Investors favour broad market ETFs as net inflows tumble 34% in Q2 CY22

Pic: Getty Images

- Aussie ETF net inflows fell 34% in Q2 CY22 but remain in positive territory

- Broad market ETFs and diversification in favour as investors overlook thematics

- Aussie equity ETFs in greater favour while international equity ETFs weaken

Australian ETF net inflows tumbled 34% but remain in positive territory at $3.1 billion in Q2 CY22 as volatility took a toll on the sector, according to data released by the ASX and Australia’s largest ETF issuer Vanguard.

Compared to Q1 CY22, industry assets under management (AUM) fell ~10% from $132 billion to $119 billion as rising inflation and interest rate hikes dampen returns.

Vanguard Australia’s Head of ETF Capital Markets (Asia-Pacific) Minh Tieu said despite the fall in AUM he was encouraged to see money flowing into the sector.

“The fall in industry AUM is no surprise given the level of volatility plaguing global markets this year, but we’re encouraged to see net inflows are still positive – a sign that most investors are still relatively undeterred and remain focused on their long-term goals,” Tieu said.

Of these flows, Vanguard received the majority with $2.1 billion, on par with Q1. The Vanguard Australian Shares Index ETF (ASX:VAS) alone accounts for almost one third of industry flows, recording $972 million. Vanguard continues to be the largest ETF issuer in the market.

Aussies favour home equities

Australian equity ETFs also saw a significant uptick with $1.7 billion in inflows in Q2, up 57% quarter on quarter, while international equity ETF flows weakened, attracting $489 million, down 70% quarter on quarter.

“Australian equities saw significant demand this quarter as investors flocked back to familiar names,” Tieu said.

“However, it’s a timely reminder that diversification not only across asset classes but regions too is important – no one country is free of economic or market risk, and there’s opportunity for investors to mitigate divergences in global economic momentum through international securities.”

Thematic ETF popularity drops

Q2 saw the ASX officially enter a correction (a fall of 10% or more) and certain sectors along with US markets finding their way into bear territory (a fall of 20%) or more.

Tieu said investors also displayed a clear preference for broad market ETFs, as evidenced by the overwhelming popularity of VAS.

“Diversification is the single best defence investors can employ when it comes to navigating market volatility. Broad-based ETFs make for a solid portfolio core as they provide investors instant exposure to hundreds of securities, reducing the reliance on the performance of any one company or trend,” he said.

“Some thematic and exotic ETFs on the other hand are novel and narrow in nature and as we’ve seen this year, fare significantly worse when volatility really hits.

“Investors must understand the risks of thematic and exotic ETFs and their underlying exposures before they invest in the hype.”

Stockspot founder Chris Brycki, who has concerns about thematic ETFs, told Stockhead Vanguard’s data mirrors his own research and findings, which found investors had lost more than $100 million by investing in ‘trendy’ or thematic ETFs.

“These trendy ETFs are generally launched to retail investors at the peak of interest in that sector and are usually followed by significant short-term losses,” Brycki said.

He said flows into thematic ETFs in Q2 have decreased by nearly 20% compared to the prior quarter, and fallen by 55% compared to the same time last year (Q2 CY21).

“It shows how during volatile markets investors gravitate away from niche themes and towards safer and more broadly diversified ETFs,” he said.

Active ETFs continue to see outflows, while passive ETFs took in most of the inflows. Nearly $1b was pulled out of active global share ETFs in Q2 – mainly from Magellan. More than $700m was pulled out in Q1.

“Over the first half 2022, broad market passive global share ETFs took in nearly $2.3b,” Brycki said.

“We expect the trend to continue as investors avoid thematic ETFs and active fund managers, the majority of whom underperform a simple index ETF over the long-term.”

Brycki is pushing to see active funds stopped from being branded as ETFs and has put in a submission to ASIC around the naming conventions of different ETF products.

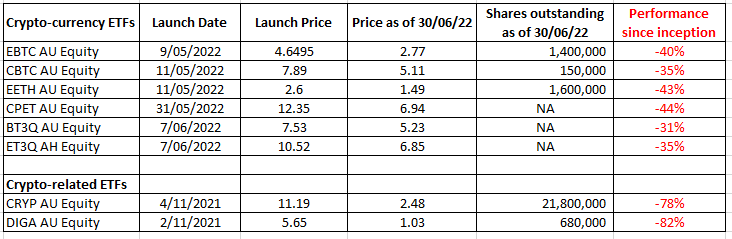

Crypto ETFs feel the pain

It’s been a year of disappointment for crypto investors with Bitcoin down more than 58% YTD. Cryptocurrency ETFs and crypto-related ETFs have consequently felt the pain.

“Most cryptocurrency investors who bought into stocks like CRYP (BetaShares Crypto Innovators ETF ASX:CRYP) would be sitting on a loss now,” Brycki said.

“CRYP, for example, has lost around 80% of its value since launching in late 2021.”

Resurgence in Australian fixed income

Australian fixed income ETFs saw a resurgence amidst rising interest rates in Q2, recording $806 million in inflows, a 148% increase from Q1.

Cash ETFs continued to see outflows in Q2 with -$313 million (Q1: -$555 million) as investors seek higher returns in other fixed income products.

Global fixed income ETFs too saw outflows with -$36 million (Q1: $278 million).

“This past quarter has seen much debate about the merit of bond allocations, but investors will do well to recognise joint declines in equity and bonds are rare and typically brief. The diversification benefits of bonds in the long-run will still outweigh any short-term downturns,” Tieu said.

“An uptick in fixed income flows suggest investors are also capitalising on the higher yields to be delivered by newer bonds as a result of recent rate hikes – a welcome boost for those retired or approaching retirement”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.