Confessions of a Day Trader: Where’s the bounce? Bounce, dammit!

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 18

Found a couple of 11.00am trades today in MIN and Z1P but that was all. Have added an extra chart on CBA as it has classic moves at 11.00am and 3.30pm.

They shot up from the open and after seeing them on Friday, wasn’t too sure where they would head, so left them alone.

Bt 1000 MIN at $42.95 and 2000 Z1P at $6.79. They touch $7.05 just after the open but couldn’t hold above $7.00, so below $6.80 looked a good punt and it was.

Sold the 1000 MIN at $43.14 (+$190) and the 2000 Z1P at $6.85 (+$120) and that was all today. Kicked the tyres on APT towards their close, as they fell below $121 but their fuse was getting too small for me.

Plus $310 today, with BBQ lunch and afternoon swim at the beach thrown in. Nice!

Tuesday October 19

Both BHP and RIO come out with some official trading results pre-market and I’ve learnt the hard way that one should avoid trading them afterwards.

They need time to settle down and have all their figures crunched and comments analysed and we have no control over what the fund managers and analyst then decide to do.

Have added their charts, so you can observe what I mean.

On a different note, MIN again offered a Perth based 12.30pm rally. Went a bit early on them but was worth the wait and they were all I could find today.

Z1P managed to break through the $7.00 barrier and hold above it, unlike yesterday.

So, bt 1000 MIN at $42.70 before 11.00am, just in case they do a ding dong rally but like yesterday, have to wait till 12.30pm for it.

They finally get back above $43.00 and tried to go higher but were unable. I had set an SMS alert at $43.00 and could see them struggling so sold the 1000 at $43.03.

Plus $330 for the day and if you see the chart on CBA, it kind of sums up the day. Small trading ranges and low volume.

Oh well, there’s always tomorrow.

Wednesday October 20

Yesterday was the 34th anniversary of the 1987 crash, when Wall Street fell 25% in a day and took two years to recover.

This brought a little trading tear to my eye, as some memories of that day came back to me and I remember the true fear you could see in people’s eyes.

Now all is screen-based so you can feel the emotion but you can’t see it, and that is what we want to trade – the fear.

Back then it was over a day but now it can kick in in 60 seconds, so it requires a different mindset.

Same emotions of fear and greed but just on a quicker scale!

AFR calling the market up in 5.00am report, with RIO and BHP both trading higher in NY, so we shall see how they go today.

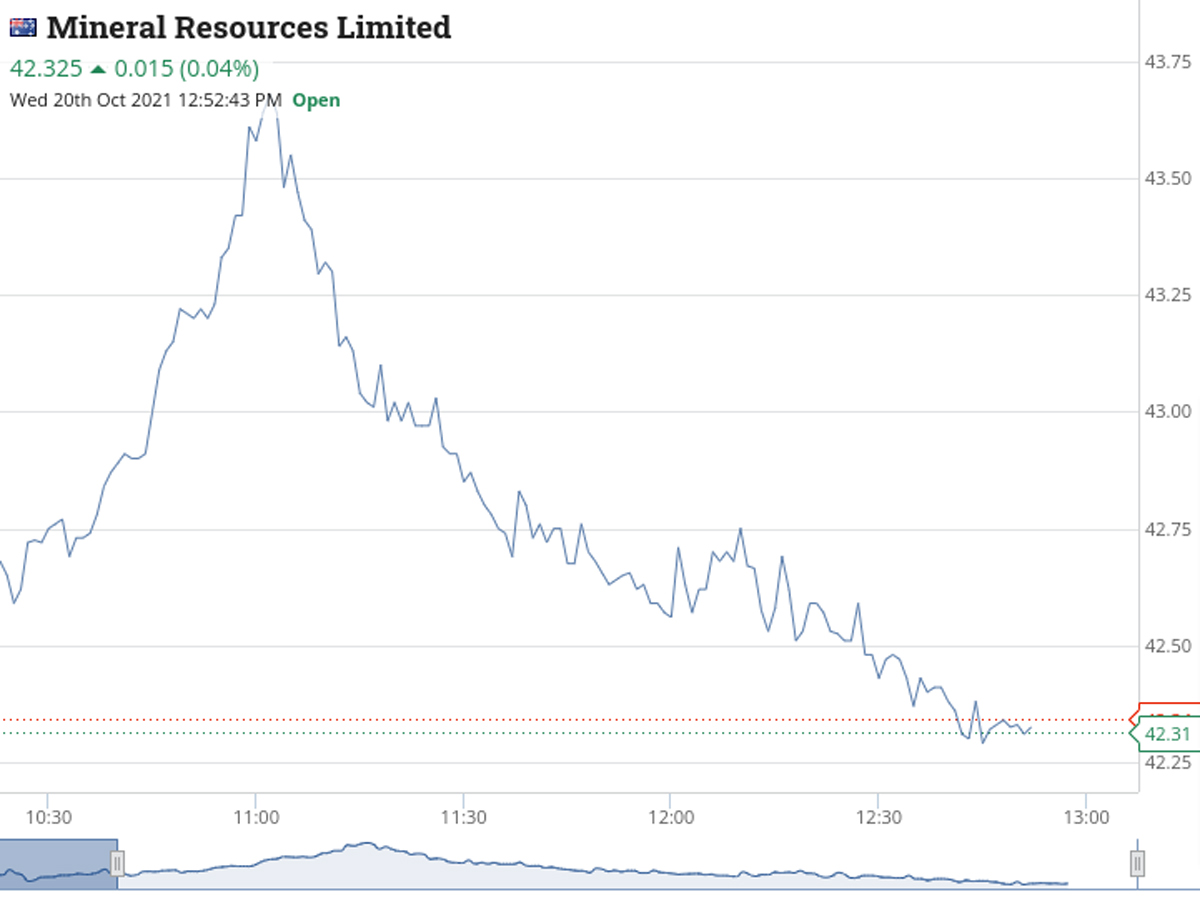

Have to wait till 12.53pm before doing anything and have add two charts to capture the timing:

Usually would be okay but not today. I manage to lose $430 – and on a Wednesday like last week!

From the charts, would have to say I was close to picking them at their bottoms, but not so. Both MIN and RIO got smashed down in 4.10pm wash-up and both closed at their day’s low.

Bt 1000 MIN at $42.25 and 1000 RIO at $98.60. Lost $300 on RIO as had to cut at $98.30 and lost $130 on MIN as had to cut them at $42.53. Both purchases at 12.52pm and both sales at 3.57pm.

So, a long day, with plenty of screen watching, waiting for a bounce which never comes. Over all, plus $210 for the week so far and thinking both should bounce tomorrow.

Mmm.

Thursday October 21

RIOs manage to fall as low as 96.61 on top of yesterday’s smash-down on the close, which looks way overdone.

Decide to go for it and break out. Buy 2000 at 96.62 and through pure skill or pure luck, I’m not the only one thinking the same.

They shoot up and go above 97.00 before my eyes, reach 97.30 and drop back a bit and then I’m out at $97.27. $1300 thank you very much.

Feeling a bit chuffed, so nip out to the supermarket and hanging back in the queue, FLT pop up as the day’s biggest faller. Snap up 2000 at $19.90 and by the time I’m back in the car, they are above $20 and knock ‘em out at $20.03 for $260 profit.

They go higher, but don’t care.

Avoided MIN today, after they closed on their day’s low and feel a bit sick. Have included a chart, with a small 12.30pm bounce but could not hold it.

So, up $1560 for the day and feeling good and waiting for the overnight movements to see how Friday may look.

Friday October 22

Mmm. Not looking good for the RIOs and BHPs today but okay for the APTs. And being a Friday, some book squaring towards the end of the day could go either way. And I bet it won’t be my way!

Bit managed to end the day even after buying 2500 Z1P at $6.88 and selling them at $6.92, then wiping that profit by cutting my 2500 BHP at $37.54, having bt them at $37.58.

So, a really nothing day. Finished the week +$1770 gross and $1518 net.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.