February: After 28 days of aimless uncertainty – and some plausible deniability – we just need a little faith

News

News

And that ladies and gentleman, boys and girls… and Gregor, was February.

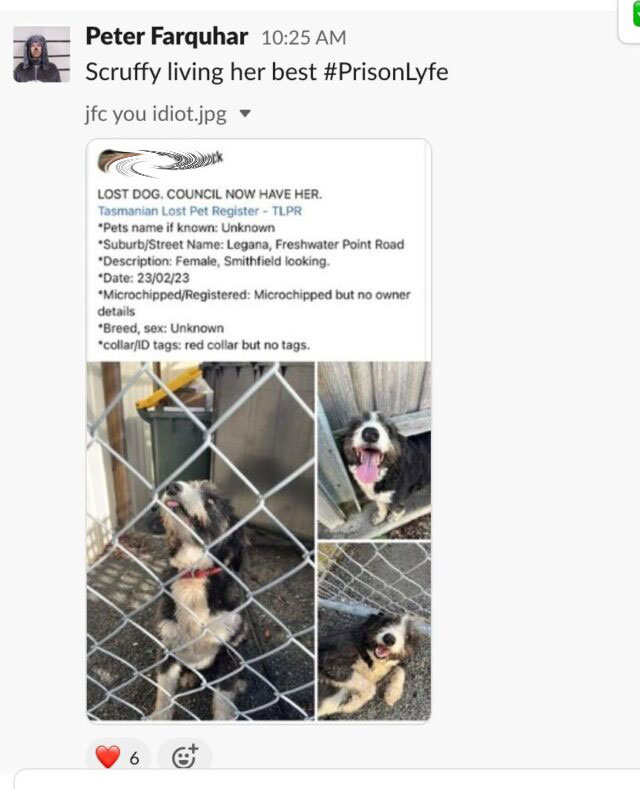

And Peter’s dog Scruffy too.

Scruffy, who this month enjoyed another brief enforced sojourn in a top Tassie CageBnB after accidentally skipping bail again… Scruffy, who – according to very tired-sounding council staff – has been microchipped and yet uncannily enjoys none of the advantages that such technology yields:

Pet’s name if known: Unknown

Description: Smithfield looking (wha..?)

Microchipped: but no owner details (that’s probably Pete staying off the grid)

Sex: Unknown (but honestly council you could look. It’s not rocket science)

Collar/ID tags: Yes Scruffy has a lovely red collar, but other than being red, like the chip it has no actual useful earthly practical purpose or function, and is therefore probably just annoying for both Scruffy and council as well as verging on garden variety animal cruelty.

I mean, at least if you jab James Bond with a chip his diverse team of analysts can pinpoint a coordinate and prep a strike team for evac. In Scruffy’s case it’s just…

Vet: Brace yourself Scruffy, this is going to pinch.

Scruffy: (whines quietly)

Vet: (turning to Peter, holds up device) Now with this chip… we can’t do anything.

Peter: Nothing?

Vet: No nothing at all. I guess it could get infected.

Peter: Ok. So you’re saying with this implant you’ve just injected into Scruffy’s neck, there’s no way at all this dog can be traced back to me.

Vet: None. Unless she gets caught in the field enough that they start to recognise her and say, oh look it’s Pete’s dog again.

Peter: Woah. Hang on there Poindexter. This is Scruffers we’re talking about. That’ll never happen. And she knows too well the consequences: (turns to Scruffy, wags finger) As always Scruffy, should you or any member of your degenerate local pack be caught or killed, the Secretary will disavow all knowledge of your actions.”

Scruffy wags tail, lolls tongue. Scratches at intolerable pain in neck.

Vet: (looks from Scruffy to Peter.) Well. Clearly you both have this in hand. Now if you’ll excuse me, I have some horses to shoot.

Peter: What do I owe you?

Vet: $8,000.

Peter: Fine… (pauses) take it out of her salary.

Vet: (worried) Is that…

Peter: Just do it doctor!

Vet: Oh, I’m not a doctor…

February.

So very ordinary that another of the guys from The Big Short, that actually pretty good film about the US housing crisis we call the GFC, said earlier this week that his ‘favourite trade’ right now is short-term (2 year to be specific) US Treasurys.

“We’re buying bonds.” Steve Eisman told CNBC on Monday, like this was a solution to something.

“Just risk-free Treasurys at 4.8(%) is a nice place to be. Look, there’s no shame in putting some of your clients’ money in 4.8%,” he said, looking pretty damn shame-faced.

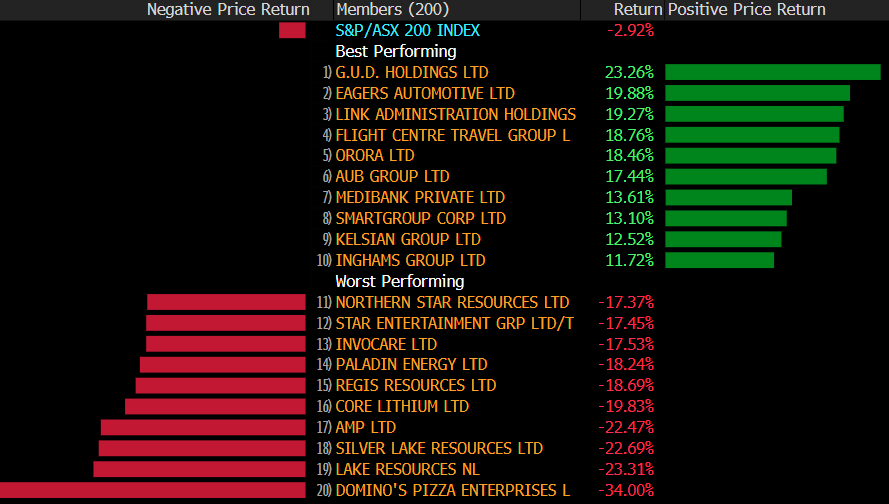

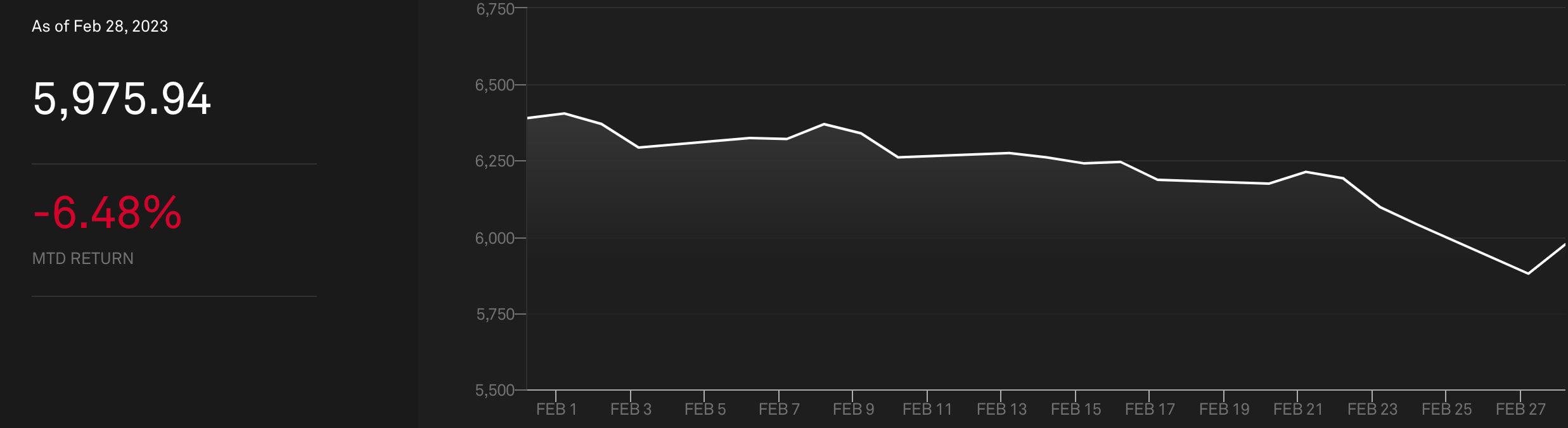

February was not a leap month for the local market either.

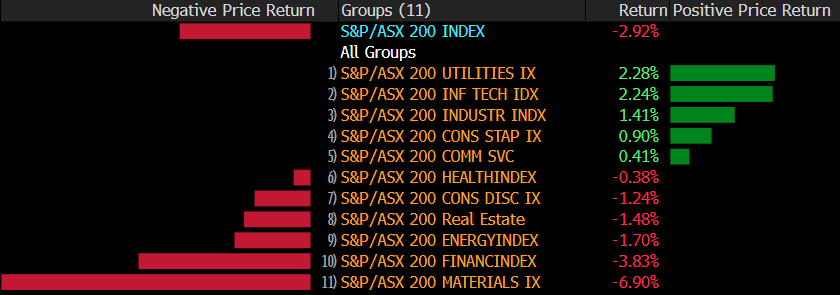

The big end of the Resources Sector proved the biggest drag on the ASX200 which fell by ~2.92% for the month.

Domino’s Pizza did not enjoy February:

And by our Heavenly Father, the last Tsesarevich, AMP Ltd (ASX:AMP). Down a lazy 22.5%.

Every single time AMP takes one of those enormous hits, I think: Is this really it God?

Is this finally when we pump $25,000 back in? And then a few weeks later I get to thank God all over for making me so skint that I couldn’t rustle up the cost of a Dominos Pizza to whack into what’s essentially a decent functioning business full of smart people.

But it’s also a stock which just regularly bleeds out with the doomed vigour of the only son of Russian Emperor Nicholas Tsesarevich II and Empress Alexandra Feodorovna (little Alexei Nikolaevich), a terrific haemophiliac whose imminent demise was regularly, inexplicably – yea, miraculously – wrested back from the edge of oblivion by (let’s say) some random peasant faith healer named Gregor.

In the end, they all got it in the neck.

Meanwhile, Resources alone dropped well over 6.5% in barely 20 days of trade.

That being said, the materials stocks have been the target of some rare buying over the last few sessions.

Elsewhere, after a slow run, both the Energy and Real Estate Sectors also took on some late momentum.

Clearly a crap time for equities, but it is against the backdrop of January’s +6% advance.

So no disaster, particularly given bond yield find themselves back testing multi-year highs.

According to James Gerrish at Market Matters, the last 3 times Australian 3-year bond yields have tested the 3.75% area the ASX200 was trading well under 7000.

“Implying there’s still another 3-4% on the downside.”

Ergo sum: yields need to fall to justify equities at current levels which lifts the risk-on pressure for stocks but doesn’t mean they’re a sell.

“While we are cognisant that if markets remain focused on bond yields we may see a 4th dip under 7000 courtesy of bonds, however, our preferred scenario remains that yields range trade between 3% and 3.75% implying we are approaching a buy zone for underlying bonds (expecting a reduction in yields), and therefore equities,” James says.

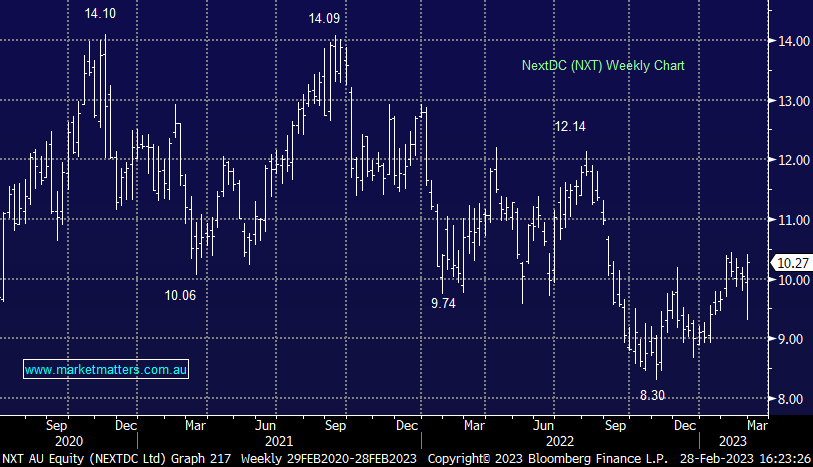

NextDC (ASX:NXT) (up 2.39%)

The data centre operator came out with HY numbers on Tuesday with a slight revenue miss. On the plus side EBITDA at $77.5m was ~7% ahead of consensus.