-term issues investors will want to resolve.

UBS puts them in this order:

1. The materiality of the product cycle upgrades

2. Pricing actions and resulting volume outlook; and

3. The implications of macro headwinds, including restrictions in China

UBS says the string of press reports helped highlight the risk for APPL of demand headwinds out of China.

Then there’s the tit-for-tat style policy initiatives which look like squeezing iPhones sales (and not to mention any other foreign-branded devices in government spaces), but resurgent competition and declining smartphone take-up.

Just in from the cold at a perfect time (surely mere coincidence), China’s flagship brand Huawei’s announced the Mate 60, a top-end smartphone targeted squarely at the domestic China market and at a price devilishly similar to the iPhone.

The buzz in China for this home-made APPL killer is genuine.

That said, the smartphone market in China has declined the past several years to just ~261m units at the end of July 23. Through that decline, however, Apple’s market share grew from 34m iPhones to moving just under 50m units as Huawei ceded unit share.

All else being equal, if the China smartphone market is flat, UBS calculates each point of share shift to Huawei from Apple would be ~2.6m units or roughly a 5% impact on China iPhone units and a ~1% hit to aggregate iPhone units.

China accounts for circa 8% of Apple’s group revenue. So in the end, perhaps 9.5% of Apple’s revenue could be hit if the ban is actually enforced. On the ground though, the hit will be far less, as Apple moves a whole lot of other devices in China.

UBS says an APPL price outperformance through the remainder of the year (particularly after a strong outperformance over the first half and underperformance between July and September) is hinging perilously dependent on beating investor expectations with this iPhone 15 launch.

And then there’s just good old earnings multiples which have never really applied to the Apple.

“Regardless of the iPhone 15 launch, investors are confronted with an earnings multiple that is at a 44% premium to the market, and more than 50% higher than it was when they launched the iPhone 11 (the last time expectations were similarly muted),” UBS noted this week.

The Launch: All you need to know

Every year in September

-

Key platform for building super-hype for the new bits and pieces and then launching a marketing blitz into the December quarter, APPL’s key sales period into Xmas

-

Event takes place Tuesday (LA time, Wed 3am AEST) at the Apple-HQ in Cupertino, California

-

Should feature the unveiling of new hardware, including the iPhone 15.

-

Market expects the release of 4x new iPhone models. That’s the ritual in place since 2020.

-

It’ll kick off with a pre-rec video message from execs, streamed on YouTube and Apple’s website (Apple’s gone for these pre-rec vids for its product showcases since 2020.

-

2022 event went about 90mins.

-

31 million watched Apple’s YouTube video from last year’s launch

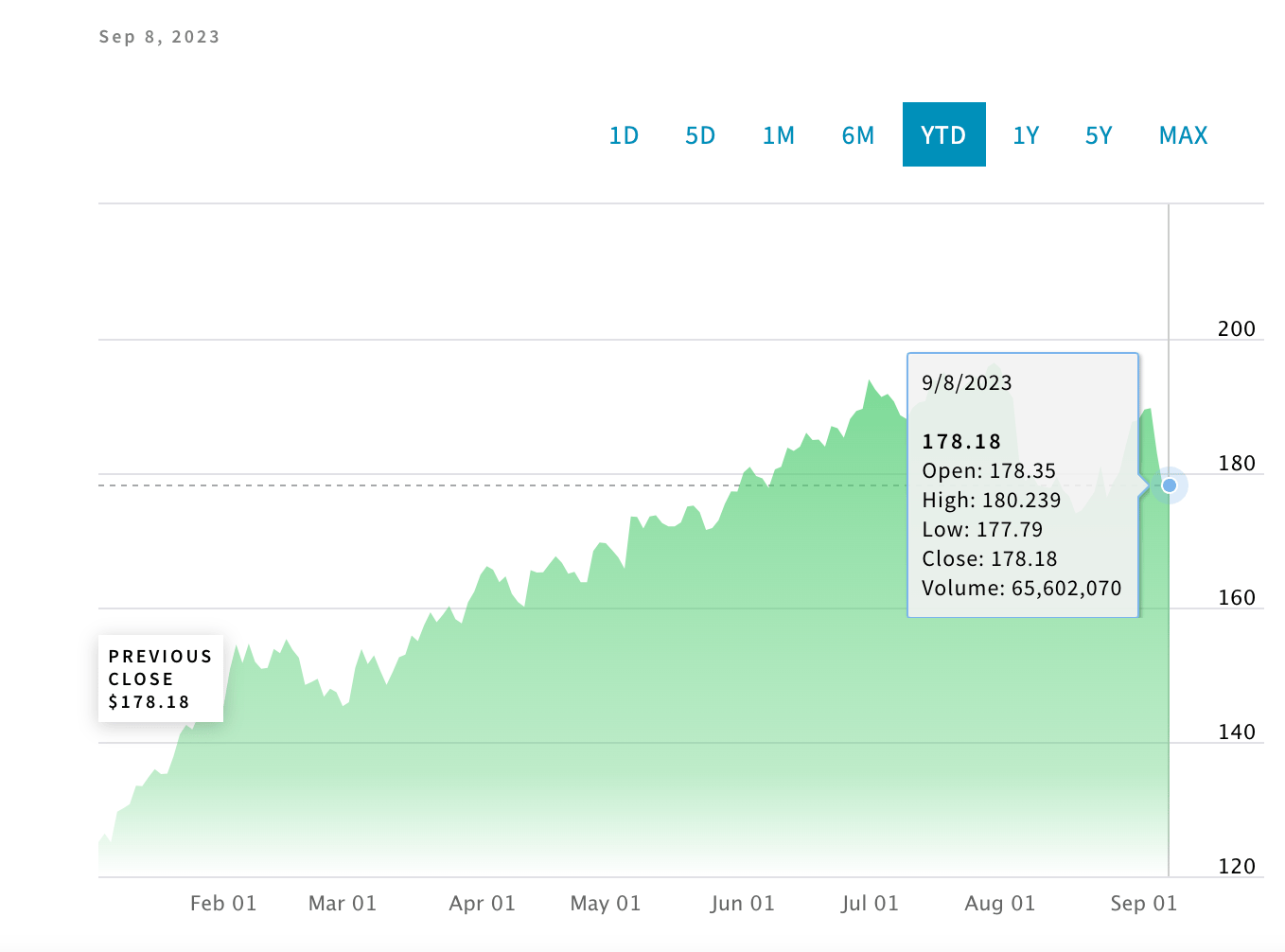

APPL: Year to date

Wall Street Consensus for Apple (APPL): Buy / Price Target US$204.55

Current Share Price US$178.18

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.