Confessions of a Day Trader: Time to collect a check (up) from Dr Copper!

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Please Note: I am expecting the bubble to burst on these tech stock valuations in 2021 and see Afterpay (ASX:APT) below 60.00 and ZIP (ASX:Z1P) at 2.75 at some point. Don’t know when (late Feb, early March maybe?) but hope it is not whilst a trading session is on and I get caught.

Coming in every morning with cash and a blank canvas to paint money with keeps for good night sleeps. Doubling up on the size of usual trades will hurt me at some point but I think worth the risk until I injure my profit bank, lick my wounds and regroup.

GLTYA in 2021.

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 11

Don’t look at anything until 12.30pm, so I can see where things are settling down. APT has a tumble from the open, so buy 200 at 112.89 and sell them at 113.10 10 mins later. My selling sets them off into a major rally.

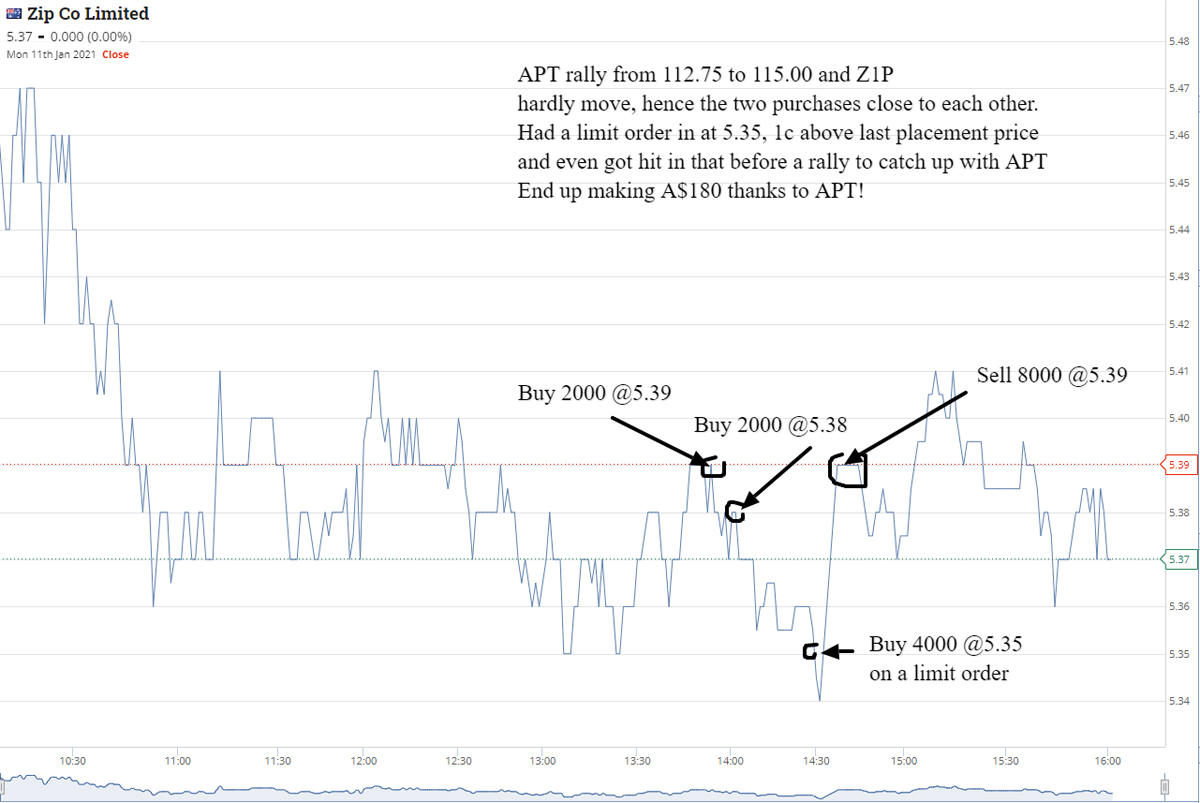

Eyeing up Z1P as APT rally and they are hardly moving, so I buy 2000 at 2pm. Price paid 5.39. Still they don’t move so buy another 2000 at 5.38 out of frustration 10 mins later. Leave in a limit to buy 4000 at 5.35 and think surely that won’t get hit. But it does and I think FFS, I cant be that stupid. Bang, they eventually spark up and I adjust a limit order to sell from 5.42 down to 5.39 and book A$180 profit and think who’s the stupid one now!

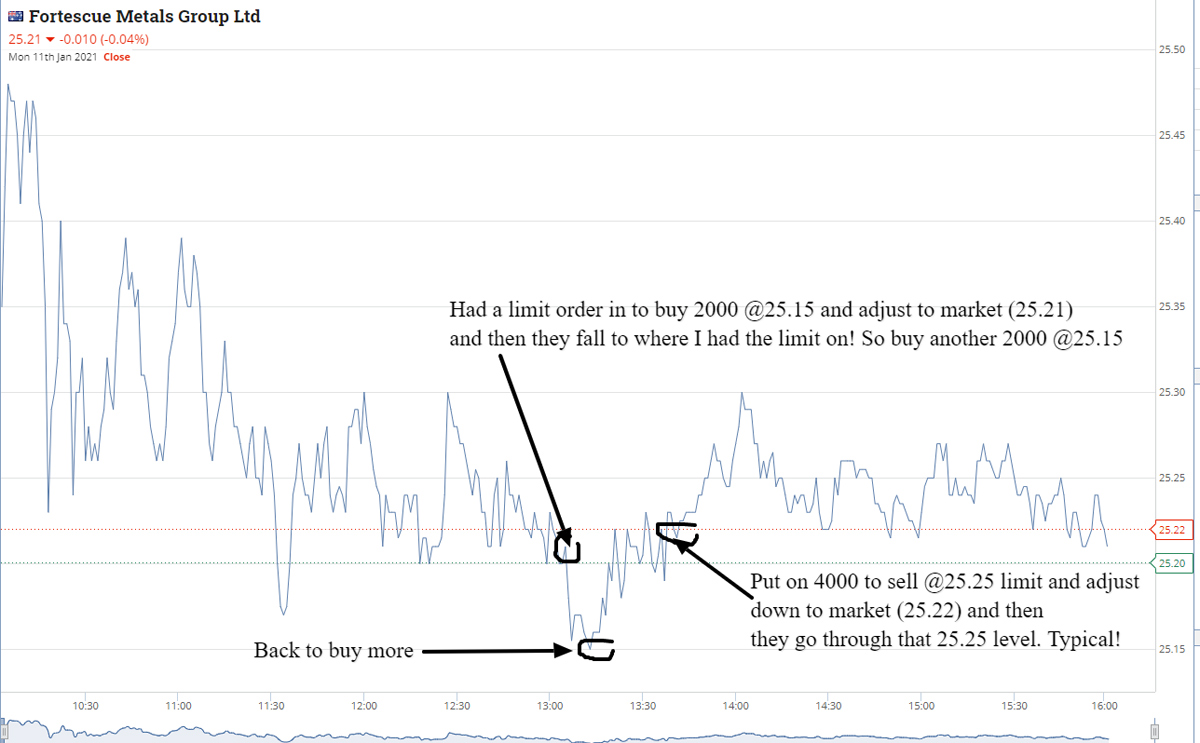

I also traded in NCM and my favourite one, the now $77bn FMG. Total for day is +$462 profit.

+2000 NCM at 26.18, -2000 NCM at 26.22, Profit $80 (looked oversold @ down 4%)

+2000 FMG at 25.21, +2000 FMG at 25.15, -2000 FMG at 25.22, Profit $160

+200 APT at 112.89, -200 APT at 113.10, Profit $42

+2000 Z1P at 5.39, +2000 Z1P at 5.38, +4000 Z1P at 5.35, -8000 Z1P at 5.39, Profit $180

Tuesday January 12

Let everything settle down and don’t take a look or open my app even until about 11.30am. Was up at 4.30am trading some Bitcoin and made 5% on their wild swings.

Have a look around and buy 2000 FMG at 24.98 and put on a limit sell at 25.04. Then buy 400 APT at 112.86 and put on a limit sell at 113.03. Both limits are taken at almost the same time.

Read about copper and CCZ’s copper find. Buy 100,000 at 6.6c and watch and sell them as they hit 6.8c. That’s $200 profit and a rare penny stock move by me.

At 11.54, I’m back into APT at 112.50 and put them on a limit higher up. Also put in a limit buy for another 400 at 112 even. After much hovering around 112.03, I finally get hit and watch them fall to 111.85. Can’t bear to keep watching so walk away and take a quick nap.

Wake up to find them back around 112.00 and then they start climbing and I watch as eventually I’m taken out of 800 at 113.39. Turn $300 loss into $114 profit. All up plus $506 for the day. APT still feels nervous in its trading ranges to me.

+100,000 CCZ at 6.6c, -100,000 CCZ at 6.8c, Profit $200 (a rare stray away trade for me)

+2000 FMG at 24.98, -2000 FMG at 25.04, Profit $114

+400 APT at 112.86, -400 APT at 113.03, Profit $72

+400 at 112.50, +400 at 112.00, -800 APT at 113.39, Profit A$114

Wednesday January 13

Not too much going on today and having a look around to see how things are travelling at around 11.00ish I notice that JIN are down below their 15.00 opening by 50c or so. Buy 2000 at 14.38 and four mins later another 2000 at 14.38.

When they do move upwards I was too slow to lock in a decent profit, selling all 4000 at 14.43. Leave in a limit order for 2000 at 14.30 and get hit at 12.00pm. Watch them bounce and sell 2000 at 14.38, for a $120 profit.

+2000 JIN at 14.48, +2000 JIN at 14.38, +2000 JIN at 14.30, -4000 JIN at 14.43, -2000 JIN at 14.36, Profit A$130

Thursday January 14

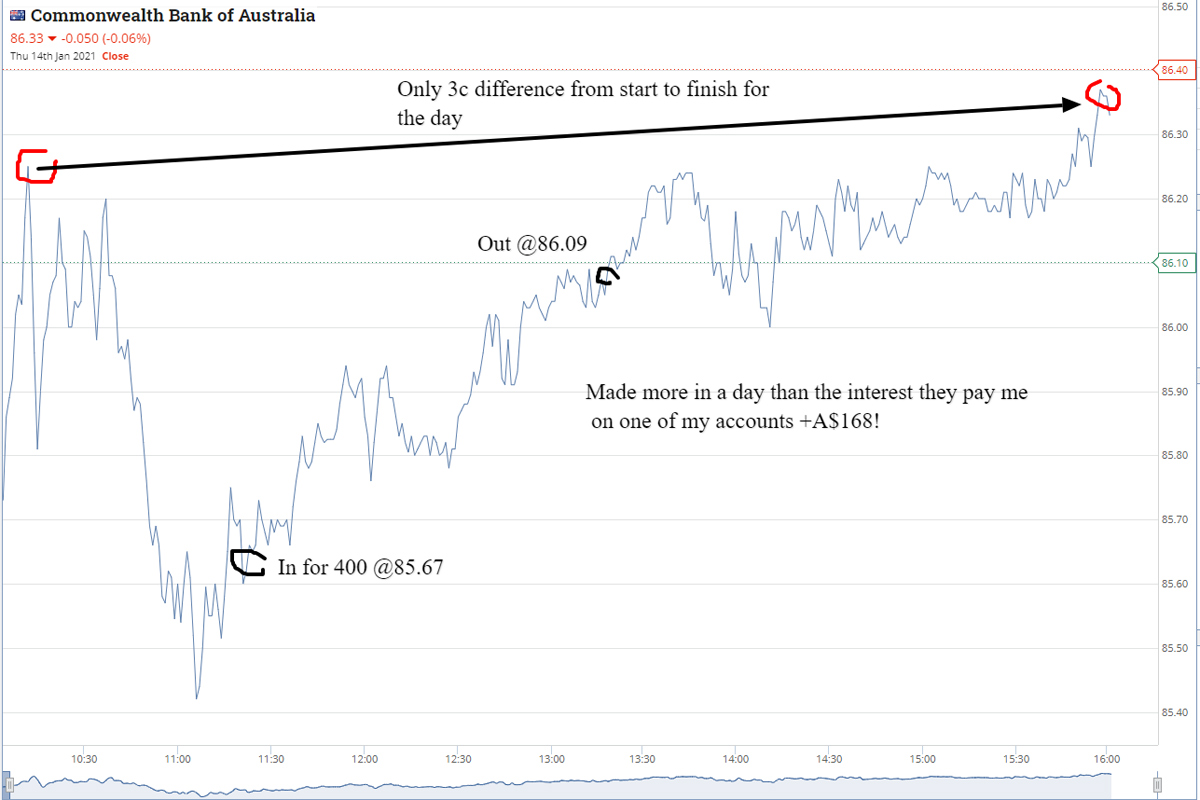

Go a bit off piste and have a go at day trading CBA as having looked at them for the last few days to see how they day range. Buy 400 at 85.67. Time 11.20. Put them on a limit above 86.00 and watch and wait.

Eventually make $168, when taken out at 86.09, about two hours later. Also been watching TYR, as they have been having some technical issues with their EFTPOS terminals. Fallen from above 3.00 in the past few days. Buy 1000 at 2.61 and sell them 2.66 on a limit.

In between all of this bt 2000 FMG at 24.72 and sold them at 24.79. Overall up $358 for the day.

+400 CBA at 85.67, -400 CBA at 86.09, Profit $168 (more than the interest they pay me)

+1000 TYR at 2.61, -1000 TYR at 2.66, Profit $50 (thought would go higher)

+2000 FMG at 24.72, -2000 FMG at 24.79, Profit $140

Friday January 15

APT are up out of the starting blocks and because Z1P starts with a Z, it doesn’t open till 9 mins later. Buy 4000 on the open at 5.80 and sell them at 5.85 for a quick $200 profit at 10.11am. Nice.

APT keep going and I don’t really look at anything until after lunch. Buy 4000 Z1P at 5.58.

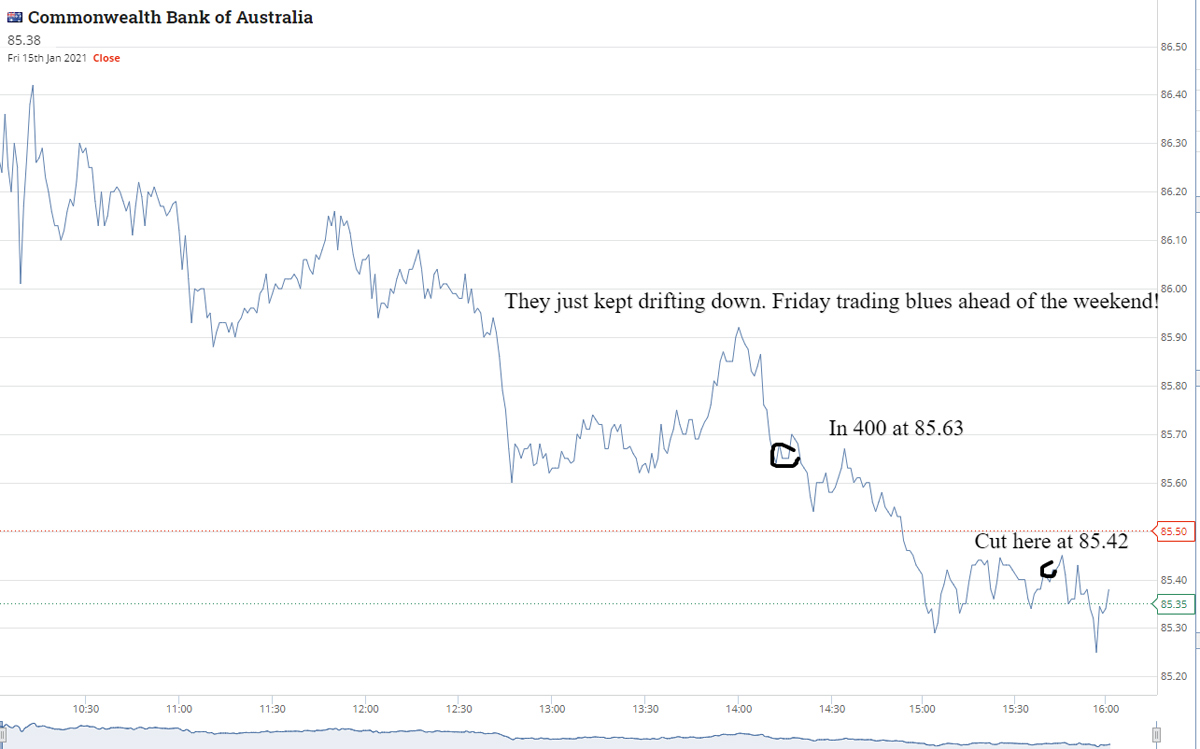

Time 2.03pm. Buy 400 CBA at 85.63. Time 2.17pm. Sell the Z1P at 5.62 to make $160 but CBA I have to cut just before the close at 85.42, to book a loss of $84.

Mmm, CBA worked yesterday but not today. Overall up $276.

+400 CBA at 85.63, -400 CBA at 85.42, Loss $84

+4000 Z1P at 5.80, +4000 Z1P at 5.58, -4000 Z1P at 5.85, -4000 Z1P at 5.62, Profit $360

Gross profit for week: $1732

Less brokerage: $189

Net profit: +$1643

Most satisfying trade: CBA +$168

Least satisfying: CBA -$84

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.