Confessions of a Day Trader: Things getting silly? Don’t be a hero

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 29

Thought I would be coming into a sea of red, with opportunities galore. But saw FLT open down about 7% and then start to recover, so kind of started to feel and see a change.

Had no way of feeling which way all of this could go, so did the hardest thing that a day trader could do – absolutely nothing.

I’ve added some graphs and you will see that they all got marked down heavily in the 4.10pm trading session, which I take as a sign that there was a book of book-squaring ahead of tonight.

This COVID thing makes everything harder to find a bottom, so will keep an eye on the volatility of things tonight and see if tomorrow offers a better day.

See graphs for a feeling of their day ranges and not on too big a volume. Low volume worries me, along with the ranges. Have a look at RIO as an example.

Recap: er, ZERO!

Tuesday November 30

Going to get back on the horse today and hope the saddle doesn’t slip as I put my foot in the stirrup. Kick off with a 1000 CBA at 11am and hold on tight with my legs and fingers crossed. After 37 mins take a $320 profit and that’s after it started out a bit hairy (see chart).

So hard to pick things today and sure that I am not alone with this. Back in for another 1000 CBA with 15 mins to go at $93.19 as they and FMG get a bit of a knock downwards. CBA rally and through pure chance, book the exact same amount of profit ($320) and happy to take a smaller one in FMG ($50).

The one that makes me fall off my chair is the closing 4.10pm auction price of APT. It got sold off from $110.70 with 30 mins to go to $108.85 in the auction – 95c down from their 4.00pm close.

Never seen that before!

Patience is the hardest thing to master, when everything is all over the place and what seems a bottom, may not be.

Plus $690 today and await APT tomorrow morning. Still feeling a bit nervous, market-wise though.

Recap:

Bought 1,000 CBA @ 94.48

Sold 1,000 CBA @ 94.80 ($320.00 profit)

Bought 1,000 CBA @ 93.19

Bought 1,000 FMG @ 17.11

Sold 1,000 CBA @ 93.51 ($320.00 profit)

Sold 1,000 FMG @ 17.16 ($50.00 profit)

Wednesday December 1

Man oh man, these kind of trading days are very hard. APT ended up having a range of $4.21 over the day. I don’t recall ever having seen this before.

You don’t know what’s around the corner and if any bad news is coming out during trading hours. I have the song ‘Billy Don’t be a Hero’ going around and around in my head.

Luckily, I came out on top today, starting with FMG, who were heading towards the $17.00 level, when I gingerly picked up 1000 at $17.01. They went straight through it, before finding a bottom and rallying in my favour.

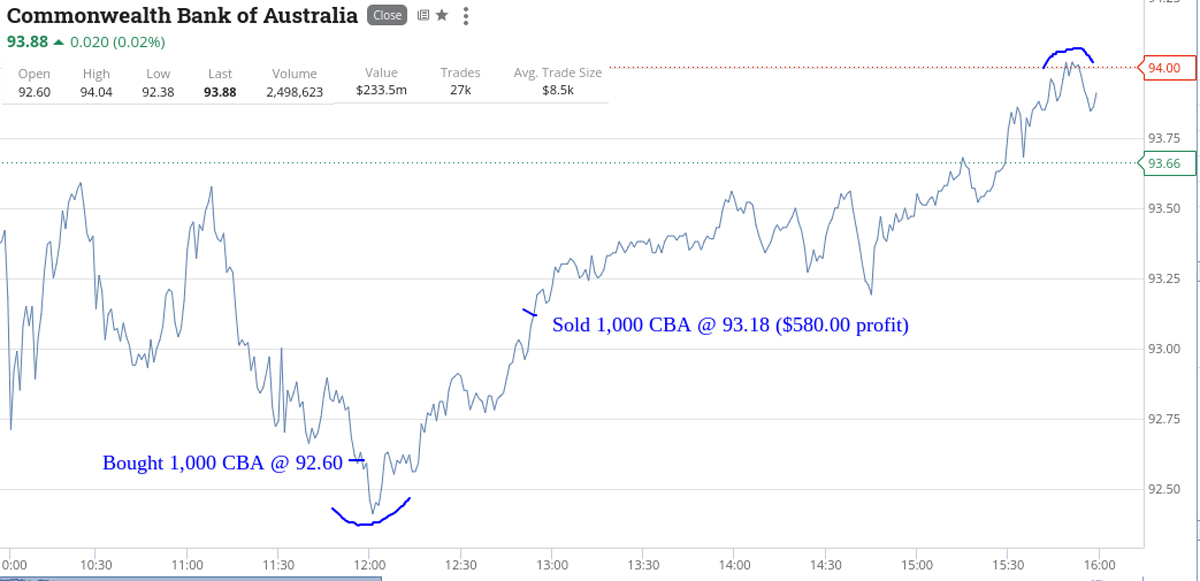

CBA were the standout for me though and they opened weaker, rallied and then came back again and looked oversold at $92.60. When they did rally again, they cracked the 93.00 level and kept on going and ended the day with a range of $1.66 overall.

Looking around towards the end of the day, I noticed that Z1P had a low of $4.99 and I managed to grab a 2c turn on 2,500. Not much, but I will take it to add to this week’s war chest, as I may need it for Thursday or Friday.

Still nervous over this market. Plus $790 today but expecting this will be given back soon!

Recap:

Bought 1,000 FMG @ 17.01

Sold 1,000 FMG @ 17.37 ($160.00 profit)

Bought 1,000 CBA @ 92.60

Sold 1,000 CBA @ 93.18 ($580.00 profit)

Bought 2,500 Z1P @ 5.01

Sold 2,500 Z1P @ 5.03 ($50.00 profit)

Thursday December 2

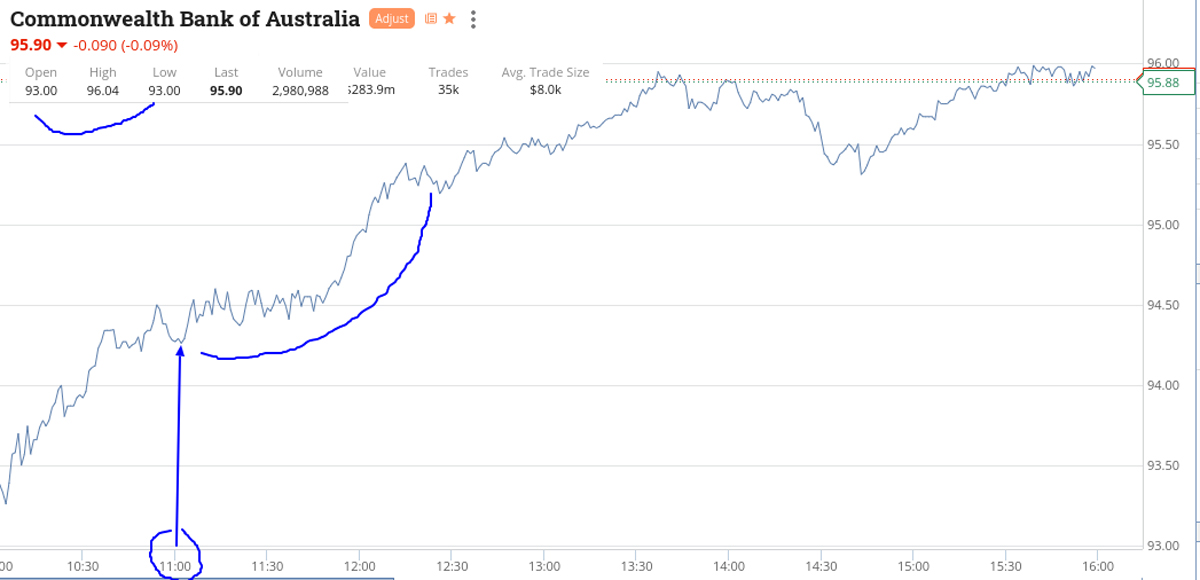

Decide to have an 11.00am pop at APT today and got set in 500 only (told you I was nervous) at $100.93. That’s right, they are below $101 today.

Amazing.

Happy to take a profit of $125 on a small parcel. Later, buy 500 at $99.89 and happy to sell them at just above $100.00.

Today means that, with CBA closing at $95.90 and APT at $100.02, the gap between them has closed in again and is down to $4.10 today. Yesterday it was $12.17!

Talking of CBA, I was tossing up between CBA and APT today at 11.00am and chose APT. CBA would have been better.

So a small day today. Didn’t have to give anything back, which is a miracle. Be glad when tomorrow finishes and the weekend begins.

Up $205 and still nervous about the trading ranges getting thrown around.

Recap:

Bought 500 APT @ 100.93

Sold 500 APT @ 101.18 ($125.00 profit)

Bought 500 APT @ 99.89

Sold 500 APT @ 100.05 ($80.00 profit)

Friday December 3

The iron ore stocks got marked up overnight, so not much I can do with them, however APT gave a classic 11.00am trade and took literally 3 mins to lock in $300.

Happy to grab and run, even with some more left on the table.

Slightly lifted the amount from 500 shares to 750.

CHN had a massive range for their share price of around 8% off their highest price. Crazy stuff and again kept the size down a bit and very happy again to lock in a profit.

Even though this week came out plus $2075 ($1860 net) it was a very hard week because of the news on COVID and the volatility that this created. The gap between CBA and APT narrowed down to $1.63 and curious to know if next week they may cross over.

Have added a chart on NVX, who were down a massive 32%. Did have a look at them but it was too close to only an hours trading left.

Didn’t touch anything in the last hour, as being a Friday, booking squaring up can be very harsh.

Need a lie down and then a few cold ones and I think I had a lucky escape.

Let’s hope we get some solid news on this new strain of COVID, so we can get some direction!

Recap:

Bought 750 APT @ 97.35

Sold 750 APT @ 97.75 ($300.00 profit)

Bought 1,000 CHN @ 9.12

Sold 1,000 CHN @ 9.21 ($90.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.