Equity strategies: Welcome to the Stagflarty, pal!

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

- Stagflation fears rise as the war accelerates alignment of economic indicators

- UBS downgrades global GDP forecast, equities in firing line

- Analysts at Crestone and T. Rowe Price on how to play the Stagflation card

Stagflation – a term coined in the 60s by British Chancellor of the Exchequer Iain Macleod, perfected by the oil crisis in the 70s – is basically this:

“…when weak economic growth and high unemployment coincide with rising inflation.”

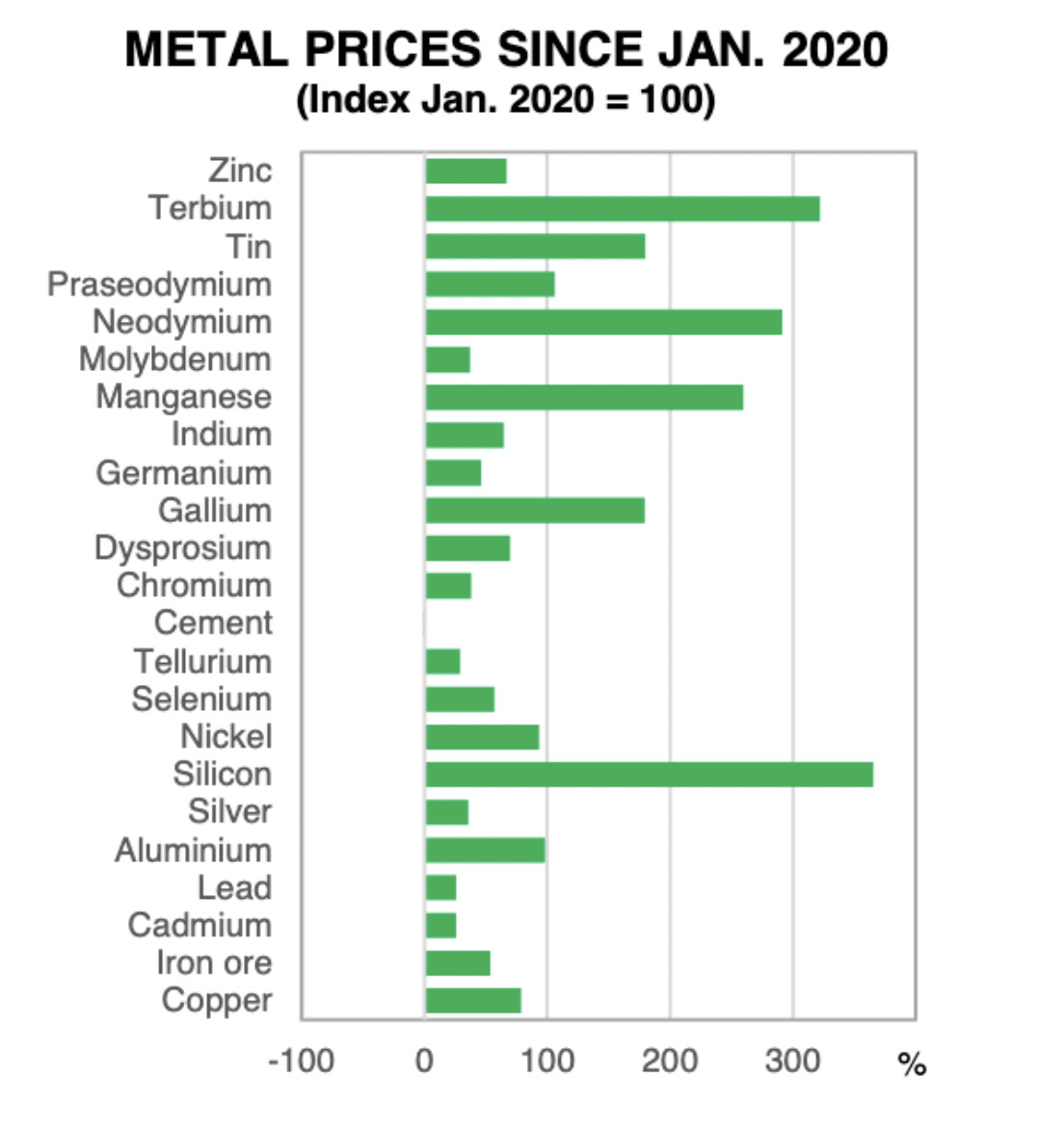

I mention it not just because I’m a smarty pants, but because in the last few weeks Google tells us internet searches for “stagflation” have insanely spiked – a lot like oil, energy and commodity prices.

Stagflation is back on the radar, last seen cruising the markets of the great American recession of the mid-70s when the US economy copped five straight quarters of negative GDP growth, off the back of the oil crisis.

Operation: Stagnation + inflation

A few days ago under complete cover of darkness, a small multi-national team of UBS economists armed with a foreboding sense of impending boom (in resources prices) culled a full percentage point of this year’s global GDP forecast, trimming some 25% (down from 4.6% to 3.6%), whilst simultaneously raising inflation forecasts across the board.

Equity enthusiasts say there’s no need for such clock and dagger excitement. Inflation has peaked and so our future pattern of interest rate rises will be at a modest clip, because those Covid-hit supply lines and the kerfuffle over in Ukraine are on a cooling, downward trajectory, while China and OPEC (in all good faith) are set to raise oil production to cover the loss of Russian exports.

Anyway, here in Australia, we sell and buy heaps of such key inflation drivers – oil, coal, grain, and base metals of all sorts – and TBH, the toppy prices are ultimately a bonus for the national coffers, and damn the mix of fury and pain consumers feel at the petrol pump.

I would leave it at that, however someone who knows the inflation game better than I, a former NSW Treasury chair told Stockhead over the weekend, many of the economists amongst us believe this is the year we will get to witness stagflation perform it’s dirty economic striptease for the first time in 40 years. Aghast, central banks will apply a credit squeeze which in turn will put an emphatic full stop on the lovely post-GFC equity bull market.

A long, relaxing 14 year bull market.

Stagflation: An approach to Aussie equity in two flavours

Crestone Wealth Management says the last half-year of rising commodity prices, a broad labor crunch and a torrent of cashed-up consumers does kinda look like the transitory is leaking violently out of the inflation.

And that ugly little idea was abroad long before the Russians decided to give everyone, including the global economy, such a frighteningly effective wedgie that, “the prospect of high inflation and weak growth coinciding – i.e. ‘stagflation’ – is no longer a tail risk.

“The global economy finds itself in a situation where very little help is expected from central banks, given inflation pressures are too acute and policy rates too low,” Crestone advisers said in a note.

On only two difficult-to-talk-about occasions Australia has been cornered and alone at such full blown stagflation partys. Both events were big enough to spill into the following year – from 1974 to 75, and from 1981 to 83. And both times equities crashed – before, during and after the event – until meekly beginning to recover about the six months later.

UBS notes that on both occasions, the entire market cap of Australian equities shrunk by about half.

Learning the lessons from Stagflarty 1 & 2

Thusly satisfied with enervating their clients, UBS goes on to say the situation we’re in right now, crap as it seems, is unlikely to be anywhere near as End of Days as the last two events.

In Stagflarty 1 (1974/75), the Australian economy staggered naked through five quarters of real negative real GDP growth. Today, UBS economists’ most bearish scenario doesn’t even see a single quarter of negative growth to be likely.

This is Crestone’s advice for a portfolio composition should we reach Stagflarty 3:

-

-

- Gold mining stocks are one of the top performers. This is not surprising given gold’s safe haven status during times of economic uncertainty. In addition, the high inflation rates which prevail through stagflation periods are likely to apply downward pressure to real interest rates, and hence the opportunity cost of non-yielding gold is reduced.

- Another top performer is the TMT sector. Its telcos would be expected to outperform in these conditions given their defensive cashflows, and ability to pass on inflation costs.

- The other proven defensive sectors of Consumer Staples (business exposed to food staples production and retailing) and Healthcare show impressive performance through these stagflationary periods.

-

The T. Rowe Price price

T. Rowe Price’s Australia Investment Committee says the reality check markets took from enduring inflation and an aggressive Fed has only been exacerbated by the turmoil following Russian decision to apply force and violence in Ukraine.

In the US the S&P 500 Index is down circa 8% lower, year-to-date. The NASDAQ gained about 8% last week alone – on Monday March 14 it was more than 20% down.

“Notable as the sell-off has deepened is that growth stocks have continued to underperform, where they are typically seen as more defensive in risk-off environments says Hong Kong based Thomas Poullaouec, head of Multi-Asset Solutions APAC.

According to T. Rowe Price, year-to-date, Russell 1000 Value stocks are down as well, but just 3%, while Russell 1000 Growth has been smacked, down over 14% – largely due to fears already high inflation could intensify leading the Fed and its daily speakers this week, warbling to a more wishfully tight trajectory.

Although more cyclically oriented, value stocks have held up relatively well. Nearly all the gains came from energy stocks, which represent upwards of the index 15% and is up 30% year-to-date.

“With the conflict continuing to unfold in Ukraine, as investors and central banks evaluate the balance of rising inflation pressures and slowing growth with the possibility of stagflation, growth and value stocks may be out of style,” Poullaouec says.

This is how T. Rowe is tweaking it’s portfolio ahead of possible stagflation:

While valuations are off recent peaks, we remain underweight equities given moderating growth and earnings outlook amid an active Fed and inflation concerns. Within fixed income, we remain overweight cash as longer rates remain biased higher.

Within equities, we trimmed our overweight to U.S. and Global ex-U.S. value stocks, shifting into core equities, and took profits following a period of strong outperformance by value stocks.

The view from bank, central

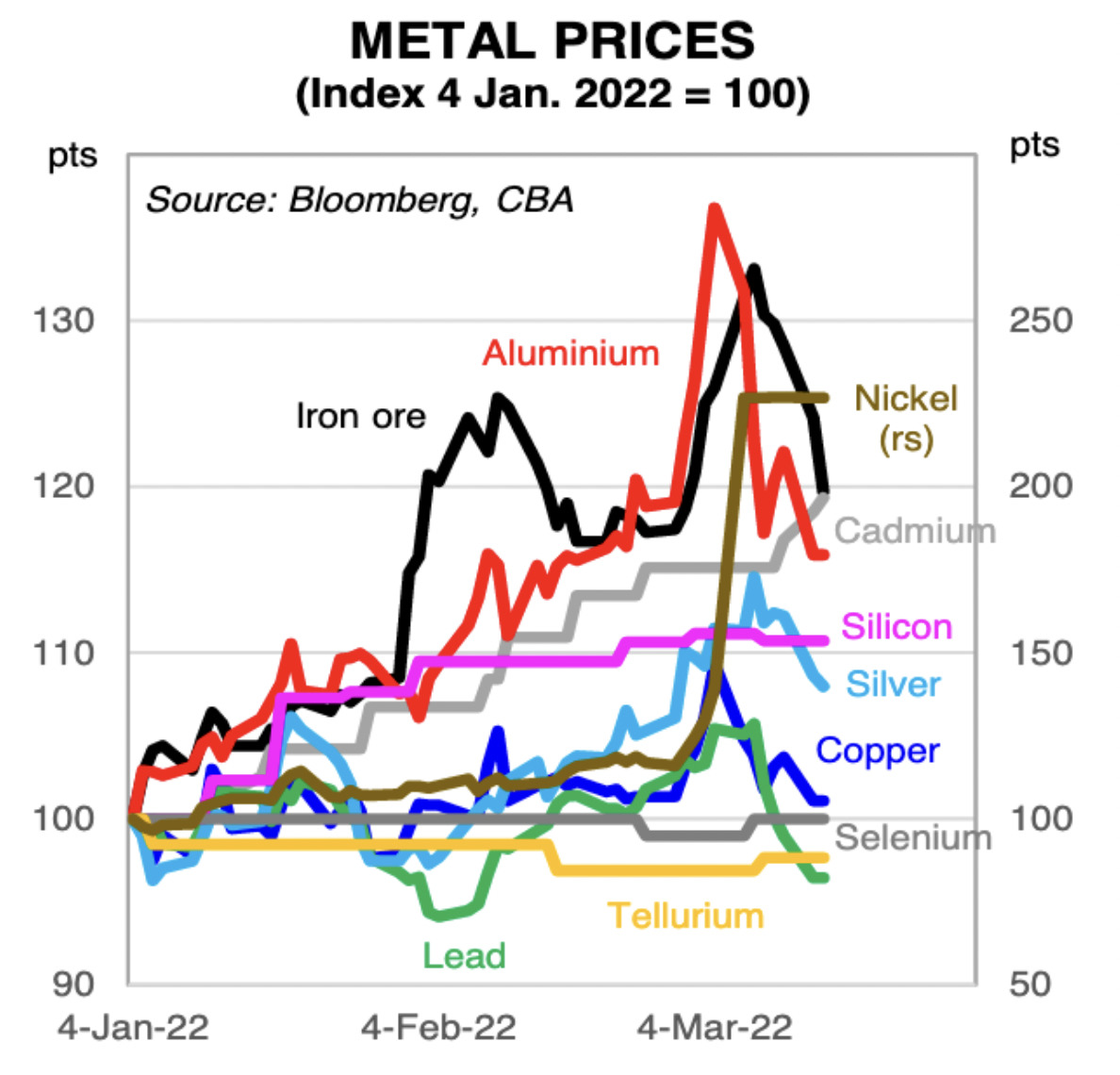

CBA’s Joseph Capurso says a commodity supply shock on top of strained supply lines and high inflation is, for central banks, a very unwelcome guest.

Like some out of control version of the Lambada, there are fears the commodity price shock will inspire a conga line of stagflation in Western economies.

A lot of economies are copping some high inflation but while labor is crunching, unemployment is techincally low. Capurso warns, though, “the supply shock will cause ‘headline’ producer and consumer inflation measures to accelerate.

Stagflarty 3: Who’s not invited

Except Australia, Japan and China, consumer price inflation were already above target in a range of advanced economies.

Central banks in economies with tight labour markets may become concerned another step up in consumer inflation will spill over into higher inflation expectations and wage growth.

High inflation expectations are a major issue for central banks because it implies more policy tightening may be needed to bring inflation sustainably back to target. More policy tightening raises the risk of recession.

The Ukraine war has made policy normalisation – shrinking balance sheets and increasing policy interest rates – riskier.

Stagflarty 3: Who’s already RSVP’d

The US and New Zealand already have elevated inflation expectations. The Reserve Bank of New Zealand has already started policy normalisation. We expect the FOMC will this week. Policy tightening is likely to continue in these economies despite the negatives of the supply shock on output.

For the first time in a while, central bank policy tightening may cause a recession next year.

Stagflarty 3: Guest(s) of Honour

Capurso has put the evil eye on the Eurozone as the “most likely candidate for a mild dose of stagflation in our view”.

“Europe faces the worst of the supply shock because of their dependence on Russia.”

“Germany is already experiencing a combination of rising unemployment and inflation like it did for brief periods in the 1980s and 1990s. Nevertheless, the German unemployment rate is very low by the standards of the past quarter century.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.