Do ESG funds really perform better? Morningstar says the jury is still out

Do ESG funds perform better? Morningstar says its too early to tell (Image via Getty)

The growth of the ESG sector has begged the question “do ESG funds perform better investors than non-ESG funds”?

Some ESG funds have been able to net positive returns for investors and the presence of some ESG funds in the lists of top performing funds has led to the assertion ESG funds perform better.

But of course whether or not the ESG sector as a whole performs “better” than non-ESG funds is a different question altogether.

Do ESG funds perform better?

And Morningstar analyst Tim Murphy says there isn’t definitive evidence on the question of if ESG funds perform better – at least not yet.

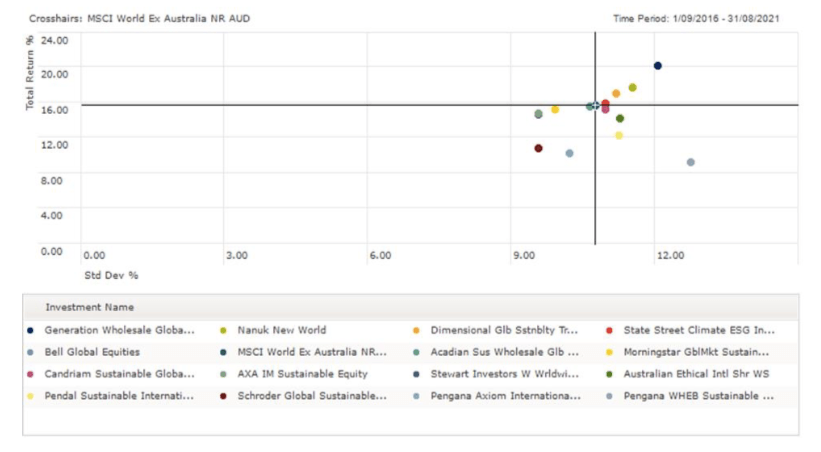

Analysing the 14 ESG global equity funds that have been available to Australian investors for five years or more, only five of them achieved higher returns with a higher risk. None achieved a higher return with lower risk.

Of the balance, five delivered lower returns with lower risk and four funds had lower return with higher risk.

While Murphy admitted this was not a compelling investment outcome, neither was it entirely negative. And in a shorter three-year period things looked rosier.

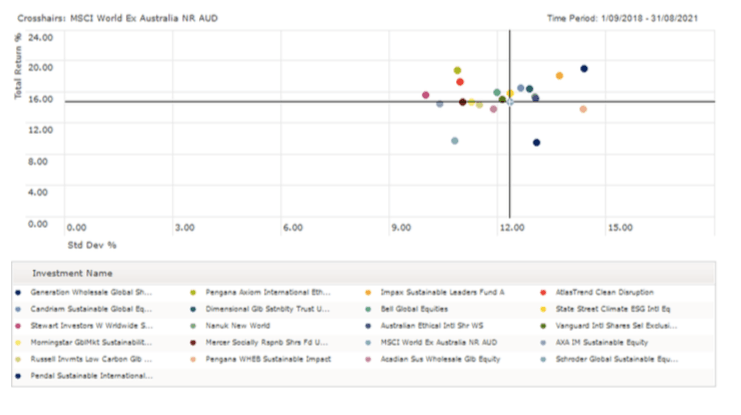

In the past three years, seven out of approximately 20 funds achieved higher returns with lower risk and another six had higher returns with higher risk.

Investors need to do their homework

But overall Murphy concluded there wasn’t definitive evidence as to whether or not global ESG funds had a direct impact on returns or risk.

Nonetheless, because some individual funds perform better than others, he said it was important investors do their research into ESG funds before they buy in, especially because different funds have different approaches.

“This is encouraging for investors who want to build ESG portfolios that align with their values, knowing that they shouldn’t have to sacrifice risk-adjusted return outcomes as a result,” Murphy said.

“Having the right tools to appropriately analyse these investments and construct such portfolios is increasingly crucial in order to identify funds that are genuinely doing something different and worth paying for, while helping to skip over funds dressing up with an appealing ESG story that lacks substance when assessed under the hood.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.