How the post-COVID rally marked the best year for stocks since the 1930’s

Investors in London watch fluctuations in the New York stock market during the Wall Street crash of 1929. (Pic: Getty)

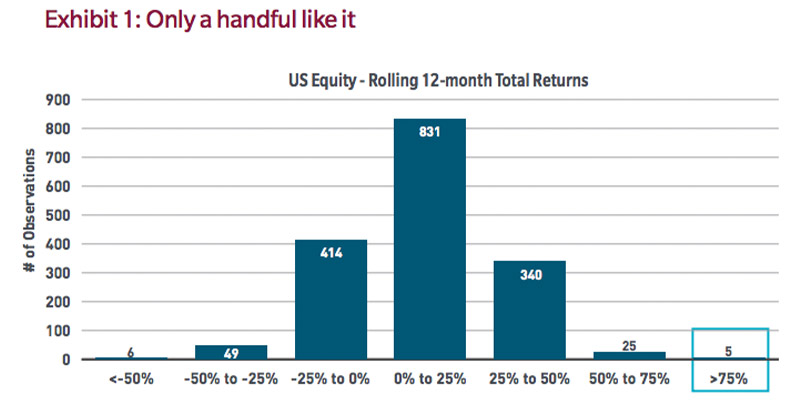

The post-COVID bull market resulted in the largest 12-month rally for stocks since the 1930, according to MFS Investment Management.

Portfolio manager Robert Almeida crunched some numbers this month, following the one-year anniversary since markets bottomed out on March 23, 2020.

Since then, the US S&P500 index posted a trailing 12-month return of 77 per cent, Almeida said.

He then put the rebound in a historical context by calculating the one-year return for every month-end going back to…1882.

And the data showed that last year’s stimulus-led bull market really was unique:

Over the last 139 years, there were only five other occasions when the S&P500 posted a trailing 12-month return of at least 75 per cent.

All of them were in the 1930’s, as markets slowly recovered from the Great Depression in what Almeida noted was “another period of extraordinary government economic intervention”.

Markets are ‘not dumb’

Almeida noted that by nature, the stock market is a forward-looking beast.

That means investors “tend to ignore seemingly material factors such as high unemployment while zeroing in on things that really matter, such as free cash flow generation”, he said.

Applied to the 1930’s, that means investors looked through the suffering of the depression to assess the impact of the US government’s ‘New Deal’ economic relief programs.

And applied to the COVID-19 response, the same market mechanisms were in play. There was a period of abject panic, followed by record amounts of fiscal and monetary stimulus.

Before long, investors began to “look through the uncertainty surrounding the virus, to what could be a massive snap-back in US economic growth in the second half of 2021”, Almeida said.

In that sense, markets are “not dumb”, and it pays to look at what markets are signalling.

And Almeida says you don’t need to be an economist to realise that a surge in household savings rates (true for both the US and Australia) combined with pent-up demand from extended lockdowns “should lead to an enormous pop in economic growth”.

In the early stage of a market cycle, companies aligned with that growth typically outperform — even if they have highly leveraged balance sheet or aren’t making a profit.

But while markets may not be dumb, their view of the future is typically short-term in nature, Almeida noted.

Right now, the short-term outlook is defined by the economic snap-back while interest rates stay anchored at rock-bottom.

At some point though, “financial markets will look through what will likely be eye-popping economic stats”, he said.

Instead, “they will begin to discount what business fundamentals will look like without the tailwind of exceptionally accommodative fiscal and monetary policy”.

And when it does, stocks that have hitched a ride to cyclical post-COVID tailwinds may fall out of favour if their economic fundamentals don’t match their valuation.

“We believe secular trends will win out in the long run, rewarding patient investors as the cycle matures,” Almeida said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.