Confessions of a Day Trader: Think and you’ll miss it!

Pic: d3sign / Moment via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday May 17

Only one in RED on the watch list at 10.45am is BHP. Buy 1000 at 49.32 just before 11.00am. Sell them at 49.54 (see graph).

FMG make the same 11am movement but missed it as on to BHP. Make A$220. Always amazed and grateful.

Later make another A$70. Back in at 49.32 and out at 49.39 in 1000.

Z1P give me my lunch money on a 2c turn below 7.00, where they seem to have support. APT hovering around 86.00. Have a limit in at 85.77 which gets hit and out at 86.06. Later have a limit in at 84.87 which gets hit.

Have to go to the Telstra shop to sort out my phone which takes two hours. Figure will be either doubling down or taking a profit when I get phone fixed. Blow me down back above 86.00 and hit sell button as soon as leave shop. Lock in A$397.

Total for day A$799. Not many people would ever say this, but thank you Telstra!

+1000 BHP at 49.32; -1000 at 49.54;; +1000 at 49.32; -1000 at 49.37; Profit A$290

+2000 Z1P at 6.90; -2000 Z1P at 6.92; Profit A$40

+250 APT at 85.77; -250 at 86.06; +250 at 84.87; -250 at 86.46; Profit A$469 (Adding Telstra to watch list!)

Tuesday May 18

Sit down at around 10.15am and open laptop. Am dressed but not showered as had to do an early drop off. CBA in paper suggesting could break the magical 100.00 level soon.

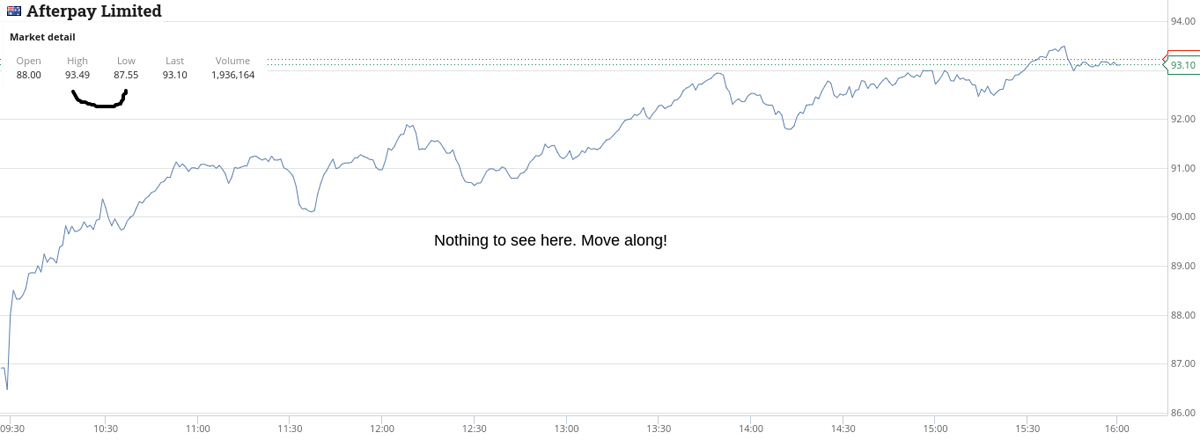

Jump in shower and aim to be out and ready for 11am trading booty call. See APT chart to see what I missed whilst preening! OMG.

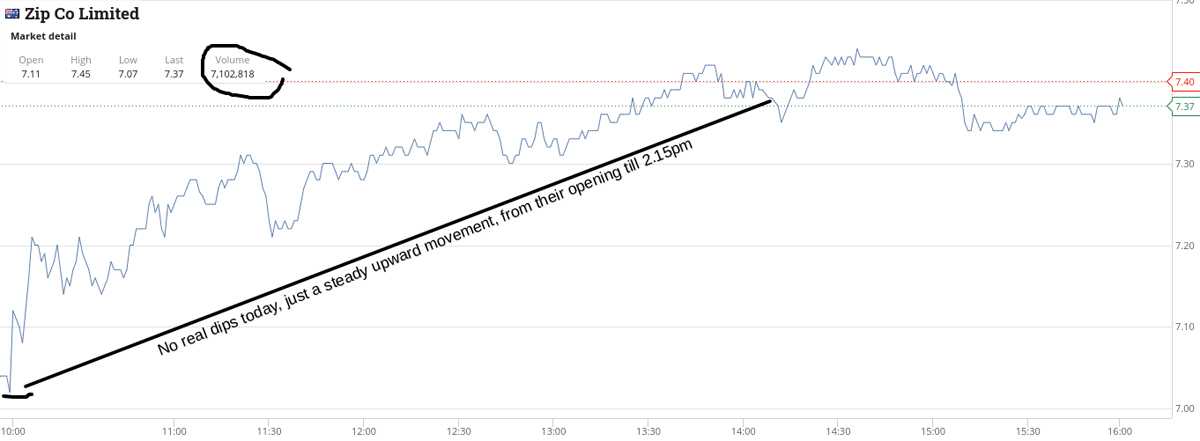

But not phased too much. Managed to make A$80 on Z1P instead.

Bought 1000 CBA at 98.26 and sold them at 98.41. Back in at 98.12 and out at 98.21.

Then it all goes a bit pear-shaped, as the ego kicks in and I decide that CBA will close at or above 98.00. An ego trade comes along every so often and leads to a sign of weakness. You break the rules and get what you deserve.

Make A$285 and lose A$230 which serves me right. Overall, up A$135 for the day. Mmmmm.

+2000 Z1P at 7.01; -2000 at 7.05; Profit A$80 (Takes a long time to book a 4c profit)

+1000 CBA at 98.26; -1000 at 98.41; +1500 at 98.12; -1500 at 98.21; +1000 at 97.91; +1000 at 97.84; -2000 at 97.76; Profit A$55 (My ego decides to come out and I let it dictate a trade instead of fighting it.)

Wednesday May 19

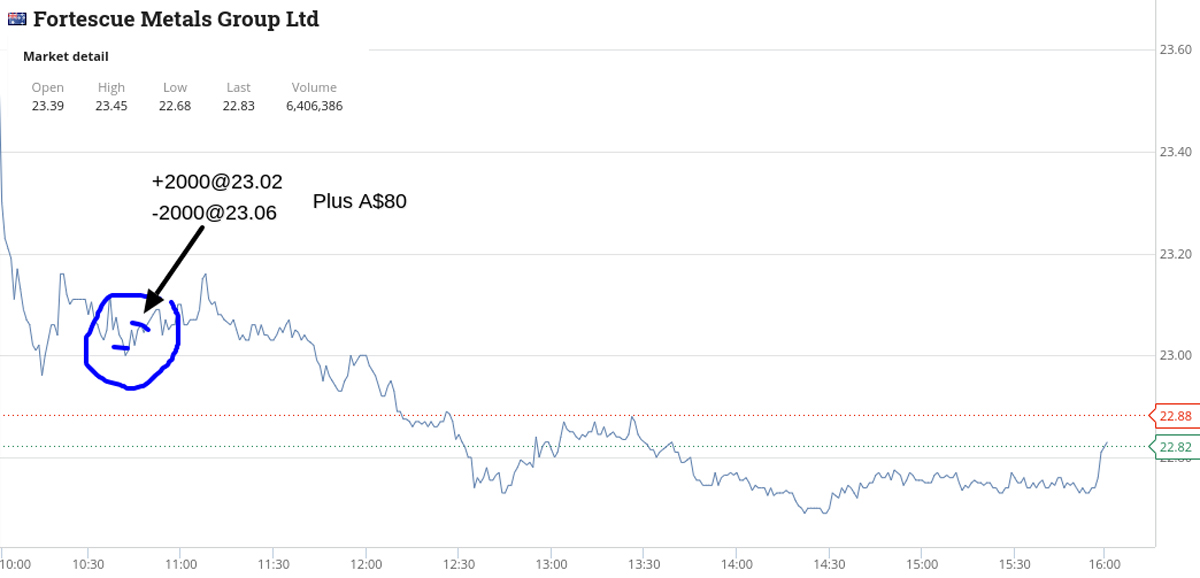

Decide to buy a commodity and an industrial stock for a potential 11am ding dong. Buy 2000 FMG at 23.02 and 1000 CBA at 96.66. Time is 10.45am.

FMG rallies 4c and so sell them at 10.50am. CBA don’t. They keep ticking lower and buy another 1000 at 96.47 @10.56am.

Still going lower and now getting annoying, so buy 2000 at 96.37. They were 98.00 yesterday. How much further can they go? Then OMG they rally so fast that as I try and organise my sale they move so fast that I make A$300 extra. Go from -A$390 to +A$690 in seconds.

That’s it. I lock in my profit. Close computer lid and walk away. Don’t look at anything till 4.15pm.

Banked A$770 by 11.04am and will only lose it if I keep watching. An amazing first hour of trading.

+2000 FMG at 23.02; -2000 at 23.06; Profit A$80

+1000 CBA at 96.66; +1000 at 96.47; +2000 at 96.37; -4000 at 96.64; Profit A$690 (the 11am rally was a minute late. Had to breath deep for an extra 60 seconds)

Thursday May 20

Doughnut day today. The only thing that fell today was crypto-related, not equity-related, so that is where I got my trading fix today.

The equities were partying like it was 1999 and every time I took a peak, they were having a strong rally. APT finish the day up 7.67%, CBA up 3.23% and Z1P holding well above it’s 7.00 support level, closing at 7.37 or +4.99%.

The biggest faller out of the top 200 was ILU, down 4.4% followed by LFS, who were down 2.4%. Let’s see what Friday brings.

Friday May 21

Getting a bit trigger happy waiting till around 11am and go a tad early in APT (10.39am). Promptly falls A$1.45 on me when I buy some more (10.51am).

Fall another 68c before buying some more (10.54am). That’s all in the space of 20mins. Far out.

Then they bounce and I’m out at 96.01 (11.01am). That makes me A$390 and in between all of that I have a 2c turn in Z1P and 6c turn in KGN, who are down 12% on news that they have overstocked and having warehouse delivery issues.

With the A$60 made in KGN, I think about buying something outrageous on his site.

Have a go in 1000 CBA at 97.97 and have to wait for almost two hours before they rally and I pocket A$180. Then APT fall again and I buy 800 at 92.74 (having sold them at 96.01!) and double down at 91.85. Out at 92.51 after thinking that I may be setting myself up for a hit here.

In the end finish the day up A$1,018. CBA was volatile in first hour and APT moves are just insane.

+200 APT @ 96.90; +200 @ 95.45; +400 @ 94.87; -800 @ 96.01 ($390.00 profit)

+1,000 KGN @ 8.86; -1,000 @ 8.92 ($60.00 profit)

+2,000 ZIP @ 7.19; -2,000 @ 7.21 ($40.00 profit)

1,000 CBA @ 97.97; -1,000 @ 98.15 ($180.00 profit)

+800 APT @ 92.74; +800 @ 91.85; -1,600 @ 92.51 ($348.00 profit)

Gross profit: A$2726

Less brokerage: A$652

Net Profit: A$2074

Most satisfying: CBA (Wed)

Least satisfying: CBA (Tue)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.