Confessions of a Day Trader: Every little tin, gonna be alright

Gonna be alright? Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peak at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday, October 26

Fresh and ready to see what the week will bring. Not really expecting too much in the markets, leading up to the elections in the USA, so it will be interesting to see what happens today.

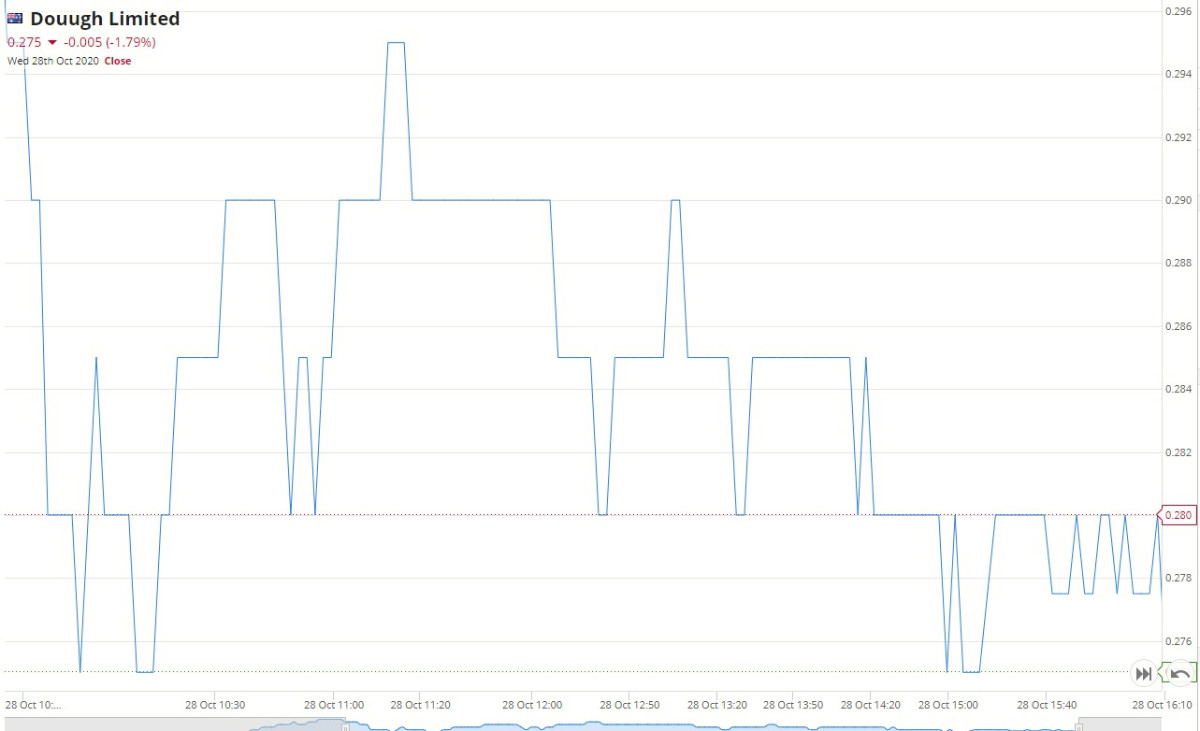

DOU opens a bit flat, so wait to see how they start to trend now that their volume is starting to fall a bit. Have to wait for an hour or so to pick up 10,000 at 29c and get out within 10 mins at 29.5c for a $50 profit.

Notice that a big faller in the first hour is Marley Spoon, having come back on after an oversubscribed placement at 3.22. The market seems a bit disappointed as they opened at 2.99 and I buy 1,000 at 2.84 as that is a fall of 11% and I also buy 1,000 FMG at 16.55, as they are finding support around the 16.50 level.

MMM just seems to keep going down, so I buy another 500 at 2.66 as bouncing around there and take a small $30 profit on FMG. So now concentrating on MMM but just keeps falling and then bouncing a bit, so I buy another 500 at 253, still searching for the bottom. Now own 2,000 MMM at an average of 2.7125 and I’m out 2.40 just before the close.

Where are the underwriters and their support? Reach out for a whisky and hum to myself, “No position no cry”. Not a great start to the week as total loss for the day is $545.

Tuesday October 27

Turn on my phone and everything looks in the red. It seems that Germany led the way with the DAX down 3.7% and Wall Street down 2.29% or 650 points. Germany fell because of disappointment over earnings outlook for SAP, one of their leading software companies.

Wondering how the highly priced but low income Aussie companies will go today. DOU should go below 25c surely and a 2% fall for my pet trading stock FMG will see them down about 32c, having closed at 16.61. Let’s see.

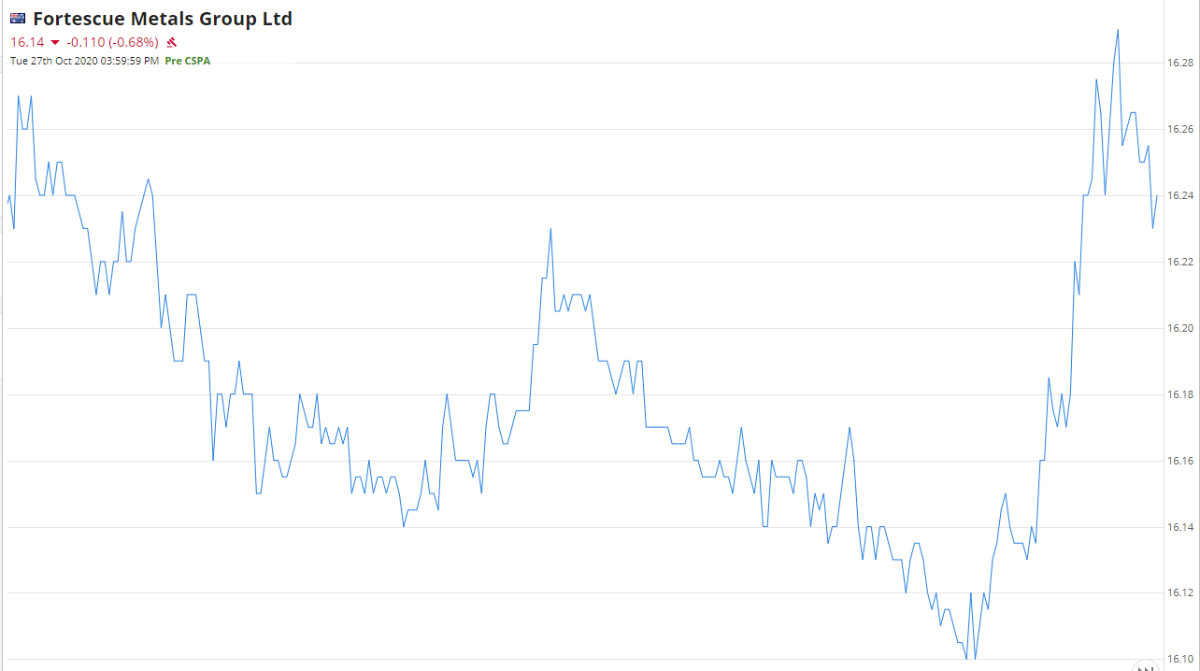

Have to go to the dentist at 10.20am which is a bit annoying, come out and check the market. Buy 1,000 FMG at 16.27, which is down 2.5% at 11.00am, which is the cut off time for margin call defaults, so can normally see an 11.00am bounce.

At 11.30am buy 10,000 DOU at 26c as they keep bouncing off of 25.5c and put in a limit order to sell at 26.5c. Mkt bouncing but FMG drifting which is annoying me. MMM higher than yesterday’s close (2.35), as clearly oversold as up 7% when the market is down 1.5% but leave alone as was hoping they would fall another 20c or so, which they don’t.

DOU position closed out automatically at 26.5c, so pocket $50. FMG around 16.15. Take BRN off watch list as now too boring to watch. Z1P keeps bouncing off of 6.00, so buy 1,000 at 6.02, as that’s down 5% and could be a quick trade in it.

Forrest last bought 6m FMG at around 16.16, so hoping to see support there. Buy another 1,000 at 16.15, down 2.7% and mkt down 1.7%. At 3.33pm, get taken out of Z1P at 6.06, having seen them fall below 6.00. So much for a quick trade! But at least we got there.

Now waiting on FMG to perform. And just like a Black Caviar coming round the final bend they run dramatically higher before the close and I sell 1,000 at 16.24 and two minutes later the other 1,000 at 16.26. Slowly clawing back yesterday’s loss.

+A$165 for the day. Phew. Good to be back on the horse.

Wednesday October 28

Overnight markets have the Dow down 200 points and most of the Europeans down 1% and the ASX futures down 88 points or 1.35%.

Afterpay numbers have just come out. Big rise in customer numbers but not sure what that means for a $29bn company. Let’s see if they hold up the BNPL sector. and keep an eye on Z!P and that 6.00 level.

FMG open at 16.15 and bounce straight off that support level and hit 16.24. Z1P open at 6.09 and quickly settle around 6.06. APT holding steady, just below their $100 barrier.

DOU got touched up to 30c yesterday at the close and as the BPNL sector looking steady, I put in an order at 27.5c thinking if I get hit they may do the same as yesterday. I do get hit with 10,000 at 27.5 cents and so put in order to sell at 29.5c. Let’s see.

Everything else is trending higher. FMG are 16.24 and APT above A$100. Z1P are now 6.17. All this and we are only 45mins in. Going out for a coffee.

Get taken out of DOU as I’m putting my shoes on, at 29.5c for $200 profit. Buy 1,000 Z1P at 6.01 as still hovering 5.99/6.02 levels but have to cut 5 mins before the close for a $20 loss. So all up, finish the day up $180 and DOU finish at 27.5c, FMG at 16.48.

The one that became someone’s shocker was EM1 as it opened at 15c but closed at 10c as rumours swirled around about their claim of six million pre-game registrations and end the day in a trading halt. Vol was 105m for their day.

Let’s see what they have to say to the ASX! Dodged a bullet there.

Thursday October 29

Another day of red. So much for my thinking that there would not be too much movement ahead of USA elections. It seems that Covid is to blame, with the whole of France going into lockdown.

Again Germany led the way with the Dax down 4.2% and Wall St down 900 points or 3.4%. Going to be an interesting day, to say the least. Will be keeping more of an eye on the futures market, as it appears Australia has handled it so well, so not getting smacked around so much. My watch screen is a sea of red so bring on 10 o’clock!

FMG open up at 16.17 and bounce again, so keeping an eye on that level. I notice that the Bitcoin company DCC were down 10% so just out of something to do, I buy 10,000 at 5.6c and sell them 28 mins later at 5.8c. I know it’s only $20 but hey, I’ll take that.

Z1P and APT are starting to bounce, so at 10.40am I buy 1,000 Z1P at 5.77, having seen them at 6.16 yesterday. FMG are only down 1% after their quarterly figs are out. Z1P bounce to 5.83 and I’m out at 5.82, so that’s another $50 to add to the bin.

Still before 11.00am, so going to be a long day of watching and waiting. Just a bit nervous of the market towards the last 30 mins of trading, so happy for really quick ins and outs today.

I never thought I would do this but buy 100 APT at 98.43. Imagine trying to day trade a stock that is a member of the $100 club. It’s 11.10am. They touch 99.00 and I’m out at 98.95 and learn that they move in strange amounts. Anyway that’s a profit of $52 and a first for me and only really possible because of the $5 brokerage charge.

I’m enjoying this but feeling a bit cocky, so will take a break in case I have a moment of weakness so off to grab a coffee. Been back watching and it appears we are in a Covid and financial bubble of our own in Australia.

Thirty mins to go and my watch list has a sprinkling of green amongst the red ones. End the day and FMG close at the devil’s quote again at 16.66, after an opening low of 16.17 and added JIN back to my watch list as they were down to 11.00, having fallen from 12.00 over the last few days.

Bugger me, they only close up at 11.61. Their range today was a low of 10.75 and a high of 11.67 on a T/O of only 882,000. I only put them on the watch list at 2.00pm, when they were 11.02. Up $122 for the day.

Friday October 30

Everything looks steady overnight so not expecting much today. Have a 9.30 doctor’s appointment and I have to go out to lunch at 12.30, so will be switching to Marketech’s phone app, which is easy to do and trade with.

Come out of doctors at 10.27am and see that FMG have taken off and having opened at 16.95 they smash through the 17.00 level and get to 17.50 before coming back down to 17.38 at 11.45am. And that’s up a A$1.20 plus from Wednesday’s trading low!

JIN are down from their opening high of 11.56 and have gapped down in last five mins or so, so buy 1,000 at 11.07 making a note of the time as 11.36am. They could go either way. Bounce or head below 11.00 again. Either through some luck or skill, they bounce off of 11.05 and go to 11.17 and I’m out at 11.16 for a nice $90 pre-lunch trade.

Decide that this afternoon may get a bit messy, so leave the phone in the car and only come back to it after the close, as I’ve learnt the hard way that Friday afternoons can be painful. If people don’t want to hold ahead of the weekend, sell-offs can be more brutal.

FMG only green stock on my watch list. JIN closed at 10.88. Melbourne Cup on Tuesday, which is another write-off afternoon.

Giddy up till Monday.

This week’s wash up:

Down: $108 for the week.

Brokerage: $135

Worst trade was MMM on Monday: -$625

Best trade was DOU on Wednesday: +$200

Total loss: $243 plus some whisky shots for Monday!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.