Crowd-sourced funding is still growing rapidly – but how good is it as an investment?

Crowd sourced funding has increased rapidly in Australia. Picture Getty

- FY22 was the best year for the crowd-sourced funding industry in Australia

- Lots of interesting deals, but food & beverage still dominates

- We look at whether it’s a good investment

Australia’s crowd-sourced funding (CSF) industry continues to grow from strength to strength, and FY22 was the best ever on record.

In the last 12 months to 30 June, over $86m was raised across 98 successful CSF offers, representing an increase of 82% in funding volumes from the previous year.

Since being licensed by ASIC in 2017, the industry has facilitated over $185m across over 240 successful offers.

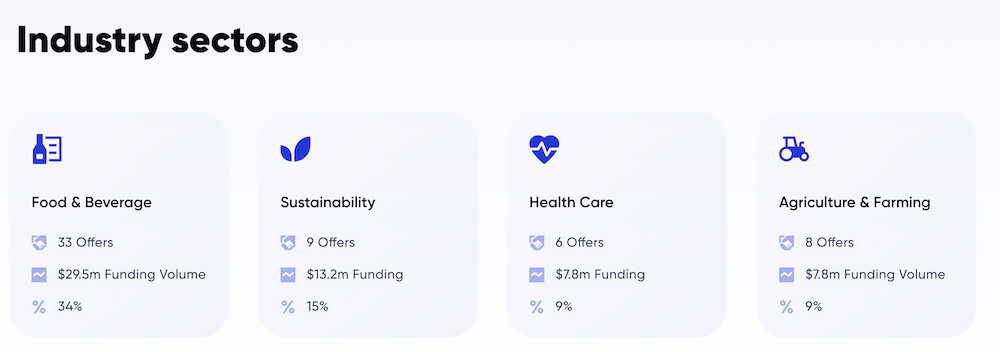

Food & Beverage makes up a third of all deals, while Sustainability themed offers totalled 15%.

Healthcare and Agriculture are the next big two, rounding up the top four sectors in terms of deal size over the past year.

There are three main CSF platforms for retail investors in this country – Birchal, Equitise, and OnMarket.

The vast majority of the deals last year, or around 70%, were made on Birchal, with the platform once again cementing its position as the dominant CSF platform for retail investors.

“Birchal, and the CSF industry have emerged from the COVID-19 pandemic as a strong partner to forward-thinking businesses, with the support of thousands of forward-thinking investors, facilitating capital at times when others could not,” said its co-founder and managing director, Matt Vitale.

Some interesting crowd-funded deals in 2022

After the success of microbiome health company Biome Australia (ASX:BIO), which became the first CSF-funded company to list on the ASX in November 2021, there were more interesting deals in 2022.

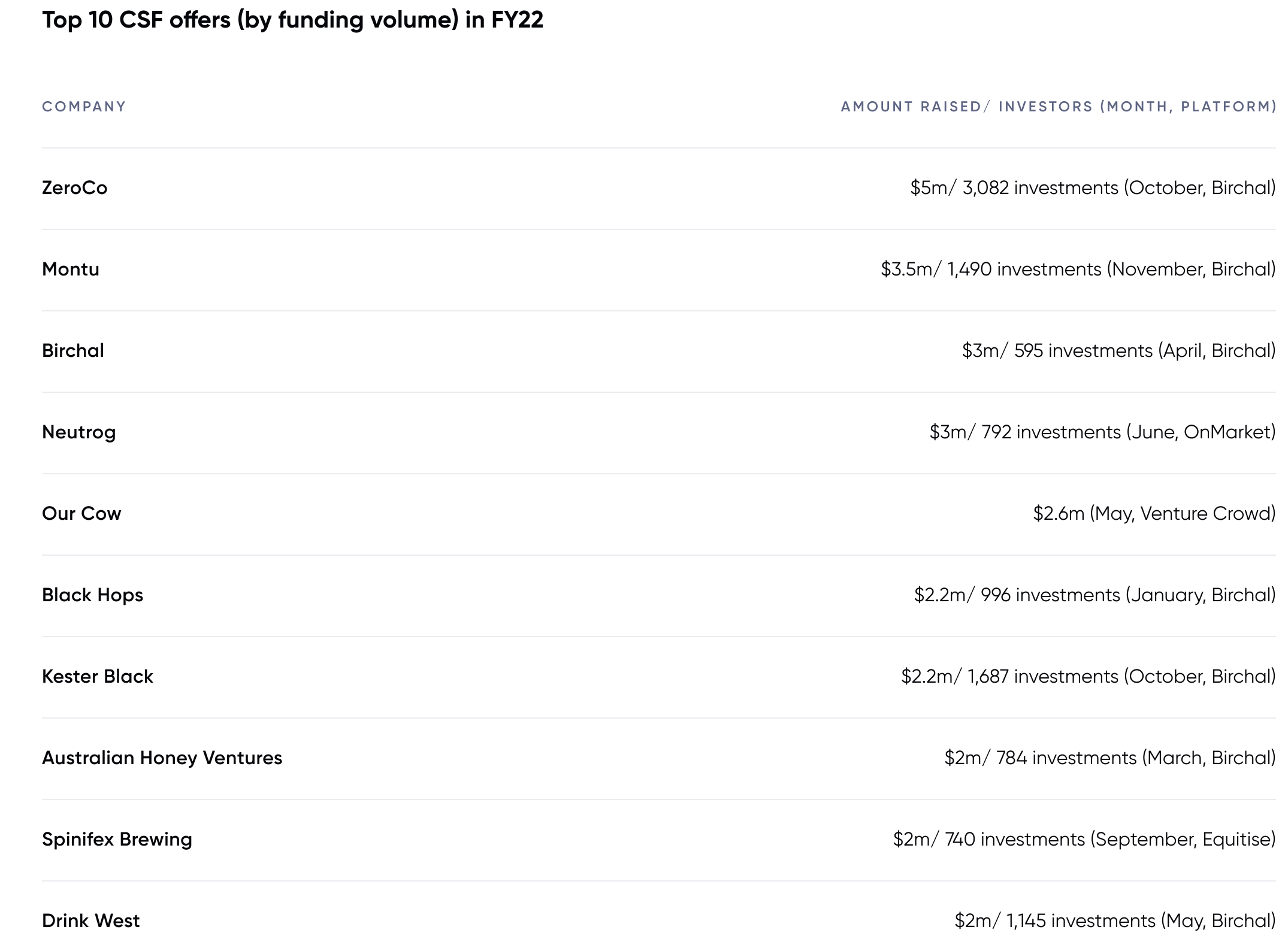

ZeroCo became the first company to raise $5m in a single CSF offer which was completed in less than seven hours.

$5 million is currently the maximum that can be raised under the ASIC CSF regime.

The Byron Bay-based company sells personal care and home cleaning products online, asking customers to send back their empty pouches after use. ZeroCo says its mission is to stop plastic going into the landfill.

Another interesting deal was Montu, which completed a successful $3.5m follow-on round, bringing its total raised to $5.5m across two offers.

Montu has built a cannabis ecosystem which connects Australians to highly qualified doctors, simplifying the process so that patients can get the medical cannabis treatment they need.

The other notable campaign this year was Kester Black, which raised $3.5 million. Kester Black sells vegan-based nail polishes and lipstick, and donates 2% of all revenue to social causes.

Whole Kids meanwhile raised $2.2 million in the first round, and raised another $1.2 million in the second. The company sells award-winning organic snacks for kids.

The craft beer sector is also among the most popular CSF investments.

Broome-based brewer Spinifex Brewing completed the biggest raise in Q1 of $2 million, while Black Hops managed to raise $2.2 million and Beer Cartel $1.5 million.

Is crowd-funding a good investment?

For brands, the benefits of equity crowdsourcing apart from raising funds is that it allows the founder to tell their story in a compelling and new way, which is a useful exercise for any executive.

There’s also the publicity and general interest from media that goes with raising funds on a CSF platform.

For investors, CSF allows them to put their money where their mouths are, and to invest in things they believe in.

“CSF investors that backed these companies have achieved tremendous growth in the value of their investments, albeit on paper at this stage,” Vitale said.

Investing in companies on Birchal is like any other equity purchase, where the amount of equity received is based on the amount you invest. The shares you get are typically the same class of shares as the founders and other shareholders

CSF is however relatively risky by nature, as companies using this facility are usually new or rapidly growing ventures, so there’s a chance you may lose your entire investment.

Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares – in another word, dilution.

Your shares are generally illiquid and will not be easily sold, and there is a minimum 12-month holding period from the date the shares are purchased.

The normal rules also apply to your investment in a company via CSF when it comes to tax-time.

At this stage, there has only been one exit from a company that raised via Birchal, and that was Biome.

Biome raised $300k on Birchal at a $6m valuation in 2019. It listed through an IPO on the ASX in November last year at a market cap of $40m.

So if you get on the right train, that’s a very tidy 7x return in just two years.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.