Confessions of a Day Trader: When to going gets tough, the tough buy Nuix

Pic: d3sign / Moment via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday May 31

Back fully refreshed. CBA shooting off to the moon, reaching 101.50 early on. Spot an 11am special in BHP. Buy 2000 at 47.86 and sell three mins later at 47.99.

NXL down another 17% on a downgrade. Bt 1000 at 2.76 and 1000 at 2.74 before selling both at 2.78.

APT offered a raft of trades today but the volatility slowed down towards the end of the day. Last trade I cut for a $45 loss but made a total A$190 out of them. The day’s APT buys ranged from 92.86 to 94.14 (see graph).

All up plus $650 on a Monday!

+2000 BHP at 47.86; -2000 at 47.99; +1000 at 47.88; -1000 at 47.99; Profit A$360 (11am special on first trade makes A$250)

+2000 Z1P at 7.09; -2000 Z1P at 7.11; Profit A$40 (Coffee n cake paid for)

+1000 NXL at 2.76; +1000 at 2.74; -2000 at 2.78; Profit A$60

+250 APT at 94.14; -500 at 94.28; +250 at 93.84; -300 at 93.55; +300 at 93.55; +500 at 93.11; +500 at 92.86; -1000 at 92.45; Profit A$190 (cut last trade for a A$45 loss)

Tuesday June 1

Bt some CBA and Z1P on the 11am bell and left higher limits, closed computer lid and cleaned up the kitchen to get my mind off the trades. Lifted lid 30 mins later and both positions closed out. Cool.

Bt some more CBA and some BHP, plus 1500 FMG ahead of heading out to meetings. Closed out the CBA, on way to meetings for a A$480 profit as deep down could see them moving back above 99.00 and held on hard.

Both BHP and FMG needed a hard double down and after small losses popping up over next 2 hours both came good in last 15 mins, as both oversold in my eyes. Total profit for the day A$1,045.

+1000 CBA at 99.17; -1000 at 99.30; +1000 at 98.95; +1000 at 98.93; -2000 at 99.18; Profit A$610 (11am special on first trade)

+1000 BHP at 47.96; +2000 at 47.87; -3000 at 47.99; Profit A$270

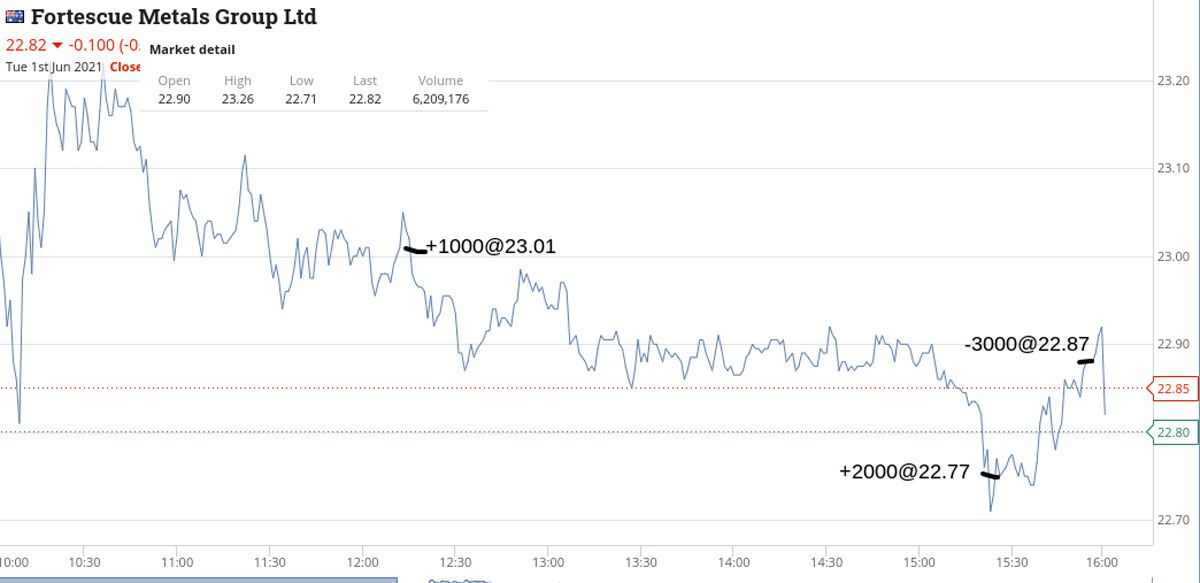

+1500 FMG at 23.01; +3000 at 22.77; -4500 at 22.87; Profit A$105 (just scraped a profit)

+2000 Z1P at 6.89; -2000 at 6.92; Profit A$60

Wednesday June 2

Come in this morning on opening bell and both BHP and FMG are up A$1.00 each on firm overnight iron ore prices.

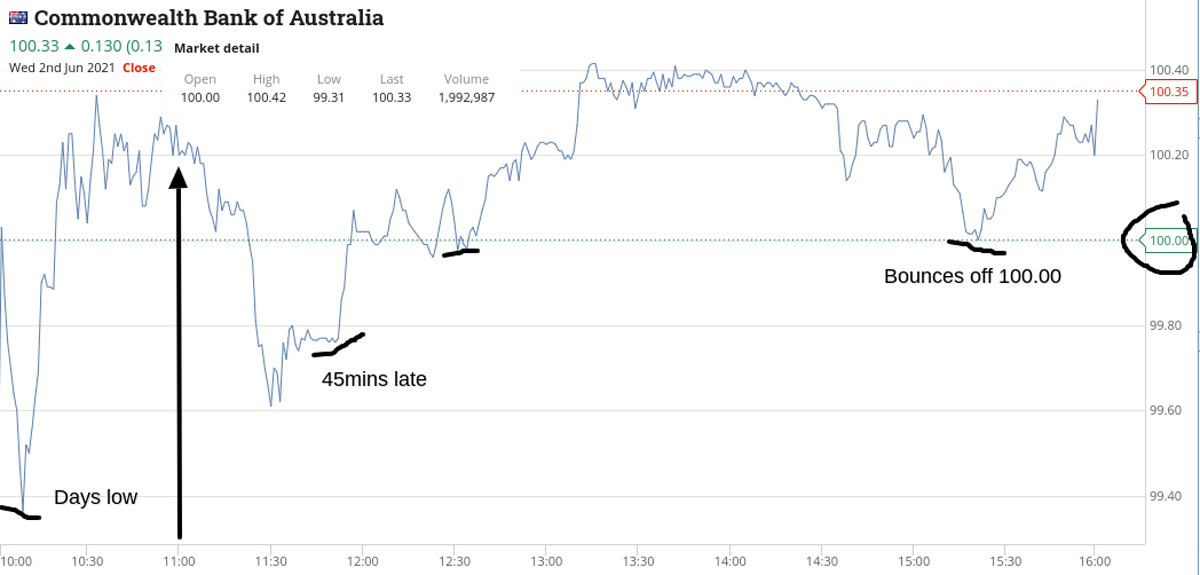

APT and Z1P both weaker and CBA just hanging around the 100.00 level. 45 mins wait till 11am but my gut feel is that nothing will really pop up till around lunch time. Let’s see.

Mmm, unfortunately my gut feeling was correct. Today was a nothing day for me. Bt 2000 Z1P at 6.90 for a 3c turn and got back in later for a 4c loss. See graph, as Z1P’s volatility almost ground to a halt.

CBA touched its low in its first 2 mins of trading and after a while settled in above the magic 100.00 level. APT had smaller than usual volume. End the day down A$20, thanks to Z1P.

+2000 Z1P at 6.90; -2000 at 6.93; +2000 Z1P at 6.90; -2000 at 6.86; Loss A$20.

Thursday June 3

The day starts out slow, comes good, bit of a sweaty palm trade in CBA but all comes good by the close, though I need a stiff drink after the close.

So, my day goes like this. Buy 300 APT at 92.61 and sell them at 93.00. They promptly shoot up another 80c.

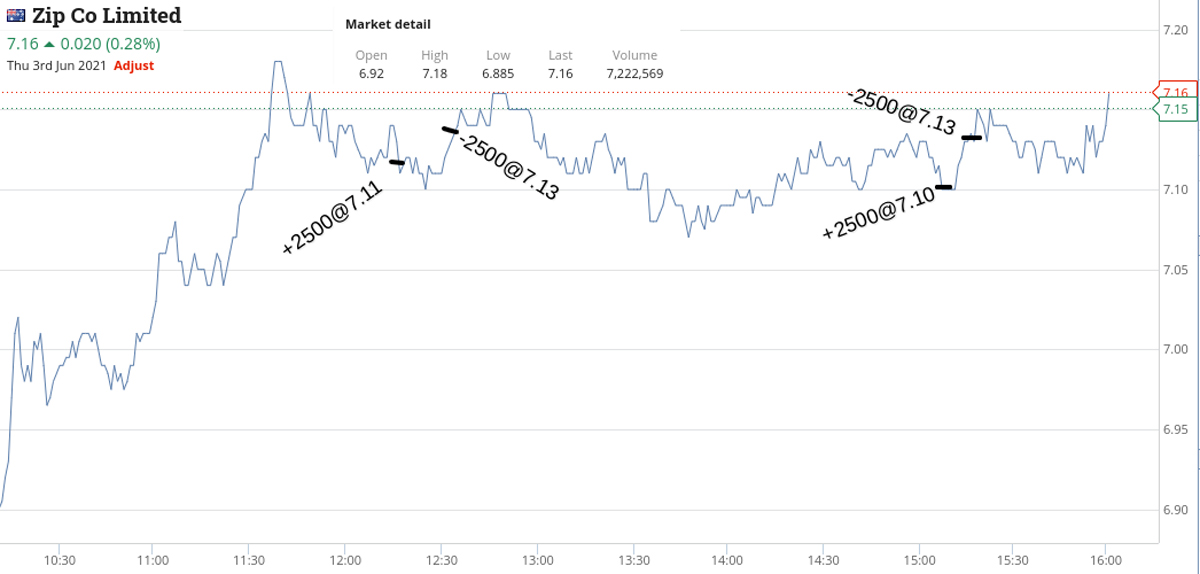

Then grab three buys. 1000 CBA at 101.36, 2000 FMG at 23.36 and 2500 Z1P at 7.11. First one out is FMG at 23.41, then Z1P at 7.13.

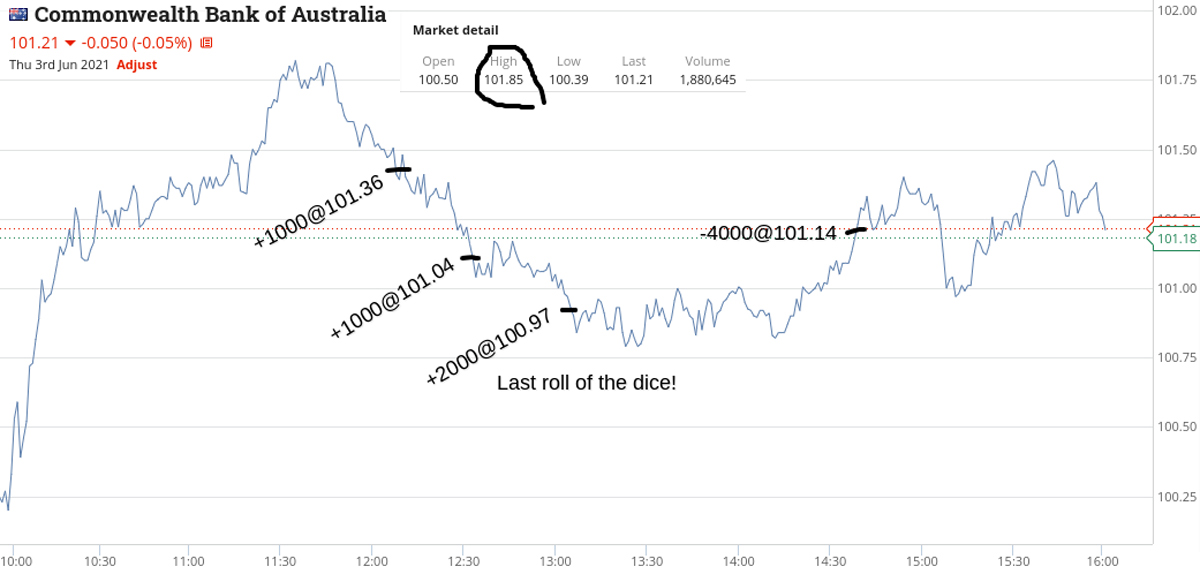

Now CBA need a double down so buy another 1000 at 101.04. Then have to buy 2000 at 100.97. Down about A$700 with big brokerage to pay.

Grab 2500 Z1P at 7.10 whilst waiting on CBA to rally. Sell them at 7.13 and then finally, CBA move up on the final bend and trigger off a limit sell order at 101.14.

I knew they would rally above 101.00 at some point but didn’t think it would take so long. From being down A$700 on them I close out plus A$220 though brokerage is a hefty A$160. Finish the day plus A$562 – less two large whiskys.

+300 APT at 92.61; -300 at 93.00; Profit A$117

+2000 FMG at 23.36; -2000 at 23.41; Profit A$100

+2500 Z1P at 7.11; -2500 at 7.13; +2500 at 7.10; -2500 at 7.13; Profit A$125

+1000 CBA at 101.36; +1000 at 101.04; +2000 at 10.97; -4000 at 101.14; Profit A$220 (as soon as did first purchase, they fell! Far out. Determined not to be beaten, though)

Friday June 4

CBA make new all-time highs today, but I’m concentrating on BHP and FMG as both marked down from yesterday’s close.

Buy 2000 FMG at 23.06 as they look like they may have an 11am rally. Wrong! My buying sets them off on a free fall, so have to double down for another 2000 at 22.88. Then I buy 1500 BHP at 48.31 and sell them at 48.45.

FMG are slowly moving the right way and keep flirting with 23.03. I keep adjusting my sell limit down and eventually out of the 4000 at 23.03. Profit today is A$450.

All up not a bad week and to think on Tuesday CBA were trading in the 98s.

+2000 FMG at 23.06; +2000 at 22.88; -4000 at 23.03; Profit A$210

+1500 BHP at 48.31; -1500 at 48.45; Profit A$240 (didn’t have to wait as long as FMG!)

Gross profit: A$2697

Less brokerage: A$601

Net profit: A$2096

Most satisfying: CBA (Tues)

Least satisfying: Z1P (Weds)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.