Confessions of a Day Trader: Which bank gives you the Hump?

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 5

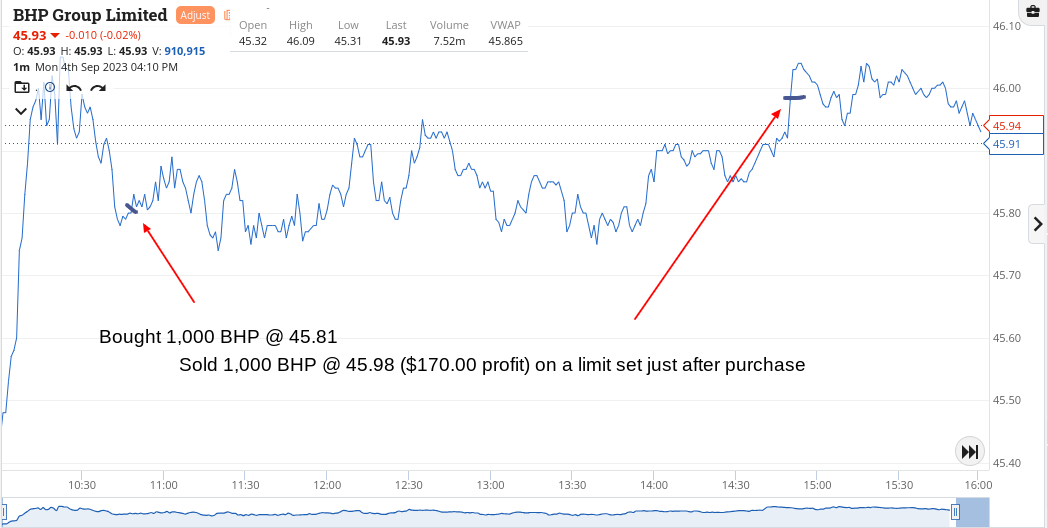

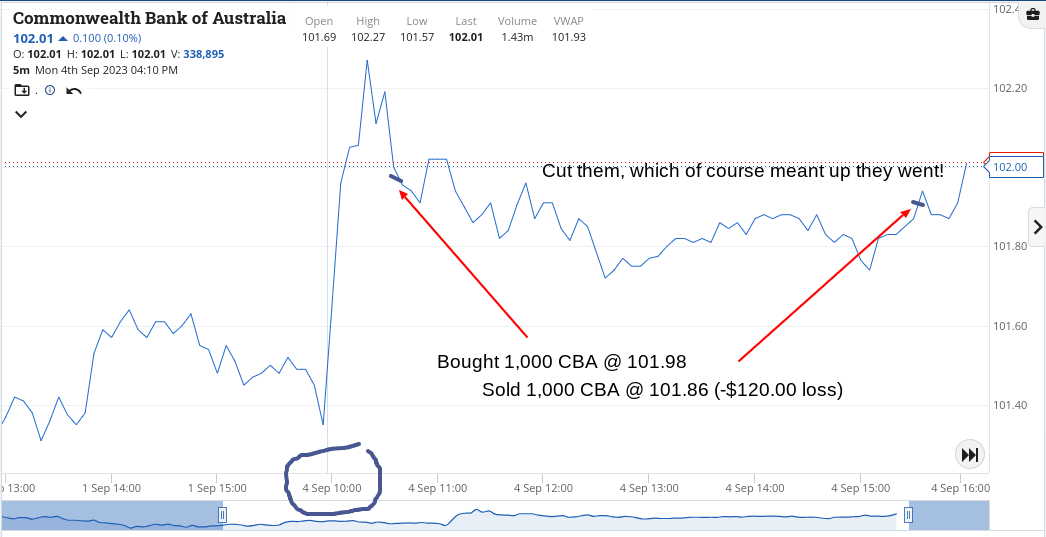

Started out with what I would call bread and butter trades and then got a bit caught up in BHP and CBA, which turned out to take a bit longer to unwind than I expected.

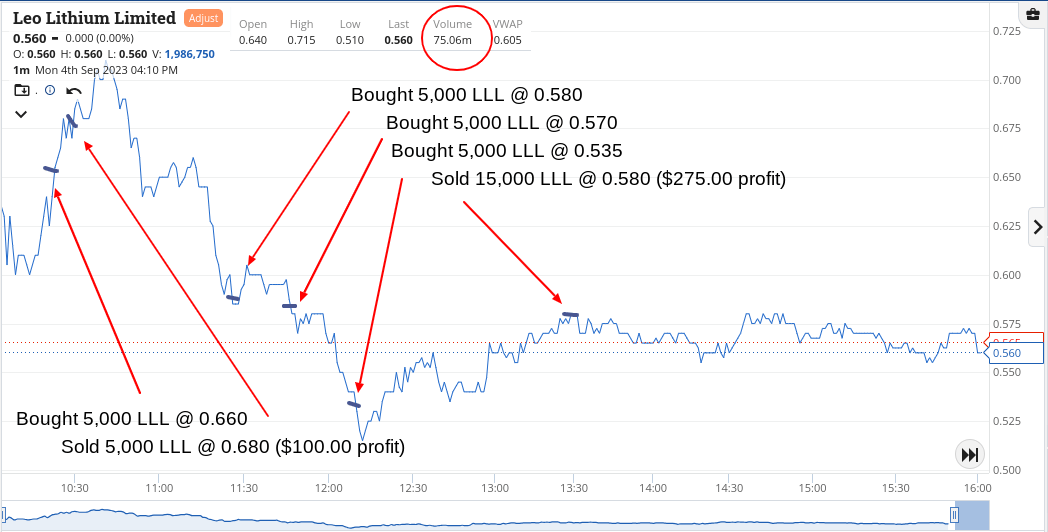

LLL were the star of the day for me, as they were down 50% (!) and came up as showing that much on my list of large cap fallers.

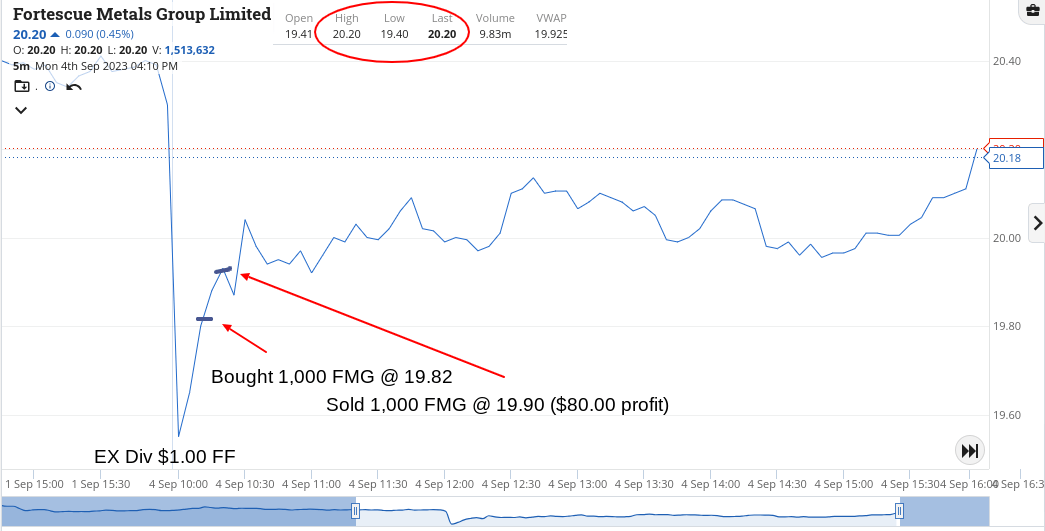

FMG went ex div $1.00 per share and were a lot stronger than I was expecting/hoping and this took me by surprise.

Just had to have a go anyway, so I could release my pent up frustration and was happy for a small turn, just to get the badge.

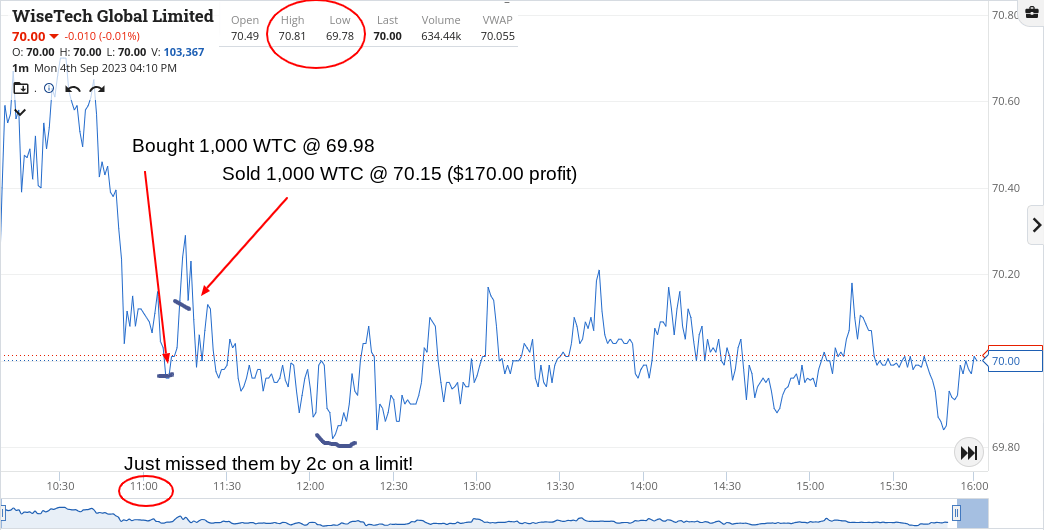

WTC came in trumps at below $70 and I almost got another go in them but missed them by 2c on a limit order.

Up $675 on a day where Wall St will be closed tonight plus we have the RBA rate announcement tomorrow, which is expected to come in unchanged. Can’t wait!

Recap

Bought 1,000 FMG @ 19.82

Sold 1,000 FMG @ 19.90 ($80 profit)

Bought 5,000 LLL @ 0.660

Sold 5,000 LLL @ 0.680 ($100 profit)

Bought 1,000 BHP @ 45.81

Bought 1,000 WTC @ 69.98

Sold 1,000 WTC @ 70.15 ($170 profit)

Bought 1,000 CBA @ 101.98

Bought 5,000 LLL @ 0.580

Bought 5,000 LLL @ 0.570

Bought 5,000 LLL @ 0.535

Sold 15,000 LLL @ 0.580 ($275 profit)

Sold 1,000 BHP @ 45.98 ($170 profit)

Sold 1,000 CBA @ 101.86 (-$120 loss)

Tuesday September 6

OMG! CHN took me on a wild ride today. I have never seen a stock get hounded so much for a long, long time.

They took a bit of nervous energy out of me before they finally – and I mean finally – came good.

Also, it was interest rate day today and I took out a pre 2.30pm punt out in WBC, which I cut after CBA reacted in a slightly negative way. Gone are the days and excitement of those, violent 2.30pm moves.

CHN finished the day down 45c at $2.90, having reached a low of of $2.57.

Up $625 but talk about seat of your pants trading. Amazing!

Recap

Bought 5,000 CHN @ 2.95

Bought 5,000 CHN @ 2.77

Bought 5,000 CHN @ 2.68

Bought 3,000 WBC @ 21.67

Sold 3,000 WBC @ 21.62 (-$150 loss)

Sold 15,000 CHN @ 2.85 ($775 profit)

Wednesday September 7

One step forward, two steps back today, as I crash and burn into the closing rotation.

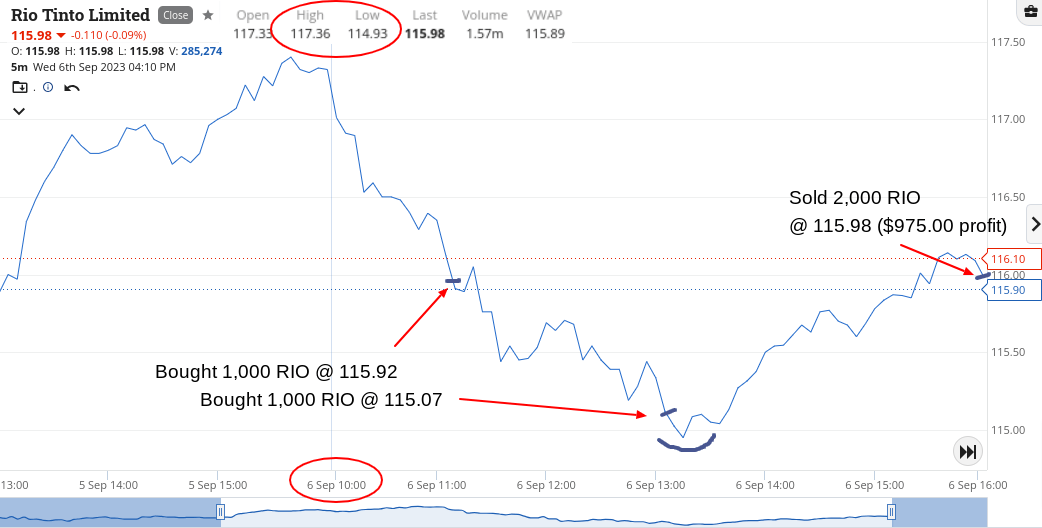

If it wasn’t for RIOs, I’d be in a very large pickle.

They were sold down below $116 and in fact they were the worst major performer on my watch list. Eventually came good as you will see from their chart.

CBA really was the one causing me pain, as I thought there was a quick 20c gain to be made, which turned out to become a 77c loss, after doubling down.

Talk about a hump day, as I managed to completely match today’s loss with yesterday’s gain to the friggin’ cent.

It feels like I’ve gone on a two-day bender, as I find myself to be in exactly the same position as Monday night but it’s Wednesday night.

Minus $625 and in a daze and a trading haze!

Recap

Bought 1,000 RIO @ 115.92

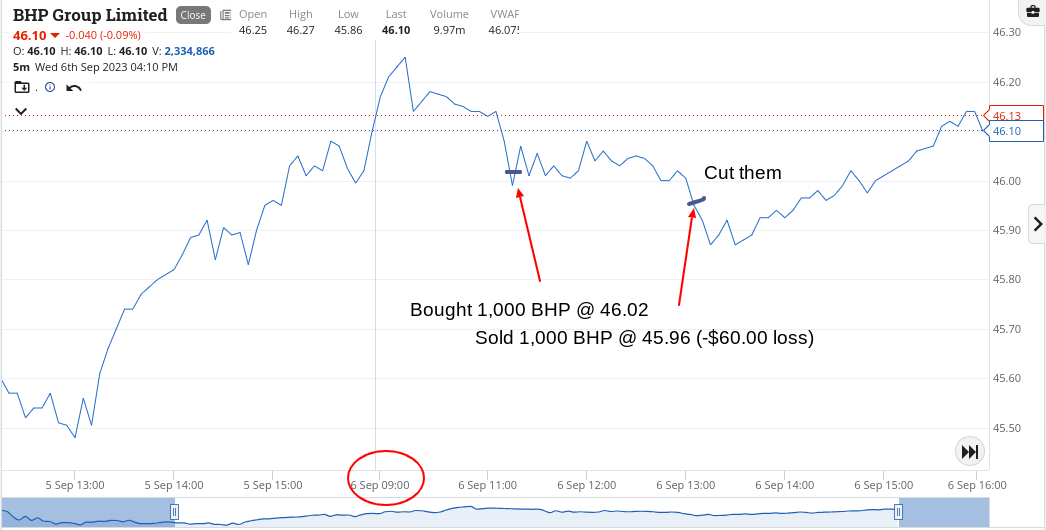

Bought 1,000 BHP @ 46.02

Bought 1,000 CBA @ 102.55

Bought 1,000 CBA @ 102.01

Bought 1,000 RIO @ 115.07

Sold 1,000 BHP @ 45.96 (-$60 loss)

Sold 2,000 RIO @ 115.98 ($975 profit)

Sold 2,000 CBA @ 101.51 (-$1,540 loss)

Thursday September 7

Was on a mission today to not give anything away! I had a feeling in my waters that CHN was about to pop, having seen it get smashed over the last couple of weeks.

They opened at $2.95, dropped a cent and then started to creep up, towards $3.00. In for a penny in for a pound, so grabbed some at $2.99 on a limit and just held on.

In my mind, I could see $3.15 written all over them and as they were heading that way in the afternoon, I let them go with a $700 profit locked in.

Thought, that makes up for yesterday’s turnout, though today feels like a Tuesday and not a Thursday and goodness knows what will happen tomorrow. Maybe RIOs at $112 and CBA below $100? Mmmmmm.

Recap

Bought 5,000 CHN @ 2.99

Sold 5,000 CHN @ 3.13 ($700 profit)

Friday September 8

Well, RIOs did go below $112 today but CBA never traded below $100.

In fact with CBA, I had to wait for their match up to claim a good prize and should have done the same for RIOs but was happy to book a profit in them, as they gave me some chest pains earlier on.

To be honest, I’m happy to have this week out of the way and looking forward to next week.

Up $755 today, which brings the week in at $2,130 gross or $1,617 net.

Recap

Bought 1,000 CBA @ 100.78

Bought 1,000 RIO @ 110.55

Bought 1,000 CBA @ 100.29

Sold 1,000 RIO @ 110.755 ($205 profit)

Sold 2,000 CBA @ 100.81 ($550 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.