Confessions of a Day Trader: Which bank causes you the most pain, with interest?

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

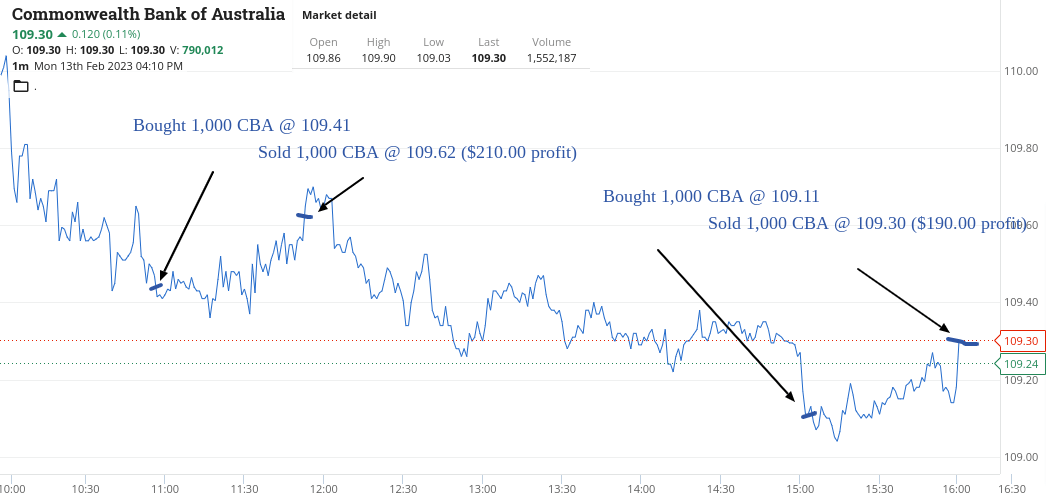

Monday Feb 13

Nervous Monday First Trade Syndrome kicks in as I hang around in the locker room, waiting to be called into action.

Kick off with CBA at below $109.50. Ya! I’ve finally done it and gone one better, as got in at $109.41 and then NCM at $24.65, after they had a high of $25.09.

After my first touchdown in NCM, I’m feeling confident and notice that Star City are down 20% or so.

I chuckle to myself that I’m having a punt in a casino, without being in it and just like being at the tables, I start out losing and having to double down, until the dice roll my way and in comes a couple of sixes.

Can’t help myself again in CBA at $109.11 and also in RIOs who are off 80c or so with less than an hour to go.

Both go out in the 4.10pm ruck and both to my advantage for a change.

Up $1,052 on Super Bowl Monday!

Recap

Bought 1,000 CBA @ 109.41

Bought 1,500 NCM @ 24.62

Sold 1,500 NCM @ 24.76 ($210 profit)

Bought 1,500 SGR @ 1.545

Bought 1,500 SGR @ 1.490

Sold 1,000 CBA @ 109.62 ($210 profit)

Bought 6,000 SGR @ 1.470

Sold 6,000 SGR @ 1.520 ($205 profit)

Sold 3,000 SGR @ 1.510 ($72.50 profit)

Bought 1,000 CBA @ 109.11

Bought 1,000 RIO @ 122.16

Sold 1,000 RIO @ 122.32 ($165 profit)

Sold 1,000 CBA @ 109.30 ($190 profit)

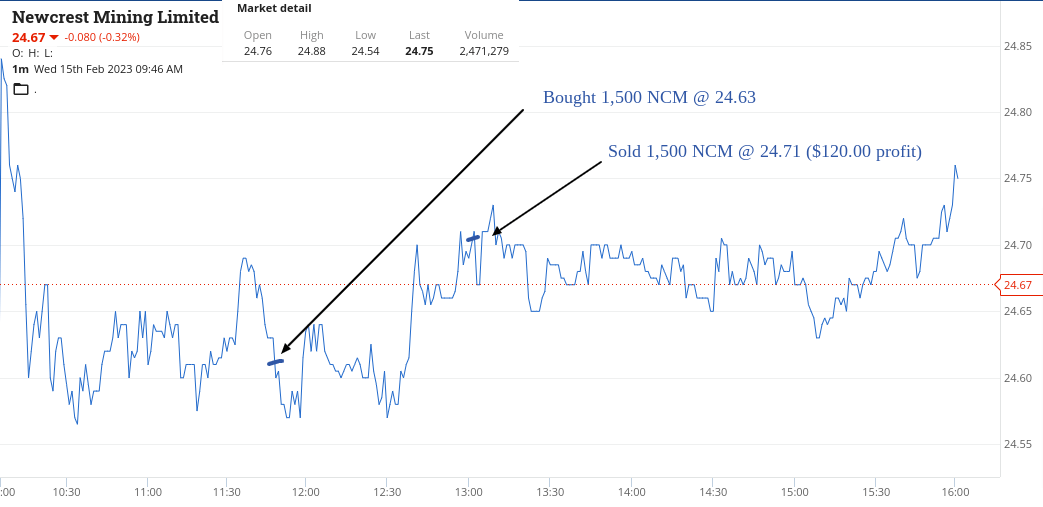

Valentine’s Day

Was hoping the only red I will see today was in the roses at Woolworths, but wasn’t to be so.

Slow day volume wise and also volatility wise, come to think of it.

I even managed to lose money in CBA at $109.31. It was that kind of day. BHP at below $48.00, I thought was a bargain but alas not so.

No champagne and roses today, so hopefully we can postpone tonight and go for tomorrow as the $10 roses maybe down 50% in price. Technically short roses overnight. Ha!

Down $60 for the day, which was very long and boring and also wet and windy.

Recap

Bought 1,500 NCM @ 24.63

Bought 1,000 CBA @ 109.31

Bought 2,000 BHP @ 47.78

Sold 1,500 NCM @ 24.71 ($120 profit)

Sold 2,000 BHP @ 47.72 (-$120 loss)

Sold 1,000 CBA @ 109.25 (-$60 loss)

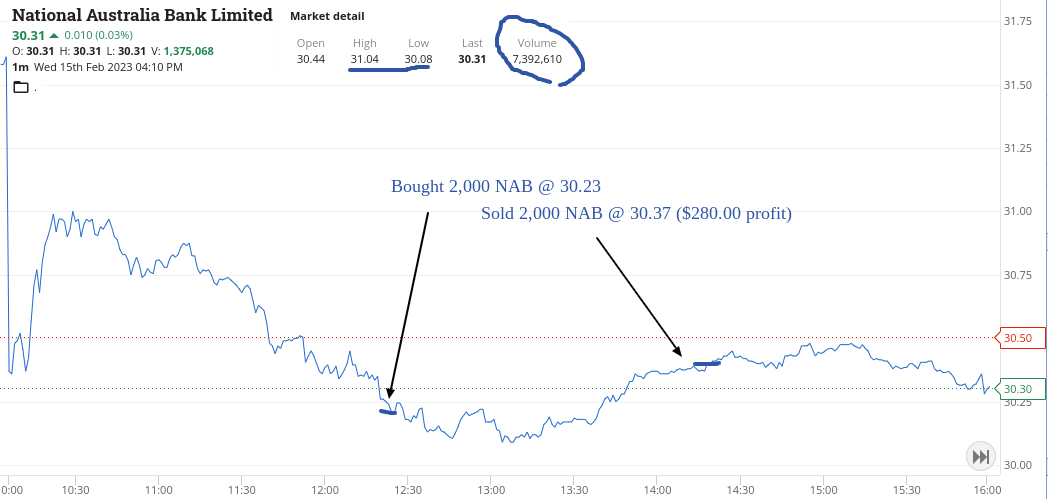

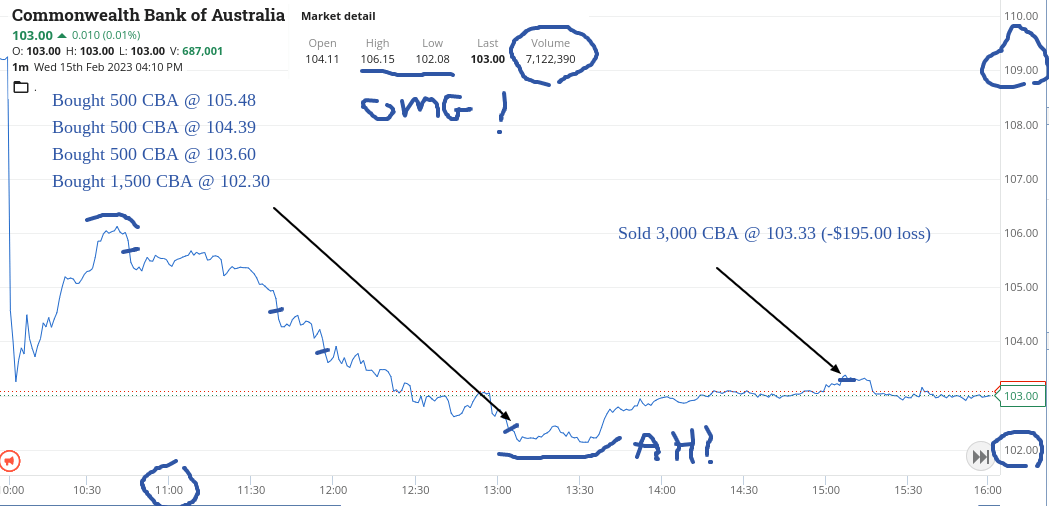

Wednesday Feb 15

Well, today turned into total mayhem as CBA went on a rampant and random run after coming out with some profit results pre market.

They opened at $104.11 (down from $109.25) had a high of $106.15, low of $102.08 and last at $103.00 on 7m shares.

They certainly took me on a wet and wild ride and at one point, I’m down $3,285 on 1,500 shares plus another $1,050 on my other banking punts.

I’ve never seen CBA move so far down on relentless selling and considering they were $111 a few days ago, I’m left a bit shell shocked.

They had an initial fall and then started to recover to $106 and when they fell another 50c, I thought I would get involved in 500 at $105.48.

Then another 500 at $104.39. Then another 500 at $103.60 and then finally 1,500 at $102.30.

Far out. Very painful. When they did go from down $3000 to down $200, I just had to cut them. They briefly gave me a profit, but after brokerage and me hovering over the sell button as they moved against me by 4c, it was not my day. Cheap roses or not!

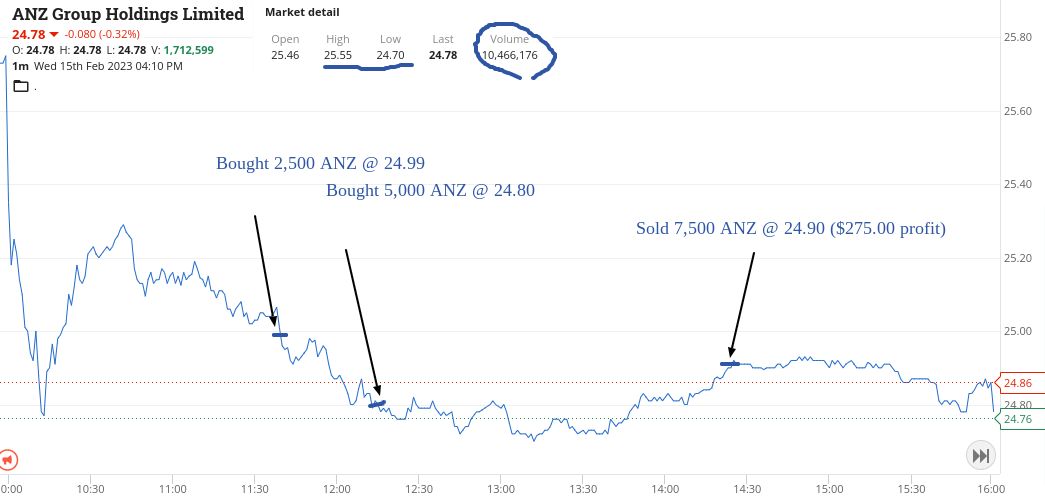

As CBA was so volatile, the other banks got dragged into their fall and I wanted a bit less volatility than CBA.

ANZ cracked below $25 and gave me good leverage for less funds needed.

Same for NAB, who were down a $1 or so. Up $525, after being down over $4,000 at one point.

I imagine the CFD providers would have had a field day on stop loss trading and hope everyone didn’t lose their nerve at the wrong time.

Recap

Bought 500 CBA @ 105.48

Bought 1,500 BHP @ 47.67

Sold 1,500 BHP @ 47.78 ($165 profit)

Bought 500 CBA @ 104.39

Bought 2,500 ANZ @ 24.99

Bought 500 CBA @ 103.60

Bought 2,000 NAB @ 30.23

Bought 5,000 ANZ @ 24.80

Bought 1,500 CBA @ 102.30

Sold 2,000 NAB @ 30.37 ($280 profit)

Sold 7,500 ANZ @ 24.90 ($275 profit)

Sold 3,000 CBA @ 103.33 (-$195 loss)

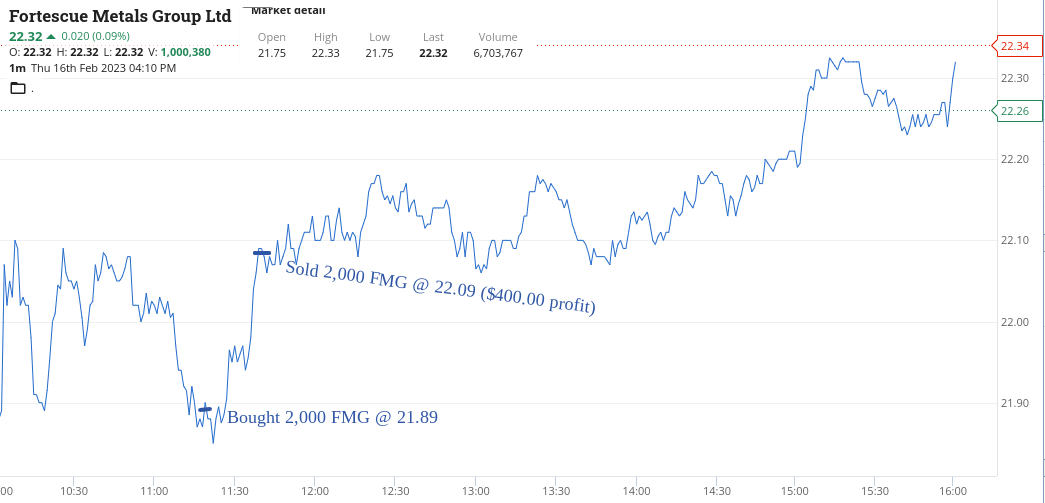

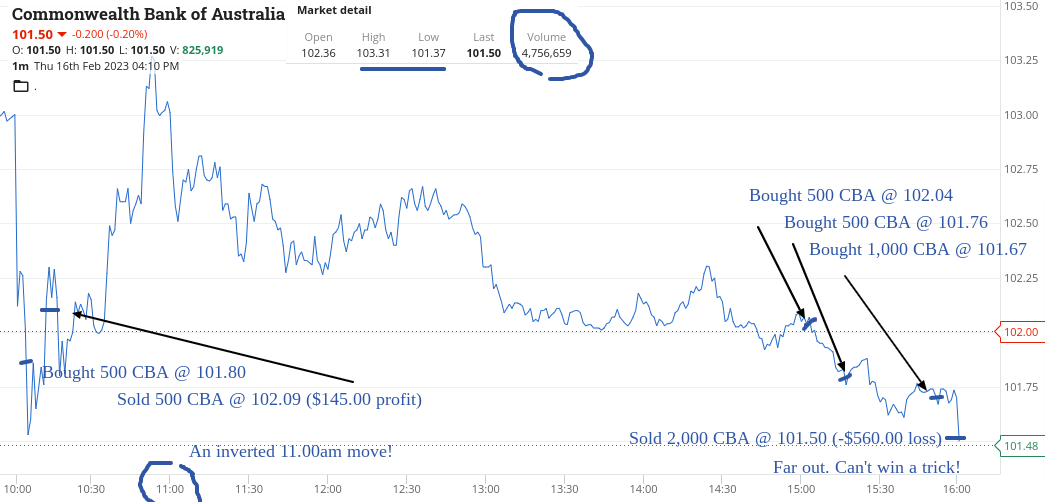

Thursday Feb 16

Another busy day in the office, which started out very gingerly and ended with a slap in the face from CBA.

Their volume is slowing down and just when you think you have them by the balls, they manage to slip out of your grip.

Man o man I’m not giving up on them but today they cost me another $560. Ended the day up $705 gross and FMG being the outstanding one. RIOs rallied and they were slow to respond.

So the gap between RIOs and CBA is now $22.18, and CBA’s day range was $2.07 on 4m shares.

I will get my revenge!

Recap

Bought 500 NCM @ 23.95

Bought 500 CBA @ 101.80

Sold 500 CBA @ 102.09 ($145 profit)

Bought 2,000 BHP @ 48.10

Bought 1,000 WDS @ 35.02

Sold 2,000 BHP @ 48.24 ($280 profit)

Bought 500 NCM @ 23.88

Bought 2,000 FMG @ 21.89

Bought 1,000 NCM @ 23.81

Sold 1,000 WDS @ 35.27 ($250 profit)

Sold 2,000 FMG @ 22.09 ($400 profit)

Sold 2,000 NCM @ 23.90 ($75 profit)

Bought 1,000 WDS @ 35.06

Sold 1,000 WDS @ 35.17 ($115 profit)

Bought 500 CBA @ 102.04

Bought 500 CBA @ 101.76

Bought 1,000 CBA @ 101.67

Sold 2,000 CBA @ 101.50 (-$560 loss)

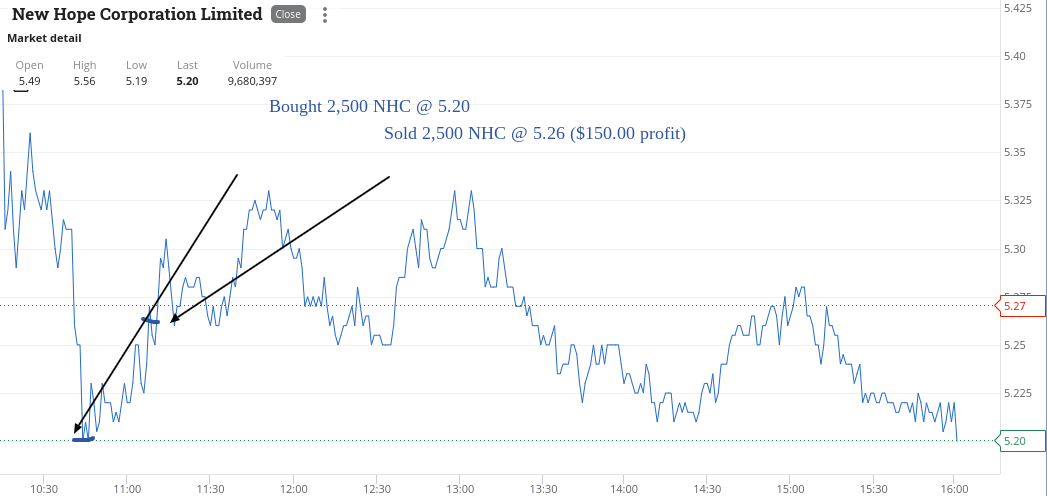

TGIF the 17th

Worked half the day today as didn’t want to be caught out in CBA again so thought best leave them alone until they hopefully settle down a bit next week.

CBA opened at $101.20, had a high of $102.57 and a low of $100.65, last $100.97 on 4m. Maybe next week they will trade with a $99 on the front. Down 10% in two weeks and haven’t gone ex yet.

Dabbled around in NCM, WDS and NHC and happy to book in profits and not try and run them harder.

Finished the day up $460 and after my CBA ‘hit below the belt’ effort this week $2,682 or $1,976 after CBA sucked up a lot of commission.

Mmmmm is all I can say on this week’s trading effort and to settle down my mind mentally, I want to get my CBA money back from them next week.

Recap

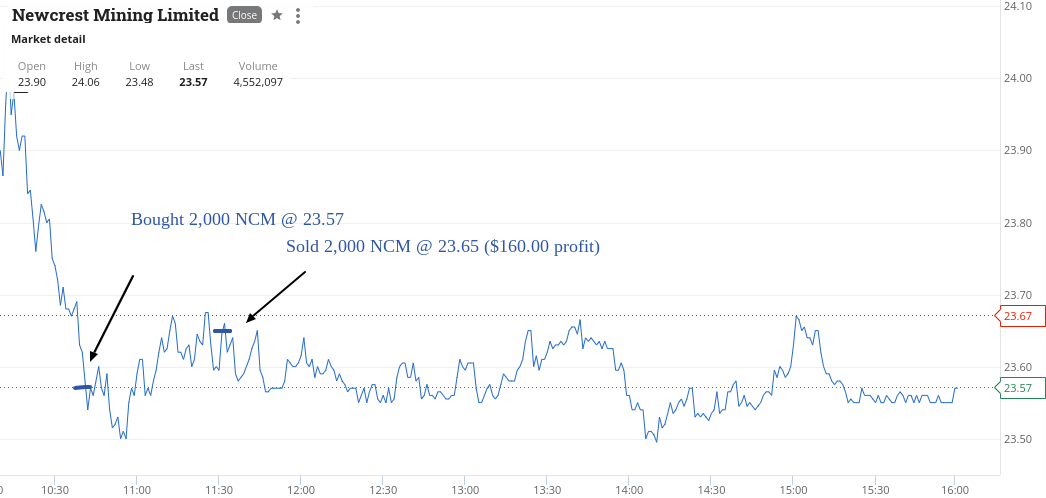

Bought 2,000 NCM @ 23.57

Bought 1,000 WDS @ 34.65

Bought 2,500 NHC @ 5.20

Sold 2,500 NHC @ 5.26 ($150 profit)

Sold 2,000 NCM @ 23.65 ($160 profit)

Sold 1,000 WDS @ 34.80 ($150 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.