Confessions of a Day Trader: What goes up, must come down

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 13

Had to play a waiting game today, as it took a bit of time for a few stocks to crack below support levels.

APT for example opened down from Friday’s $126.30, at $124.00 and its day high was only 20c above its open.

RIO opened at $106.51, had a high of $108.49, a low of $105.61 and finished at $106.20 on 1.45m shares.

My first trade was to buy 1000 RIOs after they cracked below the $106 level at $105.92.

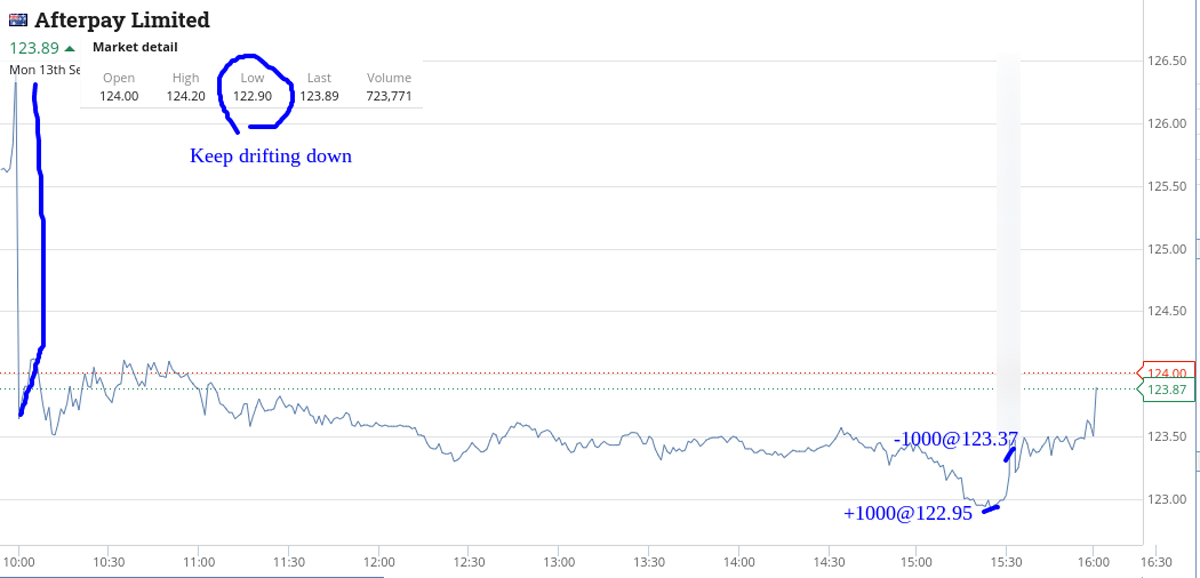

Then waited for APT to crack the $123.00 level and bought 1000 at $122.95.

Time is 15.22pm. That’s a bloody long and boring COVID lockdown wait.

Next bought 1000 BHP at $41.19 and sold the APT at $123.37 (+$420) and then the BHP at $41.26 (+$70) but was still below water in the RIOs, with 4 minutes to go.

Felt like they were due a rally so bought another 1000 at $105.78 and closed them out on a bit of day-end short covering at $105.93 (+$160). See chart.

Up $$650 for the day, so slightly better start than last week. Ha! Market felt groggy all day and think tomorrow will be worse.

Tuesday September 14

Expect an as-you-go day but then along come Brambles (BXB) opening down 10% or so. They were $12.25 yesterday and today buy I 2000 at $10.90 and sell them at $11.01 (+$220).

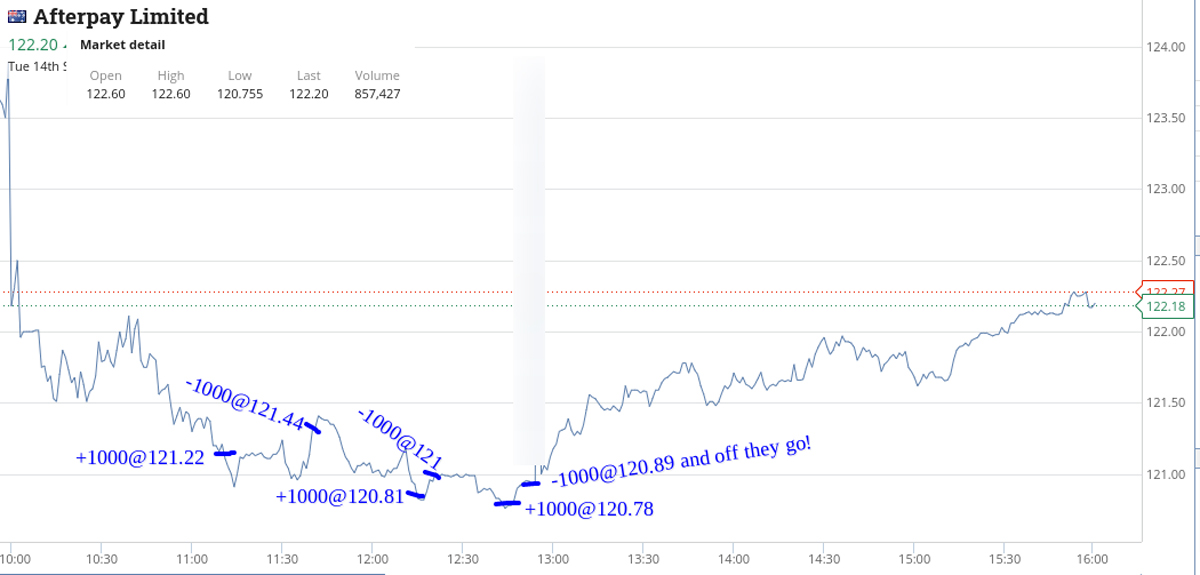

Then buy 1000 APT at 121.22.

Then back in at $10.89 for 2000 BXB.

Watch APT bounce to $121.41 and out they go (+$120).

Now able to sell the 2000 BXB at $10.85 (also +$120).

APT fall below $121 and pick up 1000 at $120.81 and knock ‘em out at $121 even (+$190).

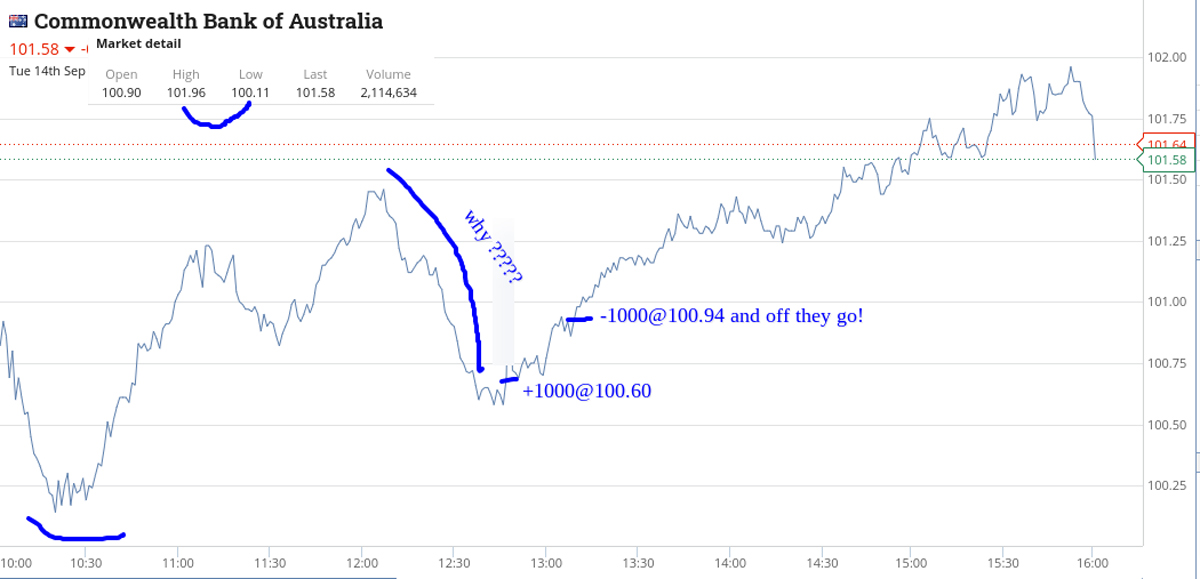

Been watching CBA above $101 for most of the day and then for some reason they drop and I pick up 1000 at $100.60. Should have made it 1500! Then back in for another go at APT. Buy 1000@ 120.78.

Sell the APT at $120.89 (+$120.89) and then the CBA at $100.94 (+$340). Both take off after I sell them!

Lastly have a quick go at RIOs in last 5 mins, which loses me $20 plus brokerage. Of course they didn’t bounce! Ha.

Anyway up $1,150 and Hump Day tomorrow.

Wednesday September 15

Talk about a hump day – RIO, BHP and FMG all got smacked around today. They started off being marked down in NY and then closed near their lows today.

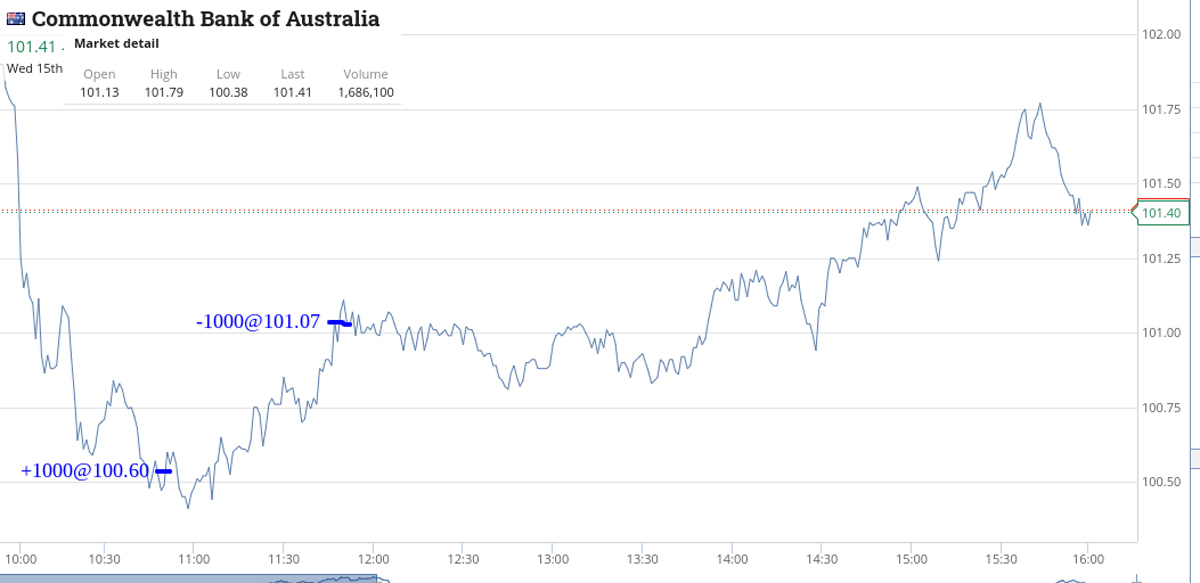

Everything started out rosey for me. Come out of a meeting and buy 1000 CBA at $100.60. Time 10.42am and at 11.45am, out they go at $101.07 (+$470). Nice.

Then buy 1000 MIN at $51.50, as down from a high of $53.45. Time is 12.10pm. Have to wait a bit and knock them out at $51.78 (+$280). Looking okay.

BHP are hovering around $40.40 (they were $1.30 higher yesterday). Buy 1000 at $40.41. Time is 3.11pm. They flirt up and down 5 cents or so and look like they are about to rally, so buy another 1000 at $40.40 and wait for a rally.

It came but it came the wrong way round, so I have to cut the 2000 at $40.24 (-$330). See chart as never bounced, even at the day’s end.

Managed +$420 today and started off so well. Oh well. There’s always tomorrow.

Thursday September 15

Futures showing up overnight and iron ore falling a bit but tech stocks up. Only have this morning to get some trades in early.

APT for some reason falls below $122, having been $123.64 yesterday and tech stocks were up overnight.

Sneak in 1000 at $121.88 and also buy 2000 Z1P, which opened at $6.82 and is now trading at $6.74.

Nothing else around. Head out and have both on a limit to sell. APT go out first at $122.45 (+$570) and I have to finally sell the Z1P at $6.74 as they never reach my limit. APT recovering well, but these babies aren’t.

Make +$40.

All the iron ore ones I follow were mixed with FMG getting constantly sold down, with BHP and RIO recovering before being sold down.

CBA now well above $102 and finish at $102.85, which is 85c above their opening price.

Plus $610 from the morning trading and not too sure if I am around tomorrow. Will see.

Friday September 17

Have to have an operation in my right eye, which is called Selective Laser Trabeculoplasty or SLT, so am away from everything for the day and in hospital.

When I come around, my good eye tells me a story which my right eye will understand. OMG. What a bashing for some and a mark up for others.

APT end the day up $4.84 at $128.38 and RIO end the day down $4.87 at $98.80. APT were below $122.00 yesterday and RIO’s had a high of $108 on Monday.

FMG were the biggest faller in the ASX200, down a massive $1.98 to close at $15.27. That’s a fall for the day of 11.48% and they were $18.40 on Monday.

BHP finished down 3.16% and finished just above $39.00, at $39.16.

Z1P closed the day up 2.55% which compares to APT’s 3.98%.

Up $2,830 gross and $2,286 net for the week.

I fancy a bounce in the iron ore stock on Monday, but not a sustained one and will have my good eye at the ready Monday morning.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.