Early release superannuation sees 10,000 Tasmanians left without retirement nest egg

Nearly 79,000 Tasmanians have shattered their retirement nest egg, by applying for early release of their super: Getty Images

A small army of savers in Tasmania have drained their superannuation accounts under the federal government’s early release scheme brought in to ease financial stress during the COVID-19 pandemic.

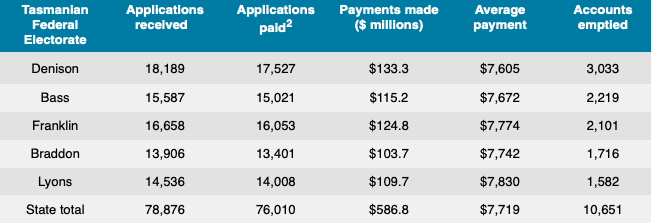

Around 79,000 Tasmanian workers have applied to access their super accounts early – equal to one in five, and super funds have paid out $586m to applicants in Tasmania to date, according to research by super fund Industry Super Australia.

Among the 79,000 early super release applicants are 10,000 people who have withdrawn all of their retirement savings from super funds.

The average withdrawal per early release application in Tasmania is $7,719, according to Industry Super Australia.

Lost super is a ‘looming tragedy’

“The tens of thousands of Tasmanians who accessed their super to prop themselves up now face a looming tragedy of retiring with less and being more reliant on the pension,” Industry Super chief executive Bernie Dean said.

They can also dip into their super accounts for another $10,000 in the six months to December 2020.

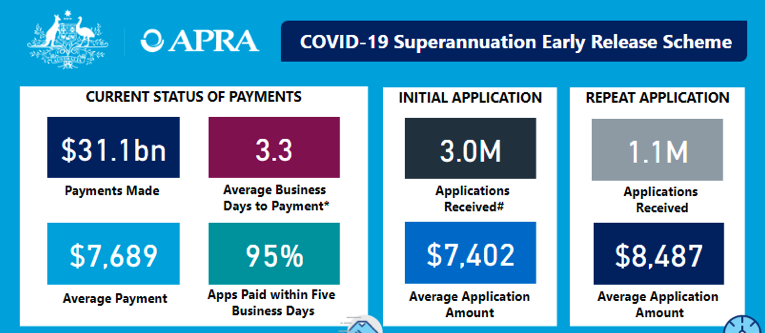

The situation in Tasmania is reflective of the national picture in Australia, with 4 million applications made under the government’s COVID-19 super early release scheme.

“Over the week to August 9, super funds made payments to 95,000 members, bringing the total number of payments by funds to their members to 4 million since inception [of the scheme],” said the Australian Prudential Regulation Authority, which monitors the scheme.

“The total value of payments during the week was $0.7bn, with $31.1bn paid out since inception.”

The national average payout per super fund early release application is $7,689.

Accessing super early can be costly for younger workers

Taking money out of super accounts can be a costly business, as a 30-year-old withdrawing $20,000 may be left with $80,000 less at retirement due to lost compound returns.

The compulsory Superannuation Guarantee Contribution (SGC) paid by employers into an employee’s super fund is set to rise from 9.5 per cent of an employee’s gross salary to 12 per cent by 2025.

Industry Super Australia analysis shows that without any rise in SGC, a 30-year-old man that took $20,000 from his super would possibly lose $180,000 over his lifetime, or have to carry on working until the age of 74.

For women workers aged 30, the loss would be around $150,000 or mean an eight-year delay to their retirement.

“The only realistic way workers can make up the difference is with the promised increase to the super rate – ditch the super increase and we will be saddling the next generation with a whopping pension bill,” Dean said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.