Confessions of a Day Trader: Trust in FMG and keep your powder dry

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

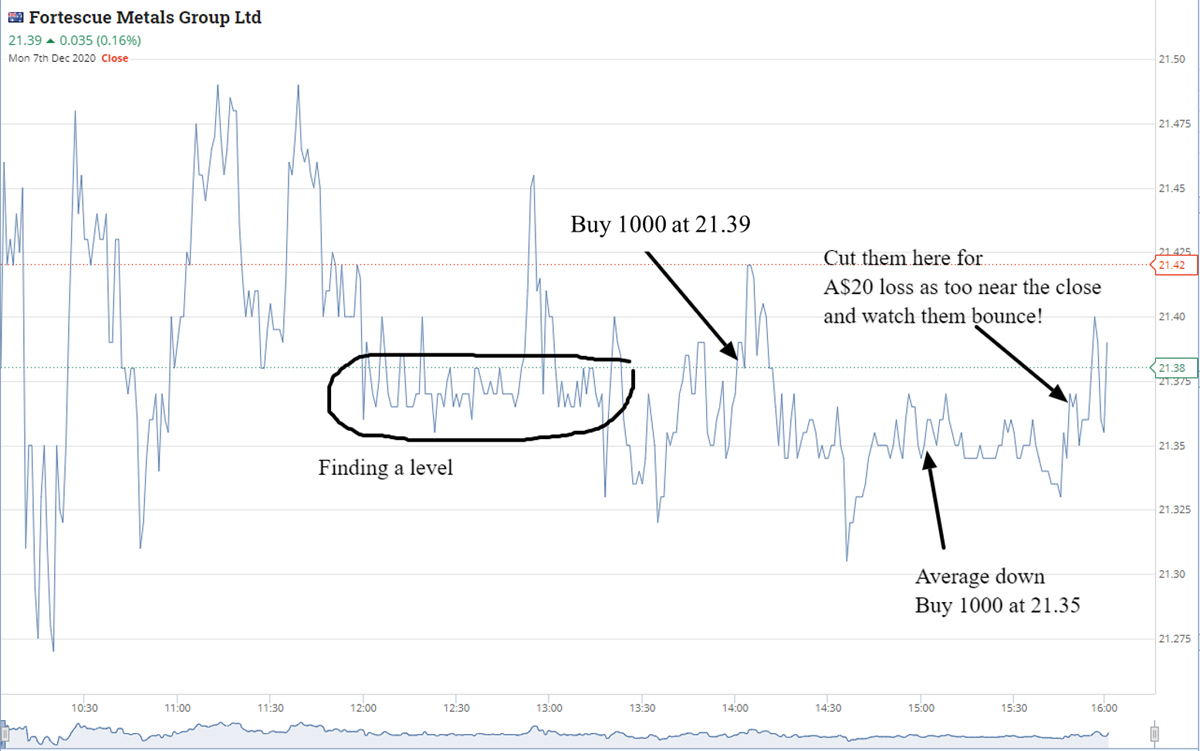

Monday December 7

Watch as FMG come out the traps and open bang on 21.00 as iron ore seems to keep going up in price. If you see the graph, the first hour looks like a shorter’s heart beat.

Can’t find any real levels in anything until lunch time. Buy 2000 Z1P at 5.56.

Time is 1.30pm. Buy 1000 FMG at 21.39 knowing that may see a 2c loss before going higher.

Time is 2.11pm and Z1P are 5.52. Average down on FMG at 21.35, so now long 2000 at 21.37 average. Forced to also average the Z1P, so buy another 2000 at 5.50. Average is now 5.53.

At one point I am down $120 on Z1P and its only in last 3 mins do they bounce and I’m out for a $80 profit. Take that and cut FMG as too near the 4pm clock. Overall up $60 for the day, having been down $170 at one point.

+1000 FMG at 21.39; +1000 FMG at 21.35 -2000 FMG at 21.36; Loss $20 (settling in a narrow band today)

+2000 Z1P at 5.56 +2000 Z1P at 5.50; -4000 Z1P at 5.55; Profit $80 (5.55 becomes my new ‘lucky level’)

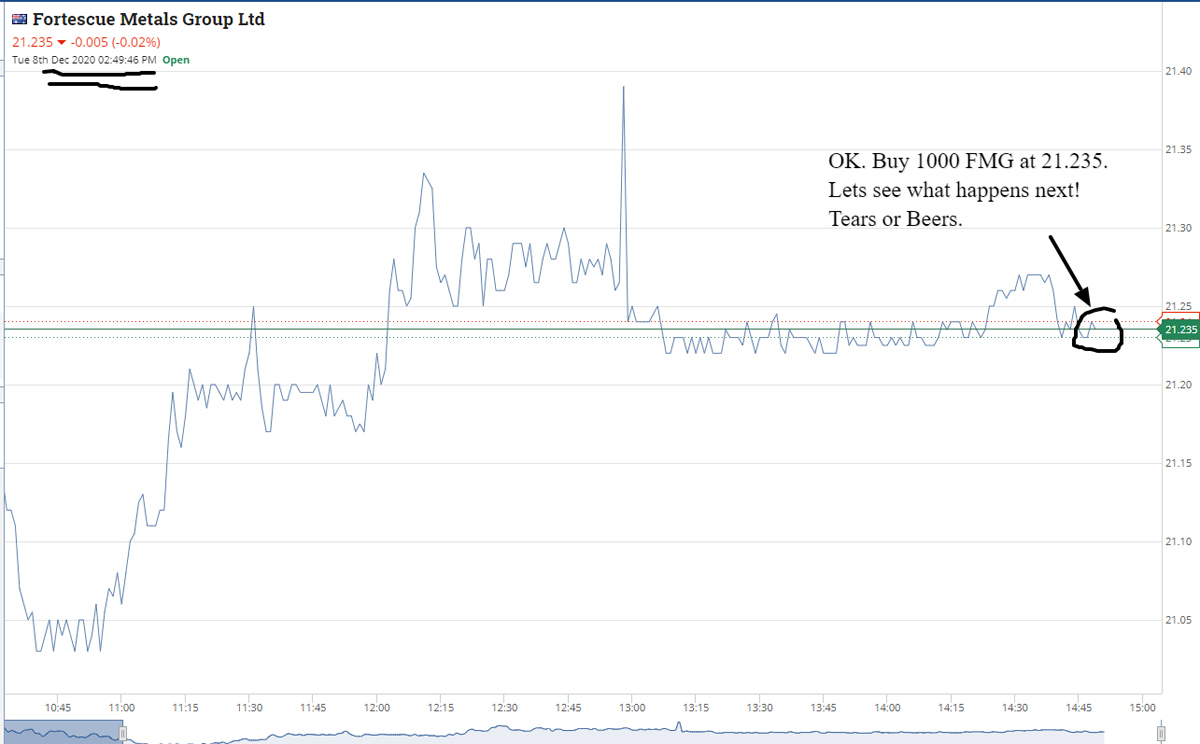

Tuesday December 8

Have to go to the RTA so leave a cheeky bid in the market for 1000 Z1P at 5.25. Come home and see I’ve been filled.

See that NST are looking good, 12.90, so buy 1000 as I think they could head to 13.00 again. 30 mins later, adjust my limit sell from 13.03 down to 12.98 and I’m gone.

Gold shares move differently to things like APT or Z1P. Z1P hit 5.30 and I’m out. FMG are just in a 2c band for about an hour and a half. Buy 1000 at 21.235 and wait. Could go either way.

For once, something goes my way and at the price of 21.34 I book in a nice $105 profit. I wish all days were like this.

A nice $235 profit for the day, half car rego paid off!

+1000 NST at 12.90; -1000 NST at 12.98; Profit $80 (could feel this trade in my waters!)

+1000 FMG at 21.235; -1000 FMG at 21.34; Profit $105 (could have gone either way – Beers or Tears)

+1000 Z1P at 5.25 -1000 Z1P at 5.30; Profit $50 (got some good luck, for a change)

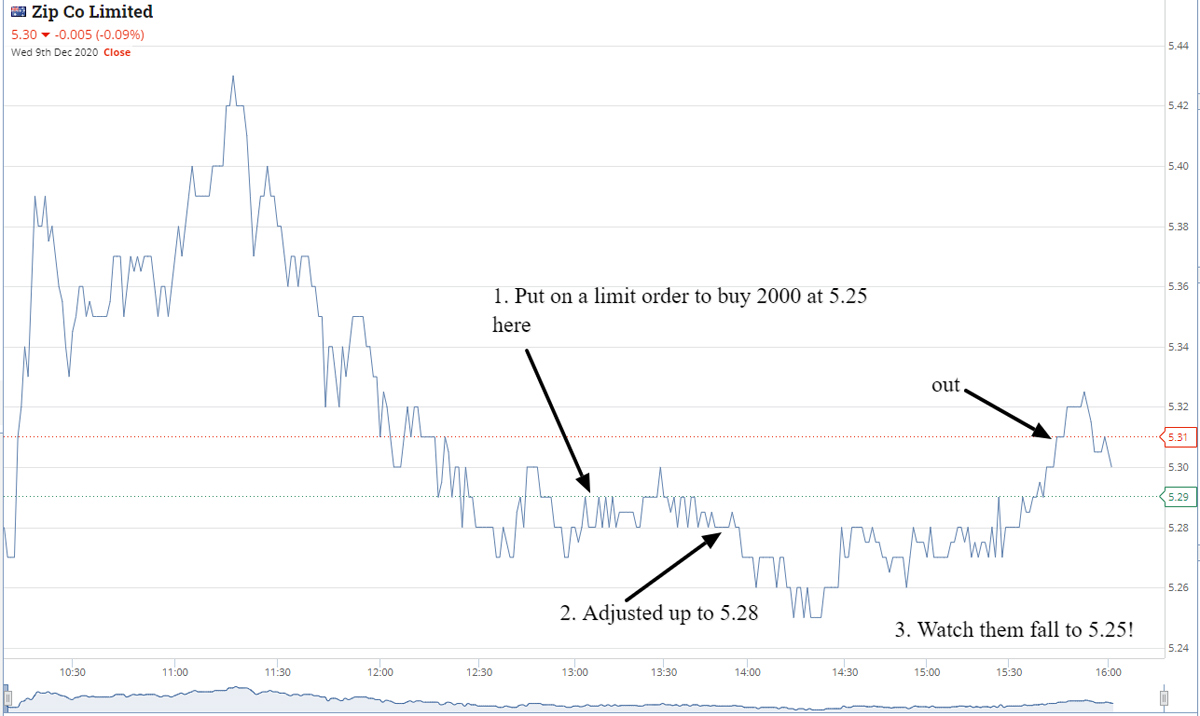

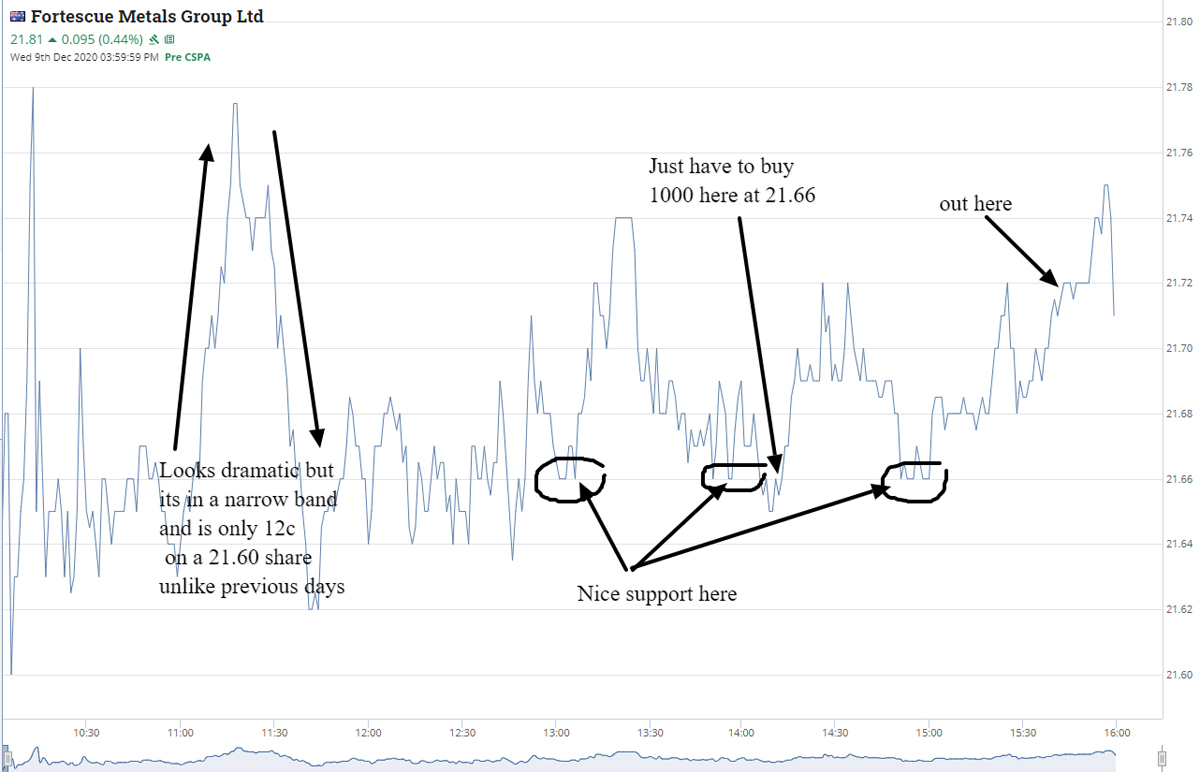

Wednesday December 9

Nothing happening too dramatic around the opening and leave everything alone till lunch time. My theory on Z1P being sold down vs APT is because escrow stock is coming out. So waiting for the day it bounces strongly. Until then, just trying to pick a low which has been 5.25 for two days in a row. So happy to double up whilst all of this goes on.

Have a limit order at 5.25 which after watching adjust it to 5.28 and then watch it fall to 5.25 and then bounce back to 5.28. Should have stuck to my guns as I had to wait for 1.5 hours to make $60 instead of maybe an hour.

Just had to buy some FMG at 21.66 up from my previous ‘lucky level’ of 16.66.

Out at 21.72 on a round trip of 1000 shares. Total for the day +$120 profit.

+2000 Z1P at 5.28; -2000 Z1P at 5.31; Profit $60

+1000 FMG at 21.66; -1000 FMG at 21.72; Profit $60

Thursday December 10

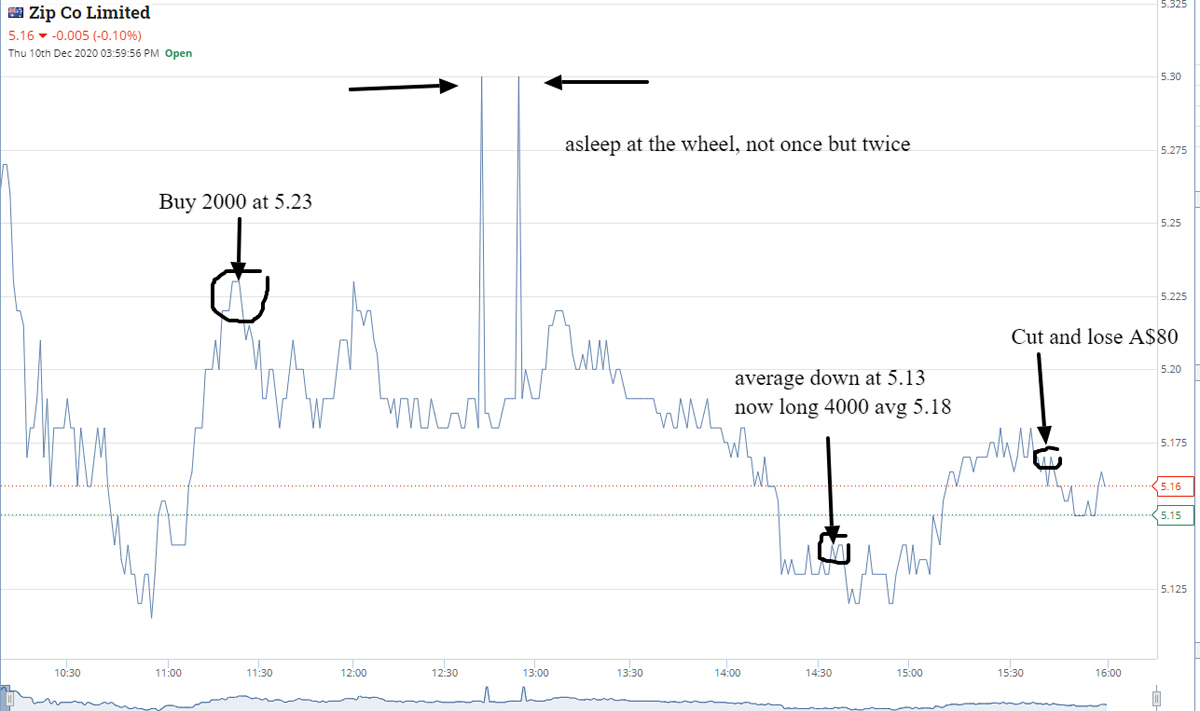

Today I made $7.00 before taking out brokerage! First trade on JIN made $100 and then it was like a rollercoaster ride. At one point I was down $332 at 2.41pm.

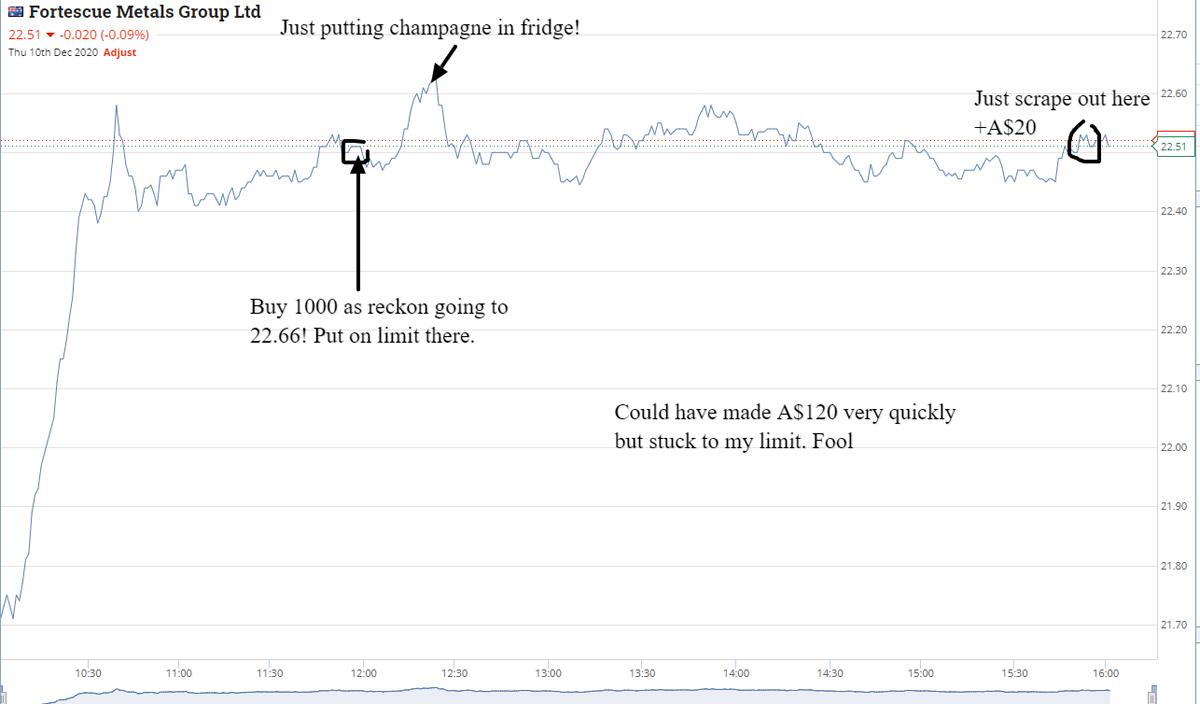

See the Z1P chart for two spikes that I missed and ended up down $80 but that is not the worst bit. I bought 1000 FMG at 22.51 and put on a cheeky limit sell at 22.66 (as a lucky number trade). They got to 22.63 very quickly but I stuck to my guns and that was it. Never got up again and I ended up $20 on them for the day.

So just scrape by for a long neck on special. 11 trades for $7 gross profit. Shaking my head as I write!

+100 APT at 96.51; -100 APT at 96.18; Loss $33 (will need AfterPay at this rate)

+1000 JIN at 13.02; -1000 JIN at 13.12; Profit $100

+1000 JIN at 12.91; -1000 JIN at 12.91; ZERO

+2000 Z1P at 5.23; +2000 Z1P at 5.13; -4000 Z1P at 5.16; Loss $80

+1000 FMG at 22.51; -1000 FMG at 22.53; Profit $20 (was up $120 but thought 22.66 would be the level. Er, no!)

Friday December 11

Iron ore up again overnight so I reckon FMG will nudge 23.00 today. Buy 1000 at 22.91 and put on a limit sell at 23.02 and everything goes to plan, unlike yesterday’s $7 effort. Buy at 11.07am and out at 12.36pm for a healthy bank balance booster of $110.

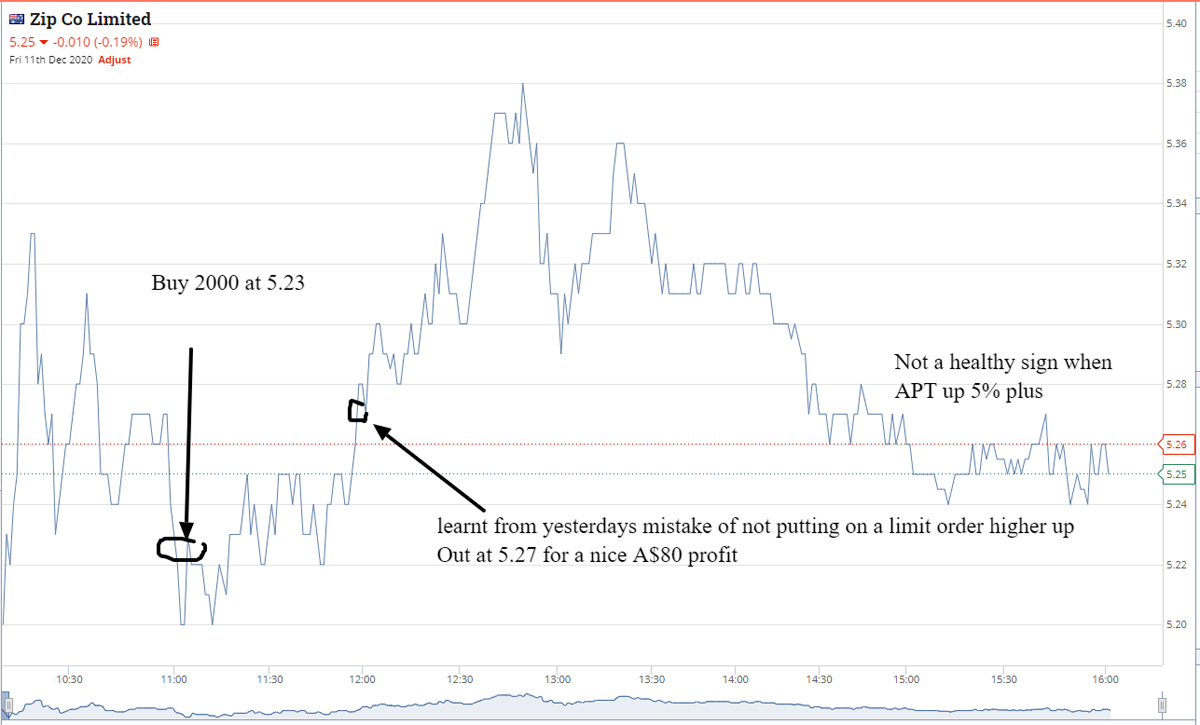

Buy 2000 Z1P at 5.23 and also put on a limit higher up and get taken out at 12.01pm at 5.27 and watch them go to 5.32 straight after. At least today I have a limit order in.

All up plus $190 for the day and on four trades unlike 11 from yesterday’s effort. All that energy and stress and today very relaxed.

Think I need a two-day break.

+1000 FMG at 22.91; -1000 FMG at 23.02; Profit $110 (never ever give up!)

+2000 Z1P at 5.23; -1000 Z1P at 5.27; Profit $80

Best Trade: FMG Friday +$110

Worst trade: The whole of Wednesday +A$7

For week: +$612 gross

Brokerage: $150

Rolling tally: $2476.60 after six weeks

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.