Fantasy M&A: Which ASX fundie would you acquire?

She backed a winner, will you? Via Getty

Once upon

…a perpetually undervalued ASX-listed investment fund, an idea (quite late in the season) arose wherein the sum of the parts was greater than the whole…

T’was a terrific idea. And there was much rejoicing.

But – as often happens in the cut-throat world of corporate finance – literally moments after Perpetual floated said cunning strategy to liberate more shareholder value by divvying up PPT’s highly successful and entirely detachable Corporate Trust and Wealth Management units along came a spider in major shareholder Washington H Soul Pattinson (ASX:SOL).

SOL told the ASX it’d struck upon exactly the same idea, minus the costs and I guess the hefty capital gains tax PPT would likely incur in such a move.

And there was less rejoicing:

SOTP! In the Name of Love

A Sum Of The Parts (SOTP) valuation is an approach to valuing a firm by separately assessing the value of each business segment or subsidiary and adding them up to get the total value of the firm.

SOL sees terrific value in PPT, but thinks it could unlock and fast-track a lot more with a more mercenary mid-80’s shake and bake move.

In fact, Soul Patts likes the idea so much it not only claimed it for itself, but bought a lot more of PPT on Tuesday.

Bursting with cash and keen for a bargain, the Soul Patts offer values Perpetual at $27 a share (circa +28.5% premium) to PPT’s November 13 closing price of $21.

There’s more to PPT than $27 dollarbucks:

On November 14, Soul Patts revealed it’d accumulated a significant interest in PPT of up to 9.99% in a substantial shareholding notice. And yesterday it upped its stake to 11.66%. So the race is on.

SOL reckons PPT’s Wealth Management and Corporate Trust businesses could go at $1.06 billion WHSP scrip with what’d be about $2bn scrip for the Asset Management business as part of an offer which would divvy up Perpetual’s three core businesses for a total implied equity value of $3 billion.

Perhaps both a little miffed and reluctant to talk shop mid-Santa rally, the Perpetual Board were unmoved:

“Perpetual has three high-quality, unique businesses that have attracted market interest from time to time. As announced this morning, Perpetual believes there is merit to exploring the separation of Perpetual’s businesses as part of a strategic review. The Board remains focused on exploring options to maximise shareholder value.”

Fantasy M&A: ASX Fund Managers

Now, in the wake of last week’s $3bn PPT bid, and after nearby ASX-listed fundie Magellan Financial Group (ASX:MFG) gained a lazy +16% over the last five sessions, Market Matters CIO James Gerrish runs his ruler over a few of these SOPT spotlit ASX fund managers.

“We’ve discussed (PPTs) break-up potential on multiple occasions and it seems both the Board and SOL had the same thoughts,” James says.

Which naturally led the MM team to, “ponder if further value is lurking in the sector.”

Popular Players — Season-to-date

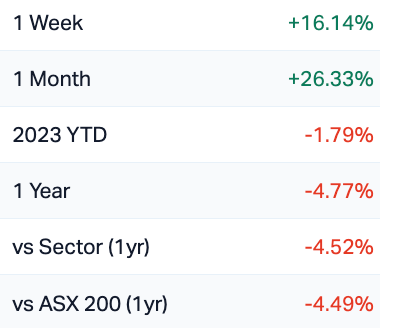

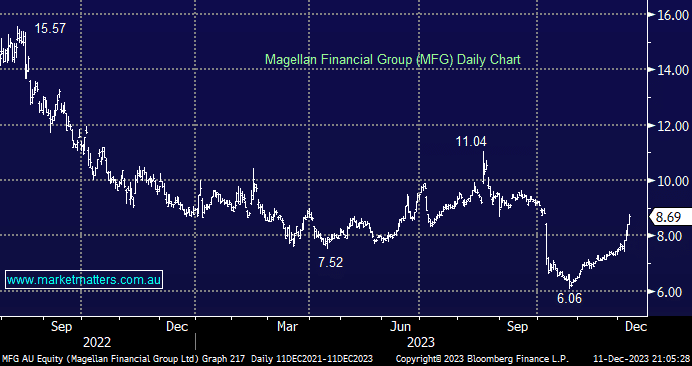

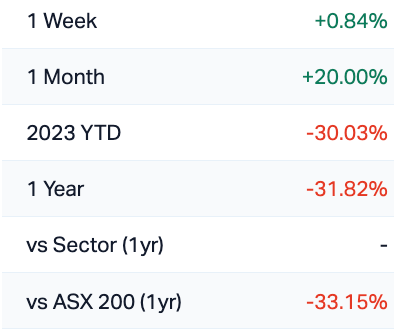

Magellan Financial Group (ASX:MFG) $8.78

Magellan had a very tough time, post-COVID – at one stage, down over -90% from its August 2020 high.

However, according to James, the last few months of business have totally reshaped the MFG discussion.

“Over the last 8-weeks, (Magellan) has been one of the ASX200’s standout performers, advancing well over 40%.

“We’ve remained patient with our holdings in the Fund Manager, holding positions across two portfolios from just below current levels, given our view around the embedded value in the franchise.”

Last week saw MFG deal with one issue that was hanging over its head, entering an agreement to buy back 650m of the 1,060m options (MGFO) at 10c each.

“The original granting of these options is an example of financial over-engineering that had unintended consequences, however, markets hate uncertainty, and this is one piece of the distracting hassle that’s been dealt with by MFG.”

James says a new CEO is next on the agenda for MFG’s turnaround story.

“And with a very solid balance sheet, underpinned by ~$1bn of assets that could be used for some form of capital management, our original thesis remains intact, especially since performance seems to have turned for the better in November.

“We are looking for MFG to test the $10-11 area into 2024: we are long MFG in our Active Growth and Active Income Portfolios.

“Both of our positions are now showing paper profits after struggling badly in October, but although it would be easy to ‘grab them’, we see another 15-20% upside.”

MM remains long and bullish toward MFG in the short-term:

Regal Partners (RPL) $2.46

RPL is a smaller $740mn Sydney-based fund manager that has shown an aggressive tilt towards growth, with FUM now sitting at ~$10bn.

“While we view the stock as reasonably expensive relative to their FUM, recent growth builds scale and diversification with a distinct skew towards alternative strategies. Phil King heads up the group and he is a deal maker, our view being that Phil is looking to get big, then get out.

“We believe RPL has the potential to evolve strongly with plenty of growth opportunities moving forward, a forecasted 4% yield over the next 12-months helps the impatient investor, however this is not the reason to own RPL.”

“We are long RPL in our Emerging Companies Portfolio, initially targeting the $3-3.50 area.”

MM remains long and bullish toward RPL:

Perpetual (ASX:PPT) current price: $25.06

“Last week saw SOL bid $27 for PPT as they looked to split up the business to deliver quick value to shareholders – very Gorden Gekko (Wall Street) and the 1980s.

“The SOL bid trumped the earlier news that PPT itself was considering a very similar value-unlocking strategy to appease disgruntled shareholders.

“PPT has rejected the SOL bid, yet the stock remains ~$1.50 below their initial salvo, ‘the game is afoot’, and with SOL owning 9.9% of PPT, it’s likely to have a major say in what comes next – if they’re prepared to pay $27, they must believe it’s worth well over $30.

“We should also remember the PPT board rejected the $33 bid from the Regal / BPEA EQT consortium only ~12 months ago.

“We can see PPT trading above $30 before it retests $20, but the risk/reward isn’t overly compelling after last week’s move.”

MM likes PPT below $25

The views, information, or opinions expressed in the interview in this article are solely those of Market Matters and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.