Coup d’état won’t stop us: Haranga Resources will list on the ASX today

IPO Watch

IPO Watch

Despite another untimely military coup in Burkina Faso, Peter Youd, executive chairman of Haranga Resources, has confirmed the company will list on the ASX today, as planned.

The gold-rich West African nation has been in turmoil since Monday when the military removed President Roch Kabore.

“Fortunately, our priority projects are Saraya in Senegal and Issia in Côte d’Ivoire,” Youd told Stockhead.

The gold and uranium junior says it will continue to monitor the situation in Burkina Faso, but Youd has a series of projects on the go with more irons in other West African fires.

”The exploration permits in this region are not the focus of our company’s efforts,” he said.

That’s probably good, because the army has closed the border and deposed democratically-elected and widely-reviled President Roch Kabore as anger peaked over his mishandling of violent armed groups led by Islamist militants. The Burkina Faso army says Mr Kabore is secured in an undisclosed location.

It’s been a journeyman effort from the Haranga Resources (ASX:HAR) team, which stepped away from the listing life back in early 2018 after its major shareholder took issue with a planned acquisition.

Haranga Resources says it’s still seeing strong investor interest in its West African gold and uranium projects as the company prepares to debut on the ASX today (Thursday, January 27).

The Perth-based digger raised $6.5 million in its oversubscribed IPO and has mapped a two-year plan to further explore and develop its West African projects.

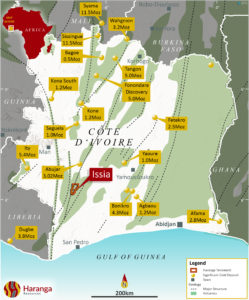

The company holds interests in a range of gold projects across the Cote d’Ivoire and Burkina Faso, and a uranium project in Senegal, covering more than 3,000 sqkm over the three areas.

This includes the Issia gold project in Cote d’Ivoire, which is located within 50km on the same geological and structural domains as Tietto Minerals’ +3Moz Abujar gold project, and the Saraya uranium project in Senegal, where uranium mineralisation has been reported in historical drilling programs.

Youd says HAR intends to advance to declaring resources for both projects in the near term.

Recent geological studies based on historical drilling at Saraya and historical geochemical surveys at Issia, coupled with the projects’ proximity to known mineralisation and proven resources, confirms their potential.

Youd is prepping for a strong response when it lists later today, adding institutional and broker interest has left it oversubscribed.

“This is an exciting opportunity to develop the Saraya and Issia projects, which show good prospects for early exploration success thanks to their locations, results from recent studies and historical data.”

“The Issia Gold Project is located in a prolific gold province with key similarities to adjacent, well-defined gold deposits and is supported by good infrastructure. There has been no historical drilling at Issia.”

“The project features extensive geochemical gold anomalies with high-grade potential, which Haranga intends to validate. We have already commenced an air core drilling program over these anomalies.’

“Our Saraya project should be considered both an advanced-stage exploration project and large greenfield exploration project.

“On one hand we have mineralisation showing good results, partially drilled around 2010 by French government-owned Areva and relinquished due to falling uranium prices. On the other hand, we have a large exploration permit, showing high order uranium anomalies, some with preliminary testing but most left unexplored,” Youd said.

“There’s renewed interest in uranium with prices climbing to a near seven-year high over the past four to five months, and acknowledgement at the recent COP26 summit by numerous world leaders that nuclear power has a major role in assisting global decarbonisation efforts.”

“We have negotiated with Areva’s successor company, Orano, for access to their data room in Paris. We will be reviewing this data in coming months with a view to determining the scope for outlining immediate resources and forming the basis for ongoing exploration programs.”

Youd says investing in gold and uranium made smart business sense as it presented optionality for shareholders.

“Analysts are pointing to the demand for uranium only increasing and the price of gold staying strong into the future, especially with the talk of increasing inflation,” he said.