Confessions of a Day Trader: World goes mad, Bottom’s up!

OK, I'll just have one. Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 9

We start the week with a result from the USA election and am expecting to have a relief rally from some of the closing prices from Friday.

Everything on the watchlist comes out of the gate higher except for Tabcorp who are marked down because their systems failed over the weekend. Sitting in my car, I watch everything keep rising bar TAH, so buy 1,000 at 3.93, which is down 4% and head into a meeting.

It’s 10.24am. Sit and watch them firming up a bit, whilst in the reception area, as they are running late. Come out at 11.00am and check the watch list. Everything still going up, and sell TAH at 4.04 for a $80 profit. Chuffed with that after Friday’s poor effort and head home.

Sit on my hands for the rest of the day, as can’t find anything that has hit a bit of profit taking to give me a buying opportunity. Considering that on Friday, FMG didn’t bounce enough for me, but today they bounced alright and closed at 17.61. That’s almost up $1.00 from where I bought 1,000 at my lucky 16.66 level on Friday.

Z1P closed up 7% at 6.52. Last week they were struggling to break the 6.00 barrier and JIN closed up 8% at 12.60, almost up a whole dollar. Last Monday I sold 500 at 10.80, so a week later they are almost $2 higher.

Even APT hit an all time high of 105 and closed at $104.53, up 4%.

+ 1,000 TAH at 3.96; – 1,000 TAH at 4.04; Profit: $80

Tuesday, November 10

All markets go through the roof on news that Pfizer has a 90% success rate with a COVID vaccine. They were up 9% but stocks like Zoom are down 15% and Peloton are down 12% as they have been seen as the work from home champion stocks. Anyone short are going to really get their pips squeezed today.

I’m a buyer on the open and then expect it to come off its highs on profit taking and close below those highs. Going to be fun!

Rush back from a coffee to get to the open, as going to get a bit aggressive and have transferred some extra money into my trading account.

And then everything goes out the window. As stocks open on a rotation basis, with the As first, Afterpay – whom I was not planning to go early on – start to plunge. I didn’t think APT or Z1P would be so affected by the COVID vaccine news, so whilst I was waiting for FMG to open I get distracted watching APT. Buy 500 at 99.40 six mins in and wait as they head back to 100 and sell out at 99.94.

At 10.11am, they are back down to 98.64 (they were 104.00 yesterday) and buy 500 at 10.11am. They keep falling. Finally get to buy 2,000 FMG at 17.77 (long way from lucky $16.66). It’s 10.15am and these are the times in the market that I love.

Sell the FMG at 17.82 three mins later. That’s how fast things are moving. At 10.20am APT are down 7% at 96.68, Z1P are 6.21 down 4.75% and Pushpay are 7.55 down 4.9%. Decide time to average down on APT, as futures are bouncing. Buy another 500 APT at 95.50 (which just stuns me) and now long 1,000 at 97.70 average. Also buy 1000 Z1P at 6.10 two mins later. They opened at 6.40 FFS. Sell 1000 APT at 97.98 for a profit of $110 and a min later sell 1,000 Z1P at 6.14, for a $40 profit.

Now square and futures showing down 35.5 points at 6401. Watching and waiting. Gold was knocked last night so add Northern Star to the watch list, as have been avoiding mining companies for trading purposes. They are 15.05 down from 16.80, which is 10.80% compared to gold’s 5% fall.

It’s now 11.30am and time for another coffee as too tempting to watch and put on a trade for the sake of it. Everything, and I mean everything on my watch sheet is now RED! Amazing.

That’s me done for the day. Up $304.

APT close down 10.86%, FMG u/c, Z1P down 9%, Northern Star down 11.9% and one of the forums’ favourites, PPY, down 12.3% to 6.4c.

+500 APT at 99.40; -500 APT at 99.94; Profit $54

+500 APT at 98.64; +500 APT at 95.50; -1,000 APT at 97.98; Profit $110

+2,000 FMG at 17.77; -2,000 FMG at 17.82; Profit $100

+1,000 Z1P at 6.10; -1,000 Z1P at 6.14; Profit $40

Wednesday, November 11

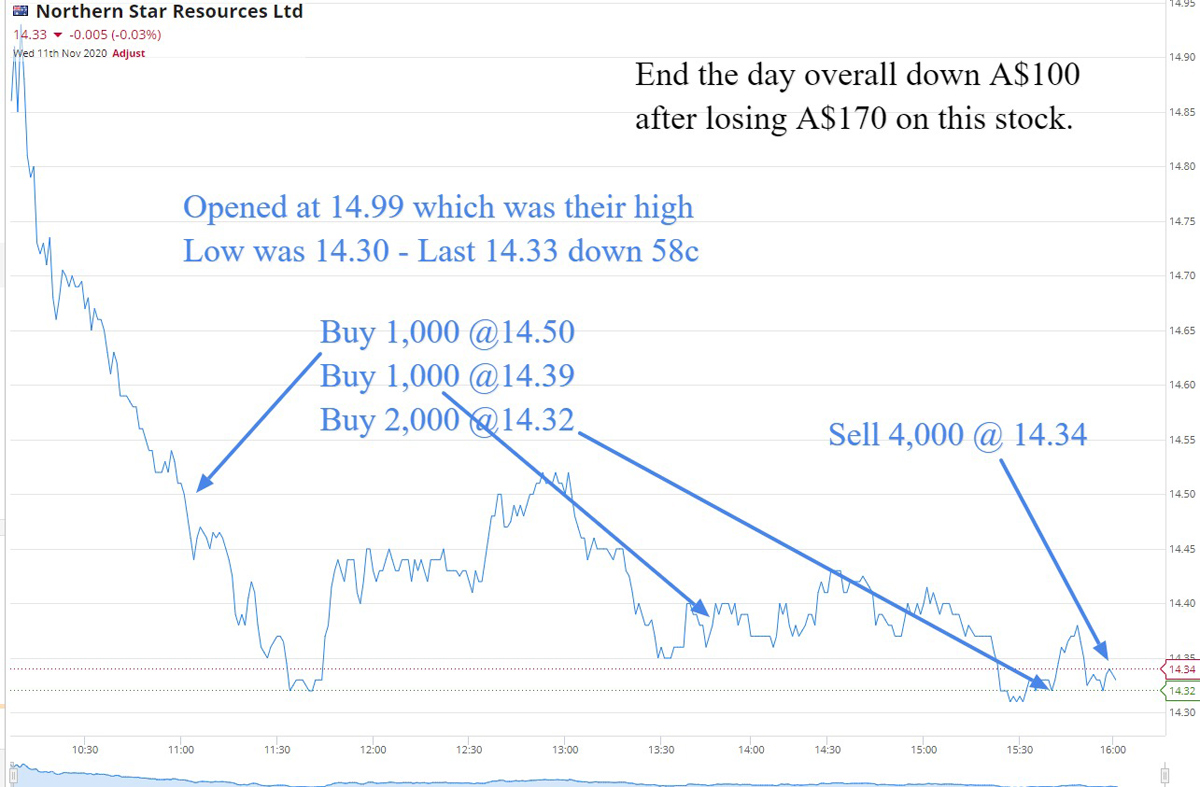

Not much happening overnight. See that Northern Star opened at 14.99 and at 10.59am buy 1,000 at 14.50 – that’s down $2.30 from two days ago, or 13.6%.

See that Z1P are below their magic 6.00 and buy 1,000 at 5.95. It’s 11.32am and Northern are now trading at 14.36. Ouch!

Z1P rally a bit with APT and pocket $70 by selling at 6.02. It’s 11.44am. Getting a bit of after lunch indigestion from Northern and average down by buying another 1,000 at 14.39.

It’s 1.42pm. Average in price now 14.445. Still giving me some pain and showing down $250. Buy another 2,000 at 14.32 with 20 mins left to trade.

With five mins to go I am up $10 on the position. Here comes the rally, or so I thought… but it fizzled out and I kept chasing them down. In last min I manage to lock in a loss of $170.

So close and yet so far! Overall down $100 for the day.

+1,000 Z1P at 5.95; -1,000 Z!P at 6.02; Profit $70

+1,000 NST at 14.50; +1,000 NST at 14.39; +2,000 NST at 14.32; -4,000 NST at 14.34; Loss $170

Thursday, November 12

Again not much happening overnight. A bit of news coming in on FMG and how Forrest wants to get into other things, which the market doesn’t like. 30 mins in and they are down 2% at 16.68.

Add Telstra to the watch list, as they have had an internal structure and are up 5%. Looking around for any big fallers. APT back above 100.00. Put in an order to buy 1,000 FMG at 16.64, which is 2c below my ‘lucky’ level and at 11.33am, I get filled in.

They fall down to 16.58 before bouncing and at 11.33am, I’m out at 16.725 for a $85 profit. Here is a couple graphs. One to see where they were when I picked up 1,000 and one to see what happened next.

+1,000 FMG at 16.64; -1,000 FMG at 16.725; Profit $85

Friday, November 13

Was away for most of the day and when I did patch in, I was not able to give my full attention. Sometimes you should have days where you take a break. The way I handle things, I clean my teeth knowing that I have cash in my bank account and go to sleep with the same feeling of security. I try and avoid getting stuck in something that has a high potential of being suspended and taking all my time and energy worrying about the missed opportunities.

HotCopper is full of suspended stock which rate in the top 10 most discussed. Not trading but taking up every man and his dog’s energy when caught. So, sticking to stocks that have market caps of over a billion dollars and are run by professional boards with professional investors, are OK to day trade. Every day they find a level because even if a person is short, they have to buy it back. Always remember that.

I’ll leave you with two graphs from today that show a pattern and both are over billion dollars in valuation.

Profit this week: $369

Brokerage: $190

Net profit: $179

Best trade: APT +$110

Worst trade: NST -$170

Rolling tally: $+778.60 net

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.