Confessions of a Day Trader: Up $2982 and awaaay, on… CBA?

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

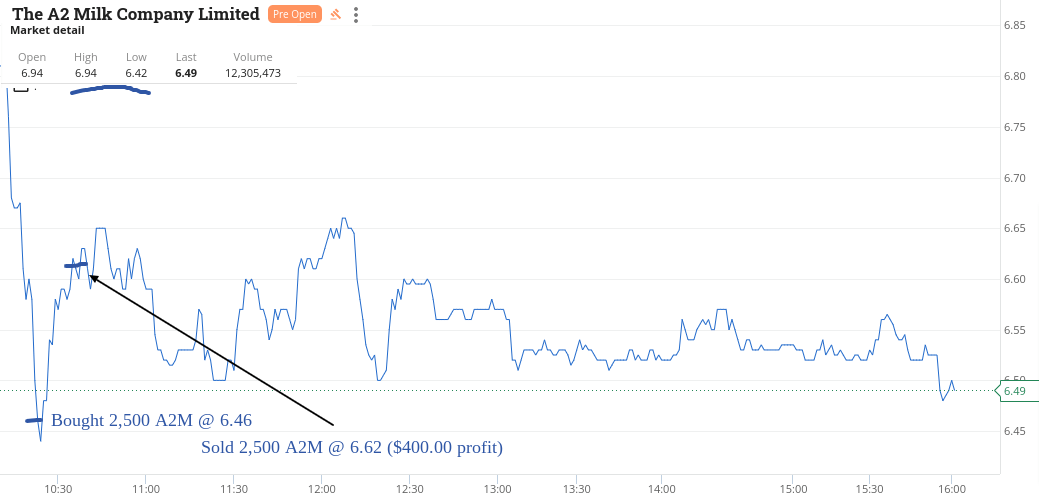

Monday Feb 20

A few results coming out today and some knee jerk reactions.

Thought better get in early and an old favourite A2M came good but in NHF and BSL, had to double down.

So, beginning to like this reporting period and the big falls it is creating.

News out, panic selling and then the thinking is, if you had shorted them, where would you start to cover them?

Up $860 and basically walked away for the rest of the day. Ignoring CBA and the other banks until we see a bit of a fall from Wall Street. USA shut down tonight so tomorrow will be interesting, with no lead.

Enjoyed today!

Recap

Bought 2,000 BSL @ 17.79

Bought 1,500 NHF @ 7.09

Bought 2,500 A2M @ 6.46

Sold 2,500 A2M @ 6.62 ($400 profit)

Bought 2,000 BSL @ 17.40

Sold 4,000 BSL @ 17.65 ($220 profit)

Bought 1,500 NHF @ 6.92

Sold 3,000 NHF @ 7.08 ($240 profit)

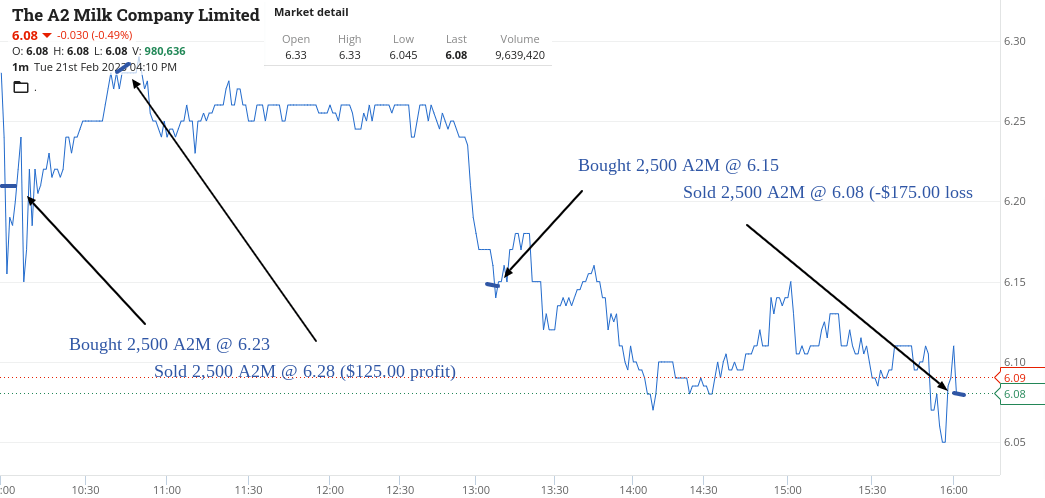

Tuesday Feb 21

BHP had their figures out and the headline was that div cut by 40%. Missed them fall and then recover, so got stuck into A2M again at $6.23, as they were above $7.00 a few days ago.

WDS below $34.00 looked OK and then finally closed my eyes and bt 1000 BHP at $47.50, which turned into a 12c turn, though they later reached above $48.00 so left a bit on the table.

Got back into A2M at $6.15 and rode them down with a $6.20 limit sell on them into the 4.10pm ruck and came out a bit bruised and battered.

So came in at plus $215 and now crying over a bit of spilt milk, into an icy cold beer but not enough to water it down though. Tomorrow will be better if Wall Street down.

Recap

Bought 2,500 A2M @ 6.23

Bought 1,000 WDS @ 33.95

Bought 1,000 BHP @ 47.50

Sold 1,000 WDS @ 34.09 ($145 profit)

Sold 2,500 A2M @ 6.28 ($125 profit)

Sold 1,000 BHP @ 47.62 ($120 profit)

Bought 2,500 A2M @ 6.15

Sold 2,500 A2M @ 6.08 ($175 loss)

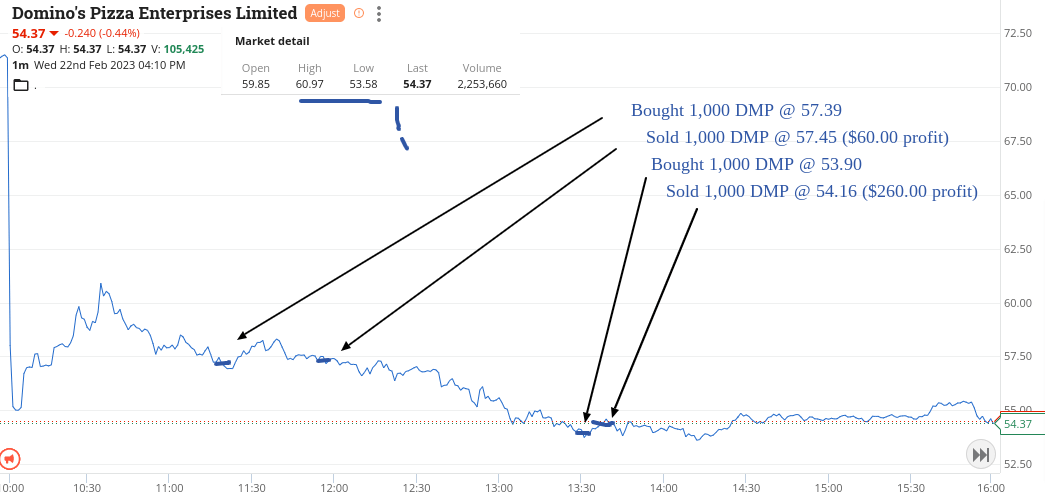

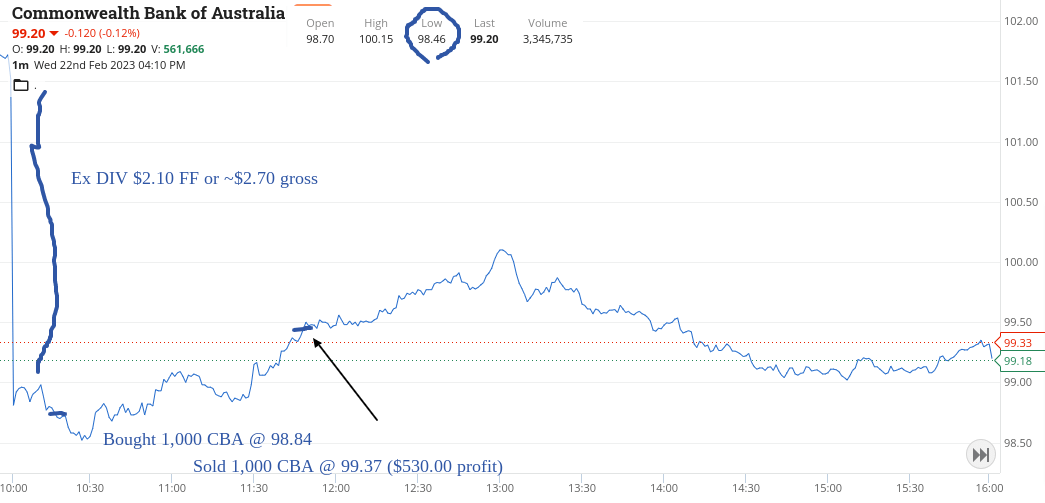

Wednesday Feb 22

Oh ye of little faith!

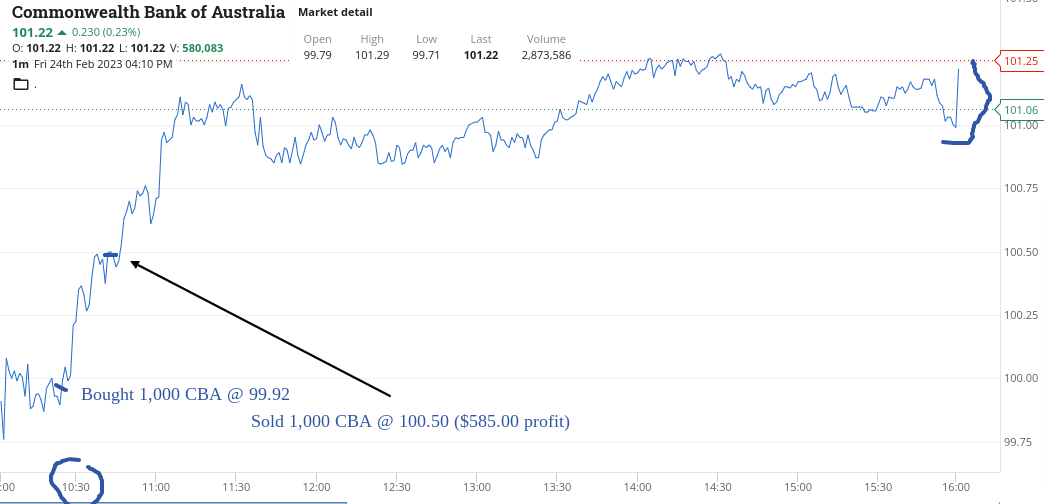

Look at what price I got some CBA at – $98.84! So not with a $99 on the front but a $98. You bloody ripper.

Well OK, they had gone ex div $2.10 fully franked but this is the sweet bit. Got back my loss from last week plus, which is like a quarter of their dividend paid and no capital tied up for a minimum of 45 days.

Then along came Dougie, the pizza delivery guy and delivered a cash pizza, not once but twice. Down from their $70 close to $57.39 which I basically cut as nice profits on the other two.

Then they basically came back even lower at $53.90 and delivered 20 x $13 pizza with the lot. Amazing to see a company fall so much. Almost down 25% at one point.

Up $1040, which I have to say is a supreme result… (sorry, just had to).

Recap

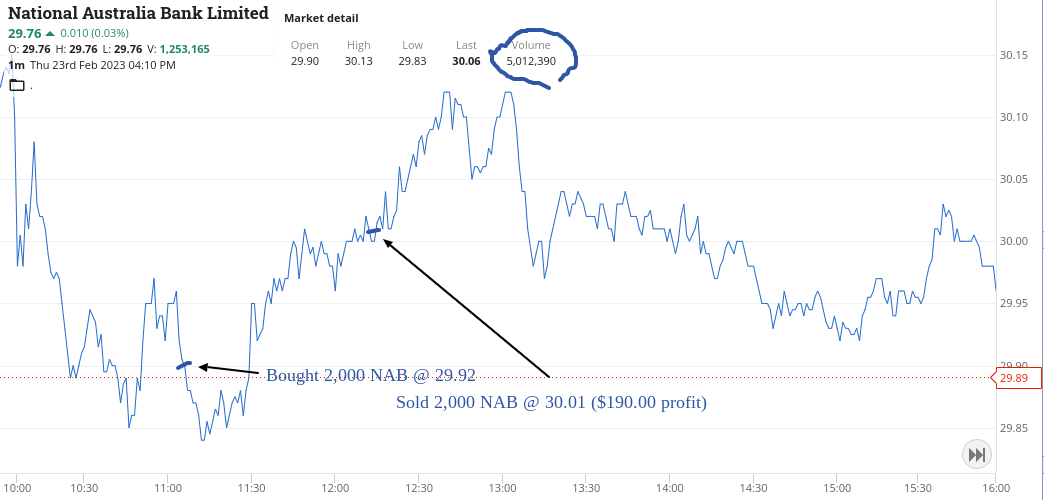

Bought 1,000 CBA @ 98.84

Bought 2,000 NAB @ 29.92

Bought 1,000 DMP @ 57.39

Sold 2,000 NAB @ 30.01 ($190 profit)

Sold 1,000 CBA @ 99.37 ($530 profit)

Sold 1,000 DMP @ 57.45 ($60 profit)

Bought 1,000 DMP @ 53.90

Sold 1,000 DMP @ 54.16 ($260 profit)

Thursday Feb 23

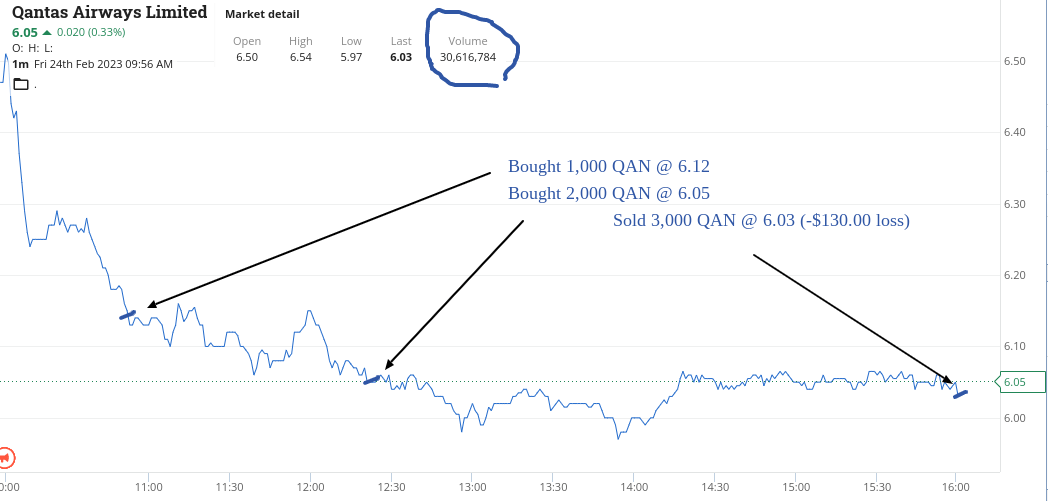

Started off in RIo today as they were down $4 or so from yesterday, though won’t be flying back with Qantas as they left me with a minus ticket on the close today.

BHP below $47 twice today. They were down in NY trading about 2% and here they were down 3.4%.

Didn’t touch CBA, even if they did trade below $100. My gut tells me they are going lower as I think we will see some falls in markets around the world soon.

$95 coming up? We shall see.

Plus $475.

Recap

Bought 1,000 RIO @ 121.69

Sold 1,000 RIO @ 121.94 ($245 profit)

Bought 1,000 BHP @ 46.96

Sold 1,000 BHP @ 47.17 ($210 profit)

Bought 1,000 QAN @ 6.12

Bought 1,000 BHP @ 46.56

Sold 1,000 BHP @ 46.71 ($150 profit)

Bought 2,000 QAN @ 6.05

Sold 3,000 QAN @ 6.03 ($130 loss)

TGIF Feb 24

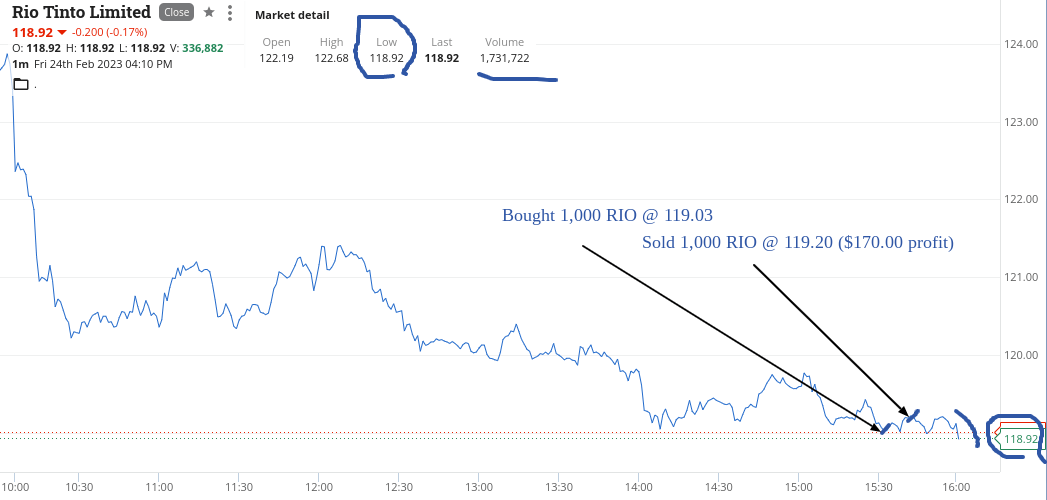

CBA below $100 and RIOs nudging $119.03, as again they were marked down in NY trading.

The range in RIOs was closed Thursday at $124. Opened at $122.19, high $122.68 and closed on its low of $118.92 and all on a volume of 1.7m shares.

I only got involved with them as I was walking into the pub for a beer and it was 3.30pm and I saw a change. On my second schooner they were gone.

As I had a good result in CBA, I basically didn’t really pay much attention to anything else all day but I could see a special in RIOs.

Finish the week up $3,345 gross or $2,982 net and this week up $1,115 on CBA which more than makes up for my losses on them from last week. Works out at about 50% of their dividend on holding 1000 shares but without any capital tied up.

Magical stuff.

Recap

Bought 1,000 CBA @ 99.92

Sold 1,000 CBA @ 100.50 ($585 profit)

Bought 1,000 RIO @ 119.03

Sold 1,000 RIO @ 119.20 ($170 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.