Confessions of a Day Trader: Was it all a dead cat rabbit bounce?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday April 11

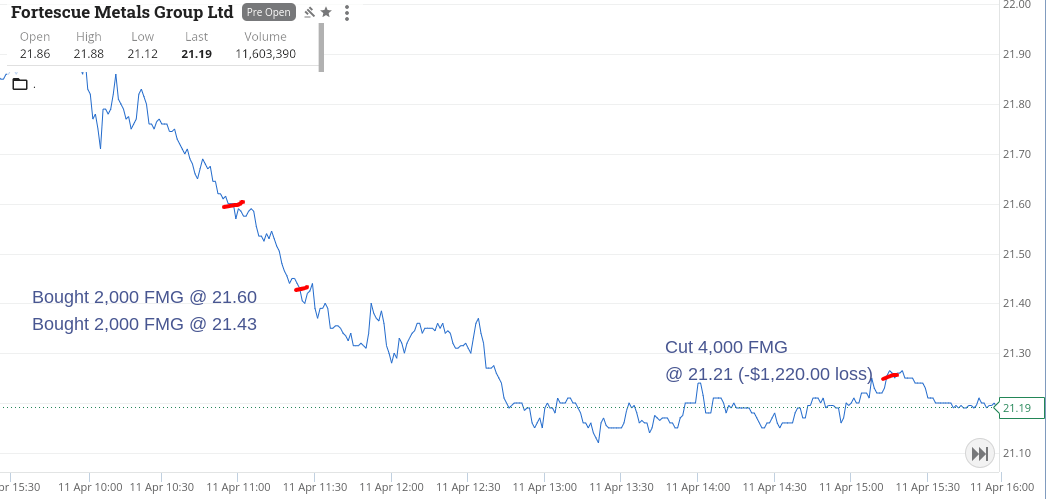

Got caught today in a downdraft of falling iron stocks with differentiating results.

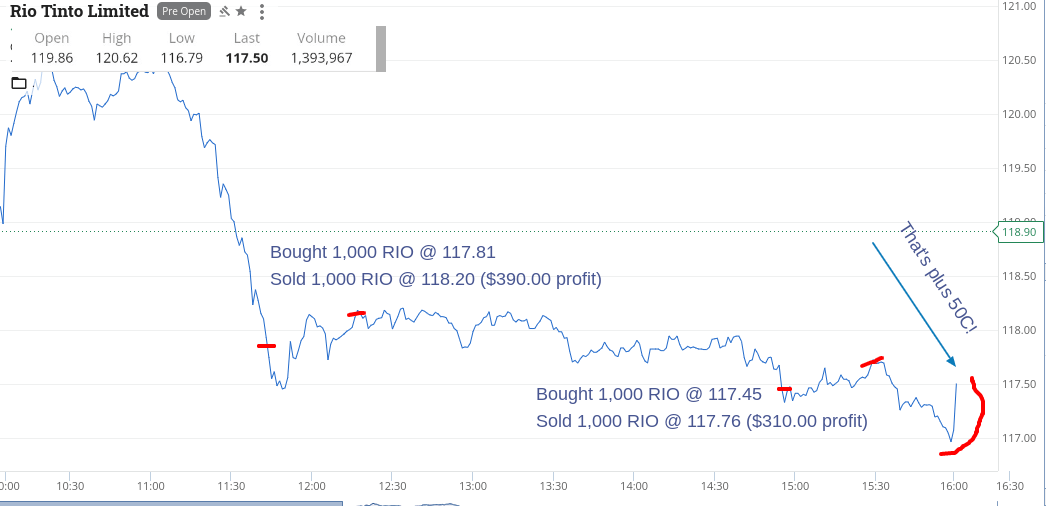

Rio had a range of $120.26 to $116.79 and I managed to get two good results from them but in FMG I got a bit cocky with my starting size.

Decided to go for 2000, instead of 1000 and paid the price and managed to snooker myself because of it. If I had stuck to 1000, I could have averaged down three times instead of once only.

So made $700 in RIOs and lost $1,220 in FMG leaving me down $520 before brokerage. I was expecting this to happen to me last week! Let’s see what Tuesday brings.

Recap

Bought 2,000 FMG @ 21.60

Bought 2,000 FMG @ 21.43

Bought 1,000 RIO @ 117.81

Sold 1,000 RIO @ 118.20 ($390 profit)

Bought 1,000 RIO @ 117.45

Sold 1,000 RIO @ 117.76 ($310 profit)

Sold 4,000 FMG @ 21.21 (-$1,220 loss)

Tuesday April 12

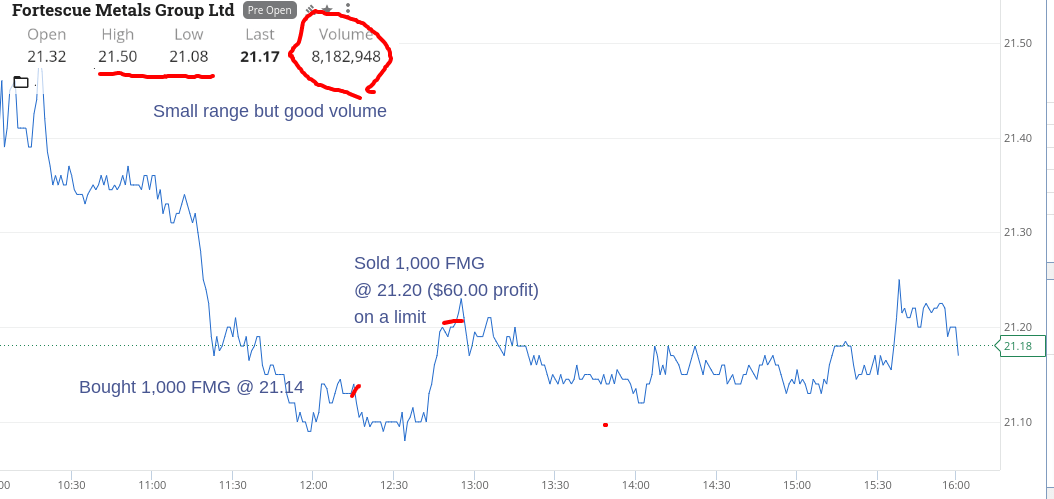

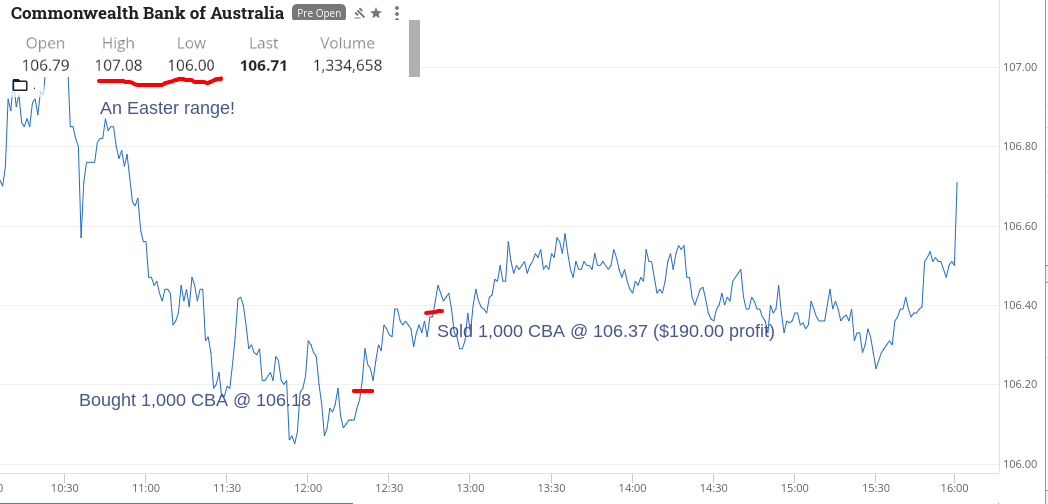

Today was getting hard to find anything as day ranges are getting tight and some volumes are Easter Holiday low.

CBA missed their 11am run and it came a little bit later. Managed to pick up 1000 at $106.18 on their way up and get a quick profit. Of course they went even higher.

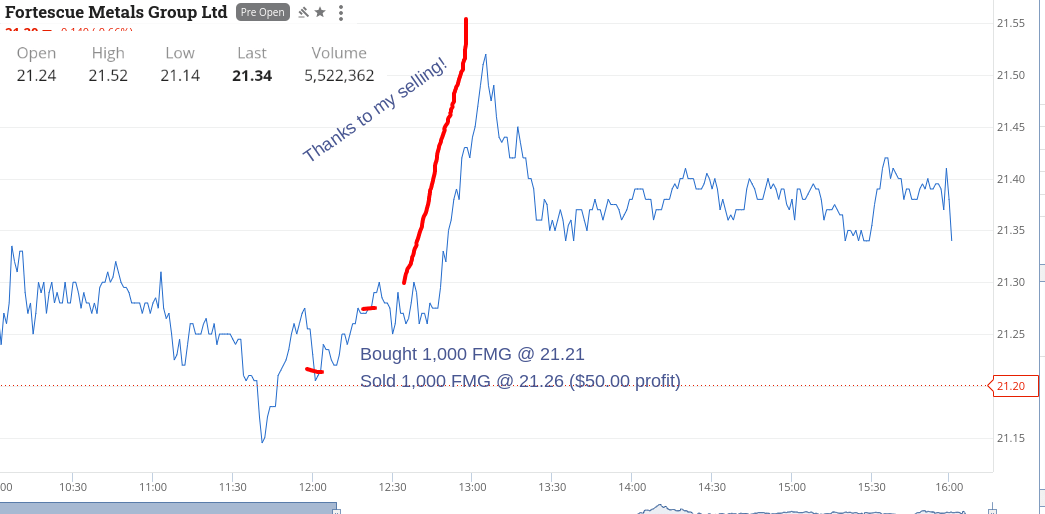

Someone asked me once how do you know a share price is about to go up? Easy I said, I just sell it and that is a signal for them to rise!

Just remember though, you do want to sell as they are going up, otherwise you can get caught with only selling a portion.

FMG seem to like the $21.19/20 level, so managed to get a small turn. Clawing back yesterday’s losses.

Up $250, so $270 left to go.

Bought 1,000 CBA @ 106.18

Bought 1,000 FMG @ 21.14

Sold 1,000 CBA @ 106.37 ($190 profit)

Sold 1,000 FMG @ 21.20 ($60 profit)

Wednesday April 13

With Easter getting closer, volumes are drying up.

Made a very small turn with FMG around that 21.20 level and RIOs a bit stronger.

Then CBA started nudging towards their day’s low, so picked up 1000 and walked away for a bit.

You can see why I did this from the screen shot. Sold them higher. See chart.

Up $410 so back in the black. Tomorrow will be slow!

Recap

Bought 1,000 FMG @ 21.21

Sold 1,000 FMG @ 21.26 ($50.00 profit)

Bought 1,000 CBA @ 106.20

Sold 1,000 CBA @ 106.56 ($360.00 profit)

Thursday April 14

Volumes low today.

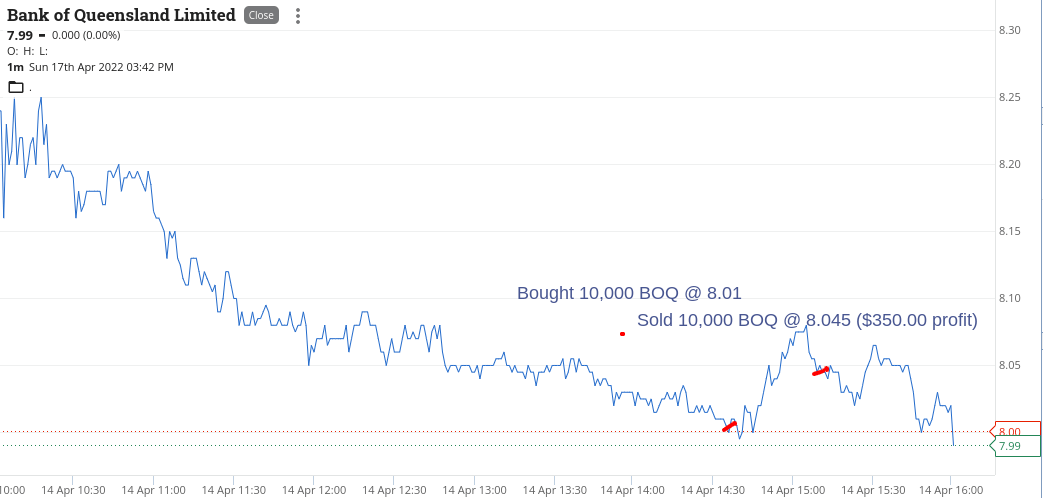

BOQ pops up as a big large cap faller today and hovers around the $8.00. Paid $1c above that as over 400,000 were on the bid there.

They actually got sold through it and then they bounced. I missed the top of the bounce – see chart – but for a one trade day very happy.

Up $350 for the day and after Monday’s loss, scrape through on a shortened week plus $490 gross or $235 net, which equates to over 200 Cadbury Creme eggs to hide around my garden!

Another short week next week and itching to see if I can beat this week’s effort.

Recap

Bought 10,000 BOQ @ 8.01

Sold 10,000 BOQ @ 8.045 ($350 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.