Confessions of a Day Trader: WE GOT A (Zip) BLEEDER!

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday April 12

Schools are still on holiday, so expecting lower volumes than usual. Going to try to pick a level and hold a bit longer than usual (within the day still). Let’s see what happens!

Buy 1000 CBA at 86.75, after seeing them at 87.40. Time is 11.13am. Put in a trigger limit of 86.99. Goes +A$100 profit, then back to zero at 11.35am. Then +A$120, then back to zero at 12.09pm.

Determined to see this through. So, have to buy another 1000 at 86.53, to bring my average in price down to long 2000 CBA at 86.64. Time 1.03pm.

If I sell CBA, want to switch into BHP but not going my way, so buy 1000 BHP at 46.24 at 1.04pm. Now with both positions, at bang on 2.20pm I am breaking even.

At 2.21pm +A$50 combined. At 2.23pm -A$110 combined. I end the day up A$420.

My determination to ride CBA through the day produces A$200 profit and BHP hands over A$220 after two round robins. See graphs for sweat and tears!

+1000 CBA at 86.75; +1000 CBA at 86.53; -2000 CBA at 86.74; Profit A$200 (was down A$300 at one point)

+1000 BHP at 46.24; -1000 BHP at 46.40; +1000 BHP at 46.26; -1000 BHP at 46.32; Profit A$220 (not as hairy as CBA)

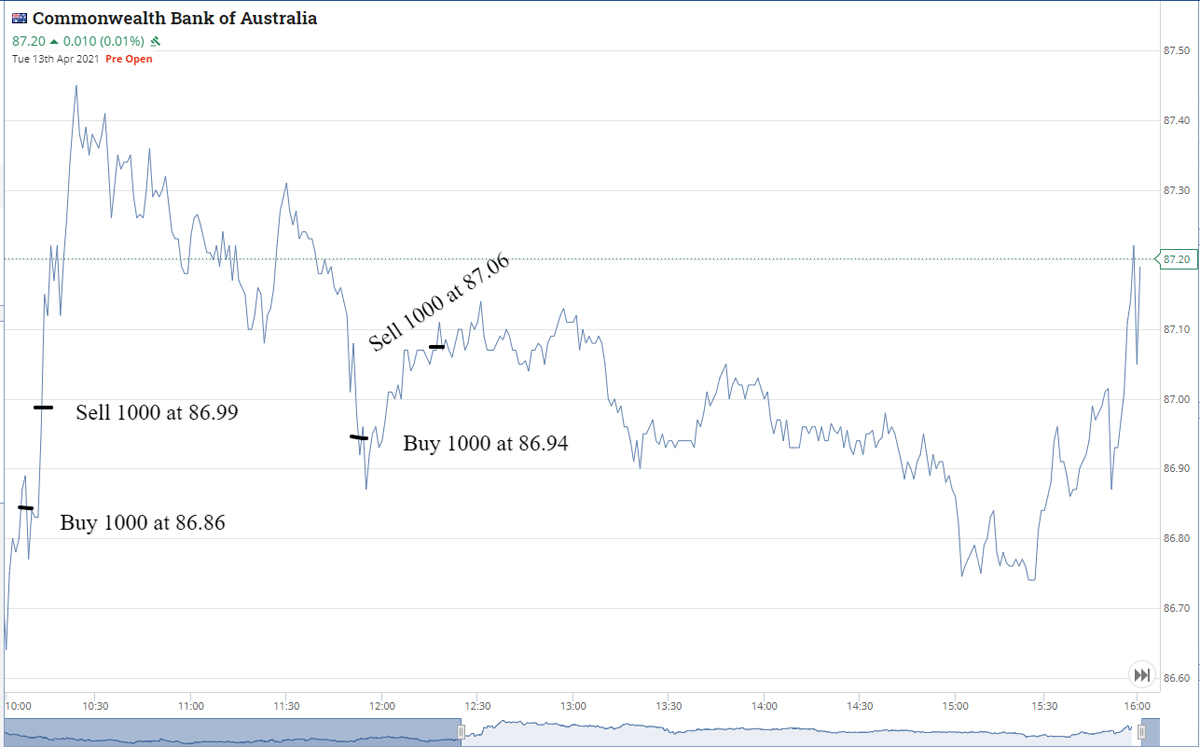

Tuesday April 13

CBA falling on open. Buy 1000 at 86.86. Time 10.07am.

Five mins later out at 86.99 on a trigger limit. Plus A$130. Manage to do the same again later. In at 86.94 and out at 87.06 for a A$120 profit.

BHP also in and out twice for 1000 shares and made A$60 on one and A$40 on the other. All up plus A$350 for the day.

+1000 CBA at 86.86; -1000 CBA at 86.99; +1000 CBA at 86.94; -1000 CBA at 87.06; Profit A$230

+1000 BHP at 45.81; -1000 BHP at 45.87; +1000 BHP at 45.76; -1000 BHP at 45.80; Profit A$100 (not much but a profit is a profit)

Zip. Hmm.

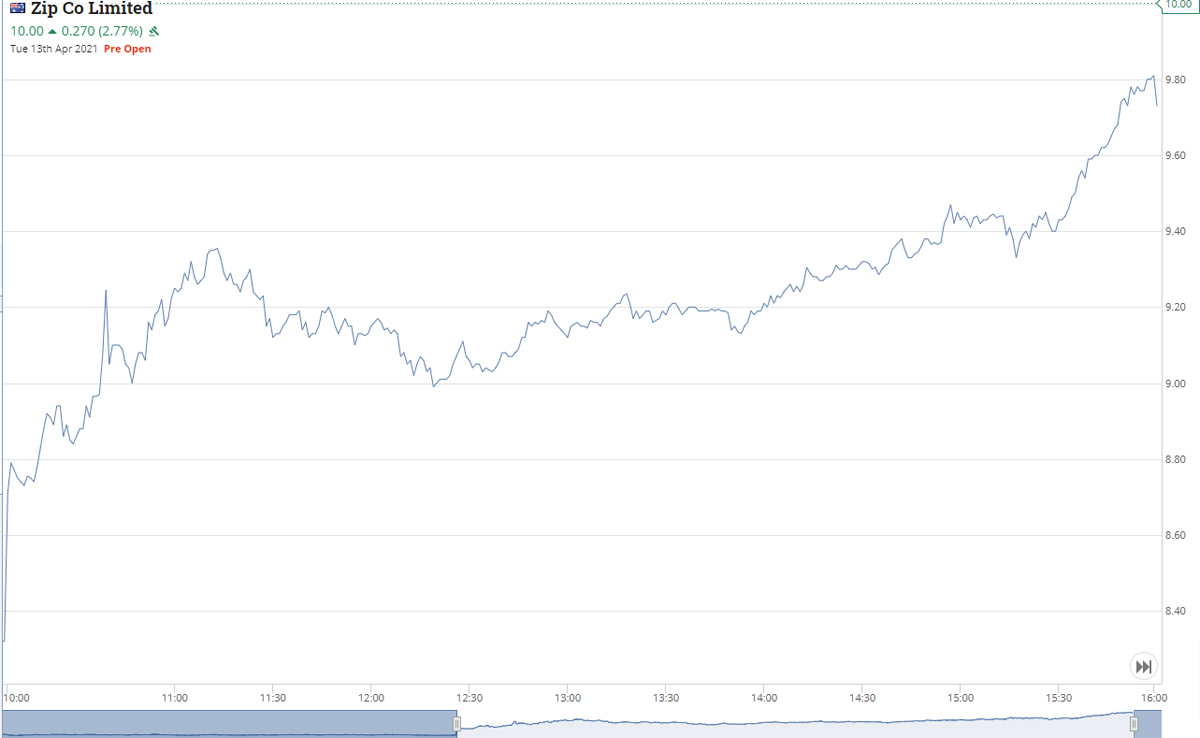

Wednesday April 14

Feels like Friday 13th. I knew it would happen at some point and today was the day. Ended the day locked into 1000 Z1P as they went into a trading halt.

Had seen them going lower and like many others not in the know, bought 1000 at 9.59 for a quick 10c turn. Kept thinking my screen was frozen when checking via my phone. Even had a notification set up if they traded at 9.70 or above and thought bound to go off.

Finally I read that they had been halted. Not a big position and don’t know what will happen tomorrow. Not happy Jan.

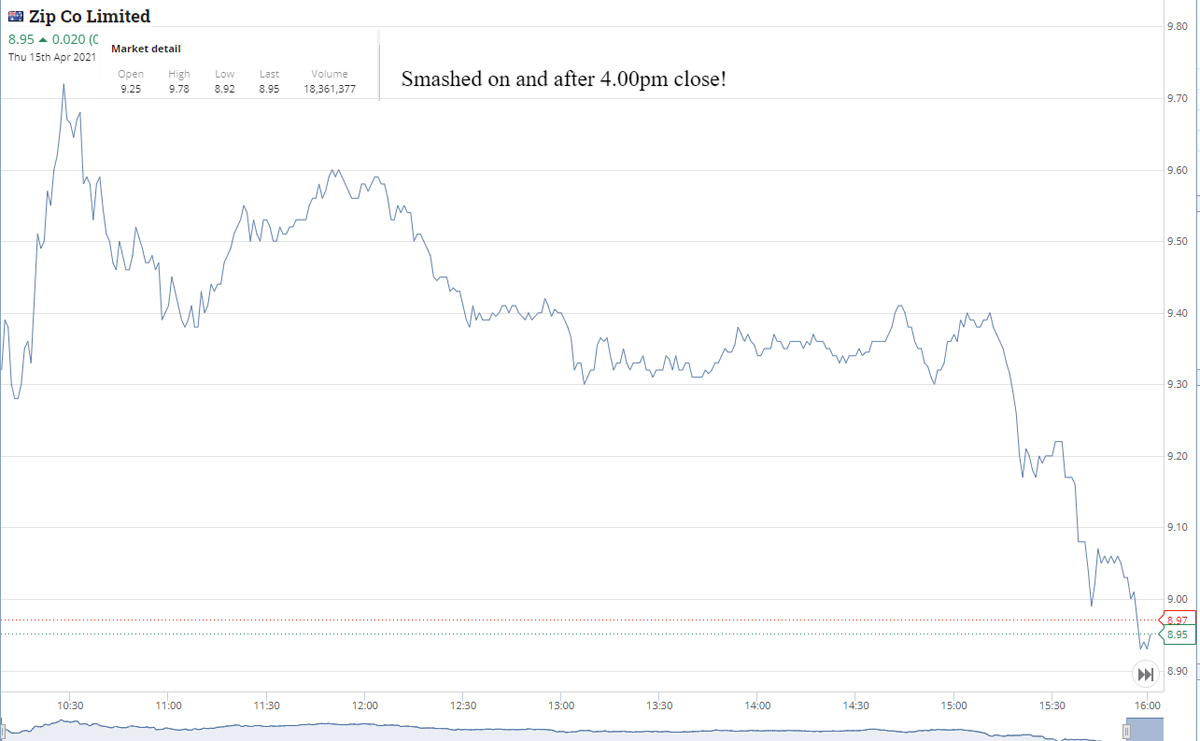

Thursday April 15

Z1P manage a very quick announcement and trading halt lifted. Phew!

They open lower and as all the news is out there, I raid my wallet and buy 2000 more at 9.36. Time 10.18am. This now gives me an average of 3000 at 9.43667.

I’m out two mins later at 9.54, for a total profit of A$310. By 10.30am they are back at yesterday’s trading halt price.

Head to beach as even though happy with the profit, not happy getting caught long overnight.

+1000 Z1P at 9.59 (Wed); +2000 Z1P at 9.36 (Thur); -3000 Z1P at 9.54 (Thur); Profit A$310 (Luckily a quick overnight trading halt)

Friday April 16

Dust myself down from yesterday’s hissy fit and empty the swear jar as too full to add anymore coin. School holidays coming to an end, so expecting a few more opportunities next week.

Start out with a bang for something a bit different timing-wise. Buy 1000 FMG at 10.02am. Price 21.10. Next buy 1000 at 10.06am. Price 20.92. Then buy 2000 at 10.14am. Price 20.55. This leaves me long of 4000 at 20.78 average.

Have to wait till 2.37pm before selling at 20.83 for a A$200 profit.

Same happened in CBA. Bt 1000 at 87.97 at 10.20am and another 1000 at 87.69. Time 10.57. Sold the whole 2000 at 87.99 for a A$320 profit.

Time 14.37pm. Was at one point down A$1300 on both positions combined. Long wait from start to finish today – maybe leave opening for some time? And go back to 10.30/10.45am.

All up plus A$520 for a long and nervous day.

+1000 FMG at 21.10; +1000 FMG at 20.92; +2000 FMG at 20.55; -4000 FMG at 20.83; Profit A$200 (went too early)

+1000 CBA at 87.97; +1000 CBA at 87.69; -2000 CBA at 87.99; Profit A$320 (went too early)

Net Profit: A$1590

Less Brokerage: A$307

Net Profit: A$1283

Most satisfying: Z1P (Thur)

Least satisfying: Z1P (Wed)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.