Dividend and conquer: Bailador Technology Investments’ new dividend policy as NTA grows

Pic:Getty

- BTI ordinary dividend policy to be 4% per annum of pre-tax NTA paid half-yearly

- BTI to also pay a special dividend after ~$140 million in asset sales

- Fund cashed up to invest in out of favour technology assets

There hasn’t been much to smile about in financial markets of late, especially the high growth tech sector which has seen a broad sell-off as investors head towards value stocks amid rising economic uncertainty.

The S&P/ASX All Technology Index (XTX) has fallen ~6% in the past month and is down ~31% year to date. However, Bailador Technology Investments (ASX:BTI) shareholders can do a happy dance today after the tech-focused growth capital fund announced a new dividend policy which commits to paying semi-annual distributions.

The ordinary dividend policy will be 4% pa of pre-tax NTA, payable half yearly – that is 2% of June 30 pre-tax NTA payable upon finalisation of annual financial statements and 2% of December 31 pre-tax NTA payable upon finalisation of half-yearly financial statements.

Breaking down the dividend, investors should pay close attention to the target yield, which is 4% of BTI’s pre-tax NTA. The target yield is significant because BTI’s share price is currently trading at a ~35% discount to BTI’s last reported NTA of $1.99 as at April 30, 2022.

This means any investor holding BTI shares at the closing price on May 31 of $1.38 stands to receive an effective 5.8% pa fully-franked yield on their investment.

As a further windfall, BTI has also announced a special dividend will be paid on top of this ongoing dividend at the next results. This special dividend adds another 2% of NTA paid on a fully-franked basis, which equates to a further 2.8% fully-franked yield on BTI’s closing share price.

So all up, an investor today is potentially holding a cheque for a 8.6% fully-franked yield based on BTI’s May 31 closing price. The dividends are due to be announced with BTI’s FY22 results in August.

At the time of writing, BTI was up a 3.62% to $1.43, so the opportunity is still well and truly there for the tech-savvy investors looking for a combination of high-growth investment and strong cash returns.

Strong growth to support dividend

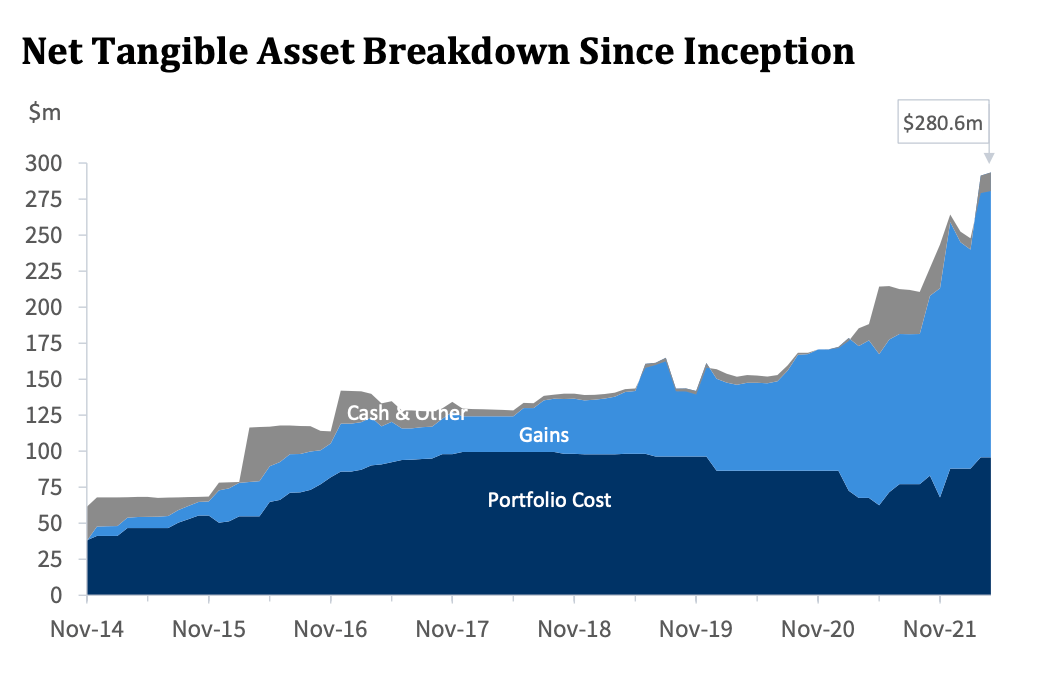

Since listing on the ASX in 2014 BTI has steadily been growing its NTA with chairman David Kirk saying the fund was now in the position to implement a dividend policy.

“The BTI portfolio has reached a stage of development where we are able to balance holdings in private companies and cash, in a manner that allows for payment of a regular cash dividend, and distribution of franking credits,” Kirk said.

BTI recently sold their share of databasing as a service (DaaS) company Instaclustr for $118 million and global advertising spend analytics business SMI for $20 million.

BTI managing partner Paul Wilson told Stockhead the fund had made a substantial return on Instaclustr to reward investors.

“With Instraclustr we invested $8.4 million so that’s 14.2 times money in cash at an 80% IRR,” Wilson said.

“As a result of those two sales we have substantial cash with about $140 million out of $280 million NTA now cash and so we are at the point where we can look at an ongoing dividend policy for our shareholders.”

Wilson said the fund puts in the time to grow technology companies, building its portfolio, team and capital base for long term gain.

“We give exposure to high growth companies and we are usually doing that by investing in private companies at attractive valuations before they are public,” he said.

“We help to grow and list a company on the stock exchange or sell them.

“We take time with companies and if you are going to get multiples of 14 times you don’t do that overnight.”

Seeking the next Instaclustr

Among other companies BTI has invested in is hotel commerce platform and tech unicorn SiteMinder (ASX:SDR), which has a market cap of $1.27 billion. Wilson said he is not concerned about the recent tech sell-off and bearish market sentiment, seeing it more as an opportunity for the cashed-up fund.

“We are not completely immune but we hold long term so for example we had Instaclustr for a number of years and so the value is created over that time frame and if you get short term fluctuations it doesn’t matter as much,” he said.

“It might be the difference between a 14 times money and 15 times money but they’re both great results.

“On the flip side prices have come down and having half our NTA in cash is a terrific place to be because we can now look at companies valued at a bit less than they were previously.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.