Confessions of a Day Trader: This time it’s war

Pic: Getty

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday February 22

Had a cracker of a day today, as the reporting season continues to have some volatility on some companies’ share price.

ALU was outstanding for me today, as it threw up two opportunities to have a go at them, post results.

At one point they were the biggest major faller, as was SUL.

After my second go at ALU, I just closed out the SUL and walked away.

My concern is if Russia invades during trading hours, I will be caught with my pants down or we get some inflation news shock.

Let’s hope that today’s profit of $1685 will help cushion any blows which may come my way.

Recap

Bought 1,500 ALU @ 31.24

Sold 1,500 ALU @ 31.35 ($165.00 profit)

Bought 2,500 SUL @ 11.53

Bought 1,500 ALU @ 31.17

Sold 1,500 ALU @ 32.10 ($1,395.00 profit)

Sold 2,500 SUL @ 11.58 ($125.00 profit)

Tuesday February 23

US market was closed overnight and European markets were mostly down about 2%, so gives an indication of where we are heading today, plus Russia is still playing their games.

Gold was firming a bit, so when CHN popped up as a big faller, just had to have a go. Picked up 5000 at $6.70 and put them on a 5c limit higher up and waited.

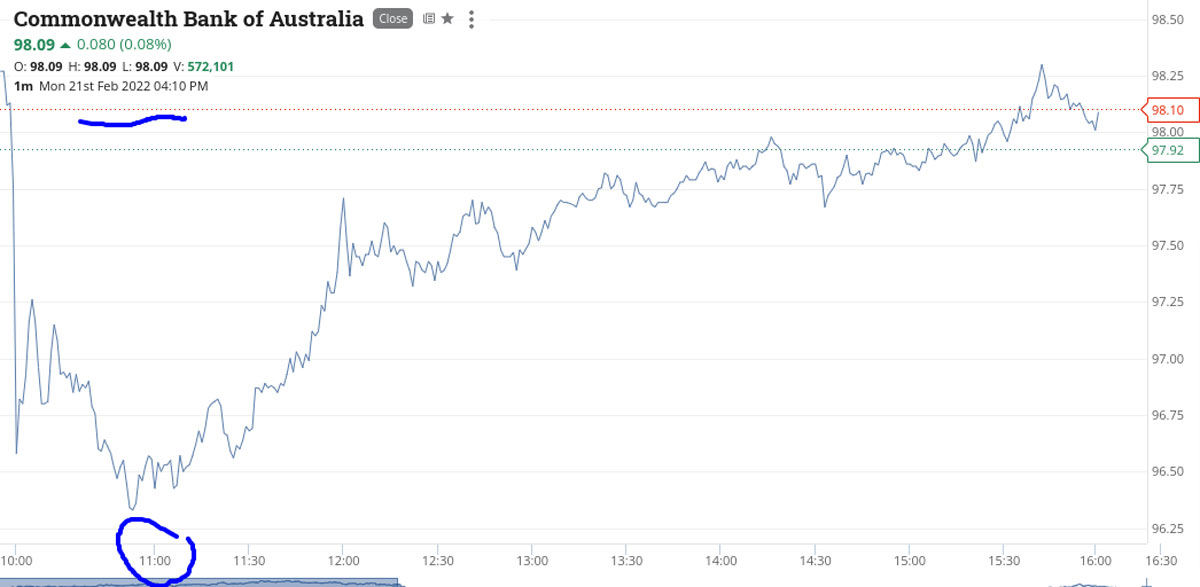

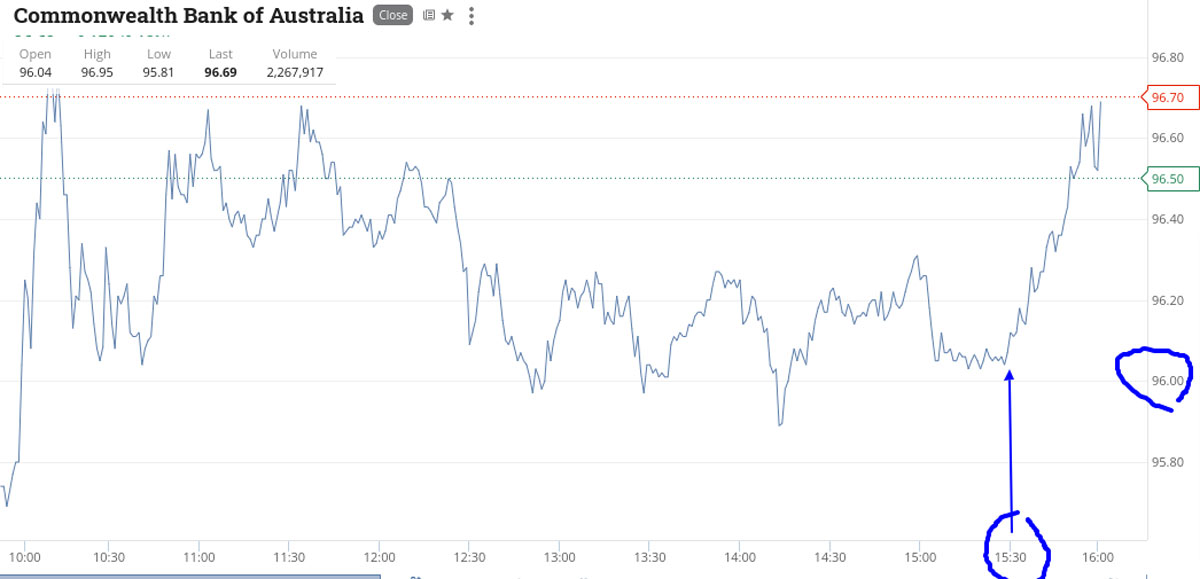

They go through the $6.75 level plus a tad more and then fall back. CBA then go below $96 and thinking they could go either way, bt some at $95.72 and again put them on a limit. Again, went through and took me out and if you look at the chart, they actually later go down to $95.05.

Finish up $380, which surprises me a bit as thought today could be a loss day. Lots of volatility and whole watch screen is in red for 90% of the day. I think tomorrow could be an up day for the market. Let’s see.

Recap

Bought 5,000 CHN @ 6.70

Sold 5,000 CHN @ 6.75 ($250.00 profit)

Bought 1,000 CBA @ 95.72

Sold 1,000 CBA @ 95.85 ($130.00 profit)

Wednesday February 24

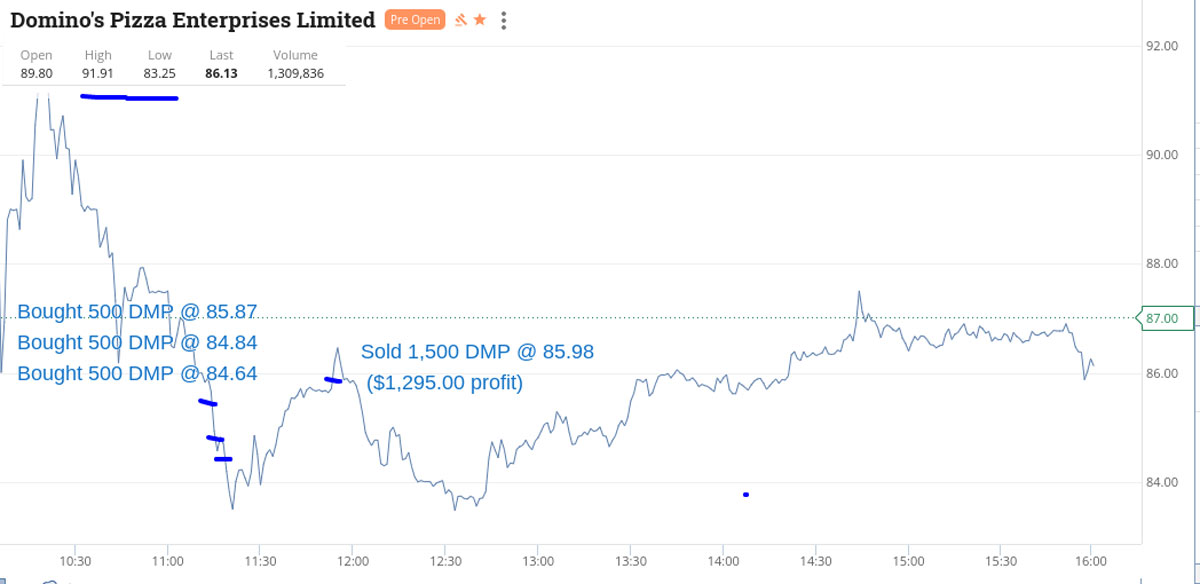

Got a wild ride out of DMP today. They managed to have a $10 trading range and were down ~15% at one point.

On the first purchase of 500 shares, at one point I was down $1,600, so I thought I need to double down. In my error, I bt another 500 but it should have been 1000, so when I bt the last parcel 20c cheaper, it was only 1 min later.

That’s how fast they were moving. Put them on a limit 2c below $86.00 and waited. Finally got there and carried on going helping me make almost $1.00 per share.

NAB was the only one on my watchlist that was hanging around a trading level, which happened to be $30.00. Bt them on a dip and they just kept hovering around that $30.00 level and I got out towards the end of the day.

I didn’t want to hang around till 4.00pm. Plus $1,670 for the day which is a lot of pizza pie.

Recap

Bought 2,500 NAB @ 29.91

Bought 500 DMP @ 85.87

Bought 500 DMP @ 84.84

Bought 500 DMP @ 84.64

Sold 2,500 NAB @ 30.06 ($375.00 profit)

Sold 1,500 DMP @ 85.98 ($1,295.00 profit)

Thursday February 24

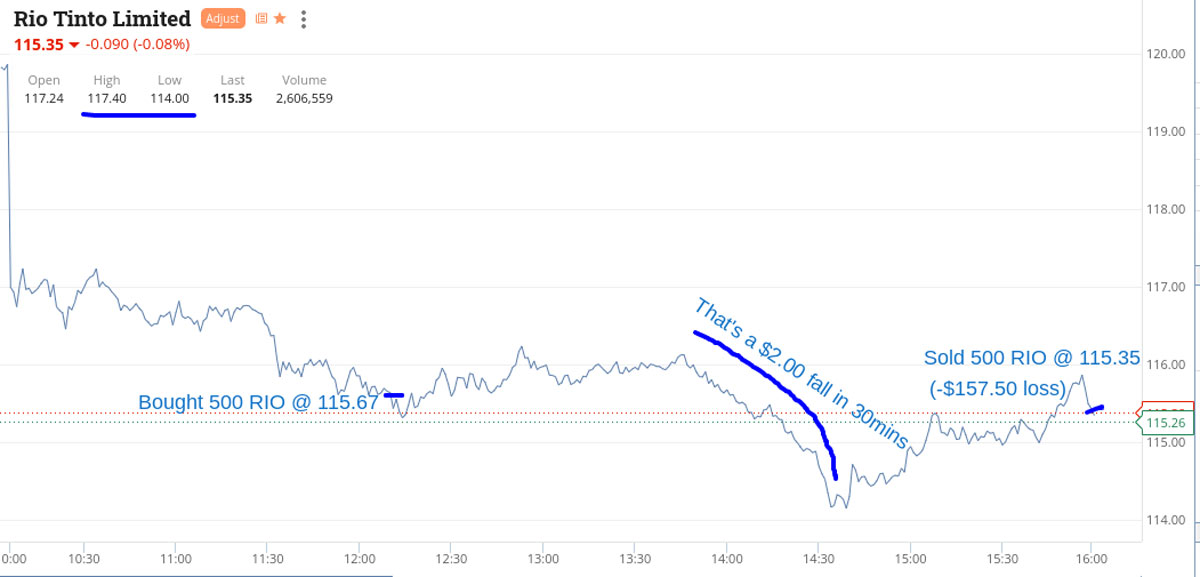

Well today was the day when I got caught out. We all knew it would happen sometime soon and today was the day.

Manage to lose $730 in BHP and RIO.

BHP was down 6% or so and on big volume so had a punt and RIOs broke below the $116.00 level.

Was very cautious in both and decided to wait until the end of the day to sell them.

Also did not double down or anything like that.

Was down over $2000 in total over both positions at one point and all I could do is watch and wait, as I was now in the hands of the trading God and the end result was not too bad with all things considered. Live to fight another day!

Recap

Bought 1,000 BHP @ 45.34

Bought 500 RIO @ 115.67

Sold 1,000 BHP @ 44.77 (-$570.00 loss)

Sold 500 RIO @ 115.35 (-$160 loss)

Friday February 25

Leave everything alone today, as a Friday and so much going on which is creating the volatility but not interested with a weekend coming up and a war being raged.

End the week plus $3005 gross and $2775 net. Hopefully there will be clarity on Monday with a bit more direction.

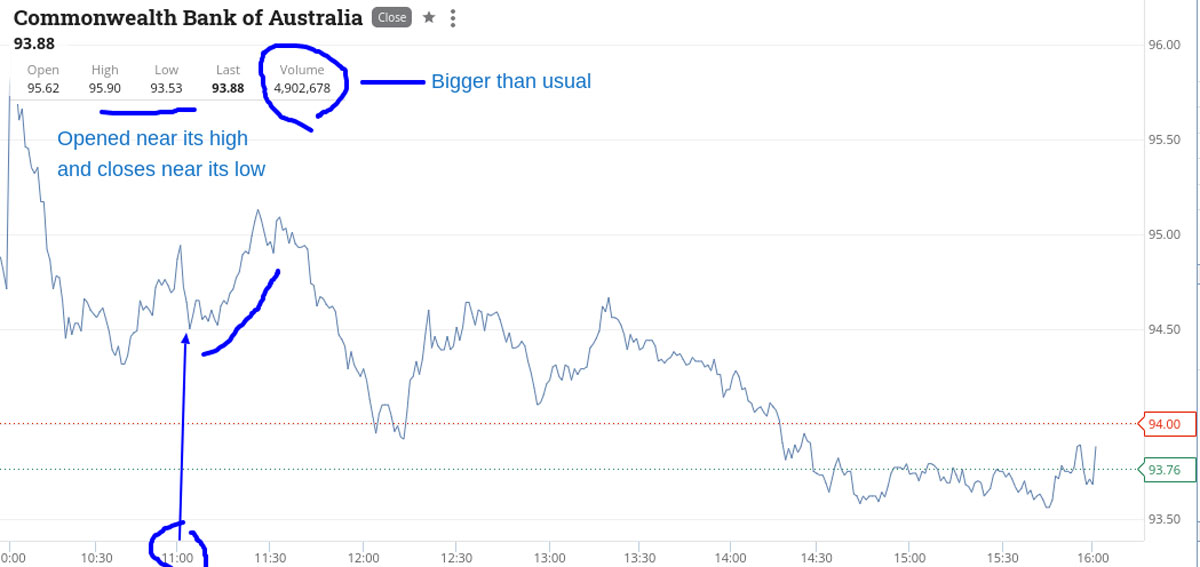

Have added some charts from today from some of our favourite plays.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.