Confessions of a Day Trader: What the Trading Lord giveth…

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Tuesday January 2

Happy New Year and to the markets as well, as a few stocks have a cracker of a day.

Have a go at CBA.

Open at $111.85. Have a low of $111.79 and close at their day’s high of $113.61 on 1.63m shares.

What is a poor little day trader meant to do when volumes are low to start out and then pick up as stocks go up?

Managed a trade in BHP and that was it my friends.

As my teacher would say to me, if you had studied a bit more, you would have got higher than just a pass. I would say, I will do as little as I can to pass. So if you want me to get higher grades, lift the limit then.

What I am saying is today I was being lazy and scraped through with one trade. Tried to sell them at $50.60 (after they had reached there once) but reduced it down to $50.55 as not trying too hard.

And if you are out there Mr Driver, I am still making more than you!

‘Pass C+ but could try harder’.

Ha!

Recap Today leaves me up $60 for the week so far. The market had a downward dog kinda day, though the only thing stretching for me today was my patience. I managed to yoga myself into a few positions, some of which I was only able to unwind at the end of the day as I was in the hands of the trading God’s and had got myself a bit stuck. Basically, everything fell but never really recovered, as you will see from the charts. Down $240 and today nothing really lined up for me, as higher limits never got touched and day’s end rotation only made things worse. Recap So, CBA who were over $113 the other day, have a bit of a tumble pre 11.00am and then blow me down, they fall below $111.00 and keep heading south. In for a penny, in for a pound and I reckon a bit of margin call coming into play. Up the size to 1500 and in I go. Doesn’t take long before they are back nudging $111.00. See chart for the picture. The other one of note was my manic child CSL. Get set below $284.40 and put them on a limit 1c below $285. They go through it and just keep on going like a firework on NYE on the Harbour Bridge. They touch $287.14 before having a breather. Manic stock! End the day plus $1,185, so it makes up for the other day’s efforts plus twice today I managed to buy something at their day’s low. That is something which only happens about two times a year. Recap Today, the trading lord, he giveth and he taketh, as I have a couple of goes in RRL. The market is in a let-down phase and you need to look at the WTC chart as a good example. I was running around today, so I didn’t have much time to really get stuck into things, so I just stuck with RRL and still managed to get caught in the market downdraft. Being a Friday didn’t help me either. Down $200 today, which takes me to a plus $1045 gross or $647 net, as had a few bigger bets to get here, so just kept my head above water! Recap

Bought 2,000 BHP @ 50.40

Sold 2,000 BHP @ 50.55 ($300 profit)

Bought 1,000 RIO @ 135.02

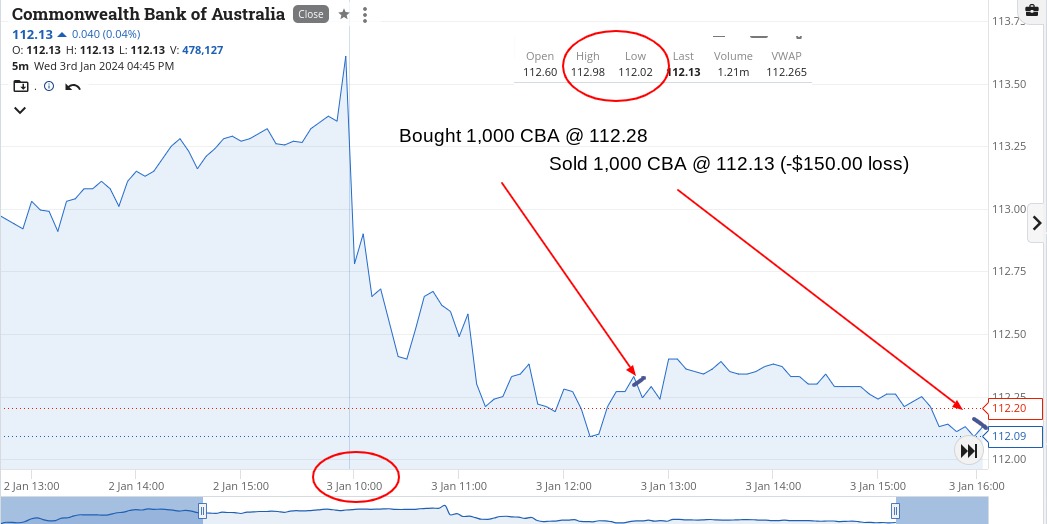

Bought 1,000 CBA @ 112.28

Bought 1,000 WTC @ 73.96

Sold 1,000 WTC @ 74.17 ($210 profit)

Sold 1,000 CBA @ 112.13 ($150 loss)

Sold 1,000 RIO @ 134.72 ($300 loss)

Thursday January 4

Bought 1,000 CBA @ 111.63

Bought 20,000 RRL @ 2.11

Sold 20,000 RRL @ 2.12 ($200 profit)

Bought 1,500 CBA @ 110.94

Sold 2,500 CBA @ 111.40 ($460 profit)

Bought 1,000 WTC @ 73.34

Bought 500 CSL @ 284.40

Sold 1,000 WTC @ 73.51 ($170 profit)

Sold 500 CSL @ 284.99 ($295 profit)

Bought 2,000 WBT @ 4.09

Sold 2,000 WBT @ 4.12 ($60.00 profit)

Friday January 5

Bought 20,000 RRL @ 2.11

Sold 20,000 RRL @ 2.12 ($200 profit)

Bought 20,000 RRL @ 2.11

Sold 20,000 RRL @ 2.09 ($400 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.