Global equity markets have ignored COVID-19 since March crash, study shows

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

A new study verifies what we already suspected – there is no correlation between COVID-19 cases and market performance.

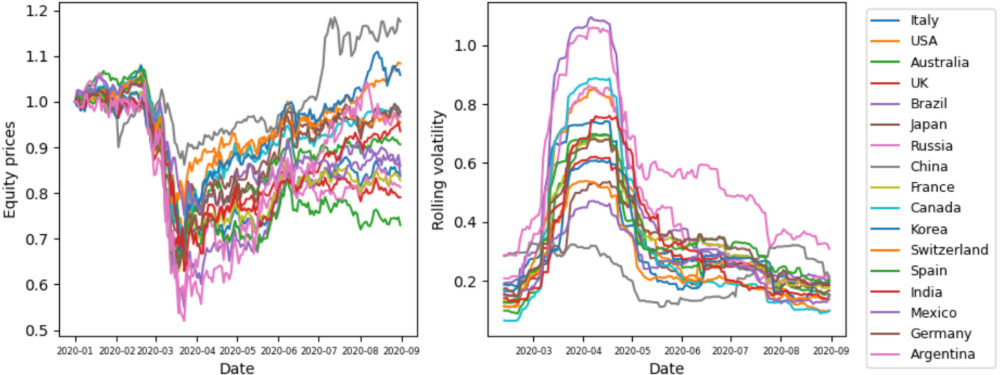

The study analysing the impact of COVID-19 on global equity markets since the March crash show that market movements have been highly uniform between countries.

Equity markets in 16 of the 17 countries studied show remarkable similarities, despite experiencing subsequent waves and peak cases at different times over the past eight months.

China has been the only outlier.

In March, China’s index experienced a less severe drawdown than every other country.

In July, China experienced a period of significant positive growth, unlike any other country.

The study also proves that there’s no relationship between COVID-19 cases and market performance.

This data could be useful to investors.

“The identification of a single country’s index behaving differently from the rest of the collection, in this case China’s, could provide opportunities for diversification of holdings and portfolio gains,” the researchers say.

“[And] the finding that the equity markets have been highly uniform, despite considerably differing trends in COVID-19 cases and deaths, may encourage policymakers to be more aggressive in pursuing containment measures.

In other words, if markets don’t respond badly to aggressive shutdowns, countries could prioritise public health “with reduced concern about harming their equity index”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.