Crypto shines as Aussie ETF market grows by 48.6pc

Pic: Getty Images

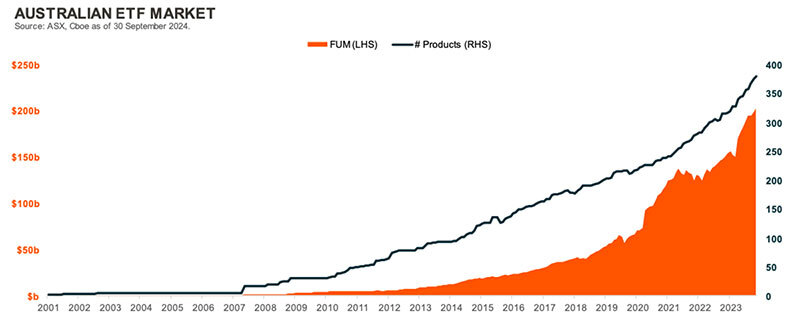

- Australian ETF market has grown by 48.6% over the past year to reach more than $226 billion across 394 products

- Global X report shows Australian investors seem to be favouring the low cost and simplicity of ETFs

- Cryptocurrency ETFs best performing ETFs over past year, buoyed by a falling interest rate environment and higher risk appetite by investors

Aussie investors continue to see ETFs as a sound investment choice, with the Australian Exchange Traded Fund (ETF) market growing by 48.6% over the past year to reach $226.6bn across 394 products, according to the latest Global X market report.

Global X said growth was driven by $26bn in net inflows, positive market movements, and the conversion of numerous unlisted active funds into active ETFs.

Favouring simplicity and low cost

Australian investors seem to be favouring the low cost and simplicity of ETFs according to the report with most of the investor dollars flowing into broadly diversified cheap ETFs such as BetaShares Australia 200 ETF (ASX:A200) and Vanguard Australian Shares Index ETF (ASX:VAS), with both funds each receiving around $2 billion in net flows.

Global X said factors ETFs such as quality remain popular, and greater product proliferation (such as those combining factors like growth and value) could see continued interest.

The VanEck MSCI International Quality ETF (ASX:QUAL) saw $1.5bn of net inflows, while Vanguard MSCI Index International Shares ETF (ASX:VGS) and iShares S&P 500 ETF (ASX:IVV) saw $1.4bn and $1.2bn of net inflows respectively.

However, Global X said that not all factors were winning, with minimum volatility less popular with high-cost active ETFs continuing to be shunned by investors in favour of their low-cost index ETFs.

The Magellan Global Fund – Open Class Units (Managed Fund) (ASX:MGOC) led the outflows with -$2.9 bn, while minimum volatility strategies such as the AllianceBernstein Managed Volatility Equities Fund (ASX:AMVE) also saw large withdrawals.

Cryptocurrency ETFs are top performers

Global X said cryptocurrency ETFs continued to be the best performing ETFs over the past year, buoyed by a falling interest rate environment and higher risk appetite by investors with strong flows into bitcoin ETFs.

“As share markets across the globe continue to reach all-time highs, funds that had magnified exposure to these markets, such as leverage ETFs, also made it into the top-performing funds over the past year,” the report said.

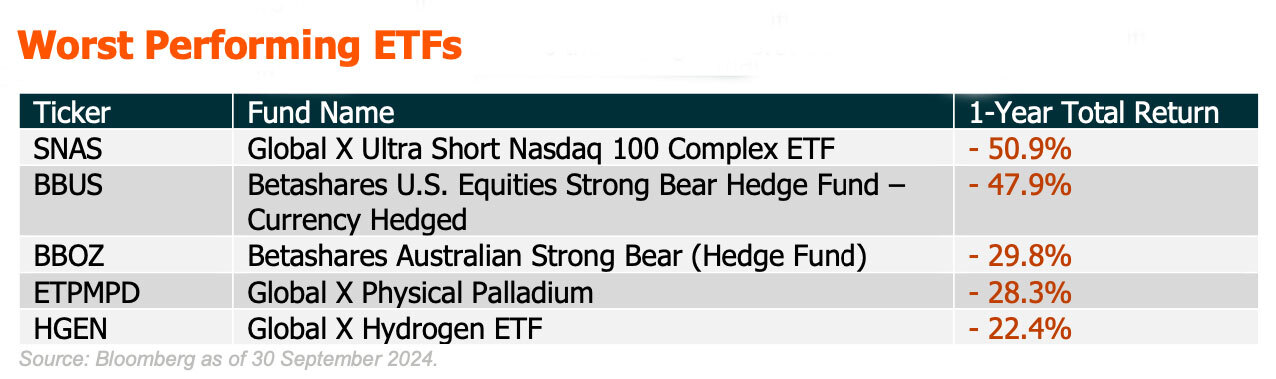

Clean energy ETFs struggle and worst performers

Clean energy ETFs have continued to struggle with weak performance over the past year.

“The transition to net zero may be more costly than anticipated, and many companies within these ETFs have faced pressures from rising borrowing costs,” the report said.

“However, as global interest rate regimes shift, there is potential for a rebound.

“Inverse ETFs, meanwhile, continue to be among the lowest performers over the past year, largely due to the strength of broader share markets.

Global Shares a popular choice

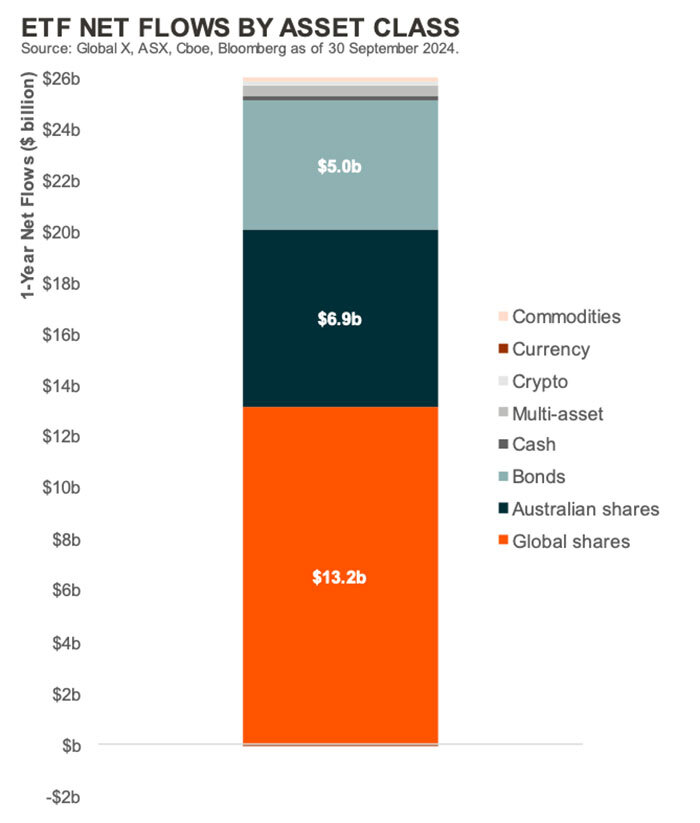

Global X said global shares continue to be the most popular asset class among Australian ETF investors, with over $13.2bn allocated to this category over the past year.

“Commodity ETF inflows have turned positive over the past year, as investors have increasingly been allocating to metals such as gold, which saw its price reach an all-time high,” the report said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.