Final New York session has Nasdaq leading Wall St to worst year since … well, a different age

2022. It reminds me of that time... Via Getty

The tech-heavy Nasdaq has led Wall Street to its worst calendar year in almost a decade and a half, with all 3 major US averages posting yet another very average session on Friday.

Overnight, the Dow Jones gave up another 0.22%, to close 2022 at 33,147.25 points.

The S&P 500 did a little worse, down 0.25% to end the year at 3,839.50.

The Nasdaq Composite did a little better – losing 0.11%, but only to end much, much worse at 10,466.88 points.

US markets have to had to cop to their worst annual performance since 2008, while the Nasdaq’s pitiful run is taking grizzled punters back to the origins of their many PTSD symptoms: from the age of the US housing crash in 2008, the dot.com disaster or – heavens forbid – the video game market blowout of ’83.

Interestingly, comms services was the standout disaster sector across the S&P 500 from Jan 1 to December 30, 2022. Those companies are down almost 41%.

Energy, the only sector to actually gain, did so in an astonishing way – ahead on this time last year by circa 60%.

Way too tech-heavy

For 2022, the Nasdaq has dropped a full-third of it’s market value – shedding 33.10%, all up.

The blue colour scheme makes it look better than it is, trust me.

2022 is the the first time the Nasdaq has ever fallen straight for all 4 quarters. Absolutely ambushed, dragged into an unmarked van, drugged and driven to an undisclosed location by exactly the same forces that gave it such strength during the COVID-led outperformance – Messrs Apple, Tesla, Microsoft et al.

The tech-heavy fell more than 9% in the first three months of the year.

Then things got real in Q2, diving 22%.

Q3 gave traders a little hope – down just 4%.

But then reality returned in December with a 9% mini-crash, after a promising earlier Q4 recovery. The Fed’s promises of further tightening taking away Q4’s incremental but volatile 8% gains to end the quarter down 1%.

Life’s like that. Don’t tell the kids.

Break, but not broken

Thankfully, New Year’s Day in the states is still a market holiday as well, so the Nasdaq and the other major indices can have a personal moment to take a good look at themselves.

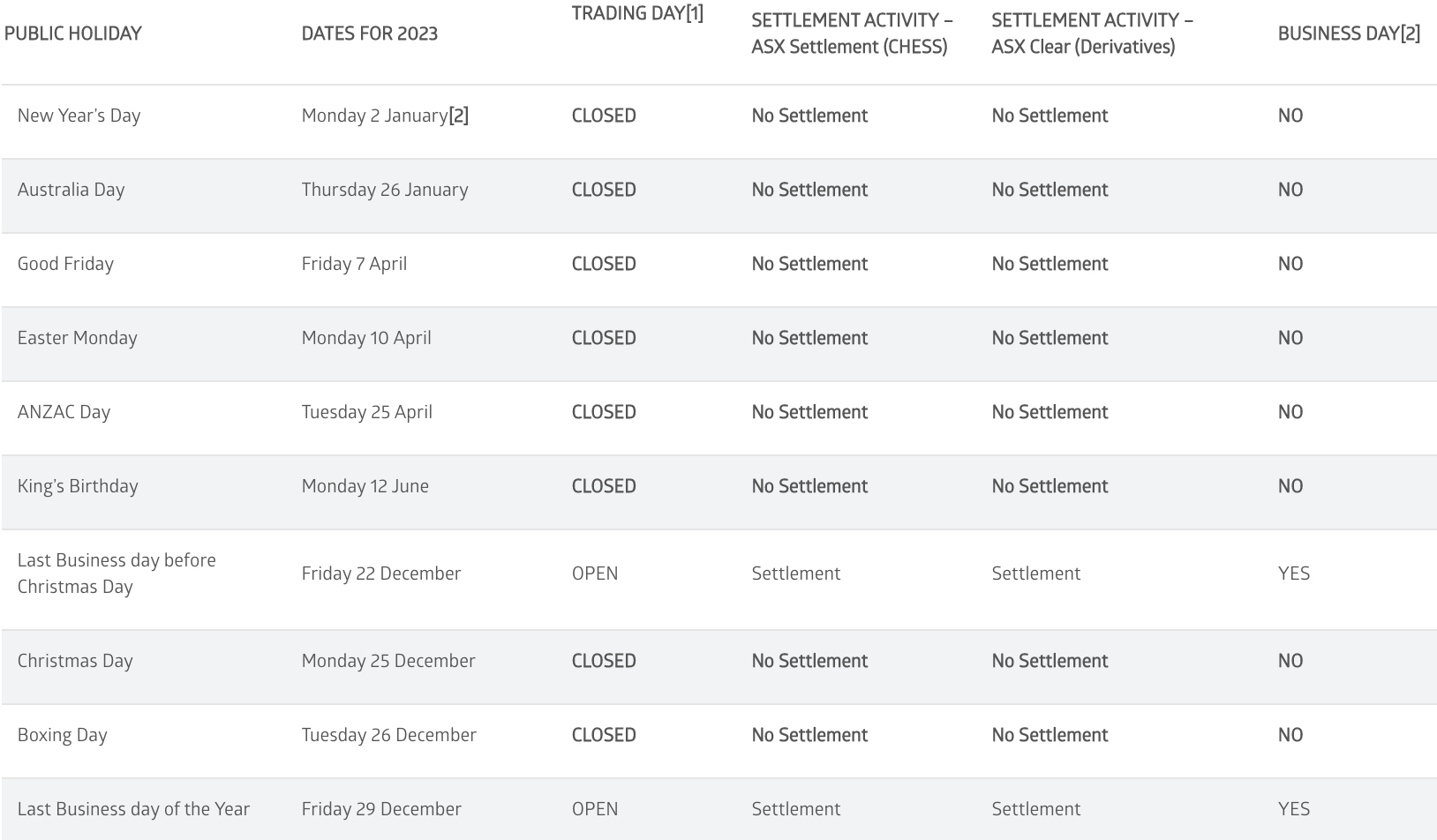

Unfortunately, New Year’s Day falls on a Sunday this year… but fortunately, with some final remaining skerrick of sanity prevailing from last year, the Nasdaq et al will be closed as will the ASX on Monday, January 2.

By the way, the next Wall Street will be my beautiful mum’s birthday on the 16th of January which also happens to be Martin Luther King Jr. Day this year.

US markets have a pretty luxurious 9 official holidays every year, as well as 1 early closing – which actually happened pretty recently on Thanksgiving – throwing the towel in at 1 pm NYT on the following day. That’s Black Friday, which has given itself over to shopping on retail markets instead.

Otherwise they do New Year’s Day, (this Tuesday night, real world time), Martin Luther King, Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Juneteenth, Independence Day, Labor Day, (Thanksgiving) and Christmas Day.

Anyway, this is us for 2023

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.