Falling prices spread beyond 40% of Aussie house markets; but these Vic hipsters know of a few holdouts

Remembering that day the sun shined in Melbourne. Via Getty

“The year is 50 B.C. Gaul is entirely occupied by the Romans. Well not entirely! One small village of indomitable Gauls still holds out against the invaders. And life is not easy for the Roman legionaries who garrison the fortified camps of Totorum, Aquarium, Laudanum and Compendium…”

It looks like we’re crossing the Rubicon already on these falling house prices.

The great housing market downturn isn’t waiting about to see which way the RBA blows. Startling inflation data, consecutive rate hikes and consumer confidence so weak it’s amazing anyone in this country got out of bed this morning has already got the numbers moving so fast, the next weeks and months are going to be fun to watch, if not experience.

Our evil mates at CoreLogic, led by economist incarnate Kaytlin Ezzy, now reckon a total of almost 42% of the nation’s houses and flats have now started to lose value.

The latest numbers out of the property data firm suggest that the March quarter losses which were already spread across almost a quarter of the country’s residential property market have already just about doubled by the June quarter.

In a language we all now know too well – this variant of the Aussie housing downturn is particularly contagious and you can strap on a mask if you want, but it may not stop the spread.

Gaul is entirely occupied by the Romans. Well not entirely!

However, there is at least one beacon of light, according to the according to the Real Estate Institute of Victoria (REIV).

They say the flight from the dark heart of Victoria’s bleak, weary, dank, cold and inexplicably sports-driven capital city has intensified.

While the rest of the country burns, the outer reaches of Melbourne have joined regional Victoria in a round of record-breaking house prices.

The REIV’s latest study says outer Melbourne houses (20km+ from the CBD) have topped their highest-ever quarterly median price, with a 1% QoQ jump to $856,000. On an annual basis, growth for outer Melbourne homes has just kept on keeping on – jumping by 12.6%.

The average price of a hovel in regional Victoria is up 21.6% on this time last year. And it’s not peanuts we’re talking – what was $500K is now $608K.

And probably devastatingly cold and lonely, but they throw that bit in for free.

CoreLogic’s Ezzy says she’s seeing a “significant uptick in the proportion of declining markets compared to March”.

Around the Ides, home values were falling largely only in the glamour Sydney and Melbourne markets.

“This analysis captures two of the three recent rate hikes so it’s not surprising to see the added downward pressure has had a broader impact on the housing market,” Ezzy sezzy.

She says all the signs of a slowdown – and price falls – were already evident before the rate rises.

“But are now becoming more widespread across Sydney and Melbourne, and beginning to impact the more expensive areas of Brisbane, Canberra and Hobart.”

Going back through previous downturns, CoreLogic notes that “the premium suburbs are more volatile than the more affordable areas”. The snazzy suburbs are the first to get toppy when the bulls are running, but they’re usually among the first to fall when the bears come out of hibernation.

Last week, CoreLogic’s go-to Home Value Index, showed national dwelling values fell -0.2% over the June quarter, with every capital city copping it as well as “rest of state region(s)” well past their peak rate of growth.

Still, the REIV president Richard Simpson is talking up “some exceptional price growth” in the southern state.

Horsham – don’t know it, don’t want to – has median house prices spiking more than 40% for the year just gone and at $393,750, it’s got to be incredibly dark and lonely compared to the Harbour City where Domain says the median house price sits just shy of $1.6 million.

Belle Property in Victoria say Melburnian sea-changers have pushed prices in a place called “Torkey” up by about 40% in the last year, where the median house now goes for $1.26 million.

Simpson: There’s plenty of bargains in the Victoria bush

Stawell sits top of the list offering homebuyers a $322,500 median, despite showing an annual 26.5% increase. And Richard says Morwell also offers a median price tag of $325,000 – and that’s after recording an annual 30% increase. (Doesn’t Sauron live there?)

Is it because both Stawell and Morwell are “well” positioned? I don’t know. I also don’t know if that gag was worth the effort.

Richard Simpson, meanwhile, says regional Victoria’s medians held pretty strong with property value increasing across houses, units and apartments. The last two differ, but I’m not sure how.

“The market remains strong, especially across regional Victoria, Simpson says. “As expected, we saw a slight decrease in metro Melbourne as the market adapts to the current rising interest rate environment.”

CoreLogic says growth conditions across Sydney have “weakened significantly” over the last quarter, with house values falling -3.0%.

Although 81.1% of house markets analysed recorded a fall in values over the three months to June, three out of four suburbs still have a median house value of more than $1 million with no house markets under $500,000.

According to Domain, a budget of $1.59 million can get you laughed out of Sydney and Byron Bay. The latter’s median house price of $1.8 million is about a million per cent higher than last week, but the same dollars aren’t enough anymore to get you into beautiful Kiama where $1.6 million is the very, very mean median.

For most of us, those Rubicons were crossed back when Julius Caesar was still wondering how cold the water was.

The last word on Melbourne and environs from CL’s K-Ezzy

While Melbourne’s median prices may still be recording positive growth, its housing values – which looks at values changes across all properties, not just the ones that have sold – are down 1.1% in June and 1.8% over the quarter.

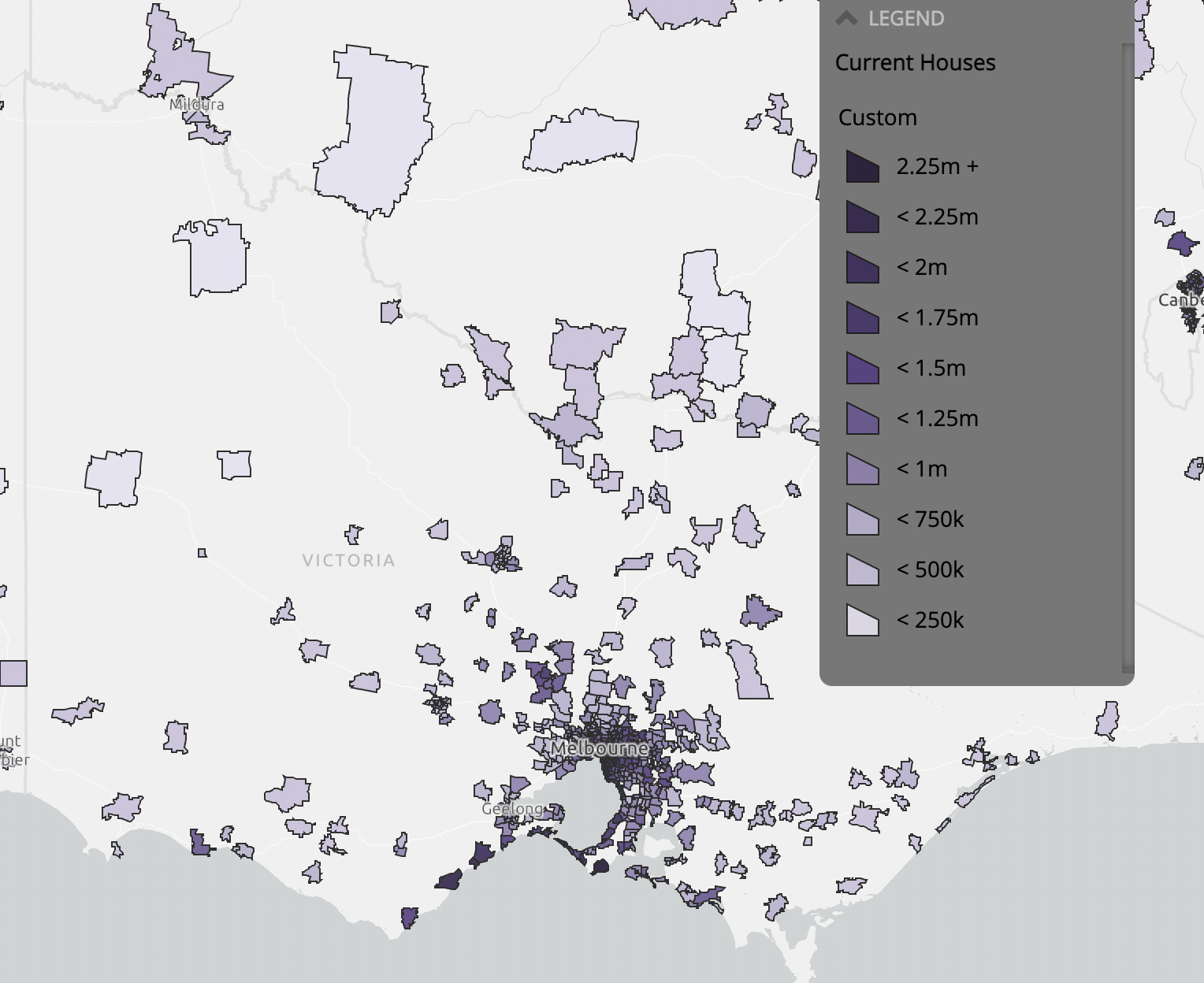

CoreLogic’s June edition of Mapping the Market, found that 80% of Melbourne’s house markets and 59.4% of Melbourne unit markets analysed saw values fall over the quarter, while values in the more affordable suburbs in the cities’ northwest and southeast regions were recording positive growth.

“Consumers are very sensitive to cost pressures and are reluctant to commit to any big financial decisions when they’re not feeling as confident about their finances.

“Recent rate hikes, strong inflation, higher cost of living, and increasing global uncertainty has seen consumer sentiment fall by around 17% since December, and continues to fall month on month.”

Kaytlin says consumer sentiment is closely correlated to sales volumes so sales tractions have been trending downwards.

“Mortgage activity nationally is down month-on-month, suggesting buyers are being more cautious and are opting to wait before making a purchase in the current climate.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.