Confessions of a Day Trader: Wham, bam – thank you ANN!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 17

And we’re off. 10.00am and the bell rings.

EDV become the biggest major faller.

No official news out but the Victorians taking the lead in pokie reforms will hit their bottom line.

Get stuck in waiting for a short squeeze and finally get annoyed with them and really get stuck in and wait. Bit of pain before the gain, as the squeeze finally did arrive and saved my soul.

BHP and NCM give me mixed results and I have to go out to lunch, so happy to cut the NCM and walk away.

Up $700 and happy to make money out of the pokies without having to play them!

Recap

Bought 5,000 EDV @ 5.70

Bought 5,000 EDV @ 5.66

Bought 5,000 EDV @ 5.61

Bought 15,000 EDV @ 5.51

Bought 2,000 NCM @ 27.74

Bought 2,000 BHP @ 45.40

Sold 30,000 EDV @ 5.61 ($850 profit)

Sold 2,000 BHP @ 45.45 ($100 profit)

Sold 2,000 NCM @ 27.62 ($250 loss)

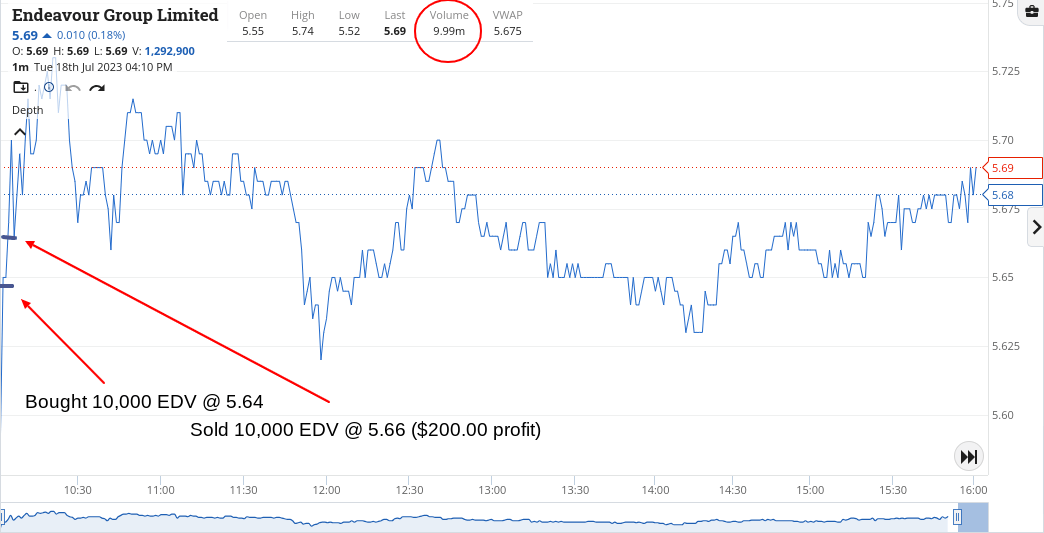

Tuesday July 18

Another day and another faller. ANN was the first one and then SYR. Made money in one and lost some in the other.

CBA touched $103! I could see a 10c trade coming on as they climbed to that level, but with CBA, not worth the risk. This turned out to be a smart move as they later fell back and gave me a better go.

So as you can see in the recap, I was a busy boy with four gains and one loss, which gave me a grand profit of, wait for it, $1,850.

Gotta love reporting season – pre-market announcement, lower opening and all news out, classic move against the grain.

Recap

Bought 10,000 EDV @ 5.64

Sold 10,000 EDV @ 5.66 ($200 profit)

Bought 2,000 BHP @ 44.72

Bought 5,000 ANN @ 23.68

Bought 5,000 ANN @ 23.58

Sold 10,000 ANN @ 23.76 ($1,300 profit)

Bought 2,000 BHP @ 44.56

Bought 10,000 SYR @ 0.78

Bought 2,000 CBA @ 102.34

Sold 2,000 CBA @ 102.45 ($220 profit)

Sold 4,000 BHP @ 44.73 ($370 profit)

Bought 10,000 SYR @ 0.745

Sold 20,000 SYR @ 0.750 ($250 loss)

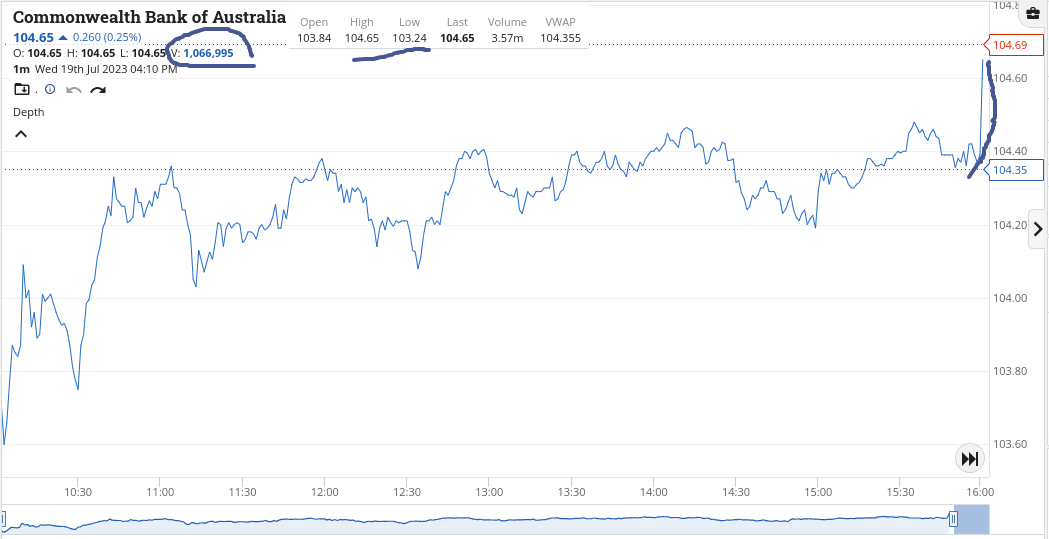

Wednesday July 19

Got myself caught up in some of the market hype, what with CBA trading above $104.00 and RIOs coming out with some production figs, pre-opening.

I thought that the RIO news would rub off onto BHP, which it did but not how I wanted.

Both stocks didn’t recover off their lows until 1.00pm by which time I was in too deep.

Had to wait till the death to book a loss of $210 for the day and have included charts on RIOs and CBA, so you can see what I went through, waiting till 4.10pm.

Long day! Not happy!

Recap

Bought 2,000 BHP @ 44.90

Bought 2,000 BHP @ 44.55

Sold 4,000 BHP @ 44.67 ($210.00 loss)

Thursday July 20

How’s this for a day?

CBA’s range was $104.70 to $106.23 and the stock I got stuck into today, TLX, had a range of $10.00 to $11.80.

I haven’t a clue what TLX does but having a high of $11.80 and then a low of $10.00 is my kind of stock.

At one point early on, I was down $1,500 on paper early on as they were moving around very fast.

They had news out pre-market, so again, it was another classic ‘all the bad news is out’ and on my second go I was all over them with limits at $9.95 and $9.80, waiting for them to crack the $10.00 level.

They never did, so I cracked on to 2,000 at $10.025 and watched them soon start to rise. I put them on a limit and out they went.

Tried to have a go at NST, as they were down 5% or so, but that went a bit pear-shaped and I cut them before the market shut at 4.00pm.

Up $1,300, thanks to TLX.

Recap

Bought 1,000 TLX @ 10.81

Bought 1,000 TLX @ 10.61

Bought 1,000 TLX @ 10.35

Bought 3,000 TLX @ 10.25

Sold 1,000 TLX @ 10.53 ($110 profit)

Sold 5,000 TLX @ 10.58 ($800 profit)

Bought 2,000 TLX @ 10.025

Sold 2,000 TLX @ 10.30 ($550 profit)

Bought 2,000 NST @ 11.80

Sold 2,000 NST @ 11.72 ($160 loss)

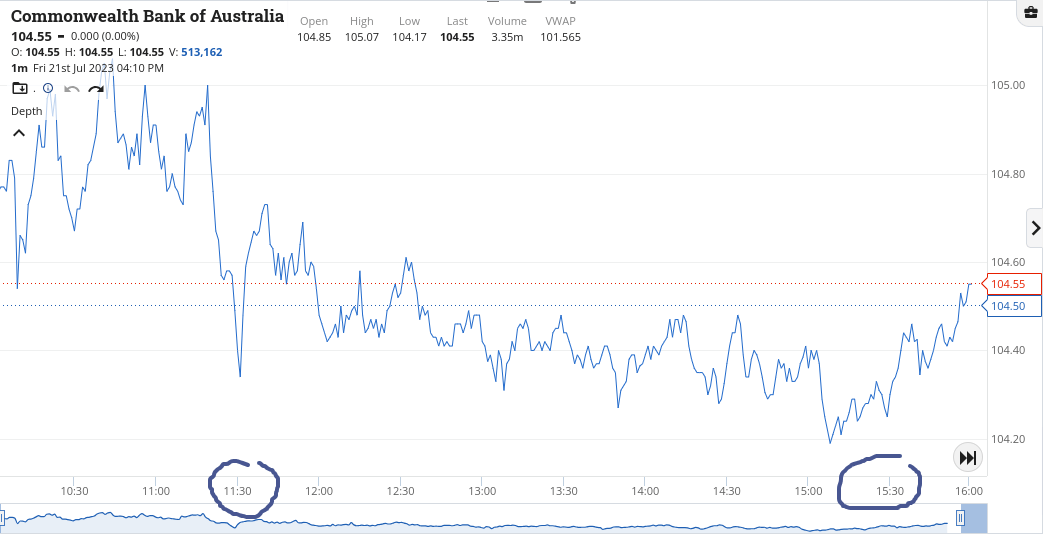

Friday July 21

Today’s diary entry is an easy one to write up as I ended up doing absolutely nothing today. TLX from yesterday could even help me out, as their day in the sun seems to have passed as their volume was but 20% of yesterday’s.

Have added charts on CBA and RIOs so you can see how they went over the day.

So, after today’s doughnut day, ended the week up $3,640 gross or $3,092 net and I still don’t know or really care what TLX do but all I do know is that they are a $3bn company who shocked.

Let’s hope for some more shocks next week!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.