Confessions of a Day Trader: What’s got two thumbs, three flat whites, 72 trades and $4672 profit? This broker!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

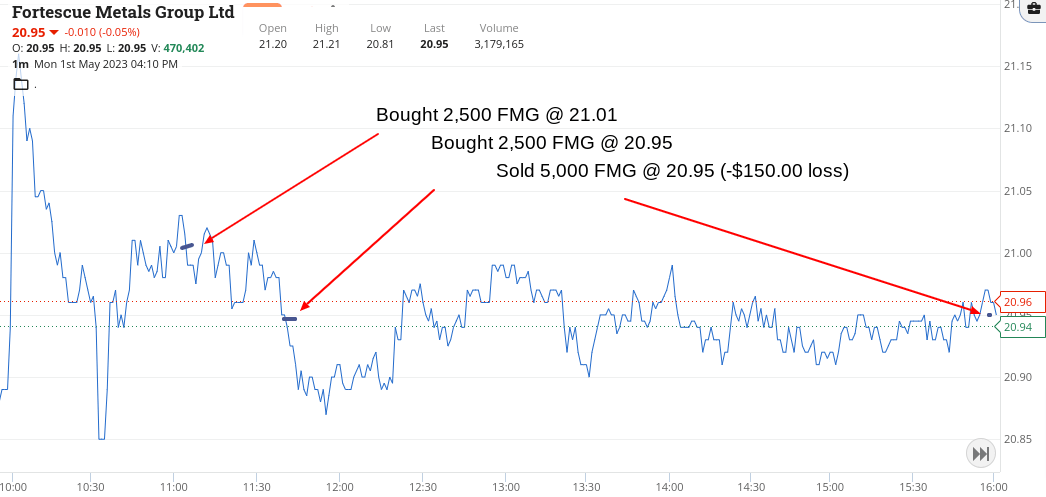

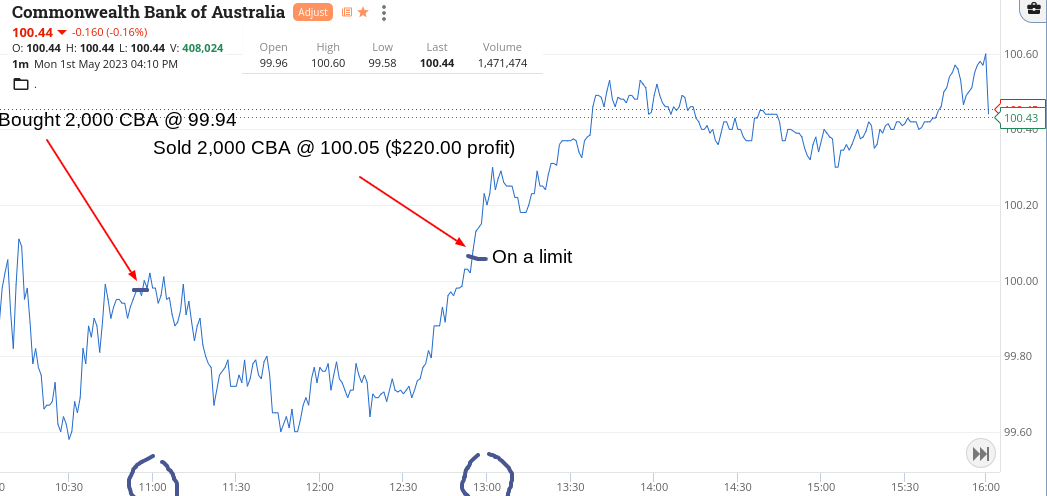

Monday May 1

Start the day all bright and bubbly and end wishing that today was another public holiday. Settle in for a quick 11.00am trade in CBA. In at $99.94 for the break out.

Put them on a limit of $101.05 and watch as they touch $101.02 a few times before fading away. It’s not until 1.00pm before my quick trade gets closed out.

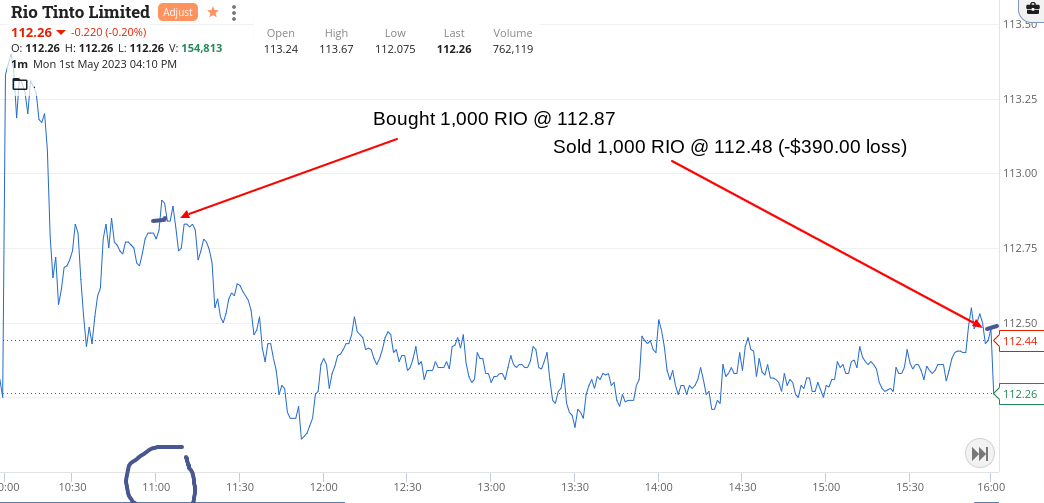

My other two trades leaves me cutting at the death in RIOs and killing the FMG trade in the 4.10pm ruck.

Great. Just great. It’s a long day just to end up going backwards. Down $320 for the day. Bob Geldof was right. I don’t like Mondays.

Recap

Bought 2,000 CBA @ 99.94

Bought 1,000 RIO @ 112.87

Bought 2,500 FMG @ 21.01

Sold 2,000 CBA @ 100.05 ($220 profit)

Bought 2,500 FMG @ 20.95

Sold 1,000 RIO @ 112.48 (-$390 loss)

Sold 5,000 FMG @ 20.95 (-$150 loss)

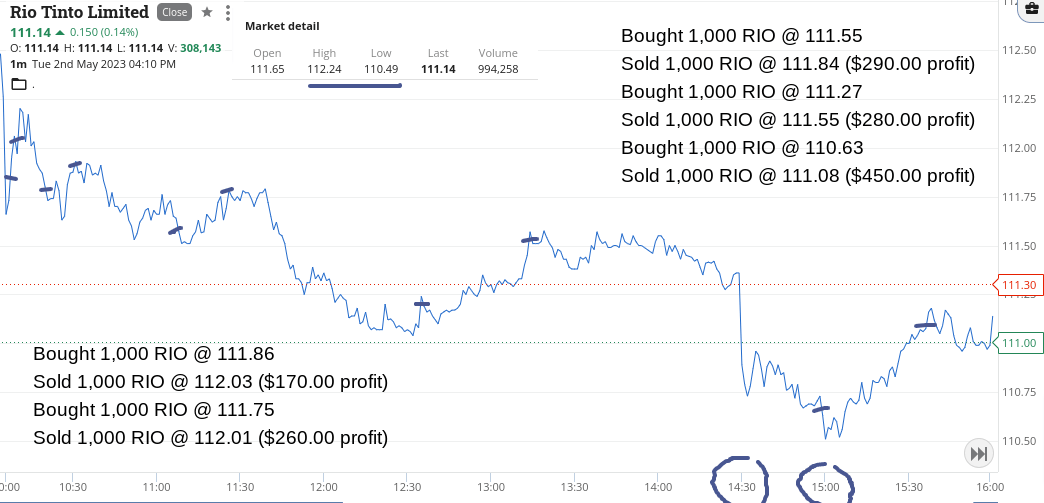

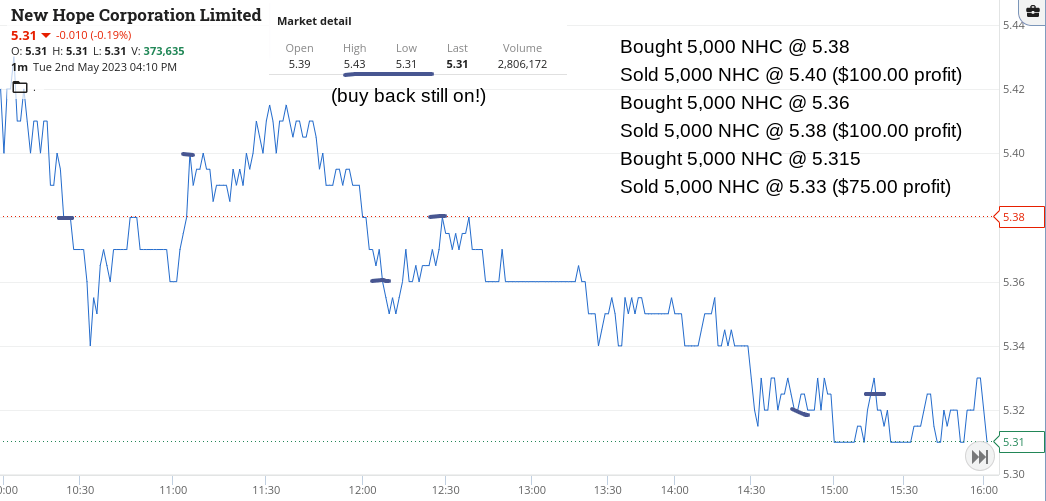

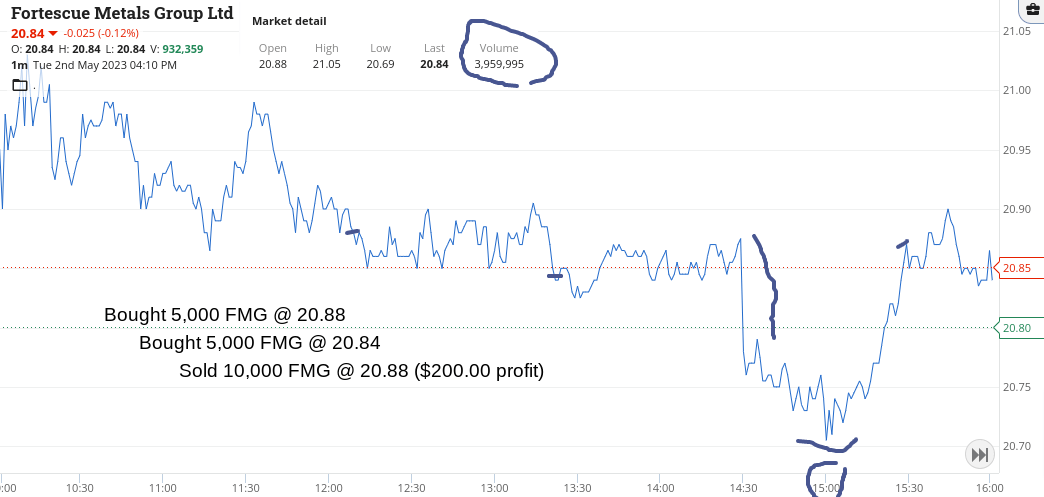

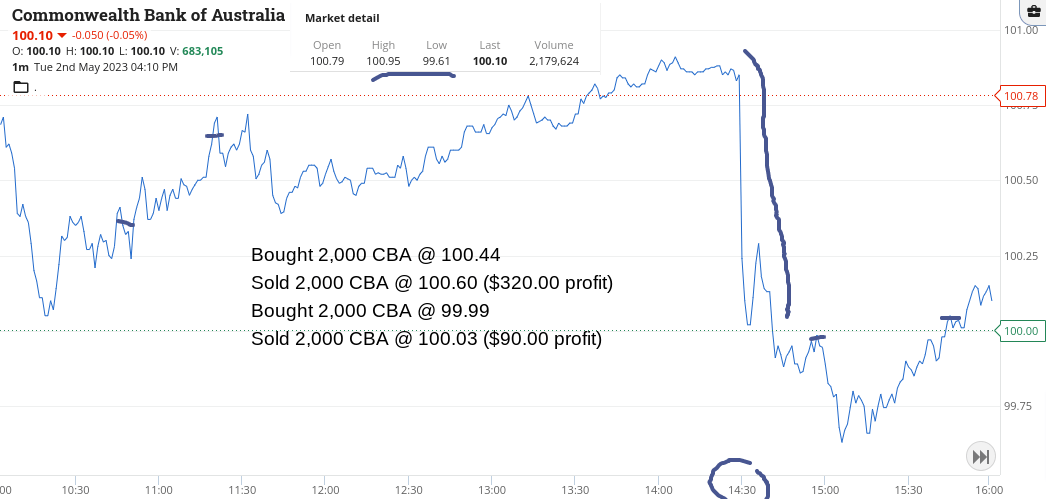

Tuesday May 2

Well, today turned out to be a bit more hectic than I thought it would be. Started out determined to make back yesterday’s loss in RIOs, which kept falling below $112 and then bouncing but in ever-decreasing bounce backs.

Four times they did this but the last trade in them was the best. They fell below $111 after the RBA gave everyone a rate rise surprise. Got some at $110.63. So their day range was $112.24 to $110.24.

Now, I don’t know if I’m getting old but I basically forgot about the RBA coming out with their rate decision today and was basically long of some FMG as I was a few cents the wrong way.

Turns out that I became wrong by 16c on 10,000 at one point. However, why iron ore stocks get marked down on an interest rate rise just amazes me, so I went against the market and waited for some sense to prevail.

The results are below and in the charts. I hope some of you managed to do the same and create a bit of sunshine on, for some, a dark day.

Up $2,755 on 29 trades and glad to have stared down the market’s knee jerk reaction on BHP, RIOs and FMG.

Crazy stuff and why I don’t run any stop losses, just alerts to keep me on my toes.

Recap

Bought 1,000 RIO @ 111.86

Sold 1,000 RIO @ 112.03 ($170 profit)

Bought 2,000 CBA @ 100.44

Bought 5,000 NHC @ 5.38

Bought 1,000 RIO @ 111.75

Sold 1,000 RIO @ 112.01 ($260 profit)

Sold 5,000 NHC @ 5.40 ($100 profit)

Bought 1,000 RIO @ 111.55

Sold 2,000 CBA @ 100.60 ($320 profit)

Bought 2,000 BHP @ 43.94

Sold 1,000 RIO @ 111.84 ($290 profit)

Sold 2,000 BHP @ 44.01 ($140 profit)

Bought 5,000 NHC @ 5.36

Bought 2,000 BHP @ 43.78

Sold 5,000 NHC @ 5.38 ($100 profit)

Bought 1,000 RIO @ 111.27

Bought 5,000 FMG @ 20.88

Sold 2,000 BHP @ 43.88 ($200 profit)

Sold 1,000 RIO @ 111.55 ($280 profit)

Bought 5,000 FMG @ 20.84

Bought 2,000 CBA @ 99.99

Bought 2,000 BHP @ 43.59

Bought 1,000 RIO @ 110.63

Bought 5,000 NHC @ 5.315

Sold 2,000 BHP @ 43.73 ($280 profit)

Sold 1,000 RIO @ 111.08 ($450 profit)

Sold 5,000 NHC @ 5.33 ($75 profit)

Sold 10,000 FMG @ 20.88 ($200 profit)

Sold 2,000 CBA @ 100.03 ($90 profit)

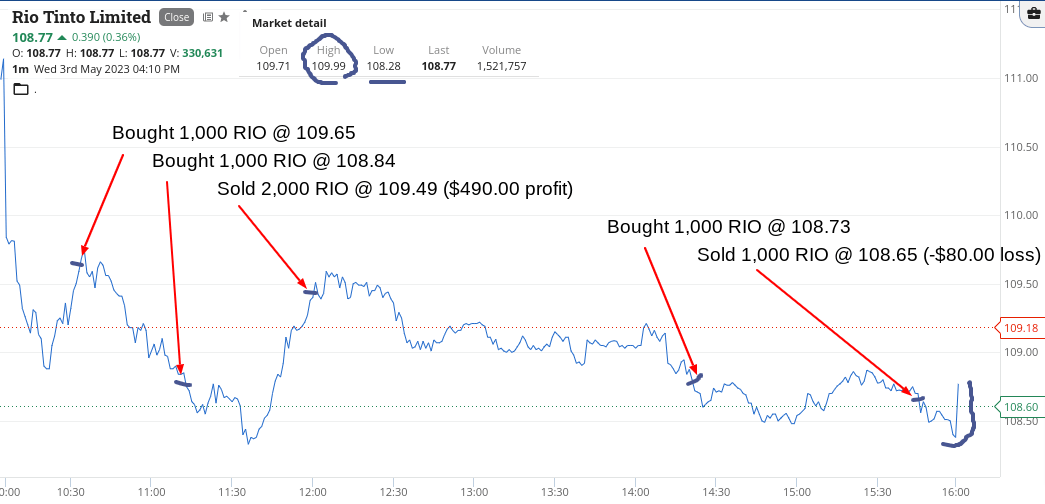

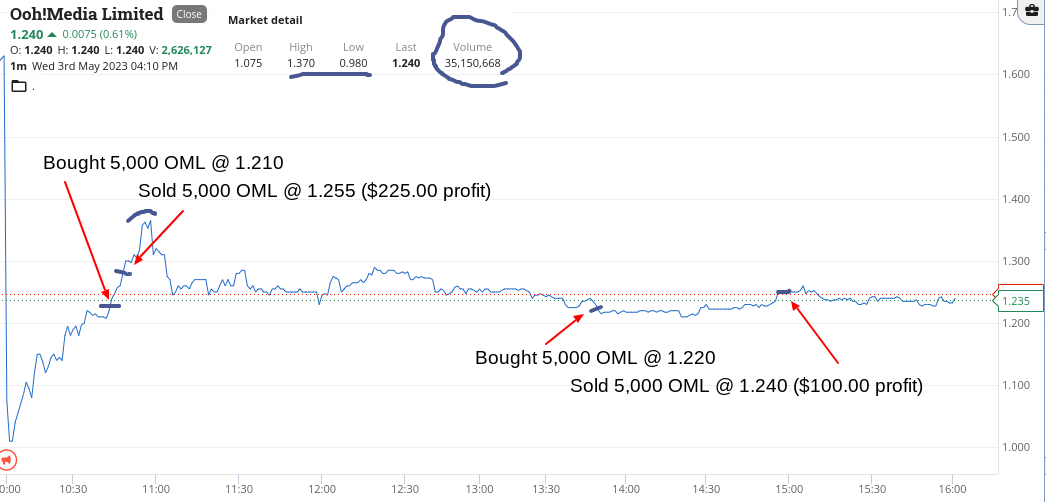

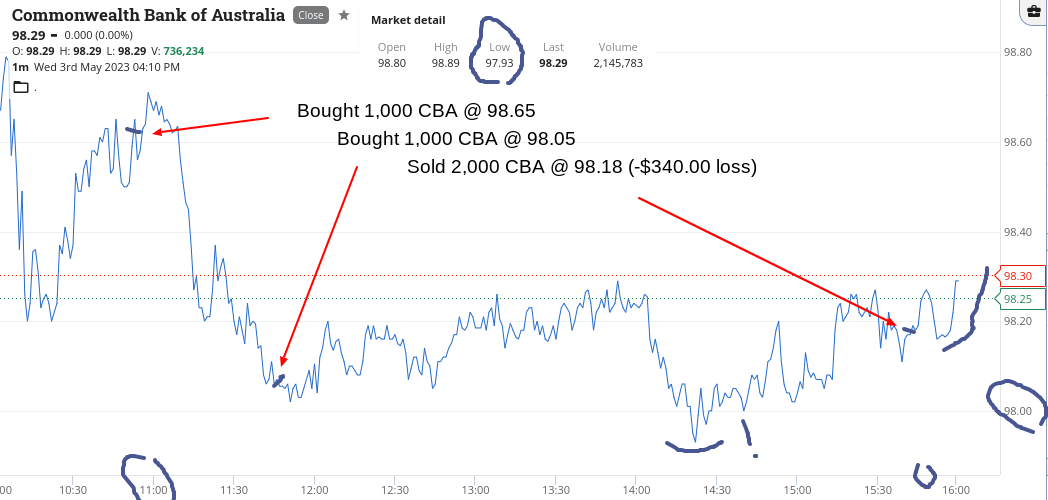

Wednesday May 3

Mmmmmm. Got a bit lost in the woods today and had to walk away with a couple of losses, which if I had held on to the very end of the game would have been a bit less.

Ooh Media or OML, popped up as a 25% faller, so just had to grab some and whilst I was at it, just had to have a go in some CBA and RIOs.

Why not, I thought. CBA at $98.65 and RIOs at $109.65, compared to yesterday’s $100.03 and $111.08.

Mmmmmm. Had to double down on RIOs at 80c or so lower before they came good (a limit order) and together with OML, I’m up 700 odd dollars or so but on my knees on CBA.

One more go at OML eases the pain a little bit but with about 15 mins to go, I bite the bullet and cut all of my positions, as things aren’t feeling good.

End the day up $345 and kicking myself for all the effort and lack of focus. I think yesterday had made me a bit cocky and today I paid for it. Tomorrow I will be more focused as I hate losing.

Recap

Bought 5,000 OML @ 1.210

Bought 1,000 CBA @ 98.65

Bought 1,000 RIO @ 109.65

Sold 5,000 OML @ 1.255 ($225 profit)

Bought 1,000 RIO @ 108.84

Sold 2,000 RIO @ 109.49 ($490 profit)

Bought 5,000 OML @ 1.220

Bought 1,000 CBA @ 98.05

Bought 1,000 RIO @ 108.73

Sold 5,000 OML @ 1.240 ($100 profit)

Sold 2,000 CBA @ 98.18 (-$340 loss)

Sold 1,000 RIO @ 108.65 (-$80 loss)

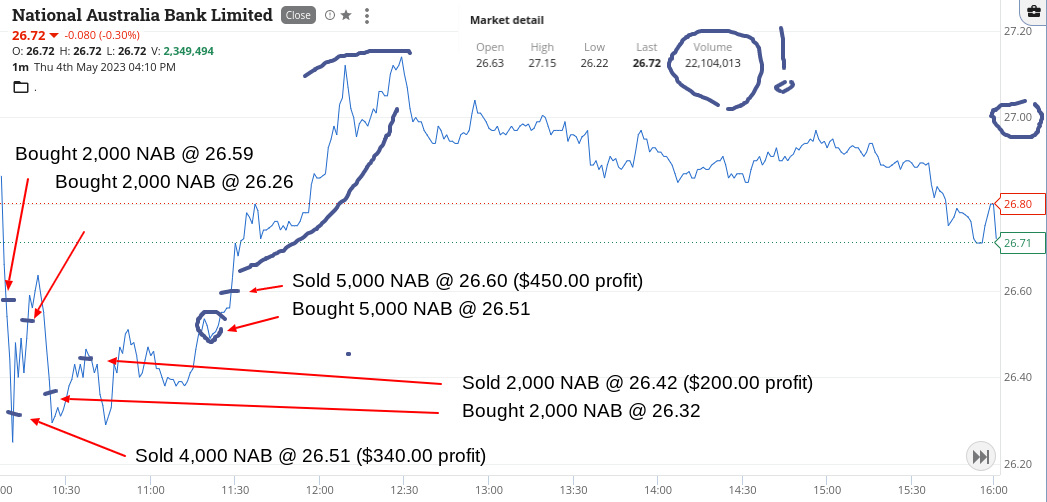

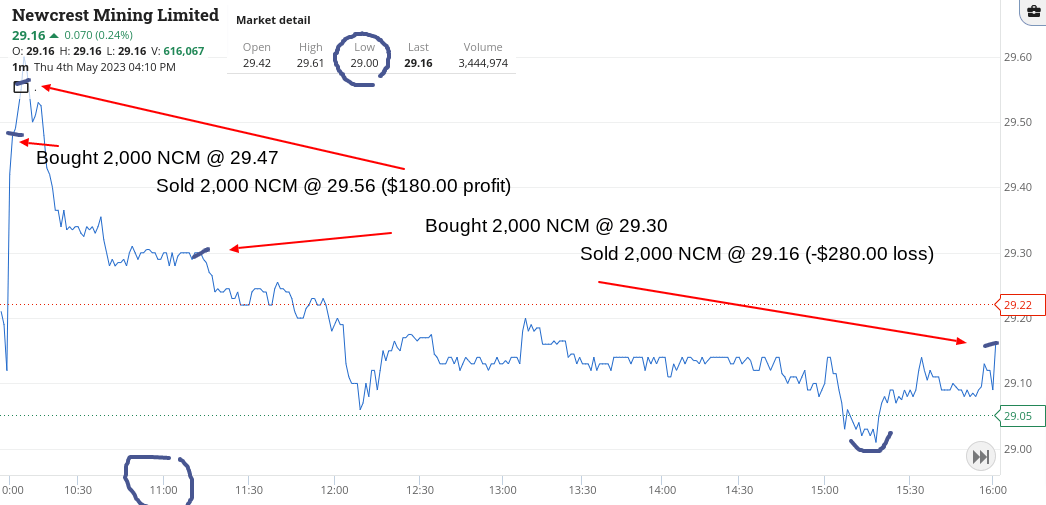

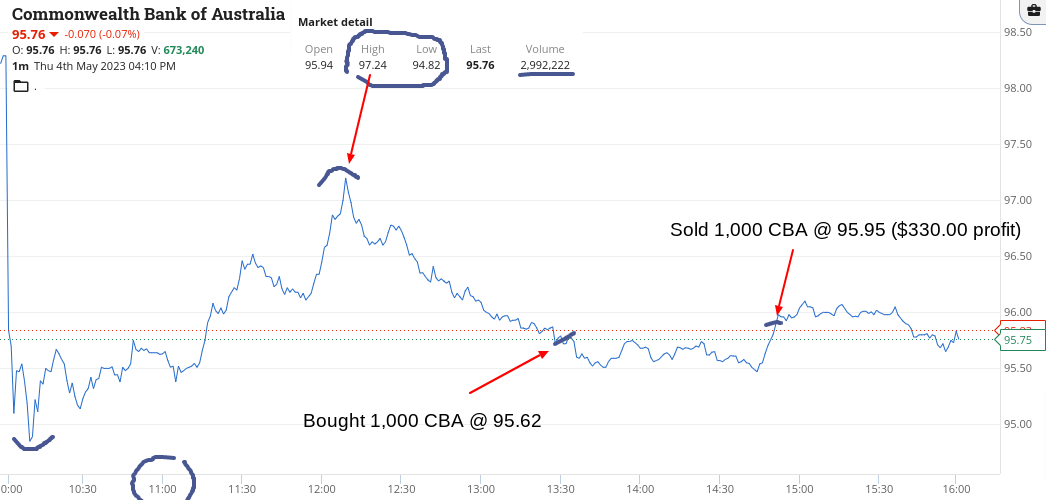

Thursday May 4

Up $1,320 on another crazy trading day, thanks mainly to NAB being marked down 6% or so after the released their figures pre market.

$26.50 was NAB’s main focal point and my second trade in 5,000 was a beauty, though I did leave a bit on the table (like 40c!) but I picked it and geared up.

At that point, over 10m had gone through the market. CBA below $96 also seemed okay as well.

Gave a little bit back at the end of the day, which is to be expected when there seems to be so many trades to have a go at.

Got in early on NCM because of the gold price though they fizzled out at the end of the day, as did my profit in them.

They were my first and last trades today. Let’s see what gold does overnight.

Recap

Bought 2,000 NCM @ 29.47

Sold 2,000 NCM @ 29.56 ($180 profit)

Bought 2,000 NAB @ 26.59

Bought 2,000 NAB @ 26.26

Sold 4,000 NAB @ 26.51 ($340 profit)

Bought 5,000 OML @ 1.150

Bought 5,000 NHC @ 5.25

Sold 5,000 NHC @ 5.28 ($150 profit)

Bought 2,000 NAB @ 26.32

Sold 5,000 OML @ 1.170 ($100 profit)

Sold 2,000 NAB @ 26.42 ($200 profit)

Bought 2,000 NCM @ 29.30

Bought 5,000 NAB @ 26.51

Sold 5,000 NAB @ 26.60 ($450 profit)

Bought 5,000 NHC @ 5.22

Bought 1,000 CBA @ 95.62

Sold 1,000 CBA @ 95.95 ($330 profit)

Sold 5,000 NHC @ 5.19 (-$150 loss)

Sold 2,000 NCM @ 29.16 (-$280 loss)

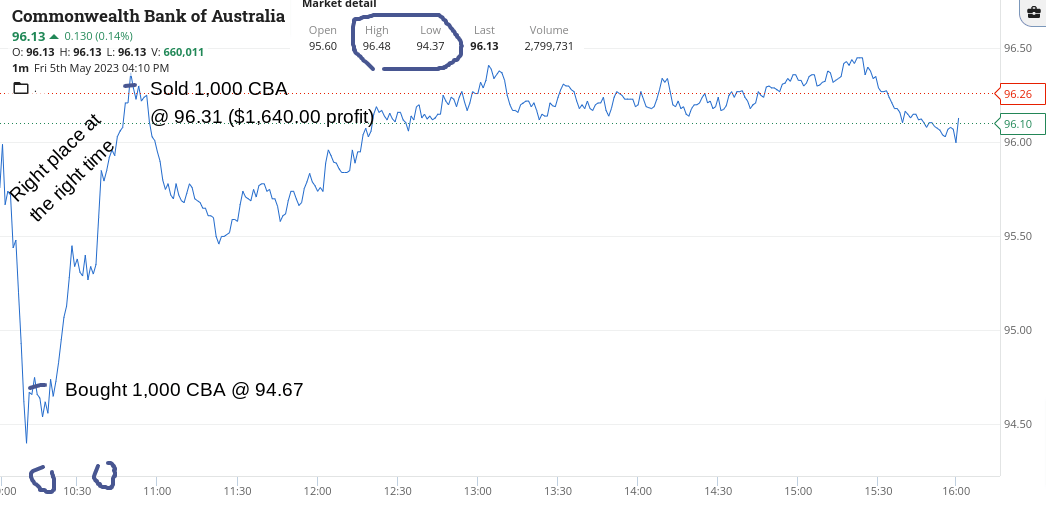

Hey hey it’s Friday 5th May

Well what can I say about today. Would like to say it was 100% skill but Lady Luck was shining on me.

CBA opened up a lot lower than yesterday’s close, so I just had to have a go.

Gold did nothing overnight, so NCM were out.

Watched CBA for a bit and then got distracted, making three regular flat whites and one regular short, without milk, for John Weaver and his three friends.

By the time I came back for a peek, a rocket had been launched under them.

When you see the chart you will see what I mean. Just happened to be at the right place at the right time.

Makes a change for once.

Love it when they go up or down very quickly, as it gives you a split decision to make up your mind.

Up $1,890 from just four trades and unlike Tuesday’s effort of 29 trades which was very tiring, today was very cruisey. That brings the week’s total to a magnificent $5,990 gross or $4,672 net and I counted a total of 72 trades. Howzat!

Recap

Bought 1,000 CBA @ 94.67

Sold 1,000 CBA @ 96.31 ($1,640 profit)

Bought 5,000 NHC @ 5.02

Sold 5,000 NHC @ 5.07 ($250 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.