Hot Money Monday: Adbri and Comet Ridge have all the momentum right now

momentum traders seek out stocks that are on the rise, riding the wave of positive momentum for maximum profit. Picture Getty

Momentum investing works on the theory that strong stocks will continue to rise in price, while weak stocks will continue to decline.

On the up side, momentum traders seek out stocks that are on the rise, riding the wave of positive momentum for maximum profit.

Whilst a short-term momentum trading strategy focuses on identifying short-term price trend, which can range from a few minutes to hours or days, long-term momentum traders take a more extended outlook, using weekly and monthly charts to identify longer-term uptrends.

Obviously there’s a bit of risk involved in momentum trading because in essence, you’re making a decision to buy a stock based on recent buying activities of other traders.

So to be a successful momentum trader, one needs to be able to identify the best stocks quickly and accurately.

The goal for momentum traders is basically to enter into trades at key points in the trend in order to maximise profits.

There are several indicators to quantify momentum, and here we look at three main signals used by the market:

- 52-week high

- Simple Moving Average

- Relative Strength Index

10 ASX small caps nearest or at 52-week highs

Traders often view the 52-week highs as entry signals.

This is due what’s called the “52-week high effect” – where if a price has broken out above its 52-week range, there must be some factor that generated enough momentum to further continue the price movement in the same direction.

On the other hand, if a stock is far away from its 52-week high, chartists believe the momentum will continue going that way.

10 ASX small caps at 52-week high

(data from Commsec)

| Code | Name | Price | How far from 52-Week High? | 1 mth return | 6 mth return | 12 mth return |

|---|---|---|---|---|---|---|

| COI | Comet Ridge | $0.20 | 0.00% | 21.88% | 21.88% | 18.18% |

| ALA | Arovella Therapeutics | $0.14 | 0.00% | 62.65% | 200.00% | 462.50% |

| FRM | Farm Pride Foods | $0.18 | 0.00% | 24.14% | 44.00% | 79.91% |

| LYL | Lycopodium | $11.62 | 0.00% | 13.04% | 18.45% | 69.88% |

| IMB | Intelligent Monitoring | $0.42 | 0.00% | 56.60% | 137.14% | 174.87% |

| AAP | Australian Agricultural Projects | $0.02 | 0.00% | 16.67% | 75.00% | 16.67% |

| RIC | Ridley Corporation | $2.64 | 0.00% | 17.33% | 35.73% | 31.34% |

| NME | Nex Metals Explorations | $0.03 | 0.00% | 36.36% | 50.00% | 50.00% |

| CAF | Centrepoint Alliance | $0.31 | 0.00% | 10.71% | 44.19% | 37.78% |

| SIO | Simonds Group | $0.21 | 0.00% | 10.53% | 40.00% | 75.00% |

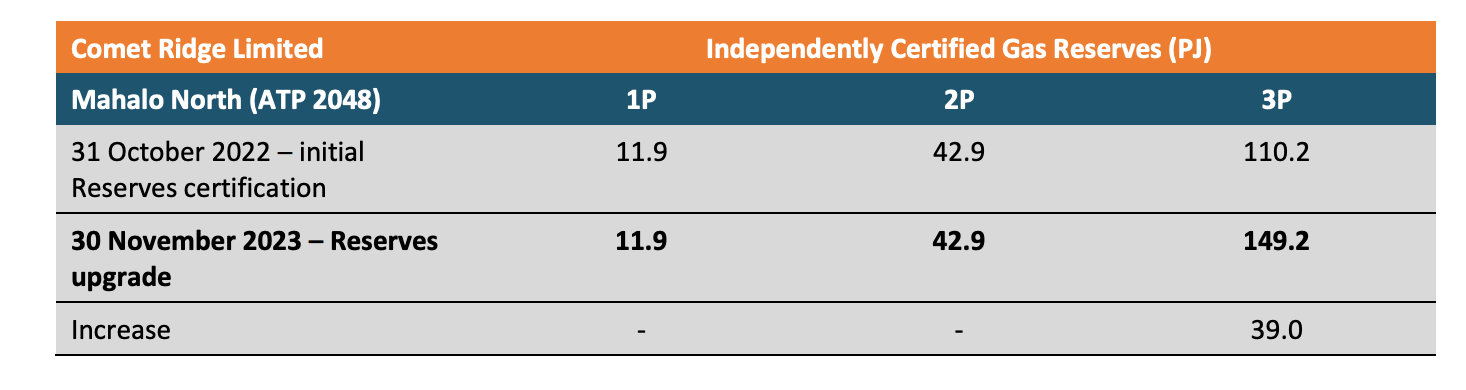

The coal seam gas (CSG) exploration company recently said that an independent global energy consulting and advisory firm, Sproule Incorporated, has upgraded its estimate of certified 3P Gas Reserves for the Mahalo North Project.

No changes to the 1P and 2P Reserve categories have been recorded.

However, optimisation of the project design for Mahalo North during pre-FEED studies has led to an increase in the developable area for the project’s 3P Reserves as below:

The engineering company won a string of contracts recently.

It was awarded a contract from Barrick Lumwana for the Feasibility Study and Basic Engineering for the expansion of Barrick’s Lumwana copper mine in Zambia.

The contract is valued at approximately $19 million, with the project having a capital cost investment of almost US$2 billion.

Lycopodium also won the Engineering, Procurement and Construction Management (EPCM) services contract for the Yanqul Copper Gold Project in the Sultanate of Oman, being developed by Mazoon Mining LLC.

The EPCM services contract is valued at approximately $45 million based on a 1.65 Mtpa throughput capacity process plant.

The company was also awarded an EPCM Services contract by FG Gold’s Baomahun Gold Project in Sierra Leone. Advancement of the project is subject to FG Gold attaining financial close.

This EPCM Services and Supply contract is valued at approximately $100 million, with work anticipated to commence in Q1 2024.

10 ASX small caps with prices above SMA

Simple Moving Averages (or SMA) is another indicator that can be used to gauge momentum.

SMA is often used to determine whether a stock price will continue in the same direction, or if it will reverse a bull or bear trend.

As a general rule, if the current stock price is above the SMA, the price trend is up. If the price is below the SMA, the trend is down.

10 ASX small caps at prices above SMA

(data from Commsec)

| Code | Name | Last Price Value | Price vs. Simple Moving Average | Price vs. 20 day SMA | Price vs. 50 day SMA | Price vs. 200 day SMA |

|---|---|---|---|---|---|---|

| ABC | ADBRI | $3.01 | >5% Above SMA | >5% Above SMA | >5% Above SMA | >5% Above SMA |

| FL1 | First Lithium | $0.57 | >5% Above SMA | 0 to 1% Above SMA | >5% Above SMA | >5% Above SMA |

| ADY | Admiralty Resources NL | $0.01 | >5% Above SMA | >5% Above SMA | >5% Above SMA | -1 to -5% Below SMA |

| AEI | Aeris Environmental | $0.04 | >5% Above SMA | >5% Above SMA | >5% Above SMA | 1 to 5% Above SMA |

| AGI | Ainsworth Game Tech | $1.30 | >5% Above SMA | 1 to 5% Above SMA | >5% Above SMA | >5% Above SMA |

| CT1 | Constellation Tech | $0.00 | >5% Above SMA | 1 to 5% Above SMA | 1 to 5% Above SMA | < -5% Below SMA |

| AJL | AJ Lucas Group | $0.01 | >5% Above SMA | 0 to 1% Above SMA | -1 to -5% Below SMA | < -5% Below SMA |

| A1N | ARN Media | $0.99 | >5% Above SMA | 1 to 5% Above SMA | 1 to 5% Above SMA | 0 to 1% Above SMA |

| AUZ | Australian Mines | $0.01 | >5% Above SMA | < -5% Below SMA | < -5% Below SMA | < -5% Below SMA |

| SIG | Sigma Healthcare | $1.00 | >5% Above SMA | >5% Above SMA | >5% Above SMA | >5% Above SMA |

The cement company has been rising since announcing that the Kwinana Upgrade Project cost and timing remains on track.

Kiwana is Adbri’s modern state-of-the-art facility that will consolidate the company’s two existing cement production sites.

The company says it is a strategic investment that will strengthen Adbri’s long-standing position as a sustainable, low-cost cement supplier in Western Australia.

Adbri also expects to record full year underlying EBITDA within the range of $310-$315 million, moderately exceeding the outlook provided at the half-year results in August.

Capital expenditure for 2023 is expected to be within the range of $310-$320 million, lower than the $330-$350 million estimate provided at the half-year results.

AUZ recently signed a a binding agreement to acquire two, 100% owned, exploration projects in Brazil, namely the Jequie Rare Earth Project in Bahia, and the Resende Lithium Project in Minas Gerais.

The Jequie project is targeting rare earths/niobium and is located adjacent to Brazilian Rare Earth Ltd.

The Resende project is located within the Sao Joao del Rey Pegmatite Province and lies to the east, within ~17km of AMG’s Mibra Mine, a producer with annual total capacity of 130,000 tonne of lithium concentrate.

Pegmatites and occurrences of lithium indicator minerals have been identified within the licences, with no previous exploration for lithium.

10 ASX small caps with low RSI (Oversold)

Here’s another momentum signal used by the market – the Relative Strength Index (RSI).

RSI is a measure of the strength of a stock’s momentum, either in the upward or the downward direction, and is used to indicate whether a stock is oversold or undersold.

Generally speaking, an RSI above 70 means a stock is overbought; and an RSI below 30 indicates that it’s oversold.

An RSI above 80 meanwhile is strongly overbought, and an RSI below 20 is strongly oversold.

10 ASX small caps at prices with RSI Oversold signal

(data from Commsec)

| Code | Name | 2 Day RSI | 9 Day RSI | 14 Day RSI |

|---|---|---|---|---|

| AQC | Australian Pacific Coal | -- | Oversold | -- |

| CYL | Catalyst Metals | -- | Oversold | -- |

| KGD | Kula Gold | -- | Oversold | -- |

| SAN | Sagalio Energy | -- | Oversold | -- |

| MSG | MCS Services | -- | Oversold | -- |

| SHM | Shriro Holdings | Oversold | Oversold | -- |

| NMR | Native Mineral Resources | -- | Oversold | -- |

| UBN | Urbanise.Com | -- | Oversold | Oversold |

| CHR | Charger Metals | Oversold | Oversold | -- |

| REC | Recharge Metals | Oversold | Oversold | -- |

The gold explorer has recently updated its Plutonic and Trident Mineral Resource and Ore Reserves.

Since taking control of those projects in June, Catalyst has been undertaking this re-estimation process.

Mineral Resources and Ore Reserves for the Plutonic Main deposit are: Resources – 17.9Mt at 2.9g/t Au for 1,654,000oz, and Reserves – 5.2Mt at 2.9g/t Au for 490,000oz.

Mineral Resources for Trident are: Resources – 4.2Mt at 3.7g/t Au for 508,000oz.

Trident Definitive Feasibility Study (DFS) is well progressed, and Reserves are expected to be released with this study in 2024.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any perceived financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.