Fitch is bullish on China, bearish on gold, and ‘meh’ on oil in 2021 and beyond

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Analysts are increasingly upbeat on the global economy in 2021 as the vaccine rollout accelerates – but it’s increasingly clear that China is experiencing a recovery like no other.

China has already recovered to pre-crisis levels of output, while most other major economies remain much smaller than before the crisis, Fitch Solutions says.

“In many countries, it will take years for output to return to the level reported in 2019,” it says.

“It is increasingly clear that China is experiencing a recovery unlike that in any other large emerging market.”

Fitch expects that China’s GDP will grow by 10.2 per cent in real terms in 2021.

This will provide a boost to economies which are closely linked into Chinese supply chains. Like Australia.

“Even Asian economies – such as India – with less direct exposure to China will still experience strong growth next year due to rising global demand and significant base effects,” Fitch says.

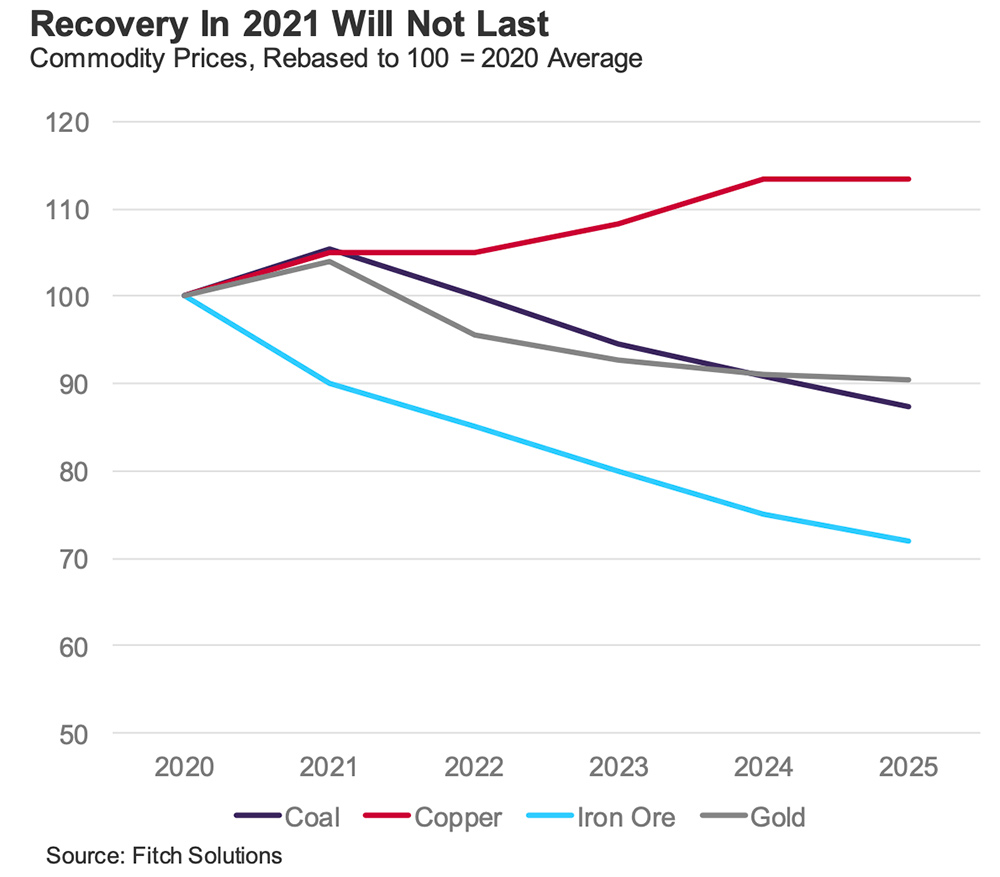

Copper goes up, gold goes down

Metal prices will rise as the global economy strengthens in 2021, but iron ore and coal will then fall between 2021 and 2025, Fitch says.

“Heavy industrial products will suffer due to slow growth in many key economies, and China’s gradual transition towards a more consumer focused growth model,” it says.

“Copper will be an exception.

“We expect that demand from the autos, construction, and power sectors will keep prices high over the coming years.”

Gold, which benefited from volatility in 2020, will “slip due to reduced risk-off sentiment”.

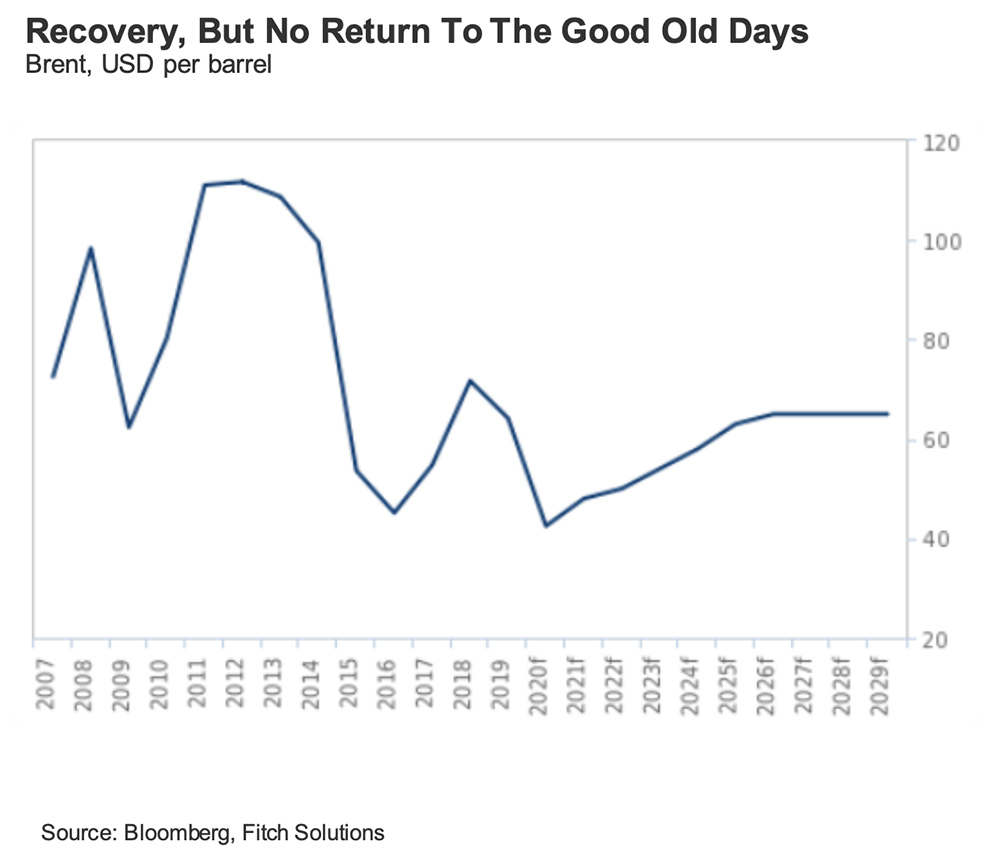

Oil prices recover, but remain weak by historical standards

As the world economy returns to growth in 2021, Fitch expects that stronger activity in key markets will boost oil demand.

“Prices have risen following positive vaccine news, and our Oil & Gas team revised their average price forecasts for Brent crude in 2021 to USD53/bbl from USD48/bbl forecast previously.”

Even so, energy prices will remain weak by historical standards.

“We believe that average annual Brent crude prices will remain below their 2019 level of USD64/bbl until 2026,” Fitch says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.