I just did it: Wall Street’s worst and best in 2022 and the 1 stock to rule them all next year

SACRAMENTO, CALIFORNIA - NOVEMBER 30: A close up of the Nike sneakers worn by Tyrese Haliburton #0 of the Indiana Pacers during their game against the Sacramento Kings at Golden 1 Center on November 30, 2022 in Sacramento, California. (Photo by Ezra Shaw/Getty Images)

Over on Wall Street it’s nearly 2023 and the major indices are headed at pace toward the concrete wall of what will be their worst annual performance since the wonderwall they crashed into we now call 2008.

The Dow has lost nigh on 10%.

The rock solid S&P 500 is down now over 20%.

And looking a little too tech-heavy is the Nasdaq Composite, just a basket case in 2022, easily New York’s worst performer, down 34%.

Twitchy US investors dumped growth stocks as if they were somehow cancerous.

An all but shoe-in go to on the tech index – the greatest stock ever to run wild across a bourse – the otherwise invulnerable Apple (APPL), is down circa 29.3% in 2022.

This is the same Apple that makes MacBooks and iPhones and such. Steve Jobs et al. Warren Buffett hisself calls it his go to when things are hot or not.

He even reckons it’s great in an inflationary environment because Apple has inspired such customer loyalty that they mugs are willing to pay whatever higher prices are required.

Across the road, Bill Gates’ Microsoft (MSFT) is down by about the same.

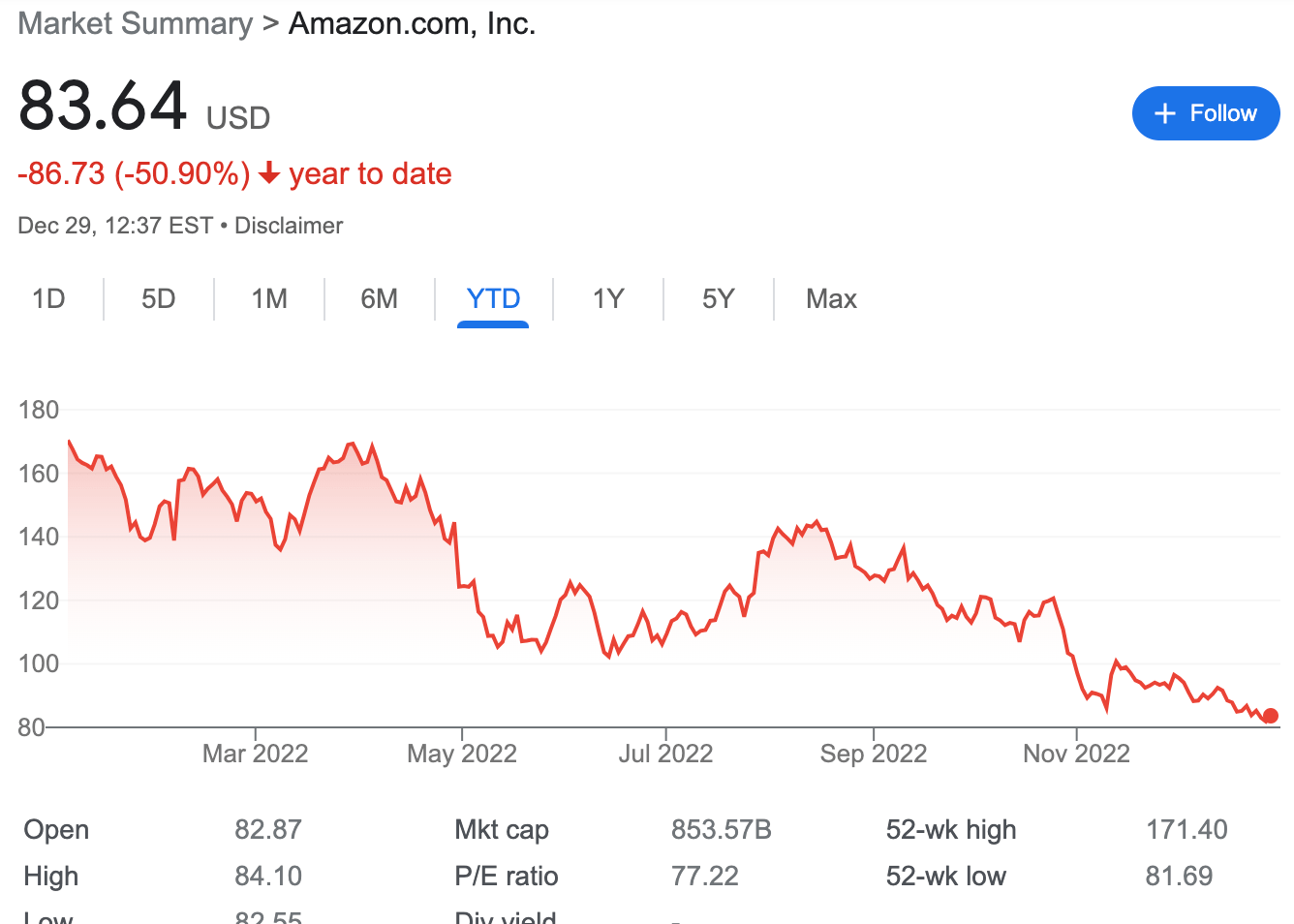

The other FAANG to get bitten real bad, Amazon (AMZN) – this is the same business which seemed like THE solution to life during Covid-19 has dropped by a galling 51%, with a day to burn.

Then there’s Elon’s Twitter and Elon’s Tesla (TSLA). One is done, the other has given up pole position in the meekest possible way – down by an incredible 69%.

Just when you thought we could turn off Elon for a few days, Tesla shares dropped 11% on Tuesday, leaving them 44% the worse in December as Musk spends time and money on Twitter and investors flee on all new production fears in mainland China.

However, shares revved hard on Thursday clawing back about 8% amid a broader gain in the stock market.

And finally, you know it’s all gone to hell in a hand basket when the greatest investment bank to ever bank investments, Goldman Sachs is nursing bruises that are proving hard to heal. There’s job cuts on the way and the GS share price is down well into double figures.

The winners

Unsurprisingly, the meek are not inheriting either the earth or the dividends of war, plague and supply line uncertainties.

That reward is going directly to the major fossil fuel specialists.

The US energy sector is up about 62% in 2022, just smashing every other corner of the S&P 500.

Not even the free lunch sector has gained more than 5% year-to-date.

Best in show as Occidental Petroleum (OXY) has been the biggest gainer of the year in the S&P 500, up 122% year-to-date.

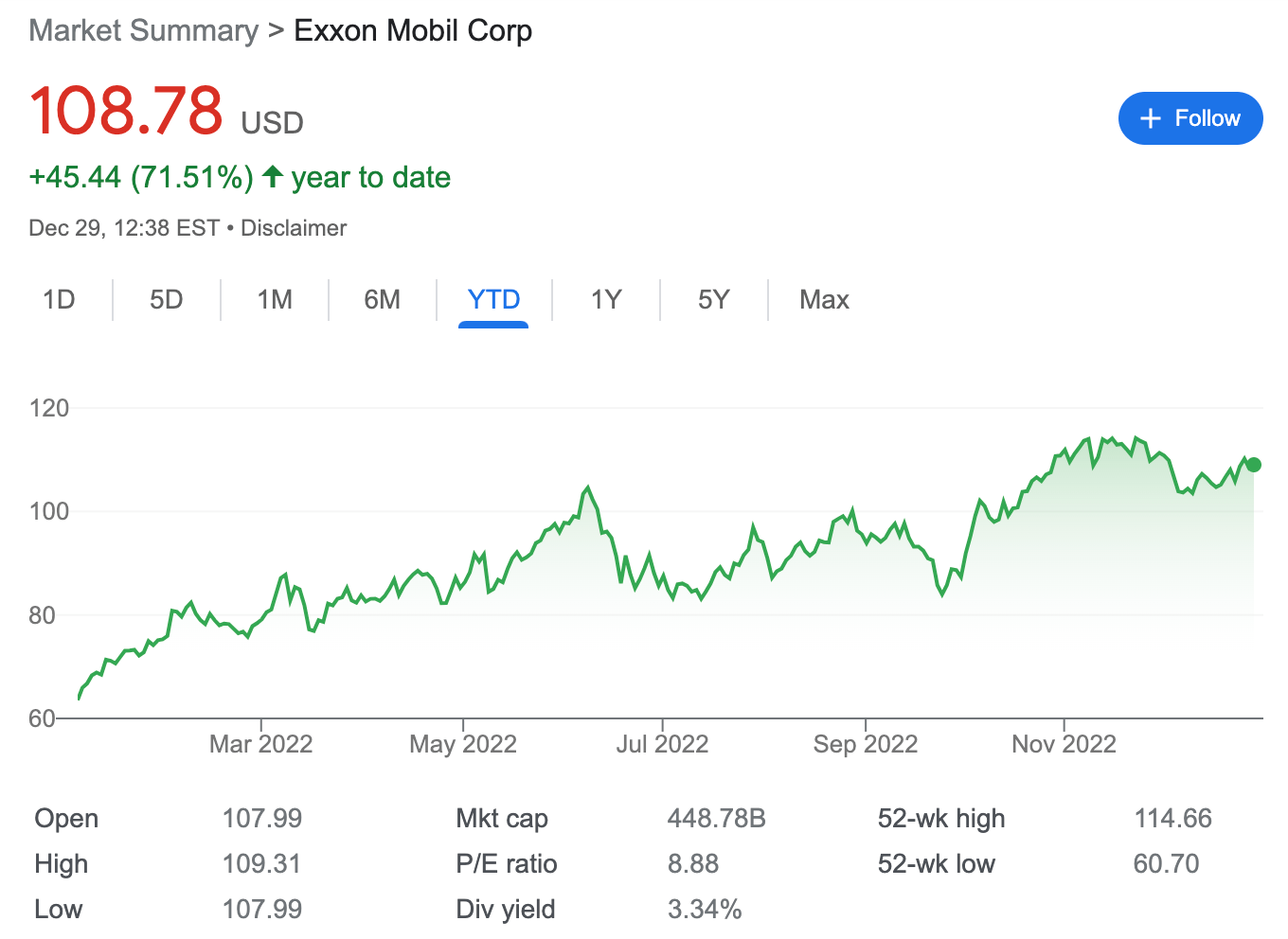

Exxon Mobil is still Wall Street’s fattest listed oil pumper and after enduring a painful stretch of COVID-19, the biggest boy is back in the biggest way, up 79% for 2022 with a day left of play on a very un-green wicket.

Next door, Chevron is up more than half. (53%).

But the other outperformers stateside in the energy sector were Constellation Energy (CEGDX) in second place behind OXY and up 110%.

Hess (HES) comes in a tired 3rd, up some 95%.

Over in London, Shell is up 40%.

They’re going to do it

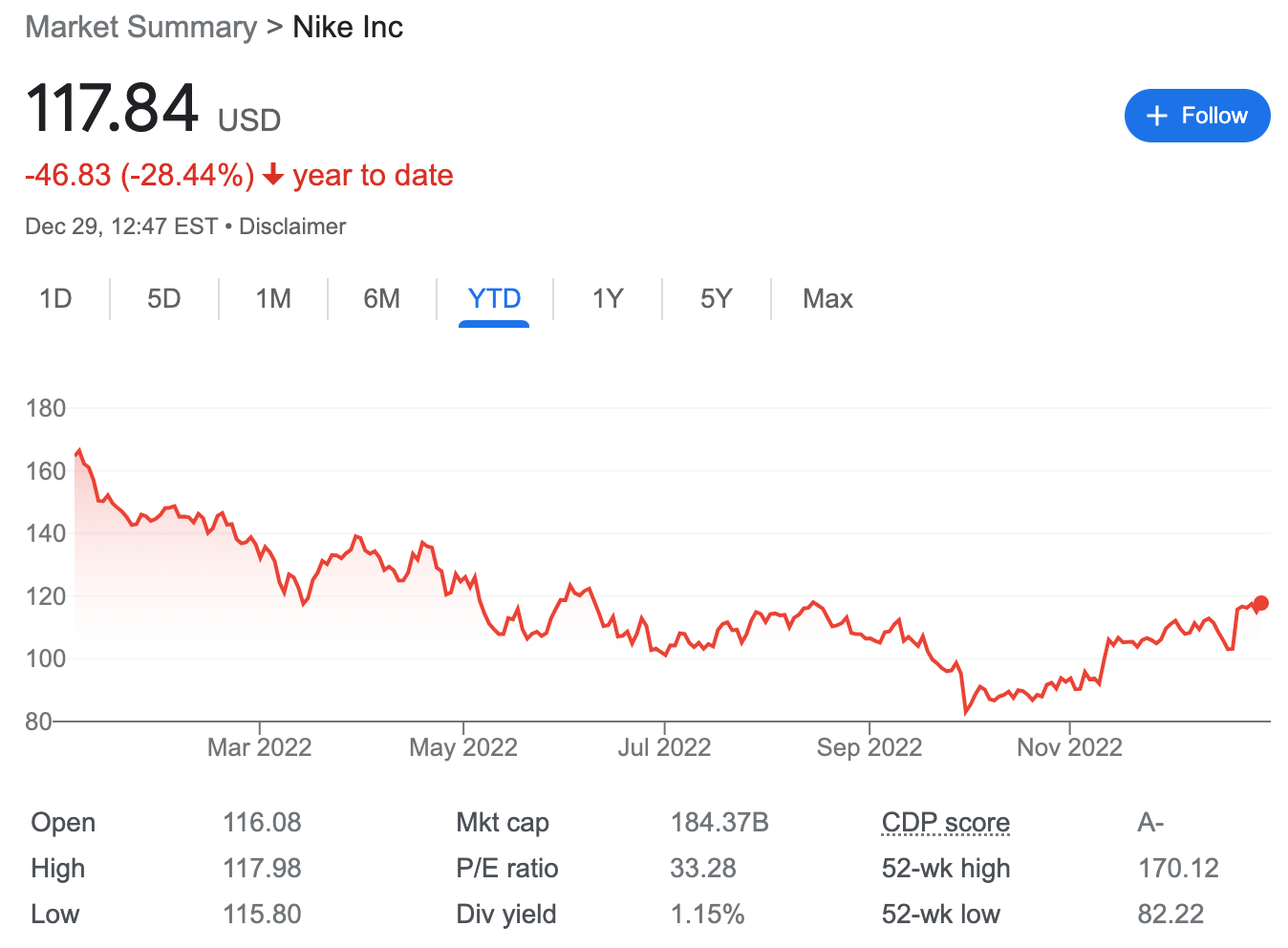

But perhaps the surprise packet as we turn the chicane into 2023 is Nike Inc (NKE).

While shares of Nike jumped about 17% last Wednesday after reporting its second-quarter results, the stock is still about 28% down on where it was this time last year.

And that has investors pumped.

The shoe shop with panache, said fiscal Q2 revenue rose 17% year-over-year to US$13.31 billion, o’er leaping analyst expectations of US$12.57 billion.

Nike reported quarterly earnings of 85 cents per share, a full 25% better than the mere 65 cents per share everyone was anticipating.

Some of these brokers are agog with enthusiasm.

While Credit Suisse see some risk given how much sentiment has improved so quickly, they see Nike as “a must-own discretionary stock for high quality exposure” to what should be the most powerful global consumer story over the next year—China reopening.

Nike’s two most important businesses are at or past their trough – and EPS revisions are more likely to the upside from here.

It’ll be key for Nike to calm market concerns around heavy inventories pushed into the channel and reassure punters that won’t pressure US revenues over the next several quarters.

Credit Suisse has analysed these apparently and they’re suggesting that while retailers were initially worried about the amount of Nike inventory being shipped, it isn’t a biggie because – hey – the Americans are showing up and buying the hell out of the brand anyway.

Keep in mind that most retailers have been worryingly low on Nike inventory for 2 years and are just happy to have enough to flog for the moment.

And while UBS says the product at retail today isn’t the most innovative, being back in stock in heaps of sizes and dazzling colour runs of whatever Nike product is available is driving a lot of business – and “significant market share gains” in the US.

Beyond that, however, it’s the China re-opening (25% of revenues) and Nike’s stabilising market share after 2 years of losses could amplify a slingshot of revenue growth in that important market after FY23.

Nike, Inc (NKE):

-

Crestone Global Best-in-Sector List / Share Price US$105.95 (-2.4%)

-

Consensus Recommendation: Buy / Price Target US$115.19

-

UBS Recommendation: Buy / Price Target US$141

-

CS Recommendation: Outperform / Price Target US$122 (from US$110)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.