‘Credit where credit is due’: Robinhood investors called the market bottom, showing ‘impeccable’ timing

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

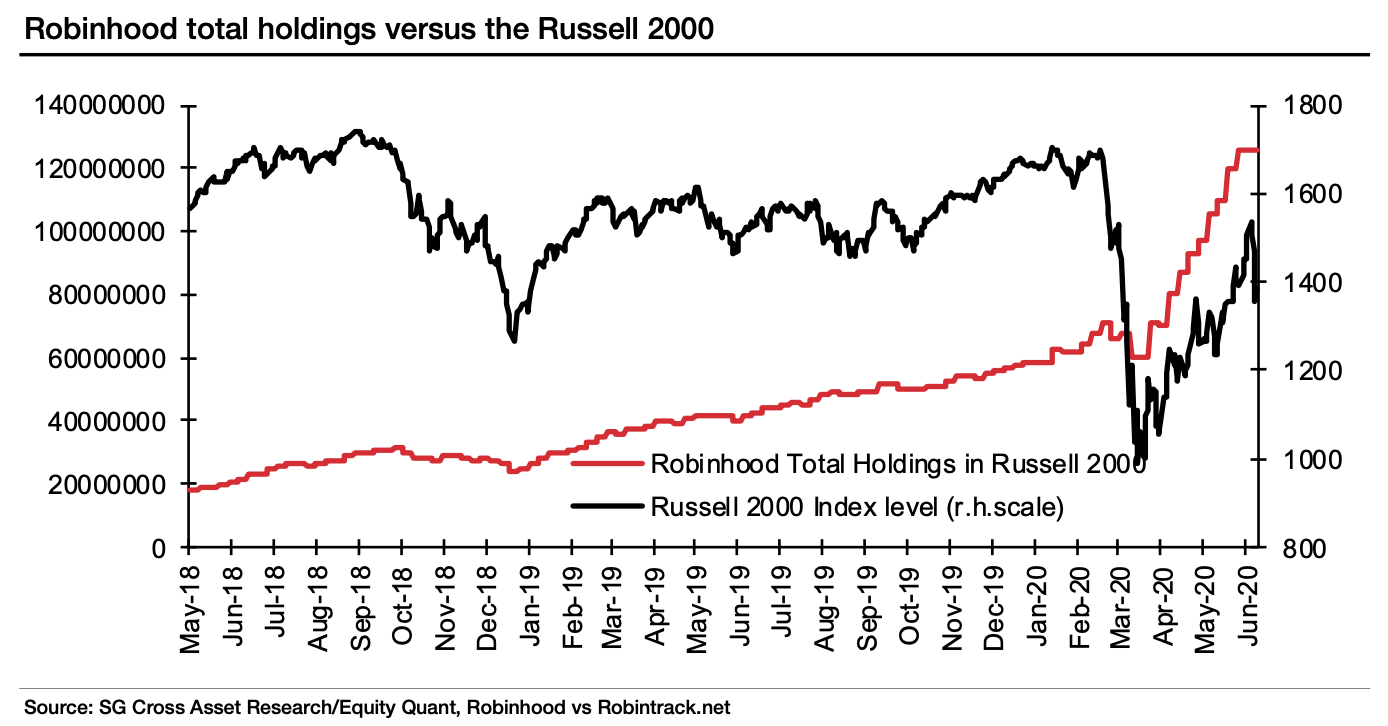

Robinhood traders displayed top-notch timing when they rushed into the market as it hit recent lows in mid-March, according to a Monday note from Societe Generale.

“For all the mocking of Robinhood investors, their timing back into the market looks impeccable, with a significant pick-up in holdings as equity markets bottomed in mid-March,” wrote Andrew Lapthorne of SocGen.

Using data from Robintrack, the firm found that the March market bottom amid the coronavirus-induced rout coincided with an overall step-up in Robinhood positions in the Russell 2000, the small-cap benchmark index.

That was just before the index surged more than 40 per cent.

“Credit where credit is due – as retail investors, based on the Robinhood dataset, have charged into the market at its very inflection point,” Societe Generale wrote in the note.

“Of course, only time will tell if this has been profitable in the long run.”

The analysis also found that Robinhood traders are buying both high- and low-quality stocks, but that investor money has a bigger impact on smaller, lower quality shares.

A similar pattern was seen when looking at stocks with the highest and lowest prices – Robinhood traders put more money into higher-priced stocks, but their investments into low-priced stocks were more meaningful.

“Retail investors have long been associated with buying stocks that are largely off-limits to many institutional investors, either because they are too small or because they are just too speculative,” said Lapthorne, adding, “this is not to say that all the retail money has solely been flowing in the direction of such speculative stocks.”

In fact, the opposite has happened – in US dollar terms, Robinhood traders have favoured momentum stocks over reversal stocks, according to the note.

Robinhood traders have been in the spotlight in recent weeks in stories of “nonsensical trading” occurring on such platforms, including buying the stock of distressed or bankrupt companies such as Hertz or JCPenney.

“When it comes to bombed out distressed equity, retail investors have a bigger voice and therefore greater potential influence,” said Societe Generale.

“And when it comes to Hertz Group it now seems they can radically change how a company tries to finance itself out of Chapter XI!”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.