Congratulations Australia! It’s World Electric Vehicle Day and we’re almost last on the grid

Picture: Getty Images

My world gets weirder, by the day.

The World EV day in this case.

World Electric Vehicle Day (WEVD) is happening to your country right now, Friday, September 9, 2022.

It’s a apparently a day when EV owners and anyone with a stake in pure electric vehicles is cattle-prodded to get on social media platforms and get digitally funky over the EV cause.

And how is the cause here?

Well as my Cornish colleague from eToro tells me, we’re still a F*&^ing long way away from electric utes and zero emission weekend road trips?

He’s Cornish, not corny and Josh Gilbert, market analyst at eToro, knows a great deal about what’s happening, if anything is, in the EV market here in Australia.

EVs: An idea who’s time arrived a while ago…

EVs have captivated retail investors for years, particularly with Tesla shares Moon-dogging or whatever it is he says – jumping 900% since the start of 2020.

“As the green tidal wave of vehicle transition ascends upon us,” Josh says, “Australia’s EV adoption has been a laggard compared to the rest of the world.”

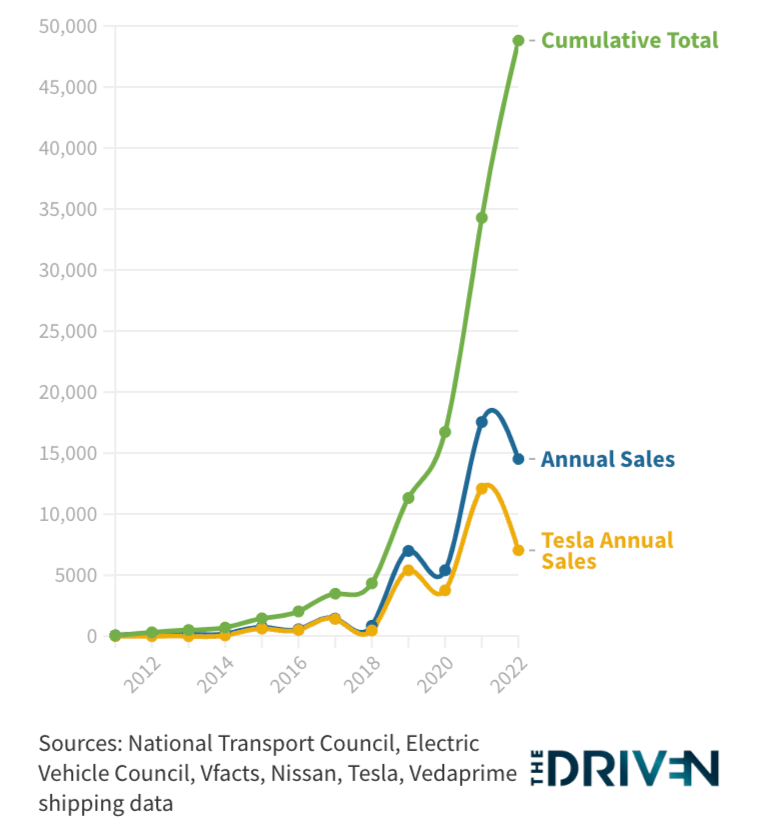

But, EV sales in Australia did at least triple to 20,665 in 2021, up from 6,900 in 2020.

EV uptake in Oz, 2011 – June 2022:

“Yeah that’s a significant increase and a decent step in the right direction, but from a very low base,” he told Stockhead.

This increase represents a 2% market share of all light vehicle sales, compared to 0.78% in 2020 of the total light vehicle market. Significantly lower than the UK (15%), China (21%) and global sales of (9%).

“So, yeah, electric vehicle sales rose sharply in 2021, with increased model availability, lower prices, and state and territory government incentives stimulating the market.”

However, Josh warns, Australia continues to struggle to attract global car manufacturers due to its low-efficiency standards compared to the rest of the world.

“Without stricter fuel efficiency standards governing the amount of carbon emitted per kilometre, these manufacturers see no benefit in cross-subsidising EV sales to sell their more profitable combustion engine vehicles.

“Australia is just one of two major countries that does not have any emission regulations for new vehicles, the other is Russia.

“Russia!”

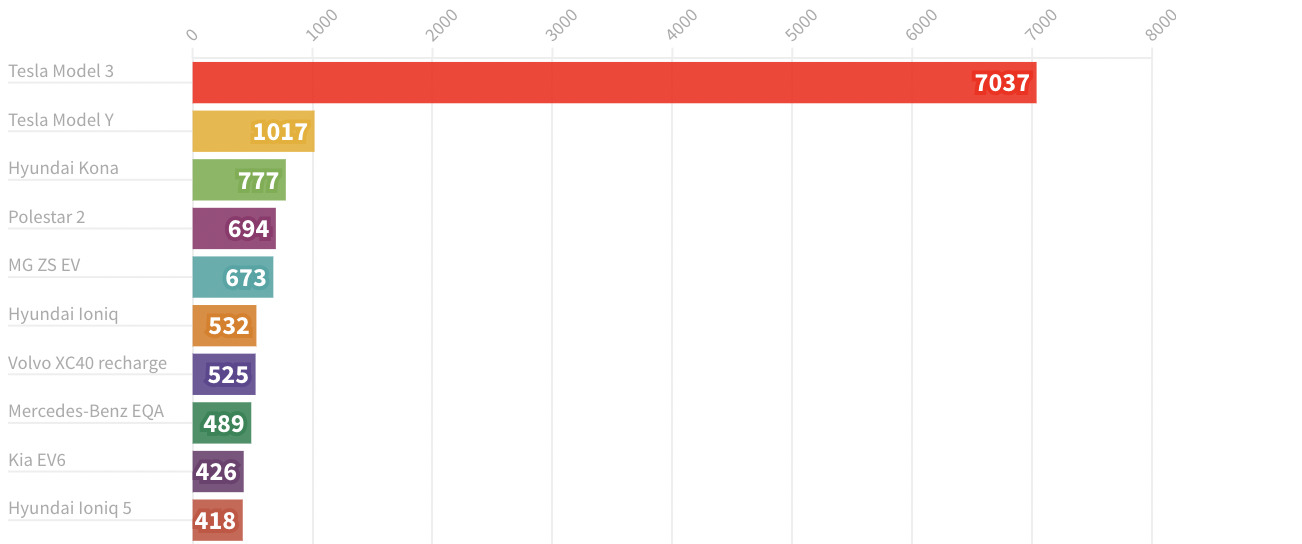

And this is who we’ve been buying, and it may not stun anyone too much:

EV Sales in Australia, YTD according to very cool-titled EV magazine The Driven:

This is maybe evident in the considerable gap between model sales in Australia.

“Tesla Model 3 is by far the top-selling EV in the country, accounting for almost 60% of all EV sales in Australia, so it’s no wonder it’s the most owned stock by Australian investors on eToro.”

And last month shows that while Mr Musk is facing competition abroad, at home he remains the EV Emperor.

Not only did Tesla launch its Model Y SUV last month, it also lifted its local market share to what is being described as an all-time high for Australia.

EV sales totalled 4235 in August, 80% were of Elon’s making

“EV sales were 4.4 per cent of the total market. This is the highest market share for pure battery electric vehicles ever recorded in a single month in Australia,” according to the CEO of the peak body for Australia’s automotive industry, Tony Weber at the FCAI .

Meet Kermit, Australia’s only 100% electric ⚡ cone truck!

Keep an eye out for this beauty during maintenance closures in Brisbane where our partner, Schramm Group, takes care of traffic moving around our work zones. #WorldEvDay #GoEV #ElectricVehicle pic.twitter.com/6vRsUaaaQo

— Transurban (@Transurban) September 8, 2022

Weber said the increase in electric vehicle sales throughout August was huge.

“We have seen strong sales of battery electric vehicles in August, with Tesla alone selling 3,397 vehicles.

“Year-to-date EV sales are 2% of the total market, hybrids are 7.6% and plug in hybrid vehicles are 0.6%. Combined electrified vehicles are now just over 10 % of total sales in 2022.”

And at least the Spanish Embassy is excited:

En la carretera hacia las cero emisiones netas! Estupendo conocer que las ventas de coches eléctricos en Australia han alcanzado niveles récord en los últimos seis meses. #WorldEVDay https://t.co/8JvsLh9Ktg

— Sophia McIntyre (@AusEmbEsp) September 9, 2021

Pierre Ferragu of New Street Research was at Tesla’s apparently-pretty-electric Gigafactory in Berlin for a Tesla event last month. If the event for industry analysts was courting favour, it seems to have worked.

In a note to clients, Ferragu said Tesla is just about to face a tsunami of want:

Tesla is facing unprecedented demand. Everybody I know at Tesla and with whom I could discuss that topic agrees that demand is way above what hopes were a few years ago.

Electric cars are so popular that for Tesla and their competitors, market shares will mostly be dictated by their ability to ramp volumes.

Ferragu seemed to think the Gigafactory is the Ferrari of factories:

Compared to Fremont, Berlin is visibly much more efficient. Logistics inside the factory are much simpler, eased by docks surrounding the fab from all sides and ensuring parts come in at the right place in the manufacturing chain. The single manufacturing line is designed for a cycle time of 45 seconds and will deliver 10,000 cars per week at full capacity. (On a side note, it takes just above 5 full days non-stop to do 10,000 cars at 45 seconds per car, so this target accounts for a healthy 25% downtime.) Most importantly, cars are manufactured today with a rear casting, and will shift to rear and front casting as soon as the 4680 structural battery packs will be available.

Traditional carmakers are catching up to Elon elsewhere, but not here

Traditional manufacturers such as Volkswagen aren’t anywhere to be seen on the EV sales list in Australia, Josh says.

“However, if we look at Europe, its sales are only marginally behind Tesla. Given the low rate of EV sales in Australia, global EV manufacturers are exploring other markets.

“For obvious reasons, Nio, the third most held stock on eToro by Australians, is looking to Europe. The company is already established in Norway and plans to enter Germany, Netherlands and Sweden by year-end, given the vast uptake in electric vehicles.

“As supply chain issues begin to dwindle, and with the Chinese Government recently handing down a huge US$150 billion infrastructure package, Nio looks set to ramp up production, which could help its deliveries soar throughout Europe.”

Tesla faced its issues in 2022, with lockdowns in China slowing production, which saw Q2 deliveries decline, ending years of gains. However, Elon Musk insisted on a recent shareholder call that the worst was behind them and announced that June was “a record month for production.”

“From global delivery data, EV manufacturers don’t have a demand problem but a supply and infrastructure problem. Chip shortages, lockdowns, and commodity pricing have all heavily affected deliveries, as well as simply not having the infrastructure to manufacture more cars.”

Rivian

Josh says Rivian, the new EV on the block, delivered 4,467 vehicles in Q2, up 72% from Q1.

“Rivian has a pre-order list stretching to 2023, and we may not see their vehicles in Australia until 2024 but Australian investors on eToro are certainly keeping an eye on the electric pick-up manufacturer with the stock being the 24th most held by Australian users.”

Like the rest of the EV industry, demand is high, but it is struggling to boost output.

“So we already know Australia is falling behind the curve on EV adoption. But, the new Labor government has pledged to cut fringe benefits and import taxes for EVs while promising to double the amount of money spent on charging infrastructure to half a billion Aussie dollars.”

Road Trip vs around the block trip

A significant drawback for Australians is losing ‘the weekend road trip’ given Electric Vehicles’ low travelling distance.

In a survey from the Electric Vehicle Council, 92% of respondents indicated that public fast charging infrastructure is vital for buying an EV.

The addition of fast charging infrastructure is starting to improve, Josh says.

“From August 2020, to January 2022, public fast charging locations across Australia have almost doubled. NSW is currently leading the way with a plan to ensure fast charging is available every 100km along regional routes and every 5km along major commuter corridors in Sydney.”

Electric road trips around Australia?

It won’t be a moment too soon.

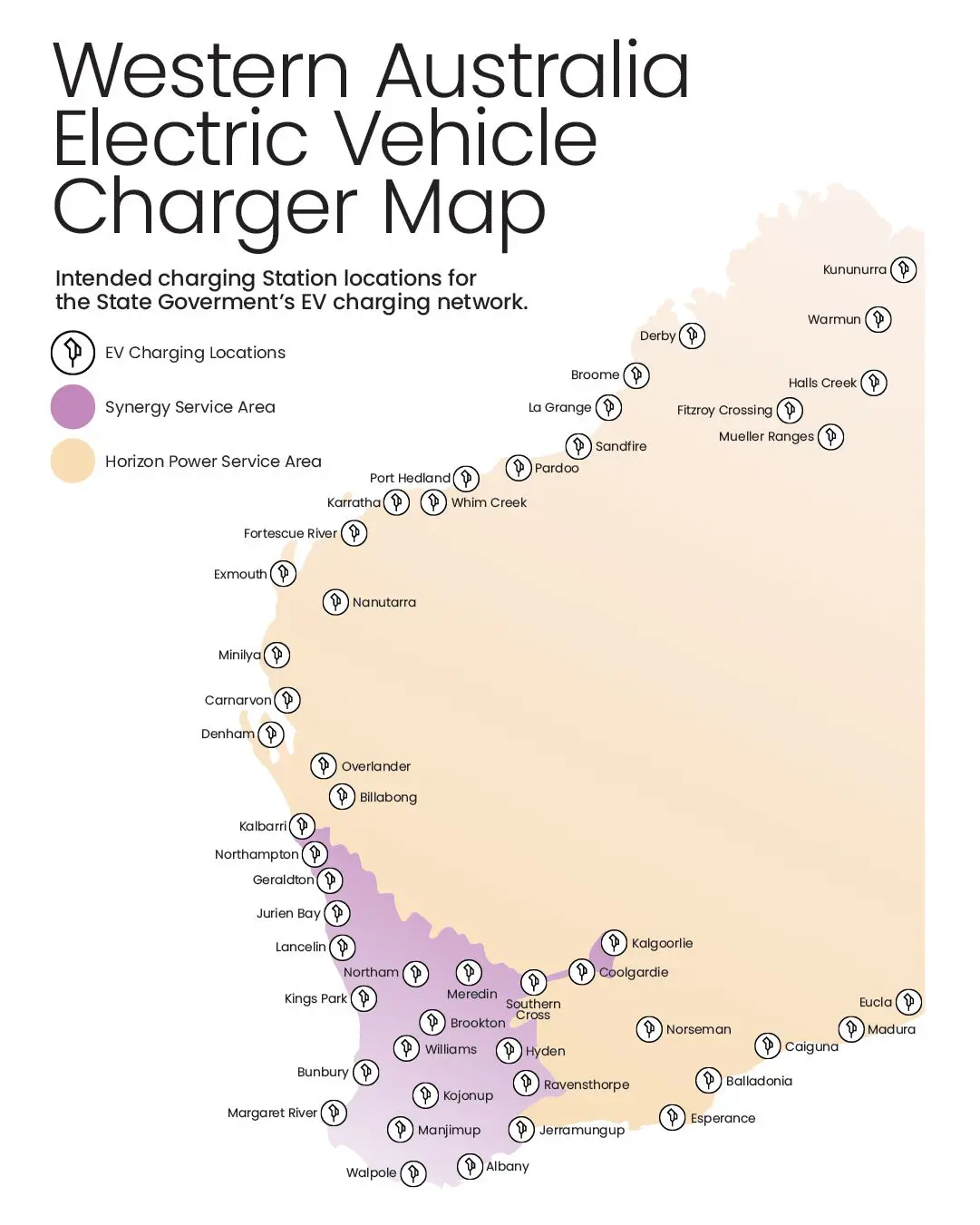

Today is World Electric Vehicle Day. #WesternAustralia will soon be home to the longest electric highway in Australia with 45 new locations to make up the state’s #ElectricVehicle fast-charging network. See the map here: https://t.co/JTD9fol5SE#WorldEVDay #sustainability #EVs pic.twitter.com/7ANNB13s0v

— DWER WA (@DWER_WA) September 9, 2021

On Monday, the WA government announced that the longest electric car charging network in Australia will be boosted by EV chargers from Finland, with the Finnish firm Kempower, chosen to, well, LEAD THE CHARGE.

The 5,300km charging network will stretch from Eucla near the South Australian border to Perth and up to Kununurra in the state’s north. All that forms a key part of the McGowan Labor Government’s $21 million EV Fund which aims to boost EV infrastructure, but when it comes down to it is really just peanuts.

For genuine EV fans and lovers of the endless Aussie road trip, the latest moves really only serve to highlight the dearth of EV charging infrastructure in remote areas of southeast and northern WA.

Last on the grid

Australia is playing catch-up from the very last spot on the grid, Josh says.

Electric has a new beat that will get your heart racing. Get ready for some fun this #WorldEVday, on 8th September.

To join the webcast and Make Electric Fun: ⚡️https://t.co/cXlP8XtoRe#Mahindra #MahindraXUV400 #XUV400 #AllElectric pic.twitter.com/hRGSlUknqh

— MahindraXUV400 (@Mahindra_XUV400) September 5, 2022

“And we probably needs to do more to attract global EV manufacturers, given that demand for electric vehicles is soaring.”

Although Australia is playing catch-up in selling the vehicles, it could ultimately be a strong force in manufacturing.

“Australia has great industrial infrastructure, clean energy resources and is a leader in lithium and rare earth minerals.”

Along current projections, Australia’s lithium industry is forecasted to contribute $9.4 billion in revenue to the Australian economy by 2023-24. This wealth of lithium, which currently generates revenue primarily as an export, provides the potential to create a self-sufficient supply chain for electric vehicles.

Kanish Chugh, head of distribution at ETF Securities, says that on the demand side there’s already local pressure.

“Demand for lithium-ion batteries remained strong in Q2, especially for use in electric vehicles (EV). Sales accelerated ahead as demand for environmentally sustainable motoring options took off.

“The sales trend is supporting conditions in the battery technology and lithium production supply chain.”

However, Chugh says, battery tech companies struggled with high input costs, and flat demand in segments outside the EV space.

“In the first half of 2022, global Battery Electric Vehicle (BEV) sales increased 81% YoY while sales for all drivetrains fell 12% over that period. Automakers varied in their ability to combat supply chain issues, reduced traditional ICE sales, semiconductor shortages, and elevated commodity pricing.”

Chugh adds: “Companies like Tesla and Ford beat on earnings, while other automakers such as GM reported more pronounced margin compression. Throughout the quarter automakers raised prices on EVs, which did not seem to negatively impact demand.”

Demand for EVs in Australia is picking up fast, he says.

“This reflects a change in consumer preferences supported by a shift to more supportive government policies and the adoption of EV targets by vehicle manufacturers.”

Tesla continues to dominate the EV market globally as it ramps up production and rolls out new vehicles. Nio, however, is rapidly expanding and promises to be a significant player in the future of electric vehicles alongside traditional manufacturers such as Volkswagen.

Just quickly, on WEVD – that enthusiastic analyst Mr Ferragu has recently updated his price target for Tesla’s stock.

It’s US$530 – a fairly significant upside considering it’s currently circling about $275 a share.

Long term, Ferragu even sees a case for Tesla being worth $10 trillion by 2030, but that’s based on the automaker achieving its goal to produce 20 million electric vehicles per year by then.

For a decent comparison, there’s not many that work – it’d be about four times Apple’s current valuation.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.