Confessions of a Day Trader: There’s blood on the trading floor! (Get us a tissue please love)

Bottom Picker's come over all woozy. Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 25

Ah. Monday morning and we have a whole week to look forward to. It looks like there will be a few ‘Inflation’ headlines coming out this week, so we may get some good volatility.

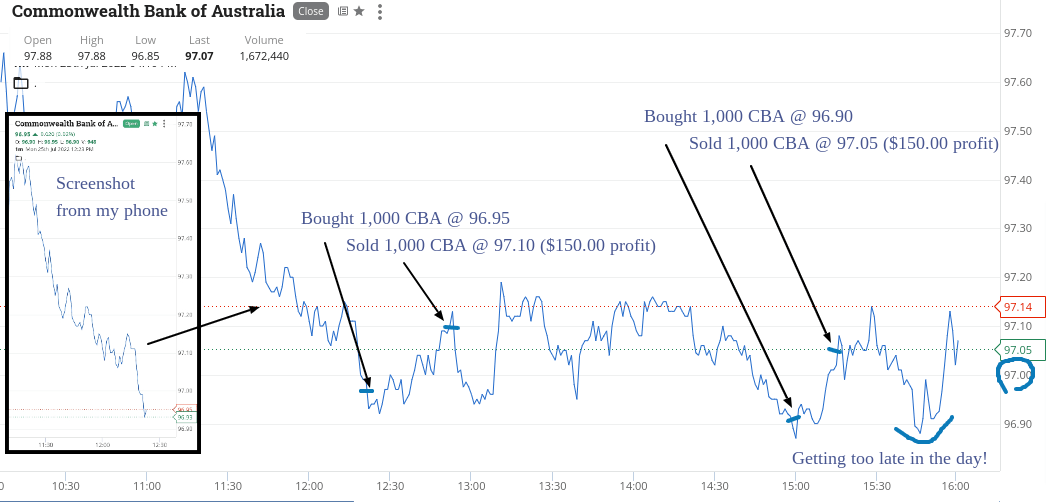

Didn’t get much volatility today though, with CBA offering a day range of $1.03 on lower than usual volume and RIO’s range was $1.02 on less than 1m volume.

Had to wait till just before 12.30pm today, before CBA looked like they would crack below the $97 level. In fact, managed to buy them twice today below $97.00 and trade back out above it.

Not big profits after brokerage but that is what days like this produce – small profits on low volumes and price range. Plus $300 gross.

Recap

Bought 1,000 CBA @ 96.95

Sold 1,000 CBA @ 97.10 ($150.00 profit)

Bought 1,000 CBA @ 96.90

Sold 1,000 CBA @ 97.05 ($150.00 profit)

Tuesday July 26

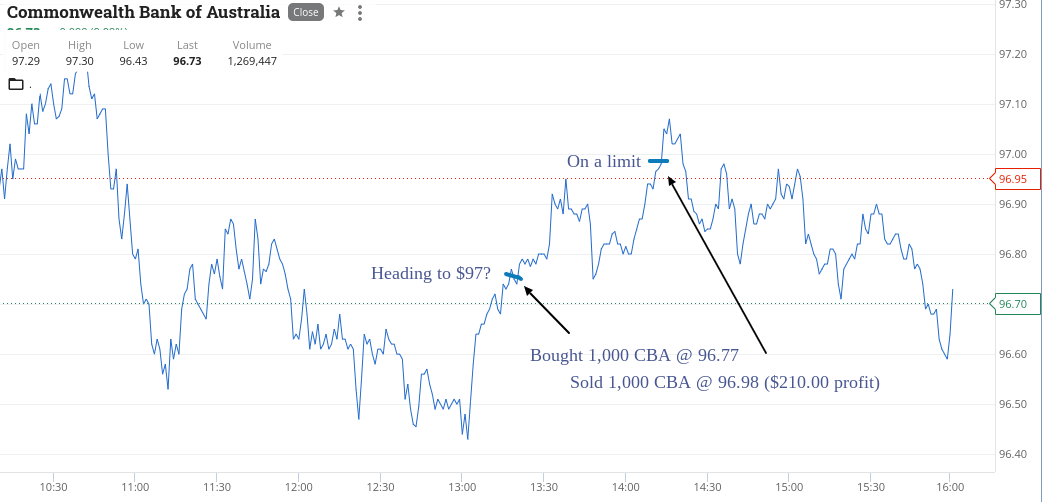

Today was a one step forward, two steps back kind of day. The only ones showing red on my list were NAB and CBA.

Had a go on both and won on CBA and lost on NAB. Both had low ranges and volumes.

Chased CBA upwards out of frustration which worked out and held onto NAB for too long.

Up $70 gross for the day. ZIP managed to get above $1.00 today and BHP bounced at 11.00pm! Hope I can get my mojo back tomorrow!

Recap

Bought 1,000 CBA @ 96.77

Bought 1,000 NAB @ 29.87

Sold 1,000 CBA @ 96.98 ($210.00 profit)

Sold 1,000 NAB @ 29.72 (-$150.00 loss)

Wednesday July 27

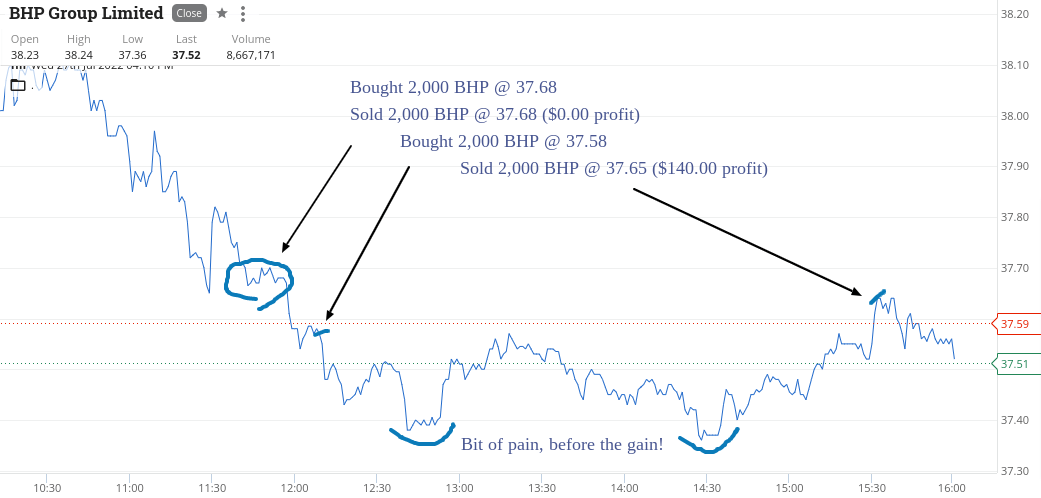

Today is inflation day and at 11.30am the official rate came in at 6.1% against estimates of 6.2%, so slightly better than expected.

I stay away till after they come out and after they have the banks rally and the iron ore stocks go down. I start to get a bit busy in BHP. I buy 2000 and then 1000 CBA on their way to crack $97.00 which they do.

I then cut the BHP for zero as the banks start to sell off. Then I had a really small trade in FMG, just to get a feel for them as they bobble around the $18.05/10 level. Make enough to cover off brokerage plus a bit towards my BHP zero trade.

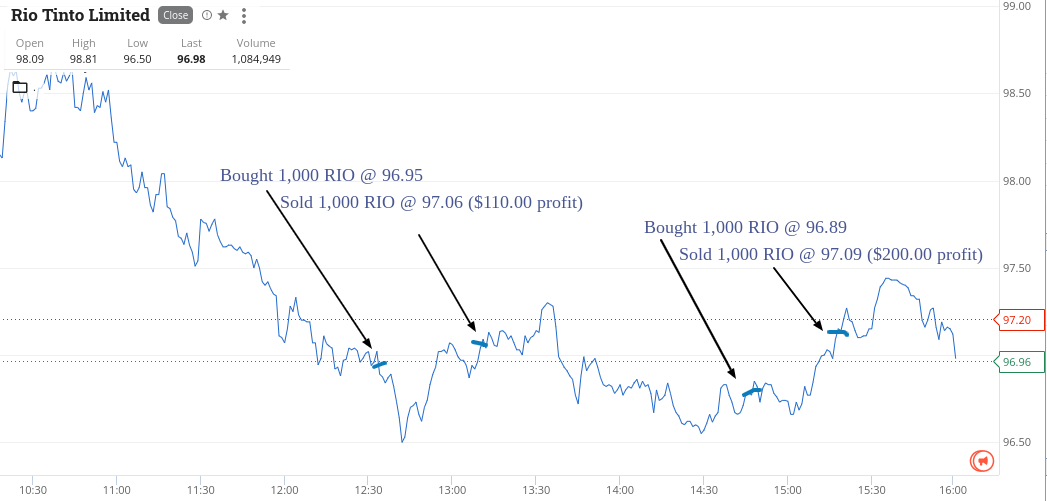

The banks start to rally, especially CBA, so back in for 2000 BHP at 10c below my last cut. Been watching RIOs like a hawk as waiting to see if they crack the $97.00 level on the way down, which eventually they do.

Manage to trade them twice as they crack and then rally through that $97.00 level.

Weirdly enough, now RIOs and CBA are trading at the same price!

BHP end up giving me grief and they fall way down but I stick to my sell limit and wait. Had to do some driving, so that distracted me from watching them.

By the time I get out of the van and check them, I’ve been taken out and that was after I was looking at a $300 plus loss.

So, a bit more volatility today, compared with the last two days brings in a profit of $710.

Even though I gave a bit of brokerage away, I had a fun day and enjoyed myself.

Sun was out and no rain, so that also helped my mood a bit.

Steak and a nice red tonight after watching a beautiful sunset. Red sky at night, traders delight!

Recap

Bought 2,000 BHP @ 37.68

Bought 1,000 CBA @ 97.68

Sold 1,000 CBA @ 97.92 ($240.00 profit)

Sold 2,000 BHP @ 37.68 ($0.00 profit)

Bought 500 FMG @ 18.06

Sold 500 FMG @ 18.10 ($20.00 profit)

Bought 2,000 BHP @ 37.58

Bought 1,000 RIO @ 96.95

Sold 1,000 RIO @ 97.06 ($110.00 profit)

Bought 1,000 RIO @ 96.89

Sold 1,000 RIO @ 97.09 ($200.00 profit)

Sold 2,000 BHP @ 37.65 ($140.00 profit)

Thursday July 28

More blue sky today. A good example is CBA. Having been neck and neck with RIOs at $97.00 a share, today they touched $100.20 whilst RIO touched a low of $95.49.

Of course this meant RIO was on the menu today and not CBA.

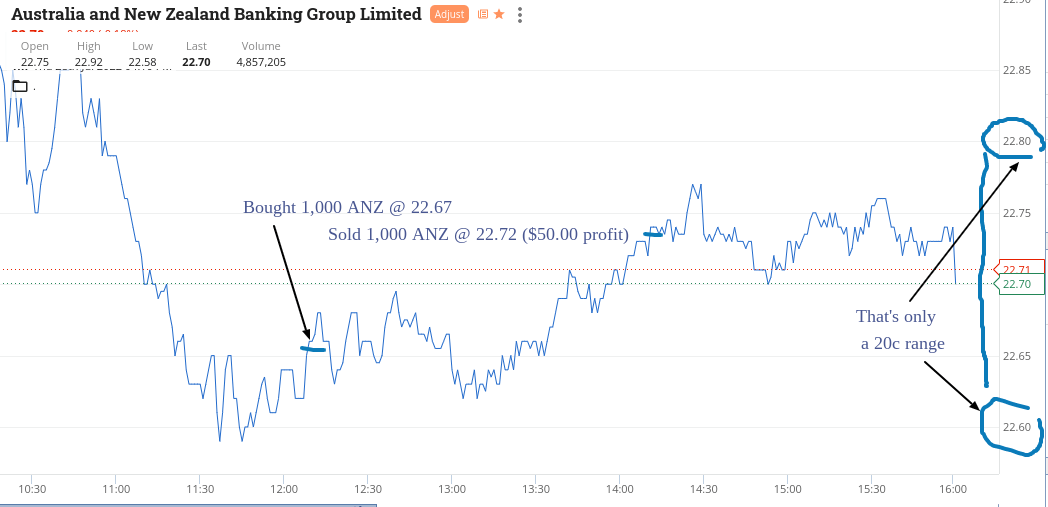

Had two goes at RIO and one token go at ANZ, as they were the only bank under a bit of pressure as they are going through their entitlement offer.

Up $470 today and that was after something that hasn’t happened to me for years. I got a serious nosebleed and it came on just as I sat down at around 11.00am and couldn’t trade and hold my head back at the same time. Eventually, after much ado, I managed to start the day with a buy in RIOs. All good now but very bizarre.

Recap

Bought 1,000 RIO @ 96.07

Sold 1,000 RIO @ 96.20 ($130.00 profit)

Bought 1,000 ANZ @ 22.67

Bought 1,000 RIO @ 95.74

Sold 1,000 RIO @ 96.03 ($290.00 profit)

Sold 1,000 ANZ @ 22.72 ($50.00 profit)

TGIF July 29

Had a bit of a nail-biter today.

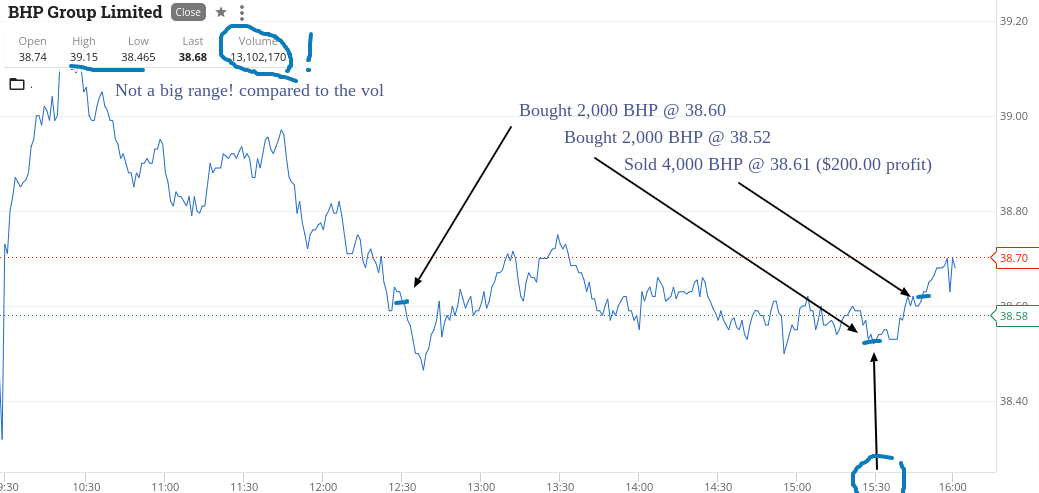

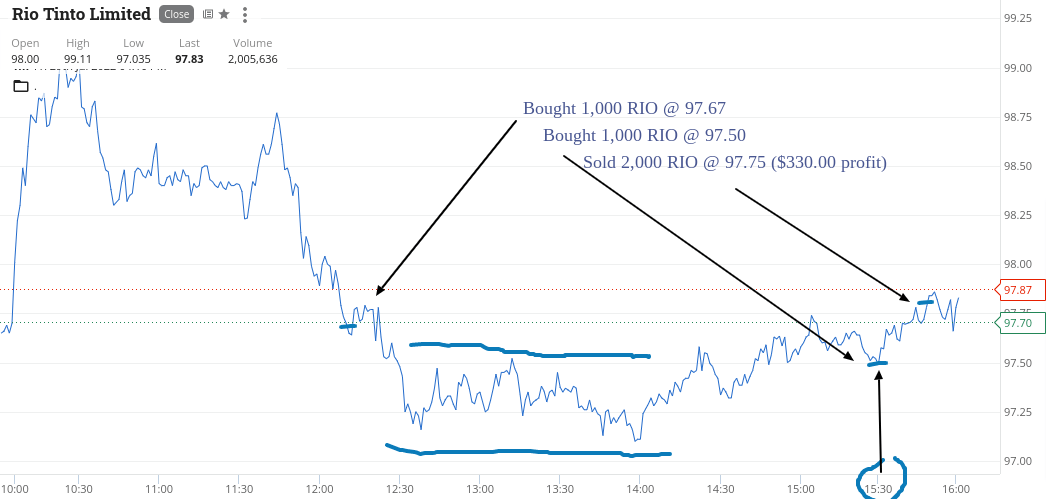

Having had a go in both BHP and RIO, I had to double down on both at bang on 3.30pm and hope it was the right strategy.

My 11.00am special didn’t happen today (for me) but my 3.30pm did!

See both charts for what I mean – a get out of jail special, not once but twice.

So end today plus $550 and for the week $2100 gross and $1631 net. Paid a bit away in brokerage but to me it is part of my overheads. Going back 30 years the price of the shares would be a lot lower but the brokerage would be 1% plus interstate phone bill!

Off to the Hunter Valley for a vino fix weekend and chill.

Recap

Bought 1,000 RIO @ 97.67

Bought 2,000 BHP @ 38.60

Bought 2,000 BHP @ 38.52

Bought 1,000 RIO @ 97.50

Sold 2,000 RIO @ 97.75 ($330.00 profit)

Sold 4,000 BHP @ 38.61 ($200.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.