Confessions of a Day Trader: When CBA = Afterpay = CBA…

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Tuesday June 15

Check in to my watch list at 10.45am via my mobile phone. Both NAB and APT have taken off at 10.30am. This is worrying for me, as for 25 years I have traded the 11.00am specials thousands of times and now I am a bit lost on whether to change tact and my daily routines.

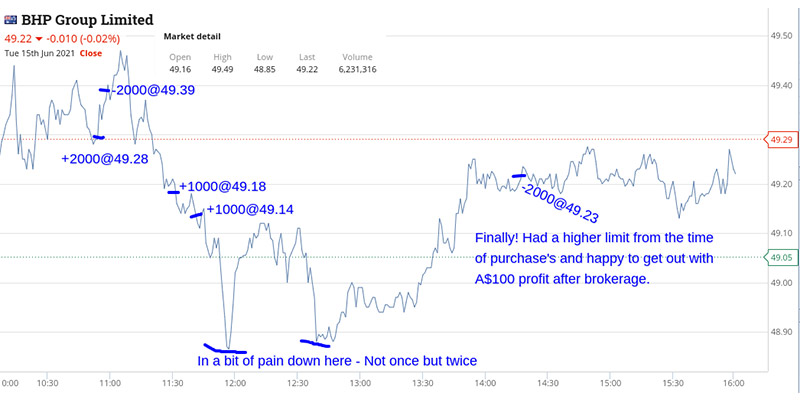

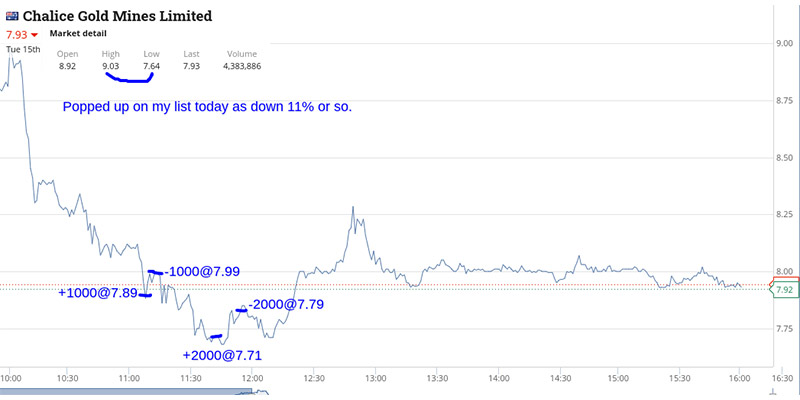

CHN fall 11% or so according to my radar. So I sneak a few trades in because that selloff seems a bit harsh, and both BHP and FMG catch me out whilst falling and cause a bit of ‘pain before the gain’ (new tee shirt coming, with the phrase).

Their movements are very erratic, especially BHP, which is a $145bn company. See graphs for movements. Finish up $760, from just those three stocks today.

This is today’s order of trades:

+1000 CHN at 7.89 (11.08am); -1000 CHN at 7.99 (11.10am); Profit $100

+2000 BHP at 49.28 (11.10am); -2000 BHP at 49.39 (11.12am); Profit $220 (all going well so far!)

+2500 FMG at 23.66 (11.15am); +2500 FMG at 23.36 (12.40pm); -5000 FMG at 23.54 (2.25pm); Profit $150 (was down $500)

+1000 BHP at 49.18 (11.16am); +1000 BHP at 49.14 (11.20am); -2000 BHP at 49.23 (2.25pm); Profit $140 (was down $330)

+2000 CHN at 7.71 (11.45am); -2000 CHN at 7.79 (11.50am); Profit $150

Total profit: $740

Wednesday June 16

Tickle in some BHP, FMG and APT pre 11.00am, just to see what will happen. Sell out of APT and BHP first, and FMG 50 mins later.

CHN fall from their highs and then really fall, so had to double down and then watched them bounce hard, which I sold into.

Both BHP and especially FMG fall hard with an hour left to go. Have two very quick ins and outs as there’s only 45 minutes left in the trading session which is too short a time. Couldn’t help myself.

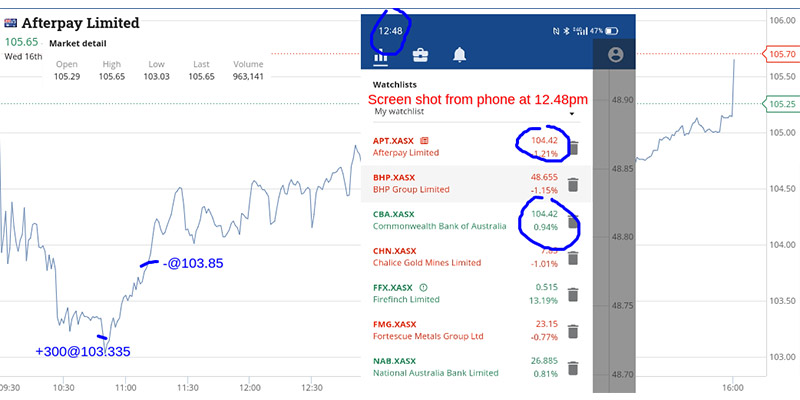

All trading after 11.30am on my mobile and at 12.48pm, I grab a screenshot as APT and CBA are both at the same price — $104.42. Amazing. Nice finish to the day, up $1,247 with most time spent at the beach, in the winter sun.

Wednesday’s order of trades:

+2000 BHP at 48.67 (10.40am); -2000 BHP at 48.76 (11.11am); Profit $180

+2500 FMG at 23.37 (10.48am); -2500 at 23.45 (11.49am); Profit $200

+300 APT at 103.335 (10.49am); -300 APT at 103.85 (11.11am); Profit $154.50

+2000 CHN at 7.92 (11.16am); +4000 CHN at 7.71 (12.25pm ); -6000 at 7.84 (12.49pm ); Profit $360

+2500 FMG at 23.19 (12.45pm ); +2500 FMG at 23.12 (12.47pm ); -5000 at 23.18 (1.30pm ); Profit $150

+2500 FMG at 22.84 (3.14pm ); -2500 at 22.865 (3.16 ); Profit $62.50 (less $22 in brokerage)

+2000 BHP at 48.26 (15.03pm ); -2000 BHP at 48.33 (15.08pm ); Profit $140 (less $40 in brokerage)

Total profit: $1,247

Thursday June 17

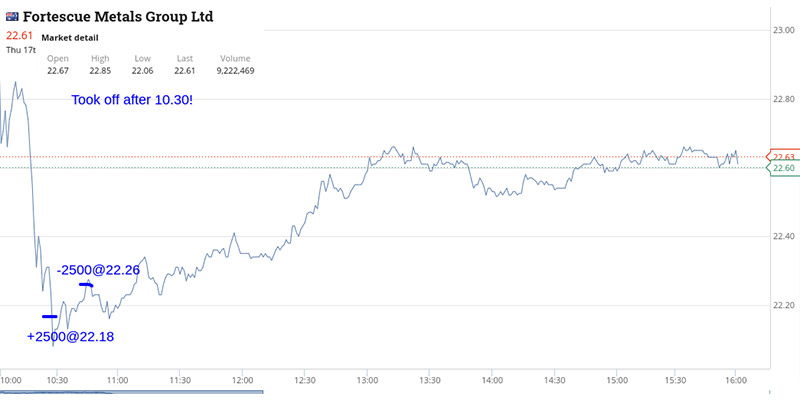

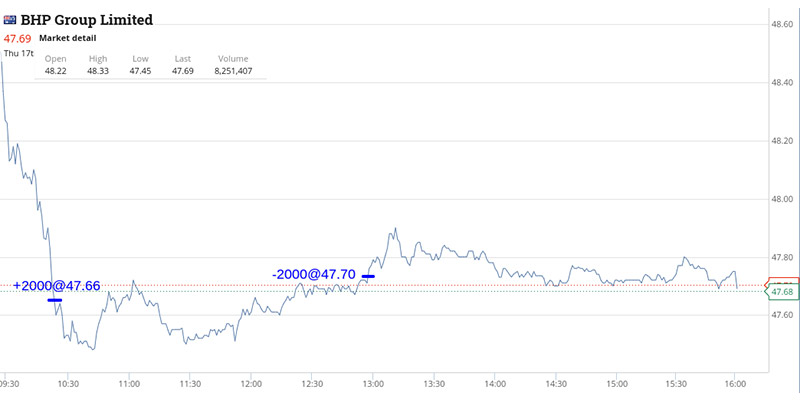

Very careful today, as I’m not sure what will happen because of the news overnight on US interest rates and a sharp fall in gold. BHP and FMG are both marked down before 10.30, so I cautiously buy some.

FMG rallies long before BHP does. As gold took a tumble last night, I cautiously buy 1,000 CHN when it’s down at $7.36 (they were above $9.00 on Tuesday). I double down at $7.19 and wait for a bit of short covering to arrive. Out at $7.27.

APT and CBA again both trade at the exact same price — $106.03 at 2.02pm. APT continues and CBA runs out of puff as the Aussie dollar gets marked down sharply against the greenback. Up $350 for the day.

Thursday’s order of trades:

+2000 BHP at 47.66 (10.22am); -2000 BHP at 47.70 (12.43pm); Profit $80

+2500 FMG at 22.18 (10.26am); -2500 FMG at 22.26 (10.44am); Profit $200

+1000 CHN at 7.36 (10.41am); +2000 CHN at 7.19 (11.44am); -3000 CHN at 7.27 (12.43pm); Profit $70

Total profit: $350

Friday June 18

CBA seemed to be opening steady and NAB lagging behind, so bt 2000 at 26.82. They eventually caught up about 50 mins later and out they went at 26.88.

A slow mover unlike FMG and BHP. Both marked down heavily. Bt 2500 FMG at 22.19 and sold them 3 mins later and off they went on a big rally. Managed to hang on to BHP a bit longer than FMG for a $200 profit. So up $470 before 11.00am and now a bit snookered.

APT again strong and they hit a high of 115.80. They close at 114.40 and CBA closed at 103.68, which was their low. Both were 106.03 yesterday and now the closing gap is almost $11.00. Amazing!

Frustrated afternoon just watching. Even Z1P had a range of 7.60 to 8.17 and closed at 8.14. Bring on Monday.

+2000 NAB at 26.82 (10.25am); -2000 NABat 26.88 (10.48am); Profit A$120

+2500 FMG at 22.19 (10.26am); -2500 FMG at 22.25 (10.29am); Profit A$150

+2000 BHP at 46.59 (10.42am); -2000 BHP at 46.69 (10.48am); Profit A$200;

Total profit: $470.

Gross for week: $2,827

Brokerage: $800

Net Profit: $2,027

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.