House prices rise again, although pace of growth ‘could slow’

(Pic: Getty)

Australian house prices are still climbing fast, although we may have already passed the “peak rate of growth”, CoreLogic says.

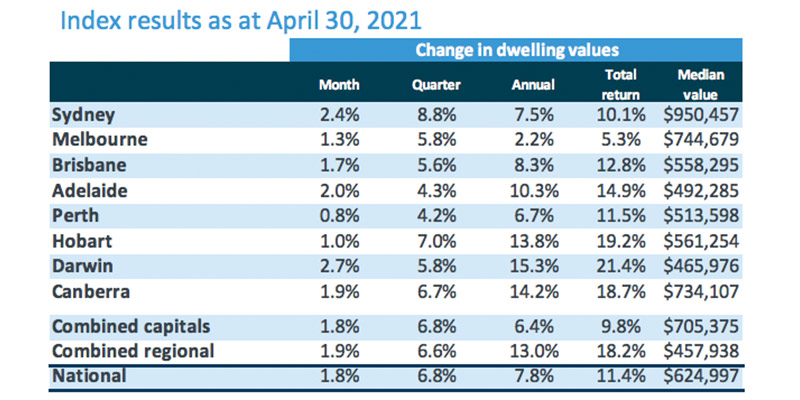

The property research group’s latest set of data showed house prices rose nationally by another 1.8 per cent last month.

Across major markets, Sydney led the pack with a big 2.4pc jump, while Darwin continued to rebound with a 2.7pc gain.

Find your capital here:

Sea change

Among the notable stats, post-COVID demographic shifts have seen annual house prices in regional centres climb by 13pc — more than double that of the capital cities.

And while Sydney joined the party this month, annual gains in capital cities have been led by the smaller centres such as Darwin, Adelaide and Hobart.

Property rents in Sydney and Melbourne have also been weaker, with rents climbing the fastest in Perth and Darwin.

Rental conditions in the high-density east coast capitals have copped the brunt of the post-COVID clampdown on international migration, saw Tim Lawless, CoreLogic’s head of research.

“Prior to COVID, Melbourne and Sydney accounted for around three quarters of overseas migrants into the capital cities,” he said.

Market risks

A combination of factors — high savings rates, rock-bottom interest rates and strength in the jobs market — have lit a fuse under Aussie house prices, which earlier this year rose at the fastest monthly rate since 2003.

Looking ahead, Lawless thinks prices will keep rising, although “there are mounting signs the housing market has moved through a peak rate of growth”, he said.

Describing the pace of growth in the March quarter as “unsustainable”, he said conditions are softening slightly as new supply comes to market and demand constricts due to “affordability constraints”.

But for now, the RBA is committed to no interest rate increases until “2024” at the earliest. With rates expectations anchored, Lawless thinks prices will continue rising through 2021 and into 2022.

The pace of house price gains has also raised the prospect of another round of macro-prudential measures, which have served to put the brakes on property gains in the past.

But CBA thinks that’s unlikely, while both the RBA and APRA have “also noted there has been little evidence of a deterioration in lending standards to date”, Lawless said.

For property watchers, another key data set to monitor will be monthly employment figures, Lawless added.

The strength of the rebound in Australia’s jobs market has “surprised the entire forecasting fraternity”, CBA economist Gareth Aird said last month.

Further falls in the unemployment rate and the possibility of long-awaited wage gains will “provide an important bearing for housing market outcomes”, Lawless said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.