Investors are fed up with pumping, dumping, gouging and shorting – and ASIC’s gutless response to it all

Who's a naughty small cap then? Picture: Getty Images

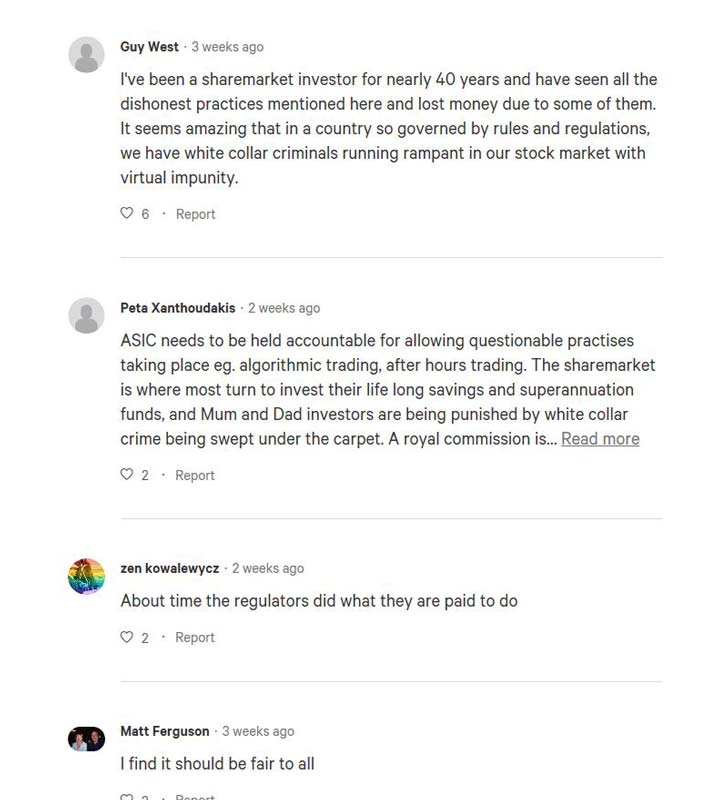

A large group of shareholders have banded together to launch a petition calling for an investigation into the dishonest practices that regulators continue to let ASX-listed companies get away with.

These are the issues the petition highlights as lacking ASIC action:

- Short selling, including during capital raises;

- Exclusive after-hours trading for select parties;

- Algorithmic trading that manipulates prices;

- Collusive trading and coordinated shorting by investment banks;

- Privately owned servers located preferentially inside the ASX;

- Liquidators under-selling company assets, price gouging, and aiding their demise for the benefit of other parties;

- Coordinated pump and dump operations using well known investor forums;

- Manipulated private equity buyouts of iconic companies, looting them and then relisting the gutted shells with inflated valuations; and

- Rampant and blatant insider trading that never leads to prosecution or conviction.

“It’s really the last resort because there’s just so many shareholder groups that I’m involved in that have tried everything now,” Ben Pauley, who is heading the action, told Stockhead.

“You get nowhere with ASIC, they’re not interested, this is when fraud happens.

“I don’t think ASIC has any lack of power; I think it’s that ASIC has a lack of willingness.”

Pauley said he is in contact with between 30 and 50 shareholder groups who have just had a gutful of reporting fraudulent behaviour to ASIC, the Corruption and Crime Commission and the Ombudsman and getting nowhere.

“We want it to be that investors can invest in a company and take the announcements at face value,” he said.

“We shouldn’t have to guess if their announcement is full of lies or not and we feel that the only way investors can feel safe again and we can take announcements at face value is if there’s pressure on directors to tell the truth, to not cheat people.

“There’ll only be that pressure on them to tell the truth if there’s consequences for lying and cheating and stealing.”

Pauley listed off several examples of instances where ASIC had failed to take action.

One of the more serious cases involved LWP Technologies (ASX:LWP). In that case the corporate cop said there wasn’t enough evidence to follow through with prosecution.

LWP’s main business had been the manufacture of proppants — sand-like materials used to “prop” open tiny fractures used to access oil and gas via hydraulic fracturing (or fracking) techniques.

Pauley said shareholders even went to the extremes of going to the company’s factory in India to see what was going on.

“They found it was just a false factory with old ice cream machines which had signs saying alkaline and acid on them,” he said.

Investors alleged that LWP had been involved in undisclosed share placements, stock price manipulation and misleading statements that saw them lose as much as $40m.

Other companies shareholders have called on ASIC to investigate include Orinoco Gold (ASX:OGX), which went into administration in April.

Brazil-focused Orinoco faced numerous problems with production at its Cascavel gold mine, and was facing allegations of poor operating procedures, gold theft and conflicts of interest.

One shareholder told Stockhead in March that many “mum and dad” investors had lost thousands of dollars as a result of Orinoco’s share price dive.

Flinders Mines (ASX:FMS) has also been in the spotlight after it told shareholders it wanted to delist from the ASX.

As part of its plan it wanted to undertake a share buyback using borrowed cash from the iron ore miner’s biggest shareholder, TIO (NZ) Ltd, which has a 55.6 per cent.

“Flinders Mines had their own phone line at ASIC because there were so many complaints,” Pauley told Stockhead.

The Takeovers Panel did look into the situation and after Flinders agreed to withdraw its plans to do both the matter was dropped.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

Nkwe Platinum (ASX:NKP) shareholders lost faith when the company allowed a takeover by major backer, China’s Zijin Mining Group.

Shareholders wanted Zijin excluded from voting on the takeover, but because Nkwe was domiciled in Bermuda, it was not subject to Australia’s corporate laws.

“They just pretty much took the whole company and shareholders were powerless,” Pauley said.

Then there is iron ore explorer IndiOre, which has now rebranded as Elmore. But prior to its latest rebrand it was NSL Consolidated and before that NSL Health.

And, according to Pauley, the new chairman of Condor Blanco (ASX:CDB) who was a former shareholder has been forced to take the former directors to court because ASIC didn’t take any action over their alleged fraud.

ASIC thinks Aussie markets are pretty well behaved

But ASIC reckons Australian equity markets are operating with a “high degree of integrity”.

The regulator recently released a report examining market cleanliness between November 2015 and October 2018.

A clean market is described as one in which prices react immediately after new information is released through the ASX’s market announcements platform.

Abnormal price movements and unusual trading patterns ahead of material announcements could suggest an “unclean market”, ASIC says.

The new report focused on insider trading and information leaks ahead of price-sensitive announcements and found that, despite a deterioration in 2016, market cleanliness improved across 2017 and 2018 to settle around 2015 levels.

On average, just 0.6 per cent of accounts that traded before price-sensitive announcements were deemed suspicious.

ASIC also reckons it is cracking down after receiving so much backlash from investors.

Deputy chair Daniel Crennan QC said at the regulator’s annual get-together in May that the corporate cop is being pushed into more action by a public that’s baying for blood.

In April, Attorney General Christian Porter launched a law review into increasing personal penalties for company directors.

Crennan said the well-publicised new ‘why not litigate’ stance at ASIC was part of a broader societal shift in Australia towards regulation that favours punishment over protective measures.

But he added that ASIC was still committed to using “protective measures” from education through to supervision and enforceable undertakings.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.