Ethical Investor: CEOs sound the alarm as the global sustainability agenda verges off track

Pic: Getty Images

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX – this week’s special guest is Peak Asset Management’s head of ESG Ali Ukani.

As the world approaches the halfway mark to achieve the UN Sustainable Development Goals (SDGs) by 2030, it is no surprise we remain drastically behind where we need to be.

The United Nations Global Compact-Accenture CEO Study on sustainability draws on insights from more than 2,600 CEOs across 18 industries and 128 countries, shedding light on the increasingly challenging environment business leaders find themselves in.

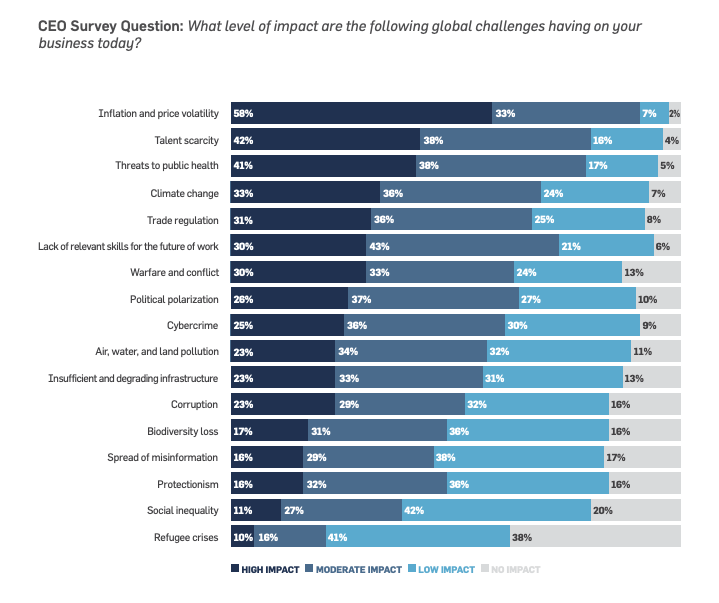

From a list of global challenges facing businesses, the reports finds 93pc of CEOs are dealing with the impacts of 10 or more.

Another 46pc of CEOs state they are dealing with all 17 challenges surveyed in some capacity, at the same time.

Ecolab CEO and chairman Christophe Beck says disruption has been huge over the last few years.

“What’s really unique right now is that none of those disruptive forces have gone away – starting with COVID, to the supply shortages, geopolitical issues, inflation, water and energy crisis.”

According to the report, CEOs are overwhelmed by the sheer number of challenges they are required to address, coupled with the uncertainty of the future.

And case in point – 91pc of study participants say that too many competing priorities hinder progress in building resilience, setting back sustainability progress and further risking the SDGs.

But amidst this global volatility, sustainability has skyrocketed to the top of the CEO agenda.

In the 2013 edition of the UN Global Compact Accenture CEO Study, 83pc of CEOs said they felt accountable for the sustainability performance of their company.

Today, 98pc of CEOs believe it is their role to make their businesses more sustainable.

In fact, the degree to which CEOs agree has also shifted – in 2013 only 19pc of CEOs strongly agreed that they were accountable for their firm’s sustainability performance, but in 2022 that percentage has leapt to 72pc.

ESG interview: Ali Ukani on ESG investing and sustainability

Momentum in ESG investing slowed in 2022. Is ESG a fad or future, and will we see investments coming back in 2023 and beyond?

Just as with many investment thematics, there is always an initial period of excitement and ill-informed frenzy. We’ve seen this with the tech bubble in the late 90s and early 2000s, as well as the crypto landscape.

ESG as an investment thematic is not going away; in fact, I consider the subdued frenzy positive. This will result in stronger sustainability expectations, regulations and outcomes. Investors are also wary of greenwashing and will become more adept at identifying companies with true ESG credentials.

On a broader note, if you look at key climate targets and investments required to get there – they are not going away. They are becoming increasingly important as we inch closer to 2030 and beyond; and so I believe is the need for ESG investing.

Has the commitment of CEOs to sustainability in Australia grown over the past decade and if so, how and in what ways?

It certainly has. Despite the dominance of resources and mining, CEOs are now attributing increasing importance to the UN’s SDGs as part of their ongoing operations.

We’ve seen this in the form of reporting and governance, with many companies now reporting on sustainability and adopting TCFD or similar guidelines.

There is also a stronger focus on community engagement and environmental permitting, especially for resource companies.

What are some of the key/top sustainability issues CEOs come to you about?

Given we work largely with >$150m market cap companies, the concerns are very different. On the larger end of town, however, CEOs are very concerned with ESG reporting and governance, as well as community engagement and social responsibility.

How can CEOs navigate global challenges e.g. geopolitical instability and the climate crisis in a sustainable way?

Depends on the type and nature of the business.

I think transparency is key when it comes to stakeholder management, including shareholders, suppliers, customers etc.

People back companies not only because of what they do, but how and why they do it. So for product-oriented businesses this would mean looking at the cradle to grave lifecycle of the product and identifying areas for enhancing sustainability and similar for service-oriented businesses as well.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.