Healthy, wealthy and semi-clad: It’s only halftime on the ASX but beats outnumber misses 2:1

Stronger, More Handsome and even a bit Richer. Via Getty

By the close of business last week the Aussie reporting season inched past the halfway mark, with some 51% of the All Ordinaries market cap in the earnings bag.

And it’s been pretty damn good.

According to the local crew at UBS, there’s been a Beat vs Miss ratio so far of around 2 to 1. Yesterday’s mixed bag might not have helped that equation, but the numbers, if not the investment banks, certainly don’t lie.

A little bit better than expectations is a lot better, even as those expectations continually diminish as the plethora of economic and market dramas swirl around our negligible corner of the universe.

Guidance has been ever-cautious and companies are still getting revised lower on the back of corporate uncertainty and a good old-fashioned refusal to provide any kind of guidance which might get someone into trouble.

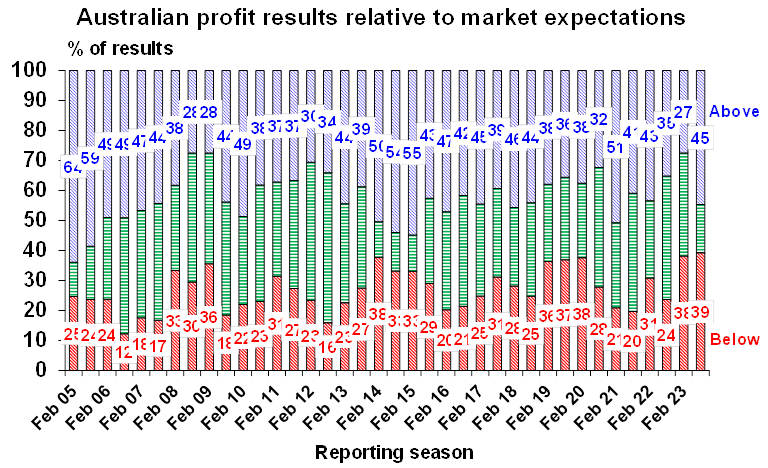

According to the seers at AMP Capital, 45% of ASX companies have surprised them to the upside, which is just above AMP’s long-term norm of 43%. And it’s a veritable smash vs the February reporting season when it was just 27%.

By the end of play last week, the measure of ASX participants by company looked closer to 35-40% done and dusted with the bulk of the balance due to drop over the next five fun-filled days.

The owner of the terrific head on the Head of AMP Capital’s Investment Strategy and their chiefest economist, Shane Oliver (PHD), says 54% of companies have seen earnings rise on a year ago – similar to February – but this is down on the norm of 63%.

And, he adds, only 48% of those reported have lifted their dividends on a year ago which is less than the norm of 58%, suggesting a degree of caution, and less companies than normal have seen their share price outperform the market on the day they reported.

Half news is good news

With circa 50% of the ASX200 having now spilled their beans, the local team at Swiss investment bank UBS say the trends are pretty clear and consistent:

Earnings beats are still outnumbering misses by a ratio of 2:1 and the bank says this “illustrates the underlying strength the domestic economy has enjoyed for much of the last six months.”

“However, with a slowing top line, sticky inflation and labour challenges clouding the outlook, consensus analysts have continued to revise down their expectations on FY24 profits by a ratio of 3:2,” UBS adds.

And reiterating what we already know, UBS reckons twice as many Aussie companies have gone and issued negative guidance (vs positive guidance) after sharing their numbers.

Although outlook statements point to a slowing top-line growth environment, UBS still sees the No #1 challenge for companies as the successful juggling of costs on a bumpy road ahead.

“(The biggest challenge) remains on the costs side. Across sectors, management teams are pointing to the cost growth they are seeing from labour, rent, energy and domestic transport.

“Despite this headwind, margins appear to be holding up, as companies have been able to pass on these higher costs. How much longer this can continue remains the key outlook variable.”

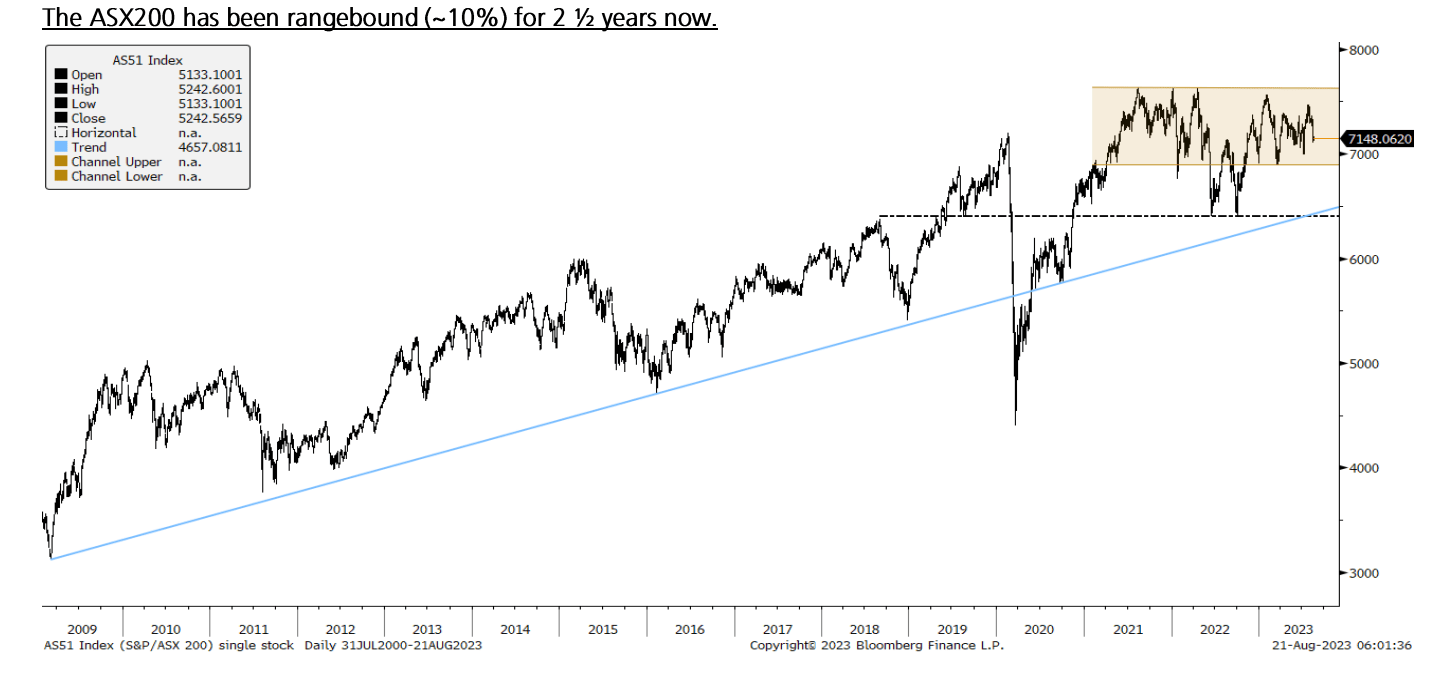

Doc Oliver says we ought to have been looking for trouble from a way back, as sharemarkets around the world look to be entering a correction.

“For some time we have been concerned about the risk of a correction for shares given strong gains for the direction–setting US share market into July which left it technically vulnerable as we came into the seasonally weak August to October period.”

From the dizzying July highs, US and local equities have pulled their heads in during the last few months by circa 6-8% and 4-5% respectively.

It’s the correction we had to have.

But admittedly, dangers lie in wait and include such hits as:

- Still high risks of recession

- Intensifying risks around the Chinese economy

- A pause in disinflation in response to higher energy prices and sticky services inflation

- Central banks still at risk of more hikes

- The high risk of another US Government shutdown from 1 October;

- Rising bond yields.

“We would regard further falls as part of a correction though and we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild,” Dr Oliver adds.

Here’s his summary, verbatim:

“…Of course, there is still a way to go yet and companies with good results have a tendency to report early. Key themes so far are that: cost pressures remain a challenge; building material companies are still benefitting from strong activity although there are expectations of a slowdown; insurers are seeing margin improvement (at the expense of their customers with big premium increases); so far home borrowers are keeping up their payments (but rate hikes have yet to fully flow through); and corporate guidance has been cautious with more negative than positive guidance and retailers in particular are warning of tougher conditions.

Partly reflecting the cautious outlook guidance consensus earnings expectations have been revised down since the reporting season started.

The consensus is now for a +1.8% rise in earnings for 2022-23 and for a -5.4% fall in earnings in 2023-24, with both revised down from +2.5% and -0.8% respectively at the end of July.”

What Morningstar learned last week

Considering the resilience of the local economy, my legendary colleague over at Morningstar, Christine St Anne shared these four takeaways to chew over with the week ahead in mind:

Take-away #1: Discount retailers will also feel the pinch

JB Hi-Fi (ASX: JBH) reported a lift in sales of nearly $10 billion, up from $9.2 billion in fiscal 2022. Its underlying earnings-per-share was 13% better than Morningstar’s expectations, outperforming its peers and tearing off more market share in consumer electronics and home appliances.

Morningstar equity analyst Johannes Faul expects JB Hi-Fi to retain the market share gains but also expects its profit margins to “revert to maintainable levels reflecting the lag effect of rising costs of doing business”.

Full year dividends of $3.12 was also ahead of Morningstar’s $2.74 forecast, representing a 65% payout ratio.

Faul expects the retailer to keep this dividend payout ratio level over the long-term, he forecasts lower near-term profits.

“For the month of July, we calculate that JB Hi Fi’s Australian sales declined by 5%.”

Take-away #2: Employment to return to pre-COVID-19 levels

Our largest online listing platform Seek (ASX:SEK) reported a 10% lift in revenue as well as a 7% increase in its dividend. Job listings fell 4% compared with the prior corresponding period with job ad volumes slowing following record levels in March 2022.

The results were broadly in line with Morningstar analyst Roy Van Keulen’s expectations, although SEK’s “deceleration has come in sooner than expected”.

Following the pandemic, Seek’s business was boosted by supportive fiscal and monetary policies as well as changing attitudes to work life balance.

Which Van Keulen says led to the “great resignation” and a “booming job market”.

But that was then, and this is now.

“Greater unemployment means advertisers are less likely to pay for higher tiers to make their listings stand out,” Van Keulen said, adding that “one leading indicator supporting this assumption is the number of applications per ad, which were down almost two-thirds through COVID-19 but are now back to pre-COVID-19 levels”.

Take-away #3: A building recovery on the horizon?

Fletcher Building’s (ASX: FBU) earnings are tied to construction activity in Australia and New Zealand. Underlying fiscal 2023 earnings before income and tax rose 6% to NZD 798 million in line with Morningstar’s expectations. Although sales disappointed, coming in 6% below Morningstar’s forecast, the group’s earnings-before-income-and-tax (EBIT) margin of 9.4% was stronger than anticipated for Morningstar analyst Johannes Faul.

“A solid outcome given the cyclical challenges facing the New Zealand and Australia construction sectors”.

On his assessment, resilience in Fletcher Building’s materials and distribution divisions was the driving force behind higher EBIT margins at the group level.

In particular, the Australia business, which accounts for 21% of group EBIT, showed significant improvement in fiscal 2023.

“We now think we are further through the construction downturn than previously credited, and we bring forward timing for the anticipated cyclical upswing,” Faul said.

Take away #4: Bad debts not expected to mirror a rise in mortgage stress.

Like the Commonwealth Bank (ASX: CBA) which escaped alarming levels of rising bad debts while dropping massive profits, National Australia Bank’s (ASX: NAB) Q3 cash profit of $1.9 billion was big and without obscene bad debts rising from (admittedly) low levels.

Morningstar’s Nathan Zaia says while these bad debts are low, they’re likely to present ‘a drag on earnings in fiscal 2024.’

Bad debt expenses for NAB now represent around 0.14% of loans on an annualised basis. Arrears past 90 days increased to 0.71% from 0.66% in the previous quarter but are still low in comparison with 0.93% in the September 2019 half, according to Zaia.

And despite bad debts trending upwards, Zaia doesn’t see this playing out as a flood of mortgage stress.

Zaia believes that borrowers will just cut their discretionary spending to meet repayments and serviceability levels are still manageable.

“We gain significant comfort that loans were made with a 3% serviceability buffer, labour and rental markets are tight, and housing demand has so far prevented significant house price falls. Few are forced sellers in negative equity”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.