Confessions of a Day Trader: Which bank will get its comeuppance soon?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 18

Leave the screens alone and when I do take a peek, I have either missed it or just can’t find anything. APT touched 140.00 per share and TYR remain suspended.

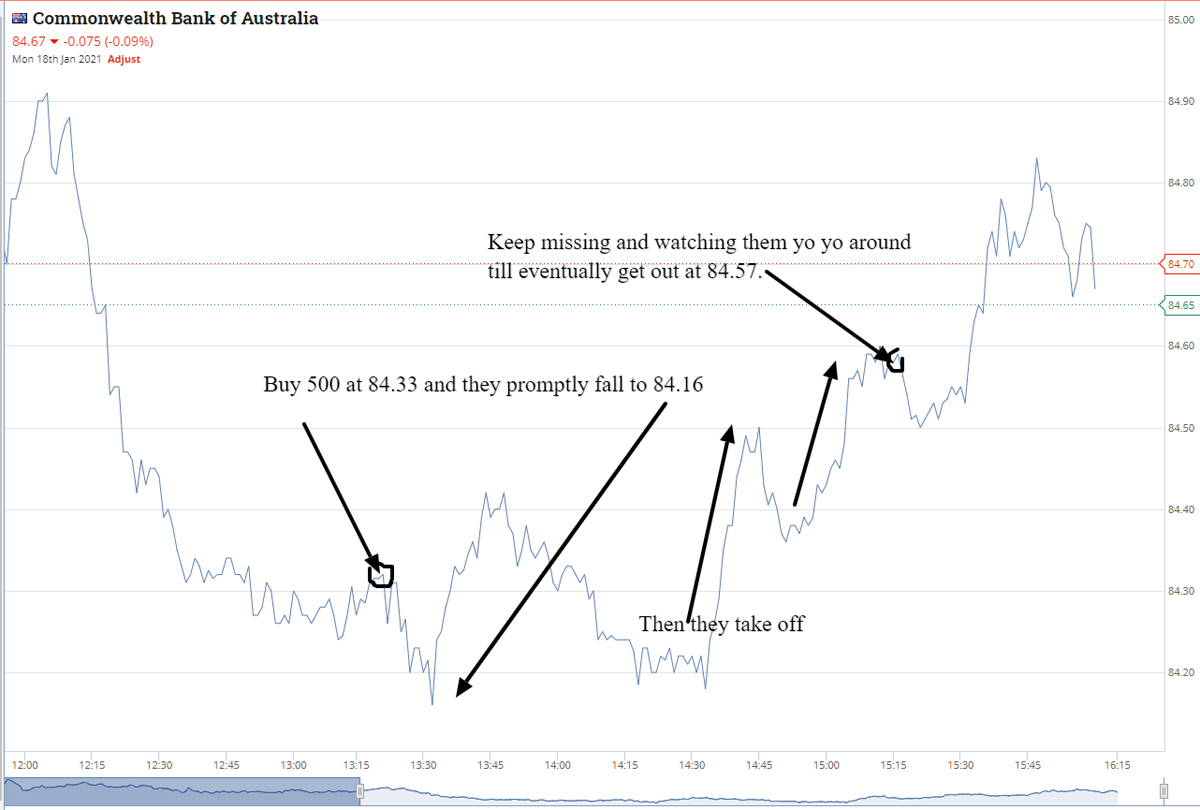

Have a go at 500 CBA at 84.33, as down from 85.00 and watch them promptly fall to 84.16. See graph.

Eventually get out almost two hours later. They move around a bit for such a large company. Also bt 2000 FMG at 24.84, thinking they are going back to 25.00. Have to double down at 24.84, as running out of trading time.

It’s 3.15pm. Have to cut them at 3.43pm as too short a fuse till end of day. At one time was down over $250 on both positions, so to walk away up $60 is a surprise to me and to my computer screen!

+500 CBA at 84.33, -500 CBA at 84.57, Profit $120 ( kept missing the top!)

+2000 FMG at 24.89, +2000 FMG at 24.85, -4000 FMG at 24.85, Loss $60 ( drifted along most of the day from its high)

Tuesday January 19

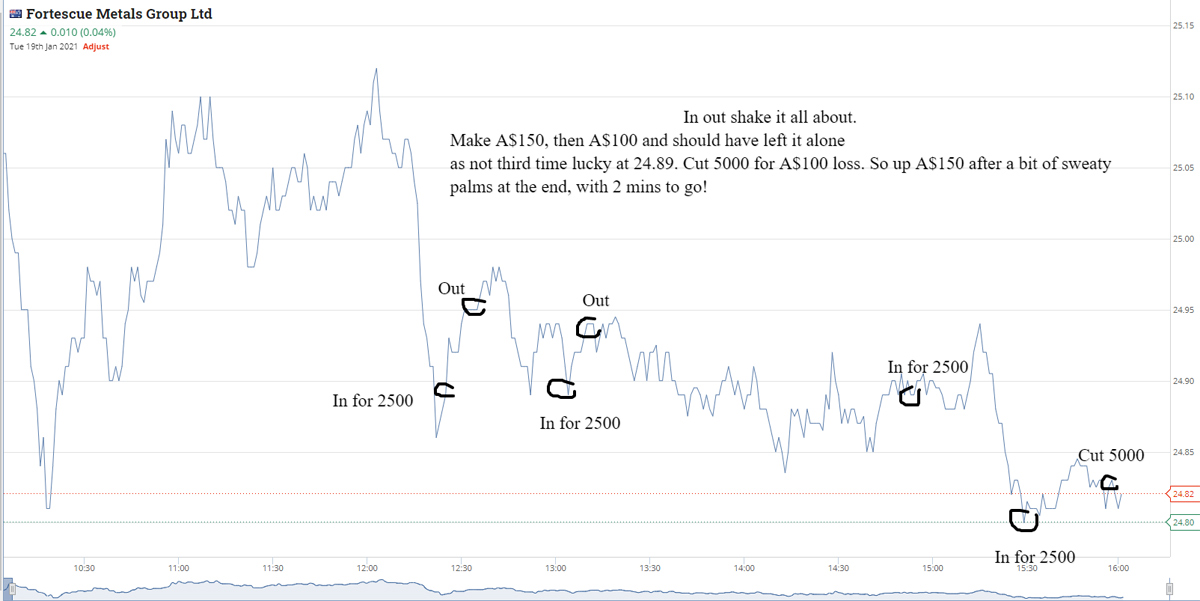

Come back from a meeting and see FMG opened above 25.00 and now trading at 24.89, so buy 2500 there. Time is 12.51.

Seven mins later out at 24.95. Back in at 24.89 and out at 24.93 for 2500 within another 10 mins. That’s +$250 in around 20 mins.

After first profit on FMG decide to have a punt in CBA. Buy 500 at 85.29 and then another 500 at 85 even. Back into FMG at 24.90 and then at 24.80 but no bouncing like before. Have to cut both positions with two mins to go. Out of CBA at 85.06 – loss A$85 and cut 5000 FMG at 24.83 for a $100 loss.

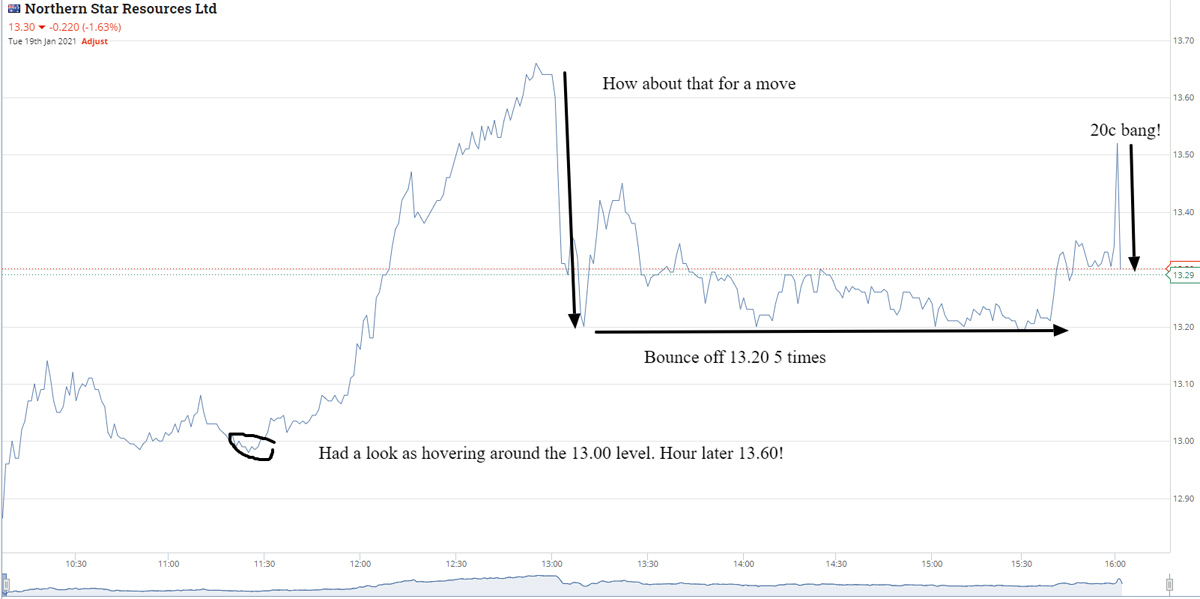

All up after all these trades $65 for the day. Mmm. Have added a chart on Northern Star. Have a look at their moves around lunch time …it sums up my day!

+2500 FMG at 24.89, +2500 FMG at 24.89, +2500 FMG at 24.90, +2500 FMG at 24.80, -2500 at 24.95, -2500 at 24.93, -5000 at 24.83, Profit $150 (third time not so lucky!)

+500 CBA at 85.29, +500 CBA at 85.00, -1000 CBA at 85.06, Loss $85 (battle is lost but not the war)

Wednesday January 20

Let the market settle for 20 mins and catch 10,000 TYR at 2.68 as good volume for them. Already over 1m have gone through.

Time is 10.19am. Out three mins later at 2.70 for a quick $200.

CBA moving around the 84.90 level and buy 500 when they hit 84.80 at 10.26am. They climb back nicely and say goodbye to them at 84.99 as a load on offer at 85.00.

FMG open above 25.00 and fall back below 24.80 at 10.27am. Pick up 2500 at 24.79 and sell them at 24.90 one min after closing out the CBA trade. Not a bad quick morning start.

APT hit a record high, so buy 5000 Z1P at 5.99. Time is 11.53am. Have to wait till 1.47pm to lock in a profit of $250.

Whilst waiting for Z1P to break above 6.00, I see FMG coming back, so put in a cheeky bid for 3000 at 24.55 (currently 24.63). Time is 12.04pm.

Forty mins later I’m out at 24.65 and watch them keep going! Oh well, all up +$1025.

+10,000 TYR at 2.68, -10,000 TYR at 2.70, Profit $200 (nice quick one)

+500 CBA at 84.80, -500 CBA at 84.99, Profit $55

+2500 FMG at 24.79, +3000 FMG at 24.55, -2500 FMG at 24.90, -3000 FMG at 24.65, Profit $575 (thank you Mr Forrest)

+5000 Z1P at 5.99, -5000 Z1P at 6.03, Profit $200 ( had to wait a bit!)

Thursday January 21

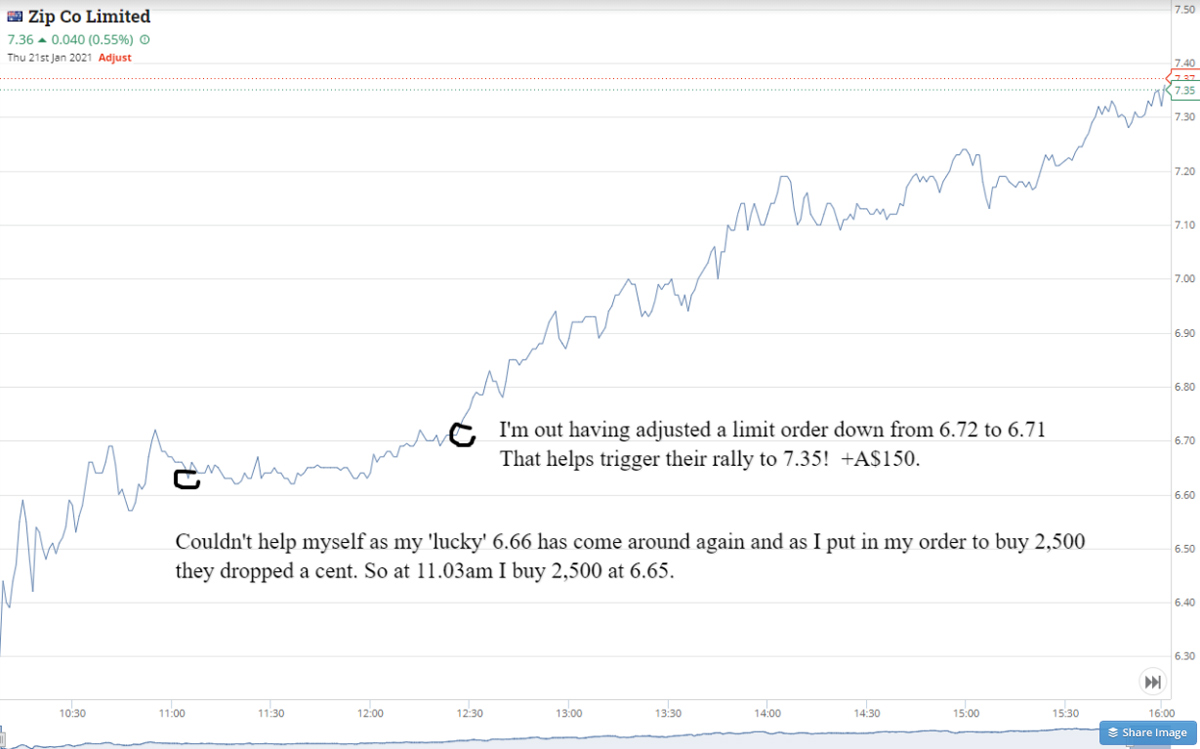

The day starts off interesting as Z1P come out with a bullish announcement pre-market, which I find a bit strange, as they could have waited for this and raised money now, instead of at 5.34 a share last week. Anyway, that’s how things roll and when they reach my lucky ‘6.66’ level, I buy 2,500 just as they tick down a cent. Put them on a limit to sell at 6.72 and when they get near I adjust it down a cent to 5.71 and I’m out.

This act sends them off to 7.35.

TYR is still offering a quick 2c profit but can only get set for 10,000 at 2.655 and I’m out at 2.67 on a limit order a couple of mins later.

All up +$300. Thinking ‘Buy Now Trade Later’ for a t-shirt slogan.

+2500 Z1P at 6.65, -2500 Z1P at 6.71, Profit $150

+10000 TYR at 2.655, -10000 TYR at 2.67, Profit $150

Friday January 22

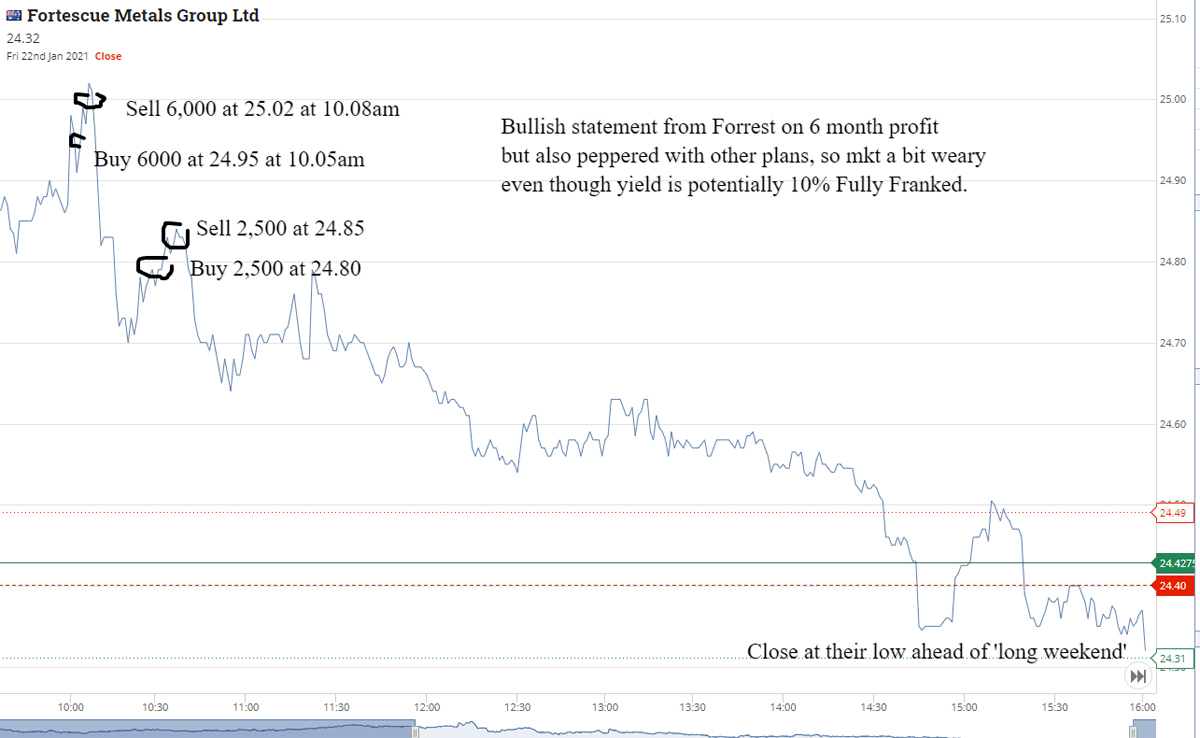

Pre-market announcement from FMG means a healthy yield but worries about straying off piste, so a mixed message. Will either fly or fade, depending on the insto’s reactions.

Buy 6000 at 24.95 as can’t believe below 25.00. Sell them three mins later at 25.02 as not flying as expected. Six mins later buy 2500 at 24.80 and sell them two mins later at 24.85.

Time is 10.16am and crazy fast movements are happening, but not feeling like I thought they would. APT and Z1P open at new highs and I can only watch because it’s Friday and we have a ‘long weekend’ coming up with a Monday being ahead of Australia Day holiday.

Went aggressive on FMG as thought they would open above 25.00 and keep going but they don’t, so happy to take those really quick turns. Had to be quick and nimble.

Luckily I didn’t have a big night, but will tonight. Make $545 for the day and think Crown lagers and steak. Monday will be quiet!

+6000 FMG at 24.95, +2500 FMG at 24.80, -6000 FMG at 25.02, -2500 FMG at 24.85, Profit $545

Profit for week: $1995

Less brokerage: $404

Net Profit: $1591

Best trade: FMG

Most satisfied: TYR

Least satisfied: CBA (but keep trying!)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.