Investor discretion advised: It looks like consumer stocks just woke up

Pic: DKosig / iStock / Getty Images Plus via Getty Images

At their own discretion, ASX consumer stocks jumped out of bed late on Tuesday morning ahead of Treasurer Josh Frydenberg’s handing down of an expected cost-of-living Budget. An election Budget, widely tipped to feature cash payments, family subsidies and even a fuel excise to encourage Aussies to get out of the house and spend money (but not catch the virus.)

Perhaps the shops are aligning for the sector that god often forgets. The consumer discretionary sector was climbing happily toward 3% after lunchtime, putting it at number 2 behind tech, the sector that proves God doesn’t exist. That was up 3.5% because Elon.

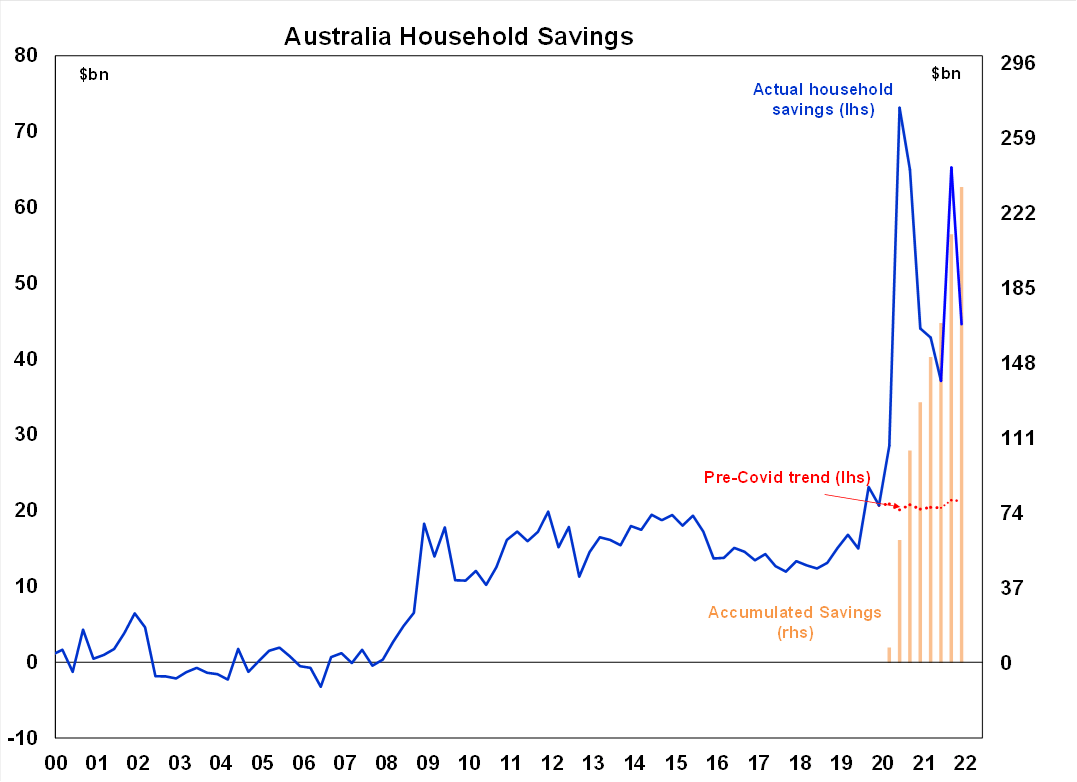

Aussie consumers have built up a massive savings war chest over the past two years of being immobile and agoraphobic. Then there’s been the steady stream of pick-me-ups. Income support, government stimulus, record low cash costs… windfalls which have built up alongside a savings but also because in lockdowns there is little availability to spend.

Diana Mousina, senior economist at AMP Investment, says we’re sitting on an accumulated pot of savings now worth in the vicinity of $240bn – more than 10% of the national Gross Domestic Product (GDP).

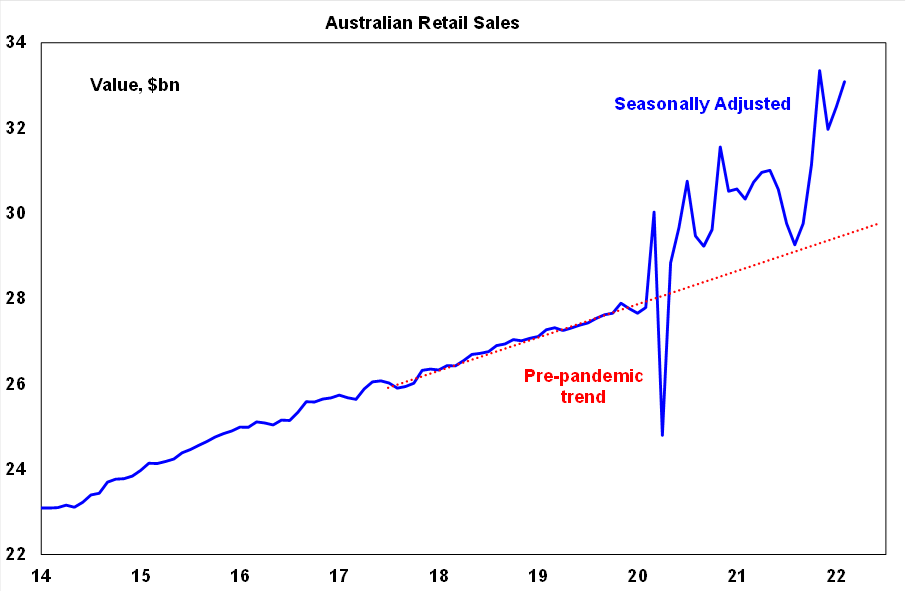

February Australian retail sales rose by a stronger-than-expected 1.8% (consensus was +0.9%).

This follows a 1.6% lift in January.

“Retail sales are now a huge 9.1% higher than this time last year,” Mousina says. “Australian retail spending has skyrocketed over the past two years with the pandemic shifting spending from services to goods over the past two years.”

Actual retail spend vs weakling pre-pandemic spending

In February, the ABS says we hit the town at last, leading to a huge 9.7% rise in “eating out” (which had been drifting and sliding for the prior two months).

Spending on clothing, footwear and personal accessories boomed, jumping over 11.%, while department stores totally killed it, climbing +11.1%.

Household goods retailing rose by a decent 2.3%.

On the bourse, wagering and travel – don’t need a national psychologist to provide running commentary here – were the leading sectors within a sector.

PointsBet up 4.6%, Flight Centre up 3.5%, while IDP Education (+4.5 per cent) and Domino’s (+4.3 per cent) joined the charge.

TabCorp, the wagering firm, within the gaming industry, within the sector, was up by 3.3%

And all while consumer confidence might not be great – the latest weekly ANZ-Roy Morgan measurement has inflation expectations clocking epic, almost decade highs.

The survey remains unchanged with a decline of just 0.1 per cent. Among the states, confidence dropped in Victoria, Queensland and SA, while it rose in NSW and Western Australia.

ANZ head of Australian economics David Plank says the doubt creeping into spending may find a resolution of sorts in the Budget.

“We think this is directly linked to concerns over cost-of-living pressures. It will be interesting to see whether the measures expected in the Federal Budget provide a boost to confidence,” Plank said in a note.

The accumulation nation

Mousina reckons the tide of Australian household savings are good for a splurge or two, but won’t support any longer-term redress for the consumer discretionary plays.

The funds are, “likely to be drawn down in 2022 (this is already happening in the US) as inflation rises especially for non-discretionary items like fuel and fresh food and puts pressure on household purchasing power.”

“A large savings pool provides some buffer for households as inflation rises and interest rates increase which could support retail spending in the short-term, but the savings bucket won’t last forever, especially as consumer spending normalises back to higher services consumption.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.