Ecommerce drove ’40pc of incremental sales growth’ for ASX retailers this year

ASX retailers finished FY20 on a role, but UBS says FY21 looks more uncertain. (Pic: Getty)

When COVID-19 fears peaked in March, discretionary retail was viewed as a sector in the firing line as consumers put their wallets away in the pandemic.

But it didn’t turn out that way, with government support measures underpinning strong sales — particularly through online channels.

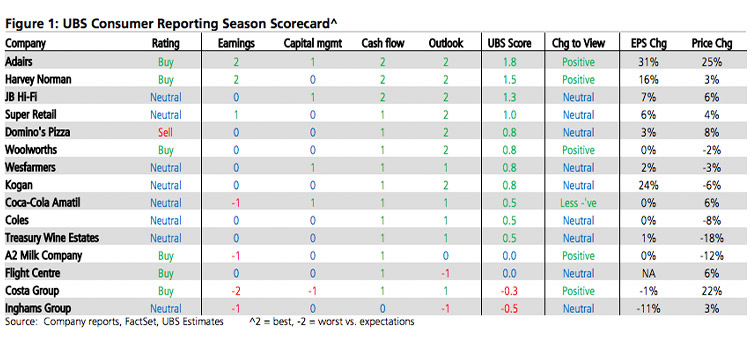

For ASX companies in the space, UBS said FY20 trading results showed discretionary retailers ended up with a 29 per cent lift in trading activity.

And in the first half of this year, more than 40 per cent of incremental sales growth came from online channels.

Among the net effects of that shift is that where Australia lagged overseas markets in terms of online adoption by around five years, that gap has been narrowed to two years, UBS says.

The analysts said gains for listed retailers were driven by three post-COVID trends, starting with a reallocation of spending away from travel-related sectors.

They also flagged changes in lifestyle in the wake of work-from-home restrictions, with increased demand for items such as home office/entertainment, and gym equipment.

And last but not least, fiscal support — the backstop provided by around “$181 billion of government stimulus”.

However, with the level of stimulus expected to be cut by around two thirds in the December quarter, “we believe the stimulus element of consumer spending will slow materially”, UBS said.

On that front, the analysts noted the outlook for FY21 remained uncertain. Currently, all ASX stocks under UBS coverage are yet to provide guidance figures for the 2021 financial year.

For now, “high-frequency industry data and company commentary suggests August retail sales are solid (but slowing), with online continuing to outperform”, UBS said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.